Element79 Gold Corp secures loi for

launching tailings reprocessing business in Arequipa, Peru

Vancouver, BC

– September 26th, 2024 – InvestorsHub NewsWire -- Element79

Gold Corp (CSE: ELEM, OTC: ELMGF, FSE: 7YS0, Hereinafter "Element79

Gold"), a mining company

focused on gold and silver committed to maximizing shareholder

value through responsible mining practices and sustainable

development of its projects is pleased to announce the signing of a

Letter of Intent (LOI) with S.M.R.L. PALAZA 16 ("Palaza"), marking

a significant milestone in the Company's strategic efforts to

restart the Lucero mine and concentrate its focus in the Arequipa,

Peru region. This agreement represents a unique and substantial

economic opportunity for both parties involved, with multiple

additional social and environmental benefits for the local region

and community.

Under the terms of the LOI,

Element79 Gold will have the exclusive right to purchase and

process approximately 1.3 million tons of tailings currently

controlled by Palaza. These tailings, a byproduct of previous

mining activities at the Shila and Paola Mines (now known as the

Lucero Mine), present a valuable resource for reprocessing for

commercial benefit, to cooperatively strengthen regional and

community ties via Palaza's long-term relationships in the region,

as well as the tailings project stands to become a stronger

foothold for the Company's mining operations in the region

immediately surrounding the Lucero mine.

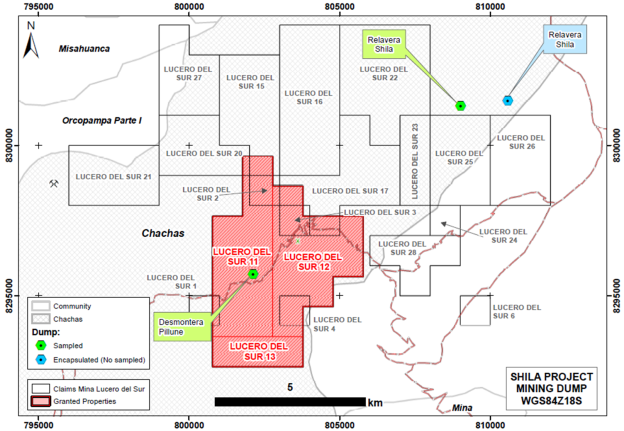

Image 1:

Element79's core mineral rights holdings of the Lucero

past-producing mine, outlining the tailings facilities facilities

(Relaveras) and former Staging Area (Desmontera)

Key

Highlights of the LOI Agreement:

Strategic

Acquisition: Element79

Gold will purchase the tailings from Palaza for a competitive price

of USD $10 per ton, plus VAT (18%), with a base case (optional

total batch purchase) of $10 per metric ton at USD 2,200 per Oz,

subject to increases based on the market value of gold at the time

that batches are purchase. This acquisition aligns with Element79

Gold 's strategic objective to enhance its resource

base.

The 43-101 and PEA Studies to be

completed on the tailings piles during the Due Diligence period and

through 2024 will feed further institutional funding of the

Company's growth.

Construction

of Processing Plant: Palaza has authorized Element79 Gold to

construct a processing plant on its property. This facility will

not only process the acquired tailings but also become a foothold

to accommodate other mineral ore inputs, from Lucero's production

and regional Artisanal Small-scale Miners (ASMs), with an eye to

maximize operational efficiency and output.

Initial

Deposit and Due Diligence: Element79 Gold will make an initial

non-refundable deposit of USD $25,000, followed by a comprehensive

due diligence period of 75 days. This thorough evaluation will

ensure the viability and profitability of the reprocessing

project.

Upon completion of Due Diligence,

an additional USD $50,000 deposit will be required to proceed, in

conjunction with the completion of the Definitive

Agreement.

All deposits paid will be

credited as prepayments for tailings.

Royalties and

Economic Impact: In

addition to the purchase price, for all tailings processed,

Element79 Gold will pay Palaza a 1% royalty based on the London

Metals Exchange (LME) spot price of gold, reflecting the dynamic

and lucrative nature of this venture. This agreement is poised to

generate significant economic benefits for both Element79 Gold and

Palaza, as well as contribute positively to the local economy in

Chachas, and other neighbouring communities in Arequipa.

New

Technologies Being Tested to Implement: Element79 Gold has been reviewing a number of

ways to increase the safety and minimize the environmental impact

of the proposed tailings processing plant, and through its due

diligence period, will be testing milling and processing with and

without chemicals, milled ore beneficiation, efficiencies, and soil

impermeability to prevent soil leaching.

