Aéroports de Paris SA - 2023 Half-year Results

FINANCIAL RELEASE

July 27th, 2023

Aéroports de Paris SA

2023 HALF-YEAR RESULTS

IN LINE WITH OUR EXPECTATIONS

TRAFFIC ASSUMPTIONS AND FINANCIAL TARGETS

CONFIRMED

- Revenue: €2,545M,

up +26.9% driven by traffic growth, both in Paris and

internationally, and strong momentum in retail activities, with

Extime Paris Sales/Pax1 reaching €29.6 (+€4.1 vs. 1st half of

2022 and +€7.1 vs. 1st half of 2019);

- EBITDA: €863M, up

+22.9%; EBITDA margin at 33.9% of revenue, reflecting the combined

effect of business seasonality, the trend in operating expenses,

and a normalization of Almaty's performance;

-

Operating income: €449M, up +31.6%;

-

Net income attributable

to the Group: €211M, up

+31.8%;

-

Net financial debt: €8,089M, with

a Net Debt to EBITDA ratio of 4.3x over the last 12 months;

-

Traffic assumptions, forecasts and financial targets for

2023-2025 are confirmed

Unless otherwise indicated, changes are expressed

in comparison with the 2022 half-year results.2023 – 2025 forecasts

and hypothesis are summarized on page 19 of this financial

release.Key figures for the half-year 2023 are presented in a table

on page 2 of this financial release.Operational and financial

indicators definitions appear in appendix 2.

Augustin de

Romanet, Chairman and CEO of

Groupe ADP, stated:"Half-year 2023

results are in line with our expectations. Since the beginning of

the year, we have welcomed 155.4 million passengers across our

airport network, including 47.1 million in Paris. Momentum is

strong in our retail activities, with Extime sales per Pax at 29.6

euros, up +4.1 euros (+16.2%) compared with the 1st half of

2022, and +7.1 euros (+31.7%) compared with the 1st half of 2019.

Overall, the group records revenue of 2,545 million euros, up

+26.9%. EBITDA reaches 863 million euros, representing a margin of

33.9% of revenue, in line with our forecasts. Net income

attributable to the Group is up +31.8% to 211 million euros. Our

activities are by nature seasonal, alternating peaks in traffic in

our airports during holidays periods with weeks of more moderate

traffic. Post-Covid, as activity recovers, we see in the airlines'

offering a trend that strengthens the seasonality effect which

could further improve performance in the 2nd part of the year. Our

assumptions remain unchanged: 2023 traffic is expected to reach up

to 93% of 2019 level in Paris Aéroport and to get close to 2019

traffic at group level. Our financial forecasts are confirmed, with

an EBITDA margin expected between 32% and 37% of revenue this year.

I would like to pay tribute to the commitment of Groupe ADP teams

who, in a challenging context, are mobilizing their expertise and

sense of hospitality for the success of the major sporting events

to come in France and for the pursuit of the decarbonization of

aviation with our "2025 Pioneers" roadmap. During summer 2024

especially, the Paris Olympic and Paralympic Games will start and

end in our airports for many people: it is a wonderful challenge

for the whole airport community, as well as for our territories,

and a unique opportunity to demonstrate our expertise and

commitment."

The Half-year 2023 results have been approved by

the Board of Directors of July 27th, 2023. They have been subject

to a limited review by the statutory auditors, and the limited

review report is in the process of being issued.

Key figures

|

|

H1 2023 |

In %

of 20192 |

Change

2023/20222 |

|

Group

traffic3 |

155.4MPax |

97.3% |

+35.8MPax |

+30.3% |

|

Paris Aéroport traffic |

47.1MPax |

90.0% |

+9.6MPax |

+25.7% |

|

|

H1

2023 |

H1

2022 |

Change

2023/2022 |

H1 2019 |

Change

2023/2019 |

|

Extime Paris Sales /

Pax4 |

€29.6 |

€25.5 |

+€4.1 |

+16.2% |

€22.5 |

+€7.1 |

+31.7% |

|

FINANCIAL RESULTS |

|

|

|

|

|

|

H1 2023 |

H1 2022 |

Change

2023/2022 |

|

Revenue |

€2,545M |

€2,006M |

+€539M |

+26.9% |

|

EBITDA |

€863M |

€702M |

+€161M |

+22.9% |

|

In % of revenue |

33.9% |

35.0% |

-1.1pt |

- |

|

Operating income from ord.

activities |

€449M |

€340M |

+€109M |

+31.6% |

|

Net result attributable to the

Group |

€211M |

€160M |

+€51M |

+31.8% |

|

|

As of June

30th,

2023 |

As of Dec.

31th,

2022 |

Var.

2023/2022 |

|

Net financial debt |

€8,089M |

€7,440M |

+€649M |

+8.7% |

|

Net financial debt / EBITDA5 |

4.3x |

4.4x |

-0.1x |

- |

Highlights

Launch of Abelia, Aéroports de Paris

SA new employee shareholding scheme

Following the approval of the Annual General

Meeting of Shareholders on May 16th, 2023,

Aéroports de Paris launched its new employee shareholding operation

on June 21st, 2023, the roll-out of which will be

phased in 2023 and 2024. Entitled ABELIA, the transaction involves

a maximum of 305,985 shares (or around 0.3% of the capital),

corresponding to the 296,882 shares bought back from Royal Schiphol

Group in December 2022 (see press release of December,

6th 2022) and 9,103 shares remaining from the

employee shareholding plan implemented in 2016.

ABELIA is part of "2025 Pioneers" roadmap (see

press release of February 16th, 2022 ) which

provides for Aéroports de Paris to carry out at least one employee

shareholding operation by 2025. It will be divided into two

parts:

-

A free allocation of shares of the company to employees of

Aéroports de Paris SA which, depending on the choices made, may be

up to a maximum of 16 shares per beneficiary.

-

An offer to acquire shares of the company on preferential terms,

reserved for employees who are members of the Group Savings Plan

(PEG). This offer will be deployed in spring 2024 and will benefit

employees who have been on the payroll for at least 3 months prior

to the end of the subscription period.

This operation is part of the development of a

new culture of value sharing, involving employees in the company's

performance.

The financial impact of this transaction to be

booked in 2023 and 2024 is estimated at around 27 million euros in

ADP SA's personnel expenses, of which 4 million euros were

booked at June 30th, 2023.

New salary measures from July

1st,

2023

To reward the involvement and commitment of

Aéroports de Paris employees during this period of strong recovery

in activity and major challenges ahead, the company has initiated

new unilateral salary measures. They come on top of measures

already taken or planned since July 2022.

From July 1st, 2023, these new measures provide

for a 1.5% general increase in base salary for all Aéroports de

Paris employees.

Progress on the GIL & GAL merger

project

During the 2nd quarter of 2023, several steps

were achieved following the agreement between Groupe ADP and GMR

Enterprises to form an airport holding company listed on the Indian

Stock Exchanges by the first half of 2024 (see press release of

March 19th 2023):

-

On June 12th, 2023, BSE Limited and National Stock Exchange of

India Limited, the Indian financial markets where GIL is currently

listed, issued a no-objection certificate to the merger application

filed by GIL on April 12th, 2023;

-

On April 12th, 2023 the merger application has been submitted for

approval to the Securities and Exchange Board of India (SEBI),

whose clearance is expected in the coming weeks;

-

The merger application will then be filed for approval with the

National Company Law Tribunal (NCLT).

As previously announced, the NCLT's final

decision, following approval by the shareholders and creditors of

both companies, is expected in the 1st half 2024, and would lead to

the completion of the merger transaction.

