January 28, 2021 -- InvestorsHub NewsWire -- via

EmergingGrowth.com -- Yesterday, MarketWatch released an

article titled “It isn’t

just GameStop. Here are some of the other heavily shorted stocks

shooting higher”.

The article goes on to discuss GameStop (NYSE: GME), AMC (NYSE:

AMC), Koss (NASDAQ: KOSS), Blackberry (NYSE: BB) and Express, Inc.

(NYSE: EXPR), and how they have realized sharp moves of 134%, 301%,

480%, and 214% respectively, and that’s only the past 24

hours.

Leading the pack is:

GME – up $1,900% over the past 10 trading sessions

and;

KOSS – up 3,000% over the past 4 trading sessions.

Where is the next short squeeze coming from, and how can you

find it?

First and foremost, there obviously has to be a sizeable, short

position in the stock, relative to the average trading

volume.

Google Ads

Next, it would help if it was in a sector what would sit

comfortably with the WallStreetBets and other online communities that

have been pushing these stocks to the point of a

squeeze. The WallStreetBets crew is made up of those who

detest the Wall Street elite, short sellers, and those who they

believe created the 2008 crisis. Furthermore, they have over 4

million followers. To put this into perspective,

Goldman Sachs (NYSE: GS), has about 3

million customers. Now ask yourself, what do many of these

individuals have in common? Crypto and

Technology.

Has the stock been beaten down? Is the stock entering an

uptrend? These are the obvious ingredients to a short

squeeze. A bonus would be some confirmation that an

insider also felt so the stock was undervalued, that he would put

his own money on the line.

Here is one you can look at.

Take a look at Nextech AR Solutions, Inc. (OTCQB:

NEXCF), and ask yourself if you can we check any of those

boxes?

Average volume is around 250,000 shares, and according

to OTC Markets,

short interest as of recent was 551,000 and an additional 866,000

shares are short in Canada. Check.

Nextech AR Solutions, Inc. (OTCQB:

NEXCF), is heavily into trading cryptocurrency, and

is the first

publicly traded pure-play AR (augmented reality)

company. Check.

Nextech AR Solutions, Inc. (OTCQB:

NEXCF) stock has been beaten down from $7.00 per share in

October, to a low of $3.70 just last week. The stock put

in a bottoming tail and has been on a strong uptick with its next

resistance level of $4.50 per share, which a squeeze can easily

break. Check.

While we’re at it, how does the CEO feel about the company?

Remember, all these short squeezes started with some new positive

catalyst in the market. It turns out, Mr. Evan

Gappelberg, CEO of Nextech AR Solutions (OTCQB:

NEXCF) purchased shares in his company 5 times in

2020 totaling 1,279,885 shares, and once already

in 2021. Bonus.

Nextech AR Solutions, Inc. (OTCQB:

NEXCF) could very well become the next major short

squeeze.

As one of the very few pure-play AR investments, NEXCF stock

facilitates more than just exposure to a growing industry. Instead,

NexTech offers end-to-end solutions for any revenue-generating

endeavor, from AR-based marketing campaigns and promotions to

platform integration to education and brand evangelization. The

possibilities are truly limitless, demonstrated by

its massive

clientele list. We’re talking names like Johnson

& Johnson (NYSE:

JNJ), Toyota (NYSE:

TM), IBM (NYSE: IBM), Carnegie Mellon

University, BCE(NYSE: BCE), NATO and many

more.

Further, NexTech’s key partnerships, such as its deal with BDA

Sports to integrate a

full-scope AR technology stack, provides organic exposure to

viable professional sports leagues such as the NHL, NBA, MLB, and

NFL. This will help broaden an already expansive list of clients,

including Unesco, TEDx, Dell

Technologies(NYSE: DELL), Luxottica, Vulcan Inc.,

Boehringer Ingelheim, Grundfos, and Arch Capital

Group (NASDAQ: ACGL).

Just as importantly, the underlying financial performance of

NexTech AR more than justifies taking a shot with NEXCF with the

risk-on portion of your portfolio. First, the fourth quarter of

2020 brought home bookings of $7.3 million, representing a 275%

increase from the same quarter in 2019. As well, bookings were up

9% sequentially over Q3 results, confirming continued demand

despite the Covid-19 disruption.

Furthermore, NexTech rang up $20.01 million in bookings last

year – a record haul for the company. This incredible figure is up

235% year-over-year, demonstrating the resilience of AR-based

technologies and their relevance in the new normal, especially

through facilitating contactless services.

For undervalued growth investments with excellent risk-reward

profiles, you’re going to be hard-pressed to find anything better

than NEXCF stock.

About EmergingGrowth.com

Through its evolution,

EmergingGrowth.com found a niche in identifying companies

that can be overlooked by the markets. We look for strong

management, innovation, strategy, execution, and the overall

potential for long- term growth. Aside from being a trusted

resource for the Emerging Growth info-seekers, we are well known

for discovering undervalued companies and bringing them to the

attention of the investment community. Through our parent Company,

we also have the ability to facilitate road shows to present your

products and services to the most influential investment banks in

the space.

All information contained herein as well as on

the EmergingGrowth.com website is

obtained from sources believed to be reliable but not guaranteed to

be accurate or all-inclusive. All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should

not be construed as an offer or solicitation to buy or sell

securities. The information includes certain forward-looking

statements, which may be affected by unforeseen circumstances and /

or certain risks. This report is not without

bias. EmergingGrowth.com has motivation by

means of either self-marketing or EmergingGrowth.com has been

compensated by or for a company or companies discussed in this

article. EmergingGrowth.com is compensated

two thousand five hundred dollars per month in exchange for posting

press releases and other content on EmergingGrowth.com beginning

January 19, 2021 and EmergingGrowth.com has also been

compensated additionally for the production and distribution of a

media campaign. EmergingGrowth.com may receive additional

compensation for Nextech AR Solutions and full details of which can

be found here: https://emerginggrowth.com/27286-32336/.

EmergingGrowth.com will not advise

if and when its relationship with this company will end. You

can easily loose money investing in highly speculative small cap

stocks like the ones mentioned within. Please consult an investment

professional before investing in anything viewed within.

When EmergingGrowth.com is long shares it

will sell those shares. In addition, please make sure you read and

understand the Terms of Use, Privacy Policy and the Disclosure

posted on the EmergingGrowth.com website.

SOURCE:

EmergingGrowth.com

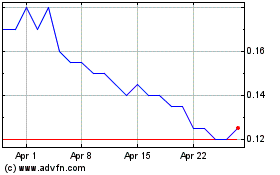

Nextech3D ai (CSE:NTAR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nextech3D ai (CSE:NTAR)

Historical Stock Chart

From Dec 2023 to Dec 2024