Community and

Environmental Considerations: The project will be executed with full

compliance with local regulations and in close collaboration with

Chachas Community and other surface landholders. Element79 Gold is

committed to ensuring that all activities meet stringent

environmental and community standards.

PROJECT DATA

AND ECONOMIC PROJECTIONS

Total

Tailings Volume: Approximately 1.3 million tons of tailings

available for reprocessing, located on the same ingress/egress road

to the Lucero mine.

Processing

Plant Capacity: The new

plant will have the capability to handle up to 350 tons per day

(tpd) of mineral.

Economic

Impact: The agreement is

expected to generate substantial revenue streams for both parties,

with significant contributions to the local economy through job

creation and community investments.

Potential

Revenue Generation from Tailings:

NOTE: *all

estimates subject to change via data collected via the Due

Diligence period, to be reaffirmed via third-party Pre-Economic

Analysis report*

Estimated

Recovery: Based on 2011

and 2012 Plenge Lab tests, AuEq found in the tailings at that time

was approximately 1.5g/t. Gold solubility/recovery from the tailings is

projected at 85% and silver at 75%. Palaza's estimates are that

there is approximately 50,000oz of gold equivalent recoverable

through the life of the project.

Projected

Revenue: Potential

estimated gross AuEq of $100 million (assuming $2,000 gold price)

with 80% recoverable resources ($80 million), minus $16 million

input (tailings) cost and scalable $6-20 million plant cost,

resulting in $44-58 million gross over a 15-year project life

($2.9-5.3 million annual gross).

SOCIAL AND

ENVIRONMENTAL BENEFITS:

Social:

This venture has been a

long-standing issue for the local population by completing the

final remediation of the with the four piles of dry-stacked

tailings that have been left inert and covered by "bio-membranes"

and limestone rock for approximately 19 years without

remediation.

In reprocessing these tailings,

they will be put in their final resting place along with additional

tailings created by production from Lucero and other regional

ASMs.

Environmental:

Cleans up a benign environmental

issue that has been outstanding for the past 20 years.

Economic:

Creates a revenue-positive

project that serves as a catalyst for building a production plant

on-site and becoming a regional hub for local

ASMs.

A common thread of conversation

with the Chachas community and the Lomas Doradas artisanal mining

association has been the desire to have a plant more regionally

proximate to the community, as they are currently shipping mined

ores approximately 600km away to have it processed today. Helping

to eliminate logistical costs, risks and time are all beneficial

factors to local miners.

NEXT

STEPS:

Due

Diligence: Upon paying

the deposit, the Company will have 75 days to complete due

diligence, which data will feed a 43-101 Mineral Resource Estimate

report and Preliminary Economic Assessment (PEA). A Go/No Go

decision will follow these reports, with a USD $50,000 payment due

upon the completion of the Definitive Agreement.

All deposits paid will be credited as

prepayments for tailings.

The Company will pull augur

samples from all four piles and, provided that lab tests meet

required internal decision-making standards, the Company will have

a 43-101 compliant Mineral Resource Estimate of the tailings

generated as well as a third-party PEA completed, which will

encompass the project economics, work flow through the life of the

project and the final resting place for up to 2.5M tons of tailings

generated from processing the tailings and other throughput.

The Company anticipates that

these reports will form the foundation of what it will require to

obtain institutional funding for the development of the

mill/tailings processing facility as well restart commercial

production at the Lucero mine.

Permitting,

Community Consultation: Securing permits for working with the

tailings and building a plant will be process undertaken with the

Chachas community and state authorities through Fall 2024/Winter

2025, aiming for a 90-day plant construction start in estimated end

of Q1 to start of Q2 2025 after the rainy season ends.

"We are thrilled to enter into this strategic

partnership with Palaza, which underscores our ongoing commitment

to strengthening our presence and operational capacity with

innovative and sustainable mining practices," said James Tworek,

CEO and Director of Element79 Gold Corp. "The Palaza team have

worked in the region for decades, have solid local relationships

and have valuable experience of having explored and worked at the

Shila mine in the past. The end point of this agreement not only

enhances Element79's accessible resource base but also positions us

for long-term growth and profitability, while helping remediate the

tailings piles to stable closure as well as provide a solution to

many of the local logistical obstacles to increasing production

from the Lucero mine and other mines in the region. We are

confident that the reprocessing of these tailings will yield

significant economic benefits for both Parties and the Communities

involved as well as strengthen our presence in the Peruvian mining

sector."

Qualified

Person

The technical information in

this release has been reviewed and verified by Kim Kirkland, Fellow

of AusIMM #309585, Chief Operating Officer of Element79 Gold Corp,

and a "qualified person" as defined by National Instrument

43-101.