Project for TAV Airports to sell part of

its stake in Medina airport

On June 22nd, 2023, the Board

of Directors of TAV Airports approved the sale of 24% of the

capital of Tibah Airports Development, the company operating Medina

airport in Saudi Arabia, in which TAV Airports holds a total stake

of 50% and which is accounted for under the equity method in the

Group's financial statements.

Following this decision, these equity-accounted

shares, together with the balance attributable to these shares of

the shareholder loan granted to Tibah by TAV Airports, have been

reclassified, as of June 30th, 2023, as assets

held for sale within the definition of IFRS 56.

See Events since June 30th,

2023, on page 17 of this press release for the agreement signed on

July 7th, 2023.

Aéroports de Paris rating confirmed by

S&P Global Ratings

On June 14th, 2023, Standard

and Poor's reaffirmed its long-term A credit rating, with negative

outlook, for Aéroports de Paris.

Deployment of

complementary hospitality initiatives

In order to ensure the best possible fluidity

and quality of service in its Parisian aiports, the group alongside

its partners has deployed various measures, particularly for the

2023 summer season, with a view to:

-

Strengthening passenger management capabilities at the

border: installation of 17 additional

PARAFE gates, enabling automated border crossing, and recruitment

by the Border Police of 287 contract workers;

-

Improving visibility and queue

management: new organization of queues

and deployment of additional workers to better support and guide

passengers, especially to the queues dedicated to them;

-

Improving real-time information:

greater number of waiting time display screens, revised audio

announcements, etc.

-

Strengthening passenger services and

care: WiFi reinforcement, water

distribution in queues, etc.

JCDecaux and Groupe

ADP launch the Extime JCDecaux

Airport

As Extime Media has been operating since June

22nd, 2023, the two co-shareholders announced on July 18th, 2023

(see press release – available in French only), the launch of

Extime JCDecaux Airport (previously JCDecaux Airport Paris), the

new Extime JCDecaux Airport brand aims to become the new benchmark

brand in the airport media world, by expanding internationally,

with the deployment of its activities in Turkey from 2024 and in

Jordan during 2025.

This announcement follows the Groupe ADP's

choice, after a public consultation, of JCDecaux as co-shareholder

in Extime Media to operate advertising activities at Paris-Charles

de Gaulle, Paris-Orly and Paris-Le Bourget airports until December

2034 (see press release of July 28th, 2022)

Groupe ADP chooses Lagardère Travel

Retail as co-shareholder in the future joint venture Extime Travel

Essentials Paris

Following the advertising and competitive

bidding process launched by Groupe ADP for the Travel Essentials

business (including books and press products, gifts and souvenirs,

groceries and take-away snacks, and travel accessories) for the

Paris-Charles de Gaulle and Paris-Orly airports, Lagardère Travel

Retail was chosen to become the co-partner in Extime Travel

Essentials Paris (see press release of July 24th, 2023 – available

in French only)

Subject to the approval of the relevant

competition authorities, Extime Travel Essentials Paris will

operate over sixty sale points for a period of ten years starting

February 1st, 2024, notably under the RELAY banner

and in partnership with a large number of brands. The joint venture

will be equally owned by the Groupe ADP (50%) and Lagardère Travel

Retail (50%).

Support for low-carbon aviation and

electric urban air mobility

On the occasion of the Paris Air Forum and the

Paris Air Show which took place from June 19th to

June 25th, 2023, Groupe ADP has announced the

completion of several projects that are part of the active approach

deployed by the group to support the decarbonization of the

sector:

-

Air Liquide and Groupe ADP announced on June 16th,

2023 (see press release) the creation of "Hydrogen Airport",

engineering and consulting joint venture specializing in helping

airports integrate hydrogen projects within their infrastructures.

The governance team is in place and the joint venture has begun

commercial activities.

-

Groupe ADP and Volocopter, alongside the French Civil Aviation

Authority (DGAC) and Paris Region, have confirmed, in a joint press

release on June 20th, 2023 (see press release),

that all safety, airspace integration, acceptability and passenger

route conditions have been fulfilled at this stage in view of the

launch of the first eVTOL (electric vertical take-off and landing)

aircraft services over Paris Region skies for the 2024 Olympic and

Paralympic Games.

-

Groupe ADP has announced on June 21th, 2023 (see

press release) having joined forces with six leaders in carbon-free

regional aviation to accelerate the introduction of electric- and

hydrogen-powered 2 to 100-seat aircraft on its airfields and at

Paris-Le Bourget, Paris-Orly and Paris-CDG airports before 2030.

These new aircraft are thus set to decarbonize flights around

aerodromes, and to serve radial, regional and short-haul routes in

Europe.

The Paris 2024 Olympic and Paralympic

Games as a driver of innovation towards the airport of

tomorrow

Ahead of the Paris 2024 Olympic and Paralympic

Games, the group is conducting innovative projects at Paris

airports with the aim of achieving greater operational efficiency,

enhanced service quality and lower environmental impact:

-

Gradual experimentation with a remote check-in service, offering

greater freedom and mobility for travelers and smoother management

of peaks in this activity by Parisian airports. A large-scale

implementation is targeted for summer 2024 at the Olympic Village,

for athletes;

-

Experimentation at Paris-Orly of a new explosives detector

technology based on 3D scanners, enabling faster baggage screening

without removing electronic devices and liquids;

-

Experimentation with an electric towing vehicle at Paris-Charles de

Gaulle, enabling minimal use of aircraft engines while taxiing on

the platform;

These initiatives are in line with the "2025

Pioneers" strategic roadmap objective of rolling out 120 innovative

experiments by 2025.

Groupe ADP's half-year 2023 results presentation

Half-year

2023 consolidated accounts

|

(in millions of euros) |

H1 2023 |

H1 2022 |

2023/2022 |

|

Revenue |

2,545 |

2,006 |

+€539M |

+26.9% |

|

EBITDA |

863 |

702 |

+€161M |

+22.9% |

|

EBITDA / Revenue |

33.9% |

35.0% |

-1.1pt |

- |

|

Operating income from ordinary activities |

449 |

340 |

+€109M |

+31.6% |

|

Income from ordinary activities / Revenue |

17.6% |

17.0% |

+0.6pt |

- |

|

Operating income |

444 |

348 |

+€96M |

+27.5% |

|

Financial result |

(139) |

(121) |

-€18M |

+14.8% |

|

Net income attributable to the Group |

211 |

160 |

+€51M |

+31.8% |

Revenue

|

(in millions of euros) |

H1 2023 |

H1 2022 |

2023/2022 |

|

Revenue |

2,545 |

2,006 |

+€539M |

+26.9% |

|

Aviation |

919 |

741 |

+€178M |

+23.9% |

|

Retail and services |

818 |

625 |

+€193M |

+30.8% |

|

of which Extime Duty Free Paris |

344 |

254 |

+€90M |

+35.3% |

|

of which Relay@ADP |

52 |

39 |

+€13M |

+33.3% |

|

Real estate |

167 |

156 |

+€11M |

+7.6% |

|

International and airport developments |

709 |

538 |

+€171M |

+31.8% |

|

of which TAV Airports |

558 |

410 |

+€148M |

+36.3% |

|

of which AIG |

126 |

104 |

+€22M |

+21.5% |

|

Other activities |

90 |

83 |

+€8M |

+9.1% |

|

Inter-sector eliminations |

(158) |

(137) |

-€21M |

+15.1% |

Groupe ADP's consolidated

revenue stood at 2,545 million euros in 1st half of

2023, up +26.9% (+539 million euros) compared to the 1st half

of 2022, mainly due to the positive effect of traffic recovery

on:

-

Revenue of Aviation activities in Paris, was up +23.9% (+178

million euros), to 919 million euros;

-

Revenue of Retail and Services in Paris, was up +30.8% (+193

million euros), to 818 million euros;

-

Revenue of International and airport developments segments,

especially in TAV Airports, was up +31.8%

(+171 million euros), to 709 million euros.

