Aalberts N.V.: Aalberts trading update - first four months 2022

May 19 2022 - 12:30AM

Utrecht, 19 May 2022

In the first four months Aalberts realised 9% organic revenue

growth compared to last year. The orderbook end of April was 51%

higher than last year. The added value margin was on a good level

due to pricing initiatives. Capital expenditure further accelerated

to facilitate the organic growth plans.

We were able to manage the ongoing pandemic, disruptions in our

supply chains and raw material and labour shortages. So far, we

faced no severe issues. We invested in additional inventory to

secure our customer deliveries, due to uncertain availability of

raw materials and components. In parallel, work in progress is

increasing to facilitate growth and gain market share going

forward.

Regional manufacturing becomes favourable to improve service,

protect the supply chains and reduce transport and energy use. We

are driving business and capital expenditure plans to anticipate on

this reshoring trend. Our activities in Russia, less than 1% of our

total revenue, continued on a lower level and we postponed our

investments. We comply with the international sanctions.

Activities in our eco-friendly buildings end

market continued to do well in all regions with a record orderbook.

We are increasing manufacturing efficiency and capacity in

combination with acceleration of our capital expenditure.

Renovation and new build of residential and commercial buildings is

continuing, driven by more demand and the transition towards

sustainable heating and cooling systems. In addition, our

innovations launched the last years are driving our growth.

Aalberts hydronic flow control further strengthened the portfolio

with the acquisition of UWS, based in Germany. We divested ETI,

based in Indiana, USA.

In the semicon efficiency end market we

continued our strong growth and performance. The orderbook further

increased to record level. Capacity expansions and efficiency

improvements are ongoing. Aalberts advanced mechatronics further

strengthened the portfolio with the acquisition of ISEL, based in

Germany.

Our activities in the sustainable

transportation end market realised a good performance with

an increased orderbook, despite disruptions in the supply chain of

our customers. The demand for passenger cars and commercial

vehicles remains strong, continuing the need for precision

manufactured parts and specialised surface technologies. This is

accelerated by new developments in e-mobility and lightweight

materials. In aerospace and marine we see further recovery.

In the end market for industrial niches we

realised a strong growth and improved our performance. The

orderbook further increased.

We are relentlessly executing our updated strategy Aalberts

‘accelerates unique positioning’, presented December 2021.

contact +31 (0)30 3079 301 (from 8:00 am CEST)

investors@aalberts.com

regulated information This press release

contains information that qualifies or may qualify as inside

information within the meaning of Article 7(1) of the EU Market

Abuse Regulation.

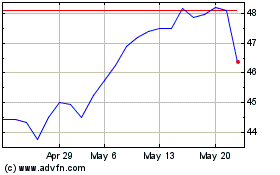

Aalberts NV (EU:AALB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aalberts NV (EU:AALB)

Historical Stock Chart

From Jan 2024 to Jan 2025