BE Semiconductor Industries N.V. (the “Company" or "Besi")

(Euronext Amsterdam: BESI; OTC markets: BESIY), a leading

manufacturer of assembly equipment for the semiconductor industry,

today announced its results for the fourth quarter and year ended

December 31, 2021.

Key Highlights Q4-21

- Revenue of € 171.7 million down

17.6% vs. Q3-21 primarily due to deferral of shipments caused by

flood at one of Besi’s Malaysian production facilities and lower

revenue from mobile applications as per typical Q4 seasonal

patterns. Up 56.5% vs. Q4-20 primarily related to significantly

increased demand for automotive and computing applications

- Orders of € 202.6 million down 3.2%

vs. Q3-21 but above December guidance. Up 28.8% vs. Q4-20 due to

broad based demand by IDM customers, particularly for mobile and

automotive applications

- Gross margin of 56.7% declined 3.7

points vs. Q3-21 due to one-time, € 7.4 million inventory

impairment charge related to the flood. Excluding such charge,

gross margin rose to 61.0%, up 0.6 points vs. Q3-21 and up 2.7

points vs. Q4-20

- Net income of € 67.1 million

declined 20.3% vs. Q3-21 principally due to adverse impact of

flood. Net margins remained elevated at 39.1% vs. 40.4% in Q3-21.

Net income up 50.4% vs. Q4-20

- Net cash continued to expand,

rising +28.7% vs. Q3-21 and 86.4% vs. Q4-20 to reach € 370.4

million

Key Highlights FY 2021

- Revenue of € 749.3 million

increased by € 315.7 million, or 72.8%, primarily due to increased

demand for mobile applications from new 