The amount of inter-sector eliminations stood at

158 million euros (+15.1%) over the 1st half of 2023, compared to

137 million euros during the same period in 2022.

EBITDA

|

(in millions of euros) |

H1 2023 |

H1 2022 |

2023/2022 |

|

Revenue |

2,545 |

2,006 |

+€539M |

+26.9% |

|

|

Operating expenses |

(1,729) |

(1,367) |

-€362M |

+26.4% |

|

|

Consumables |

(402) |

(309) |

-€93M |

+30.0% |

|

|

External services |

(597) |

(473) |

-€124M |

+26.4% |

|

|

Employee benefit costs |

(496) |

(384) |

-€112M |

+29.1% |

|

|

Taxes other than income taxes |

(176) |

(151) |

-€25M |

+16.7% |

|

|

Other operating expenses |

(57) |

(50) |

-€7M |

+14.4% |

|

|

Other incomes and expenses |

47 |

64 |

-€17M |

-26.9% |

|

|

EBITDA |

863 |

702 |

+€161M |

+22.9% |

|

|

EBITDA/Revenue |

33.9% |

35.0% |

-1.1pt |

- |

|

Group's operating expenses

stood at 1,729 million euros in the 1st half of 2023, up +26.4%

(+362 million euros). The distribution of the group's

operating expenses was as follows:

-

Consumables stood at 402 million euros, up

+30.0% (+93 million euros), mainly due to:

-

The increase of +49 million euros (+45.1%) for TAV Airports, of

which 46 million euros (+63.2%) for Almaty;

- The increase of +33 million

euros (+28.4%) for the retail subsidiaries (Extime Duty Free Paris

and Relay@ADP) due to the increase in cost of goods sold, in

line with the increase in revenue of these subsidiaries.

- External

services stood at 597 million euros, up +26.4% (+124

million euros), due to:

-

The increase in expenses related to subcontracting for +57 million

euros (+24.5%) especially in PRM subcontracting (reception and

assistance for Persons with Reduced Mobility), due to the traffic

recovery and the reopening of the infrastructures in Paris

that were still closed in the 1st half of 2022;

- The increase in expenses related to

other services and external expenses for +49 million euros

(+30.3%), due in particular to the mechanical increase in the

concession rent in Amman for +13 million euros (+22.5%), linked to

the increase in revenue of AIG (+21.5%).

- Employee

benefits costs stood at 496 million euros. Their increase

by +29.1% (+112 million euros), reflects the impact of recruitments

made in 2022 and in 1st half of 2023, as well as:

- +20 million euros

from the base effect of an employee benefits provision reversal

accounted for in the 1st half of 2022 (related to the termination

of the "article 39" defined-benefit pension plan);

- The effect linked

to measures salaries increase implemented in July 2022 and in

January 2023 on employee benefits costs of Aéroports de Paris, for

+14 million euros;

- An increase in

employee benefits costs of TAV Airports for +47 million euros

(+48.6%), due to increase of salaries in Turkey, mainly due to

inflation and, to a lesser measure, an increase in the number of

employees.

-

Taxes other than income taxes stood at 176

million euros, up +16.7% (+25 million euros), due to:

-

An increase in property taxes in Paris of +18 million euros

(+25.8%), mainly due to the unfavorable base effect of property tax

reductions in 2022, linked to infrastructure closures in Paris in

2020;

-

An increase in taxes on security services of +5 million euros

(+16.5%), linked to traffic growth;

-

Other operating expenses stood at 57 million

euros, up +14.4% (+7 million euros).

Other income and expenses

represented a net product of 47 million euros, down -26.9% (-17

million euros) due to:

- Unfavorable base

effect of a reversal of an international provision booked in 1st

half of 2022;

-

Losses on unrecoverable receivables in Paris;

-

Income of 17 million euros from the sale of excess electrical

capacities by Aéroports de Paris.

Over 1st half of 2023, the group's

consolidated EBITDA stood at 863

million euros, up +22.9% (+161 million euros). EBITDA margin stood

at 33.9% of revenue as of 1st half of 2023, down -1.1 point due to

the trend in ordinary expenses, and the normalization of Almaty's

performance after a particularly strong performance in 2022 (see

page 14, International segment performance).

Net result attributable to the Group

|

(in millions of euros) |

H1 2023 |

H1 2022 |

2023/2022 |

|

|

EBITDA |

863 |

702 |

+€161M |

+22.9% |

|

Amortization and impairment of tangible and intangible assets |

(396) |

(356) |

-€40M |

+11.4% |

|

Share of profit or loss in associates and joint ventures |

(18) |

(6) |

-€12M |

+222.8% |

|

Operating income from ordinary activities |

449 |

340 |

+€109M |

+31.6% |

|

Other operating income and expenses |

(5) |

8 |

-€13M |

- |

|

Operating income |

444 |

348 |

+€96M |

+27.5% |

|

Financial income |

(139) |

(121) |

-€18M |

+14.8% |

|

Income before tax |

305 |

227 |

+€78M |

+34.3% |

|

Income tax expense |

(110) |

(59) |

-€51M |

+85.8% |

|

Net income from continuing operations |

195 |

168 |

+€27M |

+16.1% |

|

Net income from discontinued operations |

- |

(1) |

- |

-73.2% |

|

Net income |

194 |

167 |

+€27M |

+16.4% |

|

Net income attributable to non-controlling interests |

17 |

(7) |

+€24M |

- |

|

Net income attributable to the Group |

211 |

160 |

+€51M |

+31.8% |

Amortization and

impairment of tangible and intangible assets stood at 396

million euros, up +11.4% (+40 million euros), mainly due to:

-

The increase of amortization and impairment of TAV Airports for +28

million euros (+57.5%). This evolution reflects the increase of the

amount of amortization of Airport Operating Rights (AOR) of several

of TAV assets, which is calculated according to the level of

traffic7;

- The unfavorable

base effect of a reversal of an international impairment loss of 10

million euros, booked in the 1st half of 2022.

Share of profit or loss in associates

and joint ventures stood at -18 million euros, down -12

million euros, mainly due to:

-

The performance of TAV Airports' equity-accounted companies, up +1

million euros, despite the impact of the earthquake tax in Turkey,

standing at -6.5 million euros;

-

The unfavorable base effect of the net gain of 6 million euros

recorded in 2022 in the context of disposal of the share capital

held by ADP International in ATOL, the company operating Mauritius

airport;

-

The net result attributable to GMR Airports, down -14 million

euros.

Operating income from

ordinary activities stood at 449 million euros, up +31.6%

(+109 million euros), driven by the EBITDA, up +161 million

euros (+22.9%), partially offset by the items described above.

Operating income stood at 444

million euros, up +27.5% (+96 million euros), especially due to the

increase of operating income from ordinary activities.

Financial result stood at -139

million euros, down -18 million euros (+14.8%), mainly due to the

increase of gross cost of debt of TAV Airports for -17 million

euros.

The income tax expense stood at

110 million euros, compared to 59 million euros in 1st half of

2022 due to the increase of income before tax.

Net income stood at 194 million

euros on 1st half of 2023, up +16.4% (+27 million euros) compared

to the same period in 2022.

Net income attributable to

non-controlling interests was up +24 million euros, to 17

million euros.

Given all these items, net income

attributable to the

Group stood at 211 million euros,

up +31.8% (+51 million euros) compared to the same period in

2022.

