Here’s what happened in crypto today

March 12 2025 - 4:53PM

Cointelegraph

Today, in crypto, the US Securities and Exchange Commission is

reportedly preparing to drop its case against Ripple, while a

reintroduced bill in Congress seeks to authorize the US government

to purchase 1 million Bitcoin. Meanwhile, the European Union’s

retaliatory tariffs have deepened macroeconomic uncertainty,

prompting analysts to forecast increased volatility for BTC

prices.

SEC’s enforcement case against Ripple may be wrapping up

The US Securities and Exchange Commission

may be preparing to end its enforcement action against Ripple

Labs after more than four years.

According to a March 12 X post from Fox

Business reporter Eleanor Terrett, the SEC’s case against Ripple

was “in the process of wrapping up” after the parties filed an

appeal and cross-appeal, respectively, over a $125-million court

judgment in August 2024. The civil case against the blockchain firm

filed in December 2020 alleged Ripple and certain executives used

XRP (XRP) as an unregistered security to raise funds.

Ripple chief legal officer Stuart Alderoty told Cointelegraph on

March 11 that the SEC civil case was “far more advanced” than many

of the others the regulator had dropped following the inauguration

of US President Donald Trump and the departure of Chair Gary

Gensler. Since January, the SEC has announced it will

not pursue

enforcement cases against Coinbase, Consensys, Kraken and

others.

“We do have a judgment, we are on appeal — that presents some

additional complexity,” said Alderoty in regard to the case

potentially being dropped. “But we remain optimistic that we’ll get

to a resolution with the SEC, and if we don’t, we’ll proceed with

the appeal.”

According to the Ripple CLO, there were several possible

outcomes to ending the SEC case if both parties were in agreement

that it should wind down.

EU retaliatory tariffs threaten Bitcoin correction to

$75,000

The EU’s

latest retaliatory tariffs have deepened macroeconomic

uncertainty, prompting crypto analysts to forecast increased

volatility for Bitcoin (BTC) prices, which may drop below the critical $75,000

support level.

The EU will impose counter-tariffs on 26 billion euros ($28

billion) worth of US goods starting in April, the European

Commission

announced on March 12, responding to US President Donald

Trump’s recent move to impose 25% tariffs on steel and aluminum

imports.

This move is the latest retaliatory tariff announcement in

response to

US import tariffs, which may trigger renewed

trade war concerns and market volatility in the near term.

Announcement of retaliatory tariffs on the US. Source:

European Commission

“Counter tariffs aren’t a positive signal as they suggest a

potential bounce back from the other side again,” according to

Marcin Kazmierczak, co-founder and chief operating officer of

blockchain oracle solution firm, RedStone.

This may see Bitcoin revisit $75,000, he told Cointelegraph,

adding that “given stablecoins and RWAs [real world assets] remain

at all-time-highs, it has the potential to rebound.”

“I don’t believe that news will have a strong impact for now,

but we’ll observe the response on the US end,” he added.

Related:

Bitcoin reserve backlash signals unrealistic industry

expectations

Other analysts still eye a temporary

Bitcoin retracement below $72,000 as part of a “macro

correction” during the current bull market cycle before Bitcoin’s

next leg up.

Still, import tariffs are not the only factor influencing

Bitcoin’s price, Ryan Lee, chief analyst at Bitget Research, told

Cointelegraph, adding:

“The prices are correlated with wider economic

conditions but are also influenced by factors beyond trade

policies. Worldwide institutional adoption, regulatory updates and

high utility make it more resilient than traditional financial

instruments.”

Lummis’ revamped BITCOIN Act wants US reserve to buy 1 million

BTC

US Senator Cynthia Lummis’

reintroduced her BITCOIN Act on March 11 to allow the

government to potentially hold more than 1 million Bitcoin in its

newly established reserve.

The bill, the Boosting Innovation, Technology, and

Competitiveness through Optimized Investment Nationwide (BITCOIN)

Act of 2025, was first introduced in a different form in July and

would’ve seen the US buy 1 million BTC, split across buys of

200,000 BTC a year for five years.

The revamped bill opens the door for the US to acquire and hold

in excess of 1 million BTC as long as it is acquired through lawful

means other than direct purchase, such as civil or criminal

forfeitures, gifts made to the US or transfers from federal

agencies.

The refreshed bill also now sets a formal evaluation process for

Bitcoin forked assets and airdropped assets in the reserve and

directs the Secretary after the mandatory holding period to

evaluate and retain the most valuable asset based on market

capitalization while retaining the “dominant asset.”

US President Donald Trump signed an executive order to create a

“Strategic Bitcoin Reserve” and a “Digital Asset Stockpile,” both

of which will initially use crypto forfeited to the government.

...

Continue reading Here’s what happened in crypto

today

The post

Here’s what happened in crypto today appeared

first on

CoinTelegraph.

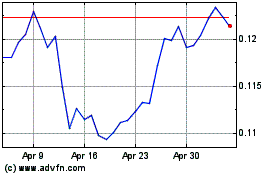

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025