Arcadis reports 2021 second quarter and first half year

results

Accelerated organic revenue growth, further margin and

backlog improvement

- Rebound of major economies creates positive business

outlook

- Further increased demand for Sustainable Solutions reinforces

strategic choices

Second quarter results:

- Organic net revenue growth of 5.7% to €644 million (Q2 2020:

€628 million)

- Operating EBITA +20% to €59 million, margin improved to 9.2%

(Q2 2020: 7.8%)

- Net working capital at 14.3% (Q2 2020: 17.7%); DSO at 74 days

(Q2 2020: 87 days)

- Solid free cash flow of €69 million (Q2 2020: €165

million)

First half-year results:

- Organic net revenue growth of 3.0% to €1.3 billion (gross

revenues of €1.7 billion)

- Operating EBITA +21% to €117 million; margin improved to 9.2%

(H1 2020: 7.6%)

- Net income from operations per share +52% to €0.90 (H1 2020:

€0.59)

- Strong balance sheet with net debt/EBITDA ratio of 0.3x

- Organic backlog growth year-over-year 7.2%, year-to-date

4.2%

Amsterdam, 29 July 2021 – Arcadis

(EURONEXT: ARCAD), the leading global Design &

Consultancy organization for natural and built

assets, reports an organic net revenue growth of 5.7% and an

operating EBITA margin of 9.2% for the second quarter. Organic net

revenue growth for the first half year was 3.0% with an operating

EBITA margin of 9.2%. Sustained good order intake is

resulting in organic backlog growth of 7.2%

year-over-year.

CEO STATEMENTPeter Oosterveer, CEO

comments: “I am pleased with both the

increased organic revenue growth and the improved margin,

as well as with the further growth of our backlog. Although we are

still experiencing the impact of the pandemic, we see growing

demand from our clients for Arcadis services, to enable them to

mitigate the impact of climate change and create more sustainable

assets and livable communities.

Responding to the pandemic over the past 18 months has led to an

even greater focus on cross sector and cross regional

collaboration within Arcadis. We were able to increase the leverage

of our global expertise across our businesses, generating

additional benefits for our clients. Our new strategy, launched in

late 2020, is therefore proving to be a timely and prudent

springboard for consistently delivering scalable sustainable

solutions. We have leveraged our digital leadership and focused on

opportunities where we have the right to play and win. We are

convinced that a more sustainable and equitable world can only be

created if all involved are willing to maximize their collaboration

and strive to deliver on aggressive targets.

The public stimulus programs have increased sustainable

infrastructure funding in the US, the EU and the UK, as well

as renewed focus by our clients on carbon reduction and

environmental mitigation projects. Additionally, these programs

have helped to secure new projects and maintain a healthy

pipeline of opportunities. We expect this to continue given

the clear objectives of these programs and the continued severe

impact of the extreme weather conditions we have experienced in

various geographies.

Our acceleration of organic net revenue growth and improved

margin, combined with a strong order backlog and a positive

business outlook, gives us confidence in our ability

to deliver the strategic targets we have set for 2023.”

KEY FIGURES

| in € millions |

HALF YEAR |

SECOND QUARTER |

|

Period ended June 30 |

2021 |

2020 |

change |

|

2021 |

2020 |

change |

| Gross

revenues |

1,660 |

1,703 |

-3% |

|

848 |

831 |

2% |

| Organic

growth |

2% |

0% |

|

|

6% |

-3% |

|

| Net

revenues |

1,276 |

1,286 |

-1% |

|

644 |

628 |

3% |

| Organic

growth |

3% |

0% |

|

|

6% |

-3% |

|

|

EBITDA |

172 |

154 |

11% |

|

86 |

78 |

11% |

| EBITDA

margin |

13.5% |

12.0% |

|

13.4% |

12.4% |

|

|

Adjusted EBITDA1) |

134 |

113 |

18% |

|

68 |

57 |

20% |

|

EBITA |

115 |

92 |

25% |

|

58 |

47 |

24% |

| EBITA

margin |

9.0% |

7.2% |

|

|

9.0% |

7.5% |

|

|

Operating EBITA2) |

117 |

97 |

21% |

|

59 |

49 |

20% |

|

Operating EBITA margin |

9.2% |

7.6% |

|

|

9.2% |

7.8% |

|

| Net

income |

78 |

62 |

26% |

|

|

|

|

| Net

income from operations (NIFO) |

81 |

53 |

53% |

|

|

|

|

| NIFO

per share (in €) |

0.90 |

0.59 |

52% |

|

|

|

|

| Avg.