Cash and investments

As of June 30th, 2023, Groupe ADP had

cash position of 2.3 billion

euros. Over the 1st half of 2023, cash is down -380 million euros

(-14.4%), operating cash flows, standing at 681 million euros was

more than offset by:

-

The subscription by Groupe ADP of 330,817 Foreign Currency

Convertible Bonds8 (FCCBs) issued by GIL for a total amount of

c.331 million euros;

-

Payment on April 27th, 2023 by Groupe ADP of 119 million euros to

the Turkish airport authority, DHMI, representing the upfront

payment of 25% of the Ankara concession rent;

-

Ex-dividend on June 7th,2023, for an amount of €3.13 per share, or

309 million euros.

In view of this available cash and its forecasts

for 2023, the group has liquidity that it considers satisfactory

in the current macroeconomic context and to meet its

operating needs and financial commitments.

Tangible and intangible

investments stood at 353 million euros over 1st half of

2023, compared to 270 million euros over 1st half of 2022.

Financial debt

Groupe ADP's net financial debt

stood at 8,089 million euros as of June 30th, 2023, compared

to 7,440 million euros as of December 31st, 2022. As of

June 30th, 2023, debt ratio stood at 4.3x EBITDA over the last 12

months, compared to 4.4x EBITDA at the end of 2022.

Analysis by segment

Aviation – Parisian platforms

|

(in millions of euros) |

H1 2023 |

H1 2022 |

2023/2022 |

|

Revenue |

919 |

741 |

+€178M |

+23.9% |

|

Airport fees |

543 |

434 |

+€109M |

+25.1% |

|

Passenger fees |

341 |

259 |

+€82M |

+31.5% |

|

Landing fees |

121 |

103 |

+€18M |

+17.5% |

|

Parking fees |

81 |

72 |

+€9M |

+12.9% |

|

Ancillary fees |

119 |

92 |

+€27M |

+28.6% |

|

Revenue from airport safety and security services |

238 |

198 |

+€40M |

+20.1% |

|

Other income |

19 |

16 |

+€3M |

+13.8% |

|

EBITDA |

224 |

186 |

+€38M |

+20.6% |

|

Operating income from ordinary activities |

37 |

7 |

+€30M |

- |

|

EBITDA / Revenue |

24.4% |

25.0% |

-0.6pt |

- |

|

Op. Income from ordinary activities / Revenue |

4.0% |

0.9% |

+3.1pts |

- |

Over 1st half of 2023, revenue of

aviation segment, which relates solely to the airport

activities carried out by Aéroports de Paris as operator

of the Parisian platforms, was up +23.9% (+178 million euros)

to 919 million euros.

Revenue from airport fees

(passenger fees, landing fees and aircraft parking fees) was up

+25.1% (+109 million euros), to 543 million euros due

to:

- the increase of +82 million euros

(+31.5%) of the revenue from passenger fees, due to the increase in

passenger traffic (+25.7%) as well as the increase of international

share of traffic (see geographical breakdown traffic on page

17);

- the increase of +18 million euros

(+17.5%) of the revenue from landing fees, due to the increase in

aircraft movements (+14.3%);

- the increase of +9 million euros

(+12.9%) of the revenue from parking fees.

Revenue from ancillary fees was

up +28.6% (+27 million euros), to 119 million euros, linked to the

increase in passenger traffic.

Revenue from airport safety and security

services was up +20.1% (+40 million euros), to 238 million

euros. Revenue from operating safety and security services are

determined by the partially fixed costs of these activities,

revenue is growing at a lower rate than passenger traffic.

Other income, mostly consisting

in re-invoicing to the French Air Navigation Services Division of

leasing associated with the use of terminals and

other work services made for third parties are up +13.8% (+3

million euros), to 19 million euros.

EBITDA was up +20.6% (+38

million euros) to 224 million euros due to the increase in

revenue.

Operating income from ordinary

activities was up +30 million euros, to 37 million euros

over 1st half of 2023, due to the EBITDA increase.

Retail and services – Parisian platforms

|

(in millions of euros) |

H1 2023 |

H1 2022 |

2023/2022 |

|

Revenue |

818 |

625 |

+€193M |

+30.8% |

|

Retail activities |

515 |

367 |

+€148M |

+40.2% |

|

Extime Duty Free Paris |

344 |

254 |

+€90M |

+35.3% |

|

Relay@ADP |

52 |

39 |

+€13M |

+33.3% |

|

Other Shops and Bars and restaurants |

78 |

44 |

+€34M |

+76.1% |

|

Advertising |

20 |

13 |

+€7M |

+56.7% |

|

Other products |

21 |

17 |

+€4M |

+25.4% |

|

Car parks and access roads |

83 |

67 |

+€16M |

+24.9% |

|

Industrial services revenue |

105 |

91 |

+€14M |

+15.4% |

|

Rental income |

79 |

69 |

+€10M |

+14.7% |

|

Other income |

37 |

32 |

+€5M |

+13.2% |

|

EBITDA |

345 |

250 |

+€95M |

+38.0% |

|

Operating income from ordinary activities |

276 |

183 |

+€93M |

+50.8% |

|

EBITDA / Revenue |

42.2% |

40.0% |

+2.2pts |

- |

|

Op. income from ordinary activities / Revenue |

33.8% |

29.3% |

+4.5pts |

- |

Over the 1st half of 2023, Retail and

services segment revenue, which includes only Parisian

activities was up +30.8% (+193 million euros),

to 818 million euros.

Revenue from retail activities

consists in revenue received from airside and landside shops, bars

and restaurants, banking and foreign exchange activities, and

car rental companies, as well as revenue from advertising.

Over the 1st half of 2023, revenue from retail

activities was up +40.2% (+148 million euros), to 515 million

euros, due to:

-

revenue from Extime Duty Free, was up +35.3% (+90 million euros),

to 344 million euros and from Relay@ADP, up +33.3% (+13 million

euros), to 52 million euros due to increase in attendance and

the number of outlets opened compared to the same period in

2022;

-

revenue from Other Shops and Bars and restaurants, was up +76.1%

(+34 million euros), to 78 million euros due the increase of number

of outlets opened compared to 1st half of 2022;

-

revenue from advertising, was up +56.7% (+7 million euros), to 20

million euros due to the increase in attendance.

Revenue from car

parks was up +24.9% (+16 million euros), to 83

million euros, linked to the increase of passengers traffic.

Revenue from industrial

services (supply of electricity and water) was up +15.4%

(+14 million euros), to 105 million euros.

Rental revenue (leasing of

spaces within terminals), was up +14.7% (+10 million euros), to 79

million euros.

Other revenue (primarily

constituted of internal services) was up +13.2% (+5 million euros),

to 37 million euros.

EBITDA was up +38.0% (+95

million euros), to 345 million euros, mainly due to higher revenue

from retail activities, notably Extime Duty Free Paris.

Operating income from ordinary

activities was up +50.8% (+93 million euros), to 276

million euros, due to the EBITDA increase.

Real Estate - Parisian platforms

|

(in millions of euros) |

H1 2023 |

H1 2022 |

2023/2022 |

|

Revenue |

167 |

156 |

+€11M |

+7.6% |

|

External revenue |

146 |

132 |

+€14M |

+10.6% |

|

Land |

65 |

60 |

+€5M |

+7.5% |

|

Buildings |

49 |

42 |

+€7M |

+17.4% |

|

Others |

32 |

30 |

+€2M |

+7.3% |

|

Internal revenue |

22 |

24 |

-€2M |

-9.2% |

|

EBITDA |

109 |

91 |

+€18M |

+19.9% |

|

Operating income from ordinary activities |

81 |

57 |

+€24M |

+40.8% |

|

EBITDA / Revenue |

65.1% |

58.4% |

+6.7pts |

- |

|

Op. income from ordinary activities / Revenue |

48.3% |

36.9% |

+11.4pts |

- |

Over the 1st half of 2023, revenue from

the Real Estate segment, which includes only Parisian

activities, up +7.6% (+11 million euros), to 167 million

euros.

