Arcadis Trading Update Q3 2024: Multi-year wins drive significant

order intake, margin expansion continues

PRESS RELEASE

Arcadis Third Quarter 2024 Trading Update

Multi-year wins drive significant order intake, margin

expansion continues

THIRD QUARTER RESULTS

- Multi-year project wins resulted in significant order intake of

€1.3 billion, up 50% yoy, providing further visibility

- Net revenue of €962 million, good organic growth of

5.0%1)

- Continued operating EBITA margin2) expansion to

11.4% (Q3’23: 10.7%3)) from strategic initiatives

- Strong free cash flow generation of €134 million in the quarter

(Q3‘23: €117 million)

Amsterdam, 31 October 2024

– Arcadis, the world’s leading company delivering

data-driven sustainable design, engineering, and consultancy

solutions for natural and built assets, sees significant order

intake of €1.3 billion from numerous large multi-year project wins.

Net revenues of €962 million resulted in good organic growth of

5.0%, and continued progress on strategic initiatives drove

operating EBITA margin expansion to 11.4% (Q3‘23:

10.7%3)).

Alan Brookes, CEO Arcadis, said: “Arcadis

has delivered another strong quarter with significant order intake

mainly driven by large multi-year project wins, particularly in

Mobility, providing further visibility on future performance.

Client demand for a single delivery partner is accelerating, for

instance for large infrastructure programs or for industrial

manufacturing projects across different sectors. Arcadis

successfully differentiates through its industry leading,

global design & engineering experience, long-standing client

relationships, and advisory expertise in sustainable

operations, buildings and manufacturing processes. We continue to

be selective in the projects we pursue while focusing on

cross-selling to our Key Clients and leveraging our Global

Excellence Centers to drive improved backlog quality and sustained

margin expansion.”

KEY FIGURES*

| in €

millions |

Third Quarter |

|

Year-to-date |

|

Period ended 30 September 2024 |

2024 |

2023 |

change |

|

2024 |

2023 |

change |

| Gross revenues |

1,239 |

1,237 |

0% |

|

3,751 |

3,714 |

1% |

|

Net revenues |

962 |

932 |

3% |

|

2,921 |

2,818 |

4% |

|

Organic growth1) |

5.0% |

9.0% |

|

|

5.1% |

10.0% |

|

|

Operating EBITDA2) |

137 |

128 |

6% |

|

408 |

369 |

11% |

|

Operating EBITDA margin2) |

14.2% |

13.8% |

|

|

14.0% |

13.1% |

|

|

Operating EBITA2)3) |

109 |

100 |

9% |

|

327 |

284 |

15% |

|

Operating EBITA margin2)3) |

11.4% |

10.7% |

|

|

11.2% |

10.1% |

|

|

Net working capital (%)3,4) |

12.7% |

12.8% |

|

|

|

|

|

|

Days sales outstanding (days) |

67 |

68 |

|

|

|

|

|

|

Free cash flow5) |

134 |

117 |

14% |

|

45 |

-18 |

|

|

Net debt |

886 |

1,080 |

-18% |

|

|

|

|

|

Order intake |

1,250 |

832 |

50% |

|

3,444 |

2,871 |

20% |

|

Order intake organic growth (%)1) |

50.3% |

0.3% |

|

|

|

|

|

|

Book-to-bill6) |

1.30 |

0.89 |

|

|

|

|

|

|

Backlog net revenues |

3,588 |

3,144 |

14% |

|

|

|

|

|

Backlog organic growth (yoy)1) |

18.0% |

5.4% |

|

|

|

|

|

|

Backlog organic growth (ytd)1) |

15.6% |

1.6% |

|

|

|

|

|

* 2023 and 2024 results as presented in this press release

are unaudited

1) Underlying growth excl. impact of FX, acquisitions,

footprint reductions, winddowns or divestments

2) EBIT(D)A excluding restructuring, integration, acquisition,

and divestment costs

3) 2023 revised to reflect the adjustments to the provisional

opening balances of acquired entities recognized 30 June 2023 (in

accordance with IFRS 3.49)

4) Net working capital %: net working capital / quarterly gross

revenues annualized

5) Free cash flow: cash flow from operations adjusted for capex

and lease liabilities

6) Book-to-bill: order intake / net revenues

PROFIT & LOSS ITEMS AND BACKLOG

Net revenues totaled €962 million with good organic growth of 5.0%

driven by all Global Business Areas (GBAs) and mostly by the US,

the UK and Germany. Revenue growth was particularly strong for

mobility and industrial manufacturing clients, and our Climate

Adaptation solutions. The improved operating EBITA margin of 11.4%

was driven by continued operating leverage, an improved project

portfolio and the materialization of cost synergies following the

successful integration of IBI and DPS.