number of shares (millions) |

89.6 |

89.2 |

|

|

|

|

|

| Net

working capital % |

14.3% |

17.7% |

|

|

|

|

|

| Days

sales outstanding |

74 |

87 |

|

|

|

|

|

| Free

cash flow |

30 |

81 |

-63% |

|

69 |

165 |

|

| Net

debt1) |

107 |

316 |

|

|

|

|

|

| Backlog

net revenues (billions) |

2.1 |

2.0 |

|

|

|

|

|

| Backlog

organic growth (YTD) |

4.2% |

2.1% |

|

|

|

|

|

1) Adjusted EBITDA and Net debt are calculated according to bank

covenants: lease liabilities are excluded2) Excluding acquisition,

restructuring and integration-related costs

REVENUES BY SEGMENTAMERICAS(34%

of net revenues)

| in € millions |

HALF YEAR |

|

SECOND QUARTER |

|

Period ended June 30 |

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

| Gross

revenues |

669 |

712 |

-6% |

|

349 |

350 |

-1% |

| Net

revenues |

432 |

452 |

-4% |

|

223 |

226 |

-2% |

| Organic

growth |

5% |

|

|

|

7% |

|

|

|

EBITA |

49 |

38 |

29% |

|

|

|

|

|

Operating EBITA |

50 |

41 |

22% |

|

|

|

|

|

Operating EBITA margin |

11.5% |

9.0% |

|

|

|

|

|

North America continued to deliver very strong financial

results. Organic net revenue growth increased in all business

lines, despite two less working days in the first half year

compared to 2020. The operating EBITA margin improved, driven by

higher billability, higher quality of work and lower operating

costs. Order intake remains robust, despite the pandemic. The

Federal public stimulus plan, if passed, will create additional

opportunities for further growth. Key priority is to retain and

attract talent and to expand the usage of our Global Excellence

Center to execute the work in the backlog.

In Latin America, the organic net revenue growth was excellent

driven by infrastructure work in Brazil. The operating EBITA margin

remained in line with last year.

EUROPE & MIDDLE EAST(48% of net revenues)

| in € millions |

HALF YEAR |

|

SECOND QUARTER |

|

Period ended June 30 |

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

| Gross

revenues |

718 |

676 |

6% |

|

360 |

324 |

11% |

| Net

revenues |

609 |

573 |

6% |

|

303 |

271 |

12% |

| Organic

growth |

6% |

|

|

|

10% |

|

|

|

EBITA |

54 |

38 |

41% |

|

|

|

|

|

Operating EBITA |

55 |

40 |

39% |

|

|

|

|

|

Operating EBITA margin |

9.1% |

7.0% |

|

|

|

|

|

Organic net revenue growth in EME was mainly driven by

significant growth in the UK and several countries in Continental

Europe, compensating for an expected and planned modest decline in

the Middle East. The operating EBITA margin improved due to the

revenue growth, improved portfolio of projects and lower

operational expenses.

The UK’s strong performance in the first quarter continued in

the second quarter with excellent organic net revenue growth driven

by key clients in all business lines. We are well positioned and

are benefitting from our strong market position and long-term plans

such as the UK Government’s “Build Back Better” stimulus program,

as well as a range of ‘green’ policy initiatives to accelerate the

decarbonization agenda in the country.

In Continental Europe we experienced steady organic net revenue

growth in Belgium, Poland, and France combined with stable

performance in the Netherlands. Our presence in several major

countries positions us well for opportunities presented by

government spending on infrastructure, energy transition and the

released European Union Green Deal programs.

Revenues in the Middle East showed a planned decline, driven by

our decision to reduce our footprint in the region.