About

S.M.R.L. PALAZA 16

S.M.R.L. PALAZA 16 is a Peruvian

mining company with extensive experience in the management of

Andean mining projects, including reprocessing of mining tailings.

Located in the Arequipa region, PALAZA is dedicated to leveraging

its decades of experience in the region and resources for

sustainable and profitable operations.

About

Element79 Gold Corp

Element79 Gold is a mining

company with a focus on exploring and developing its

past-producing, high-grade gold and silver mine, the Lucero project

located in Arequipa, Peru, with the intent to restart production in

the near term.

The Company holds a portfolio

of four properties along the Battle Mountain trend in Nevada, and

the projects are believed to have significant potential for

near-term resource development. The Company has retained the Clover

project for resource development purposes and signed a binding

agreement to sell three projects with a closing date on or before

November 30, 2024.

The Company also holds an

option to acquire a 100% interest in the Dale Property, 90

unpatented mining claims located approximately 100 km southwest of

Timmins, Ontario, and has recently announced that it has

transferred this project to its wholly owned subsidiary, Synergy

Metals Corp, and is advancing through the Plan of Arrangement

spin-out process.

For more information about the Company,

please visit www.element79.gold

Contact Information For corporate matters,

please contact:

James C. Tworek, Chief Executive Officer and

Director

E-mail: jt@element79.gold

For investor relations inquiries, please

contact:

Investor Relations Department

Phone: +1.403.850.8050

E-mail: investors@element79.gold

Cautionary Note Regarding Forward-Looking

Statements This press contains "forward-looking information" and

"forward-looking statements" under applicable securities laws

(collectively, "forward-looking statements"). These statements

relate to future events or the Company's future performance,

business prospects or opportunities that are based on forecasts of

future results, estimates of amounts not yet determinable and

assumptions of management made considering management's experience

and perception of historical trends, current conditions and

expected future developments. Forward-looking statements include,

but are not limited to, statements with respect to: the Company's

business strategy; future planning processes; exploration

activities; the timing and result of exploration activities;

capital projects and exploration activities and the possible

results thereof; acquisition opportunities; and the impact of

acquisitions, if any, on the Company. Assumptions may prove to be

incorrect and actual results may differ materially from those

anticipated. Consequently, forward-looking statements cannot be

guaranteed. As such, investors are cautioned not to place undue

reliance upon forward-looking statements as there can be no

assurance that the plans, assumptions or expectations upon which

they are placed will occur. All statements other than statements of

historical fact may be forward-looking statements. Any statements

that express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives or future

events or performance (often, but not always, using words or

phrases such as "seek", "anticipate", "plan", "continue",

"estimate", "expect", "may", "will", "project", "predict",

"forecast", "potential", "target", 4 of 4 "intend", "could",

"might", "should", "believe" and similar expressions) are not

statements of historical fact and may be "forward-looking

statements". Actual results may vary from forward-looking

statements. Forward-looking statements are subject to known and

unknown risks, uncertainties and other factors that may cause

actual results to materially differ from those expressed or implied

by such forward-looking statements, including but not limited to:

the duration and effects of the coronavirus and COVID-19; risks

related to the integration of acquisitions; actual results of

exploration activities; conclusions of economic evaluations;

changes in project parameters as plans continue to be refined;

commodity prices; variations in ore reserves, grade or recovery

rates; actual performance of plant, equipment or processes relative

to specifications and expectations; accidents; labour relations;

relations with local communities; changes in national or local

governments; changes in applicable legislation or application

thereof; delays in obtaining approvals or financing or in the

completion of development or construction activities; exchange rate

fluctuations; requirements for additional capital; government

regulation; environmental risks; reclamation expenses; outcomes of

pending litigation; limitations on insurance coverage as well as

those factors discussed in the Company's other public disclosure

documents, available on www.sedarplus.ca. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking statements, there may be other factors that cause

results not to be as anticipated, estimated or intended. The

Company believes that the expectations reflected in these

forward-looking statements are reasonable, but no assurance can be

given that these expectations will prove to be correct and such

forward-looking statements included herein should not be unduly

relied upon. These statements speak only as of the date hereof. The

Company does not intend, and does not assume any obligation, to

update these forward-looking statements, except as required by

applicable laws. Neither the Canadian Securities Exchange nor

the Market Regulator (as that term is defined in the policies of

the Canadian Securities Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Element79 Gold (CSE:ELEM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Element79 Gold (CSE:ELEM)

Historical Stock Chart

From Dec 2023 to Dec 2024