External revenue realized with

third parties, up +10.6% (+14 million euros), to 146 million euros,

mainly due to additional rents related to assets returned to full

ownership in 2022 and the effect of indexation clauses on

rents.

Internal

revenue, down -9.2% (-2 million euros),

to 22 million euros notably as a result of the reduced use of

internally offices, through the implementation of a new flex office

organization. The space freed up in this way being attended to be

rented out to third parties.

EBITDA of the segment up +19.9%

(+18 million euros), to 109 million euros.

Operating income from ordinary

activities up +40.8% (+24 million euros), to 81 million

euros.

International and airport developments

|

(in millions of euros) |

H1 2023 |

H1 2022 |

2023/2022 |

|

Revenue |

709 |

538 |

+€171M |

+31.8% |

|

ADP International |

134 |

121 |

+€13M |

+10.7% |

|

of which AIG |

126 |

104 |

+€22M |

+21.5% |

|

of which ADP Ingénierie |

5 |

12 |

-€7M |

-55.8% |

|

TAV Airports |

558 |

410 |

+€148M |

+36.3% |

|

Société de Distribution Aéroportuaire Croatie |

8 |

6 |

+€2M |

+23.3% |

|

EBITDA |

167 |

163 |

+€4M |

+2.4% |

|

Share of profit or loss in associates and joint ventures |

(22) |

(6) |

-€16M |

+258.5% |

|

Operating income from ordinary activities |

45 |

90 |

-€45M |

-50.7% |

|

EBITDA / Revenue |

23.6% |

30.3% |

-6.7pts |

- |

|

Op. from ordinary activities / Revenue |

6.3% |

16.8% |

-10.5pts |

- |

Over the 1st half of 2023, revenue from

the International and airport developments segment was up

+31.8% (+171 million euros), to 709 million euros, mainly due

to the increase in revenue from TAV Airports and AIG.

Revenue from AIG was up +21.5%

(+22 million euros), to 126 million euros, mainly due to the

increase of +34.8% of revenue from airport fees, linked to the

increase of traffic in Amman, up +33.9%.

Revenue from ADP Ingénierie

down -55.8% (-7 million euros) to 5 million euros, linked with the

business restructuring project currently underway.

TAV Airports

revenue was up +36.3% (+148 million euros), to 558

million euros, due to:

- the effect of increased traffic on

the revenue of the assets managed by TAV Airports, notably at

Almaty, up +53 million euros, in Georgia, up +10 million

euros, and at Izmir up +8 million euros.

- the increases of

revenue of TAV Airports' service companies, notably Havas (company

specialized in ground handling), for +32 million euros, due to the

increase in the number of flights served, TAV OS (company

specialized in lounges) for +20 million euros and BTA (company

specialized in bars and restaurants), for +12 million euros, due to

the increase in traffic.

EBITDA of segment was up +2.4%

(+4 million euros), to 167 million euros:

-

TAV Airports' record an EBITDA at 145 million

euros, up +18 million euros (+13.9%), despite the decrease of

Almaty airport EBITDA (-1 million euros), whose business is

normalizing compared to 2022 which was particularly strong;

-

AIG record an EBITDA at 34 million euros, up +4

million euros (+11.5%), due to the increase in revenue and despite

the increase of currents expenses up +16 million euros, especially

linked to the increase of 13 million for concession rents following

the takeover of the business;

-

These contributions were partially offset by the unfavorable base

effect of a reversal of an international provision booked in the

1st half of 2022.

Operating income from ordinary

activities of the segment stood at 45 million euros,

down -50.7% (-45 million euros), due to:

- The increase in depreciation and

amortization at TAV Airports of +28 million euros (+57.5%). This

increase is mainly due to higher depreciation of operating rights

at several TAV Airports airports, which are calculated on the basis

of traffic9 levels;

- the decrease in results from

equity-accounted companies, for -16 million euros, to -22

million euros, due to the decrease in GMR Airports' contribution

for -14 million euros, and of an unfavorable base effect of the net

gain of 6 million euros recognized in 2022 on the disposal of ADP

International's shares in ATOL, the company operating Mauritius

airport.

Hyperinflation in

Turkey: In the context of very high

inflation in Turkey, group entities whose functional currency is

the Turkish lira are obliged to apply the provisions of IAS 29

"Financial Reporting in Hyperinflationary Economies" from February

2022 onwards, requiring the restatement of the financial statements

to take account of changes in the general purchasing power of this

currency. The limited effect on the Group's financial statements is

described in note 2 of the consolidated financial statements.

Other activities

|

(in millions of euros) |

H1 2023 |

H1 2022 |

2023/2022 |

|

Products |

90 |

83 |

+€7M |

+9.1% |

|

Hub One |

81 |

78 |

+€3M |

+3.8% |

|

EBITDA |

17 |

13 |

+€4M |

+35.6% |

|

Operating income from ordinary activities |

10 |

4 |

+€6M |

+168.0% |

|

EBITDA / Products |

19.0% |

15.3% |

+3.7pts |

- |

|

Op. income from ordinary activities / Products |

10.7% |

4.4% |

+6.3pts |

- |

Over the 1st half of 2023, products from

the other activities segment, were up +9.1% (+7 million

euros), to 90 million euros.

Revenue from Hub One was up +3.8% (+3 million

euros), to 81 million euros.

EBITDA was up +35.6% (+4

million euros), to 17 million euros.

Operating income from ordinary

activities was up +168.0% (+6 million euros) compared to

the same period in 2022, to 10 million euros.

Traffic evolution in the 1st half of 2023

Group

Traffic10:

|

PASSAGERS |

H1 2023 |

|

Passengers |

Change

23/22 |

Recoveryvs.

2019 |

|

Paris-CDG |

31,778,035 |

+27.9% |

87.5% |

|

Paris-Orly |

15,316,869 |

+21.4% |

95.8% |

|

Total Paris Aéroport |

47,094,904 |

+25.7% |

90.0% |

|

Antalya |

12,870,273 |

+26.5% |

95.7% |

|

Almaty |

4,186,077 |

+37.1% |

150.0% |

|

Ankara |

5,495,966 |

+39.9% |

78.6% |

|

Izmir |

4,710,465 |

+11.0% |

81.1% |

|

Bodrum |

1,388,951 |

+7.4% |

90.8% |

|

Gazipaşa |

342,234 |

+20.0% |

80.0% |

|

Medina |

4,682,023 |

+69.3% |

113.5% |

|

Tunisia |

790,935 |

+71.2% |

73.0% |

|

Georgia |

1,801,900 |

+30.8% |

85.2% |

|

North Macedonia |

1,338,406 |

+41.1% |

115.0% |

|

Zagreb |

1,693,532 |

+30.3% |

110.4% |

|

Total TAV Airports |

39,300,762 |

+31.7% |

95.8% |

|

New Delhi |

35,765,336 |

+31.5% |

109.8% |

|

Hyderabad |

11,928,030 |

+36.4% |

108.1% |

|

Medan |

3,768,092 |

+47.8% |

97.1% |

|

Goa |

1,632,053 |

- |

- |

|

Total GMR Airports11 |

53,093,511 |

+33.7% |

108.4% |

|

Santiago de Chile |

11,133,883 |

+27.5% |

88.5% |

|

Amman |

4,350,608 |

+33.9% |

104.9% |

|

Other airports12 |

424,122 |

+90.0% |

82.0% |

|

GROUPE ADP11 |

155,397,790 |

+30.3% |

97.3% |

Traffic

at Paris Aéroport

Over the 1st half of 2023, Paris Aéroport

traffic was up +25.7% with a total of 47.1 million of passengers,

at 90.0% of traffic in the same period in 2019.