Multi-year wins resulted in significant order intake of €1.3

billion for the quarter driven by the large Mobility projects

resulting in a backlog of €3.6 billion (Q3‘23: €3.1 billion).

Organic backlog growth was very strong at 18% year-on-year. Our

long-term client relationships, global expertise in large programs

and integrated cross-GBA service offering were some of the key

differentiating factors in winning work. Whilst we continue to

remain selective in our pursuit process, we see strong project

pipeline growth on the back of stimulus driven client investments

and increased demand for our services.

OPERATIONAL HIGHLIGHTS

RESILIENCE

| (38% of net

revenues) |

|

|

|

|

|

|

|

| in € millions |

Third Quarter |

|

Year-to-date |

|

Period ended 30 September 2024 |

2024 |

2023 |

change |

|

2024 |

2023 |

change |

|

Net revenues |

361 |

328 |

10% |

|

1,088 |

1,006 |

8% |

|

Organic growth1) |

6.9% |

11.2% |

|

|

8.1% |

12.1% |

|

|

Order intake |

333 |

328 |

2% |

|

1,142 |

1,107 |

3% |

|

Backlog net revenues |

990 |

972 |

2% |

|

|

|

|

|

Backlog organic growth (yoy)1) |

5.6% |

12.0% |

|

|

|

|

|

|

Backlog organic growth (ytd)1) |

4.8% |

10.6% |

|

|

|

|

|

Strong revenue growth for Resilience was driven by Climate

Adaptation, Energy Transition and Sustainable Operations, with the

latter in particular supporting cross-GBA projects across our

markets. We continued to be disciplined in our pursuit process,

which is reflected in improved order intake quality. We see a

strong pipeline of projects that are increasingly related to

consultancy services such as environmental permitting and

sustainable operations advisory. Resilience contributed to large

project wins in Places and Mobility as our integrated offering

combined with a strong sustainability profile was a clear

differentiator.

PLACES

| (38% of net

revenues) |

|

|

|

|

|

|

|

| in € millions |

Third Quarter |

|

Year-to-date |

|

Period ended 30 September 2024 |

2024 |

2023 |

change |

|

2024 |

2023 |

change |

|

Net revenues |

363 |

378 |

-4% |

|

1,114 |

1,137 |

-2% |

|

Organic growth1) |

2.7% |

-0.1% |

|

|

1.4% |

3.3% |

|

|

Order intake |

374 |

286 |

31% |

|

1,225 |

1,078 |

14% |

|

Backlog net revenues |

1,565 |

1,508 |

4% |

|

|

|

|

|

Backlog organic growth (yoy)1) |

7.1% |

-0.7% |

|

|

|

|

|

|

Backlog organic growth (ytd)1) |

5.8% |

-3.9% |

|

|

|

|

|

Sustained revenue and strong backlog growth was driven by

mobility and industrial manufacturing clients, mostly in Europe.

Our sustainability credentials and strategic partnerships resulted

in large project wins in industrial decarbonization. We continue to

see good opportunities in our project pipeline driven by stimulus

fund allocations, including public investments in universities and

hospitals, and reshoring of industrial manufacturing

facilities.

MOBILITY

| (22% of net

revenues) |

|

|

|

|

|

|

|

| in € millions |

Third Quarter |

|

Year-to-date |

|

Period ended 30 September 2024 |

2024 |

2023 |

change |

|

2024 |

2023 |

change |

|

Net revenues |

215 |

204 |

6% |

|

649 |

607 |

7% |

|

Organic growth1) |

6.0% |

14.6% |

|

|

7.1% |

13.9% |

|

|

Order intake |

518 |

191 |

172% |

|

1,009 |

614 |

64% |

|

Backlog net revenues |

916 |

544 |

68% |

|

|

|

|

|

Backlog organic growth (yoy)1) |

74.7% |

4.8% |

|

|

|

|

|

|

Backlog organic growth (ytd)1) |

63.2% |

1.7% |

|

|

|

|

|

The significant order intake for Mobility resulted from large

multi-year wins in North America, the Netherlands and Australia

booked in the quarter. We were able to secure these wins on the

back of strong client relationships, our integrated cross-GBA

offering, and relevant global expertise from comparable programs

such as HS2 and Lower Thames Crossing in the UK, the LA Regional

Connector in the US, and the Rozelle Interchange tunnel in

Australia. These projects will generate revenues for multiple

years, providing further visibility on the future performance. This

quarter’s good revenue growth was driven by sizeable project

delivery in the US, leveraging our European workforce’s skillset

and Global Excellence Center engagement.

