Crypto Mining Equipment Makers Hope to Raise Billions in Hong Kong IPOs

August 28 2018 - 4:14AM

ADVFN Crypto NewsWire

Three of the largest cryptocurrency

mining equipment manufacturers in the world are planning to raise

billions of dollars through initial public offerings (IPOs) in Hong

Kong amid declining prices of Bitcoin and other digital currencies,

reports Financial Express.

The planned IPOs come amidst a

report by U.S. chipmaker Nvidia Corp of a decline in sales to

crypto miners to $18 million in the second quarter, as opposed to a

projected $100 million in earnings during the period. Nvidia chief

financial officer Colette Kress has also painted a bleak picture

for the firm's second-half results saying she does not see better

revenue contribution from cryptocurrency in the coming

months.

“That has raised concerns about the

upcoming Hong Kong listings by three Chinese manufacturers of

Bitcoin mining equipment, Bitmain, Canaan Inc and Ebang

International Holdings,” the report said.

All the three companies develop

high-performance computer chips used in mining digital currencies,

mostly focused on bitcoin. But falling cryptocurrency prices are

expected to impact investors’ confidence in these chip makers,

experts said.

“The marked decline in the price of

bitcoin since the start of the year is likely to weigh on

investors’ interest in these companies,” said chief executive of

financial services consultancy Quinlan & Associates Benjamin

Quinlan said and added, “The fall in the price of Bitcoin from its

peaks has not been matched by an equivalent fall in the numbers of

people mining it.”

As of Monday, Bitcoin was trading

at $6,754 down more than 60 percent from its $18,690 peak on

December 2017.

In addition to falling Bitcoin

prices, investors with knowledge of IPOs expressed concern over

regulatory uncertainties, as well as the poor performance of Hong

Kong offerings this year.

Last week, it was reported

Bitmain’s pre-IPO is facing possible risk after one of its primary

backers, Temasek, was said to be reconsidering its decision after

the Chinese firm misrepresented the list of pre-IPO

backers.

Compounding Bitmain’s woes is the

independent research by investment management firm Sanford C.

Bernstein & Co. suggesting the company might be losing its

competitive edge, which could impact its planned IPO.

“The competitiveness of Bitmain’s

chips is in question,” the analysts wrote in a report published on

Wednesday.

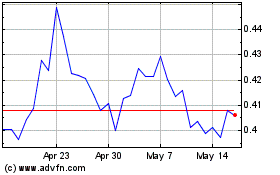

Ripple (COIN:XRPGBP)

Historical Stock Chart

From Feb 2025 to Mar 2025

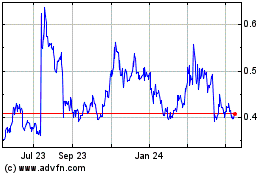

Ripple (COIN:XRPGBP)

Historical Stock Chart

From Mar 2024 to Mar 2025