ASIA PACIFIC (12% of net revenues)

| in € millions |

HALF YEAR |

|

SECOND QUARTER |

|

Period ended June 30 |

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

| Gross

revenues |

173 |

182 |

-5% |

|

89 |

94 |

-5% |

| Net

revenues |

159 |

164 |

-3% |

|

82 |

84 |

-3% |

| Organic

growth |

-3% |

|

|

|

-2% |

|

|

|

EBITA |

8 |

9 |

-13% |

|

|

|

|

|

Operating EBITA |

8 |

10 |

-14% |

|

|

|

|

|

Operating EBITA margin |

5.3% |

6.0% |

|

|

|

|

|

Net revenues in Asia declined due to a return to lockdowns in

Malaysia, Singapore, Thailand and Vietnam, and its impact on the

commercial development business. China performed relatively well

with revenues in line with last year. The operating EBITA margin

was negatively impacted by lower revenue and losses on a few

projects.

Australia’s operating EBITA continued to be strong, despite

modest organic revenue decline year-on-year. Our focus continues to

be on seizing major infrastructure opportunities in Sydney and

Melbourne.

CALLISONRTKL (6% of net revenues)

| in € millions |

HALF YEAR |

|

SECOND QUARTER |

|

Period ended June 30 |

2021 |

2020 |

Change |

|

2021 |

2020 |

Change |

| Gross

revenues |

99 |

133 |

-25% |

|

51 |

63 |

-19% |

| Net

revenues |

76 |

98 |

-22% |

|

37 |

47 |

-20% |

| Organic

growth |

-15% |

|

|

|

-11% |

|

|

|

EBITA |

3 |

6 |

-45% |

|

|

|

|

|

Operating EBITA |

4 |

7 |

-43% |

|

|

|

|

|

Operating EBITA margin |

5.0% |

6.8% |

|

|

|

|

|

Organic net revenues are still under pressure due to COVID-19,

affecting mainly retail and commercial sectors, especially in Asia.

Order intake in the US is improving, driving a book-to-bill ratio

greater than one.

REVIEW OF HALF YEAR PERFORMANCE 2021Operating

EBITA increased by 21% to €117 million (H1 2020:

€97 million). Operating EBITA

margin improved to 9.2% (H1 2020: 7.6%); driven

by strong performance in the Americas and

in EME compensating for lower margins in Asia

Pacific and CallisonRTKL. Non-operating costs were

lower at €3 million (H1 2020: €5 million).

The effective income tax rate (income taxes divided by profit

before income tax, excluding total result from investments

accounted for using the equity method and total result from former

investment in ALEN) for the six-month period ended 30 June 2021 is

21.0% (H1 2020: 34.3%). The tax rate was impacted by, amongst other

things, non-deductible expenses, updates to tax positions from

previous years and changes in recognized deferred tax assets.

Net finance expense decreased to €13 million (H1 2020:

€16 million). The interest expense on loans and borrowings of

€7 million (H1 2020: €11 million) was reduced due to lower average

gross debt and lower interest rates.

Net income from operations increased by 53% to

€81 million or €0.90 per share, compared to

€53 million or €0.59 per share in the first half of

2020.

REVIEW OF PERFORMANCE FOR THE SECOND

QUARTER Net revenues

increased by 2.6% to €644 million for the

second quarter, with an organic growth of 5.7% and

a foreign exchange impact of -3.1%, mainly related

to the weakening of the US Dollar. Operating EBITA

increased by 20% to €59 million and operating

EBITA margin improved to 9.2% (Q2 2020: 7.8%), driven by strong

performance across most regions.

CASH FLOW AND WORKING CAPITALFree cash flow for the first

half year was solid at €30 million (H1 2020:

€81 million). In 2020, the first half year free cash flow was

exceptionally strong due to the cash program undertaken and a

significant improvement in the invoicing process in the US

following the Oracle implementation.

Net working capital as a percentage of gross

revenues improved to 14.3% (H1 2020: 17.7%) and Days

Sales Outstanding decreased to 74 days (H1

2020: 87 days), resulting from our ongoing focus on

timely cash collection.

Net debt was €107 million and significantly lower

than H1 2020 (€316 million), driven by

the strong cash collection in the last 12

months. Moreover, Arcadis invested €62 million in share buy

back and distributed €31 million in dividend. The leverage

ratio further improved to 0.3x.

In May 2021, €36.0 million of floating rate Schuldschein loans

were repaid early, free of an interest penalty. In June 2021, the

US Private Placement note of $110.0 million at 5.1% was fully

reimbursed in accordance with the expected repayment schedule.

