This Is The Last Opportunity To Buy Dogecoin ‘Relatively Cheap,’ Predicts Analyst

March 12 2025 - 6:00PM

NEWSBTC

Crypto analyst Kevin (@Kev_Capital_TA) suggests that Dogecoin’s

current market structure signals “the last opportunity” for

investors to acquire the meme coin at relatively low prices. Kevin

points to several convergent technical indicators, including a back

test of the macro 0.5 Fibonacci retracement near $0.158, a retest

of descending multi‐year trend lines, a convergence with both the

200‐week Simple Moving Average (SMA) and Exponential Moving Average

(EMA), and an historically low 3‐Day RSI reading. Buy Dogecoin Now?

The DOGE/USD weekly chart reveals several Fibonacci retracement

lines that may serve as support or potential downside targets.

Around $0.158, Dogecoin is testing the 0.5 Fib level, while deeper

areas include 0.618 near $0.1157, 0.65 near $0.1092, 0.70 around

$0.097, 0.786 near $0.080, and a more distant 1.0 Fib labeled

around $0.0942. Historically, these Fib zones have been areas where

price action may stabilize if a downtrend continues. Kevin also

highlights resistance near $0.28 (the 0.236 Fib) and an upper

boundary around $0.47–$0.48 that marks a major swing high from

previous rallies. From a trend perspective, the price is hovering

in the $0.16–$0.17 region, where it is retesting the broken

descending trend line drawn from Dogecoin’s 2021 peaks. Kevin’s

analysis suggests that if Dogecoin can hold this line as support,

it would reinforce the bullish scenario. Related Reading:

Dogecoin’s Darkest Hour? Sentiment Tanks, Whales Accumulate In

tandem, the 200‐week SMA and EMA—often regarded as markers of

long‐term market health—are situated in the approximate $0.13–$0.17

corridor. The overlap between these critical moving averages and

the Fib levels underscores what Kevin sees as a strong

risk‐to‐reward setup for long‐term positioning. He also points out

that the 3‐Day RSI has reached territory he considers “historically

low,” hinting at a possible oversold condition. Beyond technical

considerations, Kevin expresses a broader macroeconomic viewpoint:

“If BTC holds up and Macro Economic Data and Monetary policy adjust

then you just got your last opportunity to buy Dogecoin relatively

cheap. A lot of factors at play and lots of work to do But the risk

reward at this level is superb given the circumstances.” He

suggests that despite strong employment numbers and moderating

inflation (supported by Truflation data and falling energy costs),

the market is “wiping out trillions of dollars of wealth everyday

on pure speculation of what imaginary Tariffs are gonna do that

they knew were coming.” Related Reading: Dogecoin Crash? Analyst

Predicts Drop To $0.12 Before Rebound He adds: “Employment numbers

are phenomenal, growth is still strong, inflation is coming down

rapidly per Truflation data and energy costs falling are the

reason, the Fed is about to start easing again, wars are getting

ready to end soon.” He argues that the Federal Reserve may soon

pivot to more accommodative policies and that ongoing geopolitical

tensions may be waning. In his words, the current sell‐off “makes

zero sense” and appears to be a “controlled attack on the markets

by the powers that be” to sway public sentiment. “I think it’s

pretty obvious that there is a controlled attack on the markets by

the powers that be to try and derail this administration and turn

the retail crowd against them because this whole sell off makes

zero sense. A lot of people are gonna look real stupid when it all

settles out and the truth is revealed,” Kevin concludes. At press

time, DOGE traded at $0.16. Featured image created with DALL.E,

chart from TradingView.com

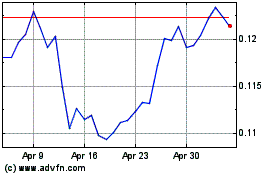

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025