INTELLIGENCE

| (2% of net

revenues) |

|

|

|

|

|

|

|

| in € millions |

Third Quarter |

|

Year-to-date |

|

Period ended 30 September 2024 |

2024 |

2023 |

change |

|

2024 |

2023 |

change |

|

Net revenues |

23 |

23 |

2% |

|

70 |

67 |

3% |

|

Organic growth1) |

3.5% |

|

|

|

4.0% |

|

|

|

Order intake |

24 |

28 |

-15% |

|

68 |

73 |

-7% |

|

Backlog net revenues |

118 |

121 |

-2% |

|

|

|

|

|

Backlog organic growth (yoy)1) |

0.2% |

14.2% |

|

|

|

|

|

|

Backlog organic growth (ytd)1) |

-3.3% |

5.1% |

|

|

|

|

|

Solid revenue growth in North America driven by our Enterprise

Decision Analytics (EDA) solution. Integrating Intelligence

solutions into our offerings from other GBAs continued to act as a

strong differentiator, playing a pivotal role in winning

large-scale projects, which was exemplified by the Fraser River

Tunnel win. We continue to see ample opportunity to extend

Intelligence products to other GBAs’ clients, e.g. providing EDA

for data centers or industrial manufacturing facilities.

BALANCE SHEET & CASH FLOW

Days sales outstanding improved to 67 days at the end of Q3‘24

(Q3‘23: 68 days). Net working capital as a percentage of

annualized quarterly gross revenues was 12.7%

(Q3‘23: 12.8%2)3)).

Free cash flow in the quarter was a positive €134 million resulting

in €45 million for the first nine months (9M‘23: €-18 million),

from continued disciplined cash management and in line with

seasonal trends. Net debt decreased to €886 million (Q3‘23: €1,080

million3)).

2024-2026 STRATEGY "ACCELERATING A PLANET POSITIVE FUTURE"

On 16 November 2023, Arcadis presented its 2024-2026 Strategy

“Accelerating a planet positive future” and its 2026 financial

targets; these include: organic net revenue growth of mid to high

single digits over the cycle, operating EBITA margin of 12.5% in

2026, Net Debt / Operating EBITDA of 1.5-2.5x with an Investment

Grade credit rating and a dividend payout ratio of 30-40% of Net

Income from Operations.

FINANCIAL CALENDAR

- 13 February 2025 – Q4 & Full Year 2024 Results

- 7 May 2025 – Q1 2025 Trading Update

- 31 July 2025 – Q2 & Half Year 2025 Results

- 30 October 2025 – Q3 2025 Trading Update

Arcadis IR investor calendar:

https://www.arcadis.com/en/investors/investor-calendar

ARCADIS INVESTOR RELATIONS

Christine Disch | +31 (0)615376020 |

christine.disch@arcadis.com

ANALYST WEBCAST

Today at 14:00 CEST

https://www.arcadis.com/en/investors/investor-calendar/2024/trading-update-q3-2024

ABOUT ARCADIS

Arcadis is the world’s leading company delivering data-driven

sustainable design, engineering, and consultancy solutions for

natural and built assets. We are more than 36,000 architects, data

analysts, designers, engineers, project planners, water management

and sustainability experts, all driven by our passion for improving

quality of life. As part of our commitment to accelerating a planet

positive future, we work with our clients to make sustainable

project choices, combining digital and human innovation, and

embracing future-focused skills across the environment, energy and

water, buildings, transport, and infrastructure sectors. We operate

in over 30 countries, and in 2023 reported €5.0 billion in gross

revenues. www.arcadis.com

REGULATED INFORMATION

This press release contains information that qualifies or may

qualify as inside information within the meaning of Article 7(1) of

the EU Market Abuse Regulation.

DISCLAIMER

Statements included in this press release that are not historical

facts (including any statements concerning investment objectives,

other plans and objectives of management for future operations or

economic performance, or assumptions or forecasts related thereto)

are forward-looking statements. These statements are only

predictions and are not guarantees. Actual events or the results of

our operations could differ materially from those expressed or

implied in the forward-looking statements. Forward-looking

statements are typically identified by the use of terms such as

“may”, “will”, “should”, “expect”, “could”, “intend”, “plan”,

“anticipate”, “estimate”, “believe”, “continue”, “predict”,

“potential” or the negative of such terms and other comparable

terminology. The forward-looking statements are based upon our

current expectations, plans, estimates, assumptions and beliefs

that involve numerous risks and uncertainties. Assumptions relating

to the foregoing involve judgments with respect to, among other

things, future economic, competitive and market conditions and

future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond our control.

Although we believe that the expectations reflected in such

forward-looking statements are based on reasonable assumptions, our

actual results and performance could differ materially from those

set forth in the forward-looking statements.

- Arcadis Q3 2024 Trading Update Press Release

- Arcadis Q3 2024 Trading Update Presentation

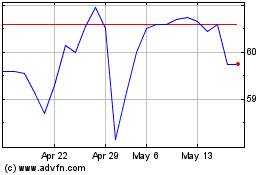

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Arcadis NV (EU:ARCAD)

Historical Stock Chart

From Feb 2024 to Feb 2025