Geographical breakdown is as follows:

- Traffic within mainland France was

up +2.2% compared to the same period in 2022, at 75.1% of 2019

level;

- Traffic with the French Overseas

Territories was up +7.1% compared to the same period in 2022,

at 97.2% of 2019 level.

- European traffic (excluding France)

was up +24.9% compared to the same period in 2022, at 92.8% of 2019

level;

- International traffic (excluding

Europe and French Overseas Territories) was up +41.4% compared to

the same period in 2022, at 92.0% of 2019 level, due to the

increase of the following destinations: North America (+33.3%),

Latin America (+8.9%), Middle-East (+32.5%), Asia-Pacific

(+175.3%) and Africa (+38.8%).

IMPORTANT NOTE: Since the traffic release of

December and the year 2022, the geographical breakdown at Paris

Aéroport within this release as well as in the historical data used

for variation and recovery calculations are aligned with the

different categories applicable to airport fees. It presents the

detailed breakdown of the "Europe" traffic into three categories:

"Schengen Area" traffic, "UE excluding Schengen & United

Kingdom" traffic, and "Other Europe" traffic. Traffic with "French

overseas territories", is presented separately from the

"International" traffic, in which it was included until the

November 2022 traffic release. It is reminded that airports fees

applicable to these different categories are available on the

company website.

| |

H1 2023 |

|

|

Share of traffic |

Change

23/22 |

Recoveryvs.

2019 |

|

Mainland France |

12.8% |

+2.2% |

75.1% |

|

French Overseas Territories |

4.8% |

+7.1% |

97.2% |

|

Schengen Area |

36.9% |

+23.1% |

95.9% |

|

EU ex. Schengen & United-Kingdom13 |

6.1% |

+37.8% |

91.3% |

|

Other Europe |

2.3% |

+23.0% |

62.8% |

|

Europe |

45.3% |

+24.9% |

92.8% |

|

Africa |

13.0% |

+38.8% |

106.0% |

|

North America |

11.2% |

+33.3% |

98.6% |

|

Latin America |

2.9% |

+8.9% |

79.6% |

|

Middle East |

5.5% |

+32.5% |

95.8% |

|

Asia-Pacific |

4.5% |

+175.3% |

61.4% |

|

Other International |

37.1% |

+41.4% |

92.0% |

|

PARIS AEROPORT |

100.0% |

+25.7% |

90.0% |

The number of connecting passengers was up

+19.8%. Connecting rate stood at 20.3%, down – 1.1 point compared

to 1st half of 2022. Seat load factor was up +6.1 points, at

84.5%.

Aircraft movements at Paris Aéroport was up

+14.3%, at 311,701 movements, of which 214,247 movements

at Paris-Charles de Gaulle, up +16.4%, at 88.9% of

2019 level, and 97,454 movements at Paris-Orly, up +10.1%, at

88.0% of 2019 level.

Events occurred since June 30th, 2023

TAV Airports sells part of its stake in

Medina airport

TAV Airports have signed a share purchase

agreement (SPA) with Mada International Holding (Mada) on July 7th,

2023 of 24% of shares of Tibah Airports Development (Tibah), the

company operating Medina airport in Saudi Arabia, equally owned by

TAV Airports and Mada. This agreement provides that:

-

TAV Airports will transfer 24% of shares of TIBAH to Mada for a

consideration of USD135 million, leading the shareholding of TAV

Airports in Tibah to 26% (against 50% previously);

-

If the total passengers served in Medinah Airport for the calendar

year of 2023 is below 8.14 million passengers and the force-majeure

period is extended for one more year, the purchase price will be

updated to USD165 million.

-

With the financial close of Group’s TIBAH share sale, expected

during the 2nd half of 2023, TAV Airports will also transfer 48% of

the balance of the shareholder loan to Mada.

In addition, a new shareholder agreement will be

signed with Mada, preserving the current method of co-controlling

governance of TIBAH.

Reminder of traffic assumptions, forecasts and targets

2023-2025

As part of the 2025 Pioneers strategic roadmap

communicated on February 16th, 2022, Groupe ADP has set out targets

up to 2025. These targets have been built on the assumptions of no

new restrictions or airport closures linked to the health crisis,

of a stability of the economic model in Paris and of an absence of

abnormally high volatility in terms of exchange rates and inflation

rates. They have also been built on the basis of the consolidation

scope at the end of 2021, with no assumption of changes up to

2025.

It is specified that any further changes to the

assumptions on which the group's targets are based could have an

impact on the volume of traffic and the 2025 Pioneers financial

indicators.

|

|

2023 |

2024 |

2025 |

|

Group traffic14In % of 2019

traffic |

95% - 105% |

- |

- |

|

Back to 2019 level between 2023 and 2024 |

|

Traffic at Paris AéroportIn % of 2019 traffic

|

87% - 93% |

90% - 100% |

95% - 105% |

|

Back to 2019 level between 2024 and 2026,above 2019 level from

2026 |

|

Extime Paris Sales / Pax15In

euros |

- |

- |

€29.5 |

|

ADP SA operating expensesper

passenger, in € |

- |

€17 - €20 / pax |

|

Group EBITDA growthCompared to 2019 |

At least equal to the 2019 EBITDA (i.e. ≥ €1,772M) |

- |

- |

|

Group EBITDA margin In % of revenue |

32% to 37% |

35% to 38% |

|

Net income, attributable to the Groupin millions

of euros |

Positive |

|

Group investments(excl. financial

investments) |

c.1.3 billion euros per year on average between 2023 and 2025, in

current euros |

|

ADP SA investments(excl. financial investments,

regulated and non-regulated) |

c.900 million euros per year on average between 2023 and 2025, in

current euros |

|

Net Financial Debt/ EBITDA ratio incl.

Selective international growth |

- |

- |

3.5x – 4.5x |

|

DividendsIn % of the NRAG due for the year N, paid

N+1 |

60% pay out rateMinimum of €3 per share |

Financial calendar16

-

A conference call (audiocast in english) will be held on

Thursday July

27th,

2023, at 06:00 pm

(CET). The presentation can be followed live at

the below links, which are also posted on the Groupe ADP

website:

A live webcast of the conference will be

available at the following link: webcast (only in english)

Registration to participate in the Q&A

session is available at the following link: call registration

-

Next traffic

publication: Wednesday august 16th, 2023 – July 2023 traffic

figures

-

Next financial

results publication: Wednesday

October 25th, 2023 - 2023 nine months revenue

-

Next thematic conferences:

- Real Estate

thematic conference: November 2023

-

GMR Airports thematic conference: Upon

contemplated GIL & GAL merger completion17 (expected in H1

2024)

Forward looking statements

This presentation does not constitute an offer

to purchase financial securities within the United States or in any

other country.

Forward-looking disclosures (including, if so,

forecasts and objectives) are included in this press release. These

forward-looking disclosures are based on data, assumptions and

estimates deemed reasonable at the diffusion date of the present

document but could be unprecise and are, either way, subject to

risks. There are uncertainties about the realization of predicted

events and the achievements of forecasted results. Detailed

information about these potential risks and uncertainties that

might trigger differences between considered results and obtained

results are available in the registration document filed with the

French financial markets authority on April 14th, 2023 under

D.23-0284, retrievable online on the AMF website www.amf-france.org

or Aéroports de Paris website www.parisaeroports.fr.

Aéroports de Paris does not commit and shall not

update forecasted information contained in the document to reflect

facts and posterior circumstances to the presentation date.

Definitions

Definition and accounting of Alternative

Performance Measures (APM) as well as the segmentation of group

activities presented in this press release are fully published in

the Group universal registration document. It is available in

Groupe website: AMF Information.