ORDER INTAKE AND BACKLOG Order intake in the

first half year was €1.4 billion leading to a

book-to-bill of 1.07. The book-to-bill ratio was greater

than 1 in all regions, except for the Middle East, driven by our

decision to reduce our footprint. Organic

backlog increased by 7.2% year-over-year,

and 4.2% year-to-date to €2.1 billion representing

10 months of net revenues. There were no material project

cancellations in the quarter.

STRATEGIC PRIORITIES 2021-2023 The update of

our strategy in November 2020 sets the course for us

to maximize our impact by developing resilient and future-proof

solutions and creating value for all our

stakeholders, clients, employees, shareholders and societies.

This has also led to a new framework of

improved targets for 2023 with both financial as well as

non-financial objectives.

Financial objectives:

- Organic net revenue growth: mid-single digit

- Operating EBITA margin to exceed 10% of net revenues in

2023

- Net working capital as percentage of gross revenues: <15.0%

and DSO (Days Sales Outstanding): <75 days

- Return on net working capital between 40%-50%

- Leverage: Net debt/EBITDA excluding leases between 1.0x and

2.0x

Non-financial objectives:

- Voluntary employee turnover: <10%

- Women in workforce: >40%

- Reduced emissions aligned with 1.5C science-based target

initiative before 2030

- Carbon neutral operations: investing in high quality, certified

abatement, and compensation programs from 2020

- Top-3 brand strength index in markets Arcadis serves

- Staff engagement: improving annually

FINANCIAL CALENDAR 2021

| 28 October

2021 |

Trading update Q3

2021 |

| 17 February

2022 |

Fourth quarter

and full year results 2021 |

FOR FURTHER INFORMATION PLEASE CONTACTARCADIS INVESTOR

RELATIONSJurgen PullensMobile: +31 6 51599483E-mail:

jurgen.pullens@arcadis.com

ARCADIS CORPORATE COMMUNICATIONSMonika GrabekMobile: +31 6 11 40

36 96E-mail: monika.grabek@arcadis.com

ANALYST MEETINGArcadis will hold an analyst webcast at 10:00 hrs

CET today in which Peter Oosterveer (CEO) and Virginie Duperat

(CFO) will discuss the second quarter and first half year 2021

results. The webcast can be accessed via this link, also made

available on the investor section of our website.

ABOUT ARCADISArcadis is a leading global Design &

Consultancy organization for natural and built assets. Applying our

deep market sector insights and collective design, consultancy,

engineering, project and management services we work in partnership

with our clients to deliver exceptional and sustainable outcomes

throughout the lifecycle of their natural and built assets. We are

28,000 people, active in over 70 countries that generate €3.5

billion in revenues. We support UN-Habitat with knowledge

and expertise to improve the quality of life in rapidly

growing cities around the world. www.arcadis.com.

REGULATED INFORMATIONThis press release contains information

that qualifies or may qualify as inside information within the

meaning of Article 7(1) of the EU Market Abuse Regulation.

FORWARD LOOKING STATEMENTSStatements included in this press

release that are not historical facts (including any statements

concerning investment objectives, other plans and objectives of

management for future operations or economic performance, or

assumptions or forecasts related thereto) are forward-looking

statements. These statements are only predictions and are not

guarantees. Actual events or the results of our operations could

differ materially from those expressed or implied in the

forward-looking statements. Forward-looking statements are

typically identified by the use of terms such as “may,” “will”,

“should”, “expect”, “could”, “intend”, “plan”, “anticipate”,

“estimate”, “believe”, “continue”, “predict”, “potential” or the

negative of such terms and other comparable terminology. The

forward-looking statements are based upon our current expectations,

plans, estimates, assumptions and beliefs that involve numerous

risks and uncertainties. Assumptions relating to the foregoing

involve judgments with respect to, among other things, future

economic, competitive and market conditions and future business

decisions, all of which are difficult or impossible to predict

accurately and many of which are beyond our control. Although we

believe that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, our actual results

and performance could differ materially from those set forth in the

forward-looking statements.

- Arcadis Q2 and HY 2021 results press release

- Arcadis Q2 and HY 2021 results analyst presentation

- Arcadis Q2 and HY 2021 interim financial statements

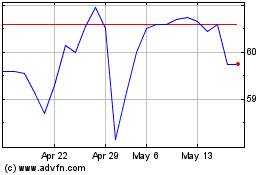

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Feb 2024 to Feb 2025