Investor Relations contacts:

Cécile Combeau +33 6 32 35 01 46 and Eliott Roch +33 6 98

90 85 14 - invest@adp.fr Press contact: Justine

Léger, Head of Medias and Reputation Department +33 1 74 25 23

23Groupe ADP develops and manages airports, including

Paris-Charles de Gaulle, Paris-Orly and Paris-Le Bourget. In 2022,

the group handled through its brand Paris Aéroport 86.7 million

passengers at Paris-Charles de Gaulle and Paris-Orly, and nearly

193.7 million passengers in airports abroad. Boasting an

exceptional geographic location and a major catchment area, the

Group is pursuing its strategy of adapting and modernizing its

terminal facilities and upgrading quality of services; the group

also intends to develop its retail and real estate businesses. In

2022, group revenue stood at €4,688 million and net income at

€516million.Registered office: 1, rue de France, 93 290

Tremblay-en-France. Aéroports de Paris is a public limited company

(Société Anonyme) with share capital of €296,881,806.

Registered in the Bobigny Trade and Company Register under no. 552

016 628.

groupeadp.frAppendix 1 –

Consolidated financial statement as of June 30th, 2023

Half-Year 2023

consolidated financial statement

|

(in millions of euros) |

H1 2023 |

H1 2022 |

|

Revenue |

2,545 |

2,006 |

|

Other operating income |

53 |

30 |

|

Consumables |

(402) |

(309) |

|

Personnel costs |

(496) |

(384) |

|

Other operating expenses |

(831) |

(675) |

|

Net allowances to provisions and Impairment of receivables |

(6) |

34 |

|

EBITDA |

863 |

702 |

|

EBITDA/Revenue |

33.9% |

35.0% |

|

Amortisation, depreciation and impairment of tangible and

intangible assets net of reversals |

(396) |

(356) |

|

Share of profit or loss in associates and joint ventures |

(18) |

(6) |

|

Operating income from ordinary activities |

449 |

340 |

|

Other operating income and expenses |

(5) |

8 |

|

Operating income |

444 |

348 |

|

Financial income |

397 |

169 |

|

Financial expenses |

(517) |

(290) |

|

Financial income |

(139) |

(121) |

|

Income before tax |

305 |

227 |

|

Income tax expense |

(110) |

(59) |

|

Net results from continuing activities |

195 |

168 |

|

Net results from discontinued activities |

- |

(1) |

|

Net income |

194 |

167 |

|

Net income attributable to the Group |

211 |

160 |

|

Net income attributable to non-controlling interests |

(17) |

7 |

|

Earnings per share attributable to owners of the parent

company |

|

|

|

Basic earnings per share (in €) |

2.14 |

1.62 |

|

Diluted earnings per share (in €) |

2.14 |

1.62 |

|

Earnings per share from continuing activities attributable

to the Group |

|

|

|

Basic earnings per share (in €) |

2.14 |

1.62 |

|

Diluted earnings per share (in €) |

2.14 |

1.62 |

Consolidated balance sheet as of June

30th,

2023

|

(in millions of euros) |

As of 30/06/2023 |

As of

30/06/2022 |

|

Intangible assets |

2,915 |

3,004 |

|

Property, plant and equipment |

8,342 |

8,253 |

|

Investment property |

616 |

621 |

|

Investments in associates |

1,774 |

1,879 |

|

Other non-current financial assets |

1,192 |

668 |

|

Deferred tax assets |

34 |

42 |

|

Non-current assets |

14,873 |

14,467 |

|

Inventories |

127 |

133 |

|

Contract assets |

1 |

4 |

|

Trade receivables |

1,113 |

938 |

|

Other receivables and prepaid expenses |

382 |

307 |

|

Other current financial assets |

229 |

237 |

|

Current tax assets |

31 |

121 |

|

Cash and cash equivalents |

2,251 |

2,631 |

|

Current assets |

4,134 |

4,371 |

|

Assets held for sales |

43 |

7 |

|

Total assets |

19,050 |

18,845 |

|

(in millions of euros) |

As of

30/06/2023 |

As of

30/06/2022 |

|

Share capital |

297 |

297 |

|

Share premium |

543 |

543 |

|

Treasury shares |

(38) |

(40) |

|

Retained earnings |

3,385 |

3,408 |

|

Other equity items |

(205) |

(183) |

|

Shareholders' equity - Group share |

3,982 |

4,025 |

|

Non-controlling interests |

789 |

830 |

|

Shareholders' equity |

4,771 |

4,855 |

|

Non-current debt |

8,365 |

8,763 |

|

Provisions for employee benefit obligations (more than one

year) |

401 |

386 |

|

Other non-current provisions |

57 |

56 |

|

Deferred tax liabilities |

431 |

433 |

|

Other non-current liabilities |

782 |

960 |

|

Non-current liabilities |

10,036 |

10,598 |

|

Contract liabilities |

2 |

2 |

|

Trade payables and other payables |

822 |

909 |

|

Other debts and deferred income |

1,350 |

1,171 |

|

Current debt |

2,016 |

1,233 |

|

Provisions for employee benefit obligations (less than one

year) |

29 |

56 |

|

Other current provisions |

12 |

6 |

|

Current tax liabilities |

12 |

15 |

|

Current liabilities |

4,243 |

3,392 |

|

Total equity and liabilities |

19,050 |

18,845 |

Half-Year 2023 consolidated statement

of cash flows

|

(in millions of euros) |

H1

2023 |

H1

2022 |

|

Operating income |

444 |

348 |

|

Income and expense with no impact on net cash |

393 |

244 |

|

Net financial expense other than cost of debt |

(21) |

17 |

|

Operating cash flow before change in working capital and

tax |

816 |

609 |

|

Change in working capital |

(106) |

22 |

|

Tax expenses |

(28) |

(11) |

|

Impact of discontinued activities |

(1) |

1 |

|

Cash flows from operating activities |

681 |

621 |

|

Purchase of tangible assets, intangible assets and investment

property |

(353) |

(270) |

|

Change in debt and advances on asset acquisitions |

(38) |

(104) |

|

Acquisitions of subsidiaries and investments (net of cash

acquired) |

(81) |

(397) |

|

Proceeds from sale of subsidiaries (net of cash sold) and

investments |

10 |

11 |

|

Change in other financial assets |

(472) |

(18) |

|

Proceeds from sale of property, plant and equipment |

2 |

4 |

|

Proceeds from sale of non-consolidated investments |

92 |

- |

|

Dividends received |

61 |

10 |

|

Cash flows from investing activities |

(779) |

(764) |

|

Proceeds from long-term debt |

306 |

340 |

|

Repayment of long-term debt |

(134) |

(564) |

|

Repayments of lease liabilities and related financial charges |

(10) |

(10) |

|

Capital grants received in the period |

2 |

10 |

|

Revenue from issue of shares or other equity instruments |

- |

(2) |

|

Net purchase/disposal of treasury shares |

(1) |

- |

|

Dividends paid to shareholders of the parent company |

(309) |

- |

|

Dividends paid to non controlling interests in the

subsidiaries |

(8) |

(7) |

|

Change in other financial liabilities |

1 |

12 |

|

Interest paid |

(162) |

(174) |

|

Interest received |

38 |

(2) |

|

Impact of discontinued activities |

- |

- |

|

Cash flows from financing activities |

(277) |

(397) |

|

Impact of currency fluctuations |

(6) |

8 |

|

Change in cash and cash equivalents |

(381) |

(532) |

|

Net cash and cash equivalents at beginning of the period |

2,630 |

2,378 |

|

Net cash and cash equivalents at end of the period |

2,249 |

1,846 |

|

of which Cash and cash equivalents |

2,251 |

1,847 |

|

of which Bank overdrafts |

(2) |

(1) |

Appendix 2 – Glossary

Definition and accounting of Alternative

Performance Measures (APM) as well as the segmentation of group

activities presented in this press release are fully published in

the Group universal registration document.

It is available in Groupe website: AMF

information - Groupe ADP (parisaeroport.fr)

Financial

indicators:

-

EBITDA is an accounting measure of the operating

performance of fully consolidated Group subsidiaries. It is

comprised of revenue and other ordinary income less purchases and

current operating expenses excluding depreciation and impairment of

property, plant and equipment and intangible assets.

-

EBITDA margin is the ratio

corresponding to: EBITDA / Revenue.

-

Gross Financial debt as defined by Groupe ADP

includes long-term and short-term borrowings and debts (including

accrued interests and hedge of the fair value of liabilities

related to these debts), debts related to the minority put option

(presented in other non-current liabilities)

-

Net Financial debt as defined by Groupe ADP refers

to gross financial debt less, fair value hedging derivatives, cash

and cash equivalents and restricted bank balances.

-

Net Financial Debt/EBITDA Ratio is the ratio

corresponding to the ratio: Net Financial Debt/EBITDA, which

measures the company's ability to repay its debt.

Operating indicators:

-

Sales / Pax Extime Paris or Sales

per passengers Extime

Paris is the ratio correponding to: Sales in the airside

activities: shops, bars & restaurants, foreign exchange &

taxe refund counters, commercial lougnes, VIP reception,

advertising and other paid services in the airside area / Departing

passengers at Paris Aéroport.

Group traffic includes airports

operated by Groupe ADP in full ownership (including partial

ownership) or under concession, receiving regular commercial

passenger traffic, excluding airports under management contract.

Historical data since 2019 is available on the Company's

website.

|

Sub-group |

Airport |

Country |

|

Paris Aéroport |

Paris-Charles de Gaulle |

France |

|

Paris-Orly |

France |

|

TAV Airports

|

Antalya |

Turkey |

|

Almaty |

Kazakhstan |

|

Ankara |

Turkey |

|

Izmir |

Turkey |

|

Bodrum |

Turkey |

|

Gazipasa |

Turkey |

|

Medina |

Saudi Arabia |

|

Monastir |

Tunisia |

|

Enfidha |

Tunisia |

|

Tbilissi |

Georgia |

|

Batumi |

Georgia |

|

Skopje |

North Macedonia |

|

Ohrid |

North Macedonia |

|

Zagreb |

Croatia |

|

GMR Airports |

Delhi |

India |

|

Hyderabad |

India |

|

Medan |

Indonesia |

|

Goa |

India |

|

ADP International |

Santiago de Chile |

Chile |

|

Amman |

Jordan |

|

Antananarivo |

Madagascar |

|

Nosy Be |

Madagascar |

Appendix 3 – Evolution of tariffs at Paris Aéroport

As a reminder, the French Transport Regulation

Authority (ART) has, for the 2022 tariff period,

i.e. since April 1st, 2022 approved the tariff

proposals as follows: a +1.54% increase in passenger fee, a freeze

in the unit rate of the parking fee and the landing fee

and an average increase of +0.95% for ancillary fees with the

exception of the PRM (Person with reduced mobility) fee which will

increase by +10.0% on the Paris-Charles de Gaulle platform and

+0.94% at Paris-Orly. For the Paris Le Bourget

airport, the ART approved fee evolutions of +0.91% for landing fees

and +19.9% for parking fees.

By its decision n°2022-087 of December 8th,

2022, published on January 13th, 2023, the ART has approved the

airport fees for Aéroports de Paris for the tariff period from

April 1st, 2023, to March 31st, 2024. The approved proposal

translates, by an average rate stability, for Paris-Charles de

Gaulle and Paris-Orly, tariffs evolutions offsetting each other.

These measures involve the reduction of the parking fee by

approximately -2.7%, the increase of the fee for assistance to

persons with reduced mobility by +2.5% at Paris-Charles de Gaulle

and by +10.0% at Paris-Orly and the +7% increase in the fixed

portion of the annual fee for check-in counters, boardings desks

and local luggage handling for Paris-Orly and Paris-Charles de

Gaulle.

For Paris-Le Bourget airport, the average

increase in fees is approximately +2.5%, resulting from a +2.1%

increase in the landing fee, a modification of the acoustic

modulation coefficients for group 6 aircrafts, a freeze in the fee

for the provision of airport circulation permits and a +2.5%

increase in the parking fee. The applicable fees are available on

the company's website.

1 Sales per passenger in the airside activities,

including shops, bars & restaurants, foreign exchange & tax

refund counters, commercial lounges, VIP reception, advertising and

other paid services in the airside area.2 Changes vs. 2022 and

traffic % vs. 2019 hereabove are calculated on a like-for-like

basis, by comparing 2023 traffic data with historical traffic data

for the current scope (see Appendix 2 of this press release),

except from Goa airport in 2023, opened on January 5th, 2023.3

Group traffic includes airports operated by Groupe ADP in full

ownership (including partial ownership) or under concession,

receiving regular commercial passenger traffic, excluding airports

under management contract. Historical data since 2019 is available

on the company's website.4 Sales per passenger in the airside

activities, including shops, bars & restaurants, foreign

exchange & tax refund counters, commercial lounges, VIP

reception, advertising and other paid services in the airside

area.5 Net financial debt compared to EBITDA over the last 12

months.6 IFRS 5 accounting standard "Non-current assets held for

sale and discontinued operations" sets out the requirements for the

classification, measurement and presentation of non-current assets

held for sale. This standard is intended to prepare the reader of

the financial statements for the future removal of the asset from

the company's balance sheet, and for the impending disappearance of

income and cash flow items.7 See note 6.1.1 "Airport Operating

Right" to the consolidated financial statements of Groupe ADP,

shown on page 381 of the 2022 Universal Registration Document .8

see press release of March 19th 2023

9 See note 6.1.1 "Airport Operating Right" to

the consolidated financial statements of Groupe ADP, shown on page

381 of the 2022 Universal Registration Document .10 Group traffic

includes traffic from airports operated by Groupe ADP in full

ownership (including partial ownership) or under concession,

receiving regular commercial passenger traffic, excluding airports

under management contract. Historical data since 2019 is available

on the company's website.11 Changes vs. 2022 and traffic % vs. 2019

hereabove are calculated on a like-for-like basis, by comparing

2023 traffic data with historical traffic data for the current

scope (see Appendix 2 of this press release), except from Goa

airport in 2023, opened on January 5th, 2023.12 Antananarivo &

Nosy Be airports.13 Traffic with Croatia was included in the EU ex.

Schengen until April 2023. It is now accounted within the Schengen

Area since April 2023 onwards.

14 Group traffic includes traffic from airports

operated by Groupe ADP in full ownership (including partial

ownership) or under concession, receiving regular commercial

passenger traffic, excluding airports under management contract.

Historical data since 2019 is available on the company's website.15

Sales per passenger in the airside activities, including shops,

bars & restaurants, foreign exchange & tax refund counters,

commercial lounges, VIP reception, advertising, and other paid

services in the airside area.16 Subject to change17 See press

release of March 19th, 2023.

- Aéroports de Paris SA - 2023 Half-year results

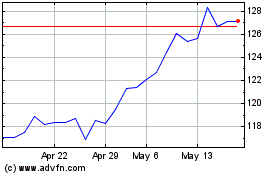

ADP Promesses (EU:ADP)

Historical Stock Chart

From Dec 2024 to Jan 2025

ADP Promesses (EU:ADP)

Historical Stock Chart

From Jan 2024 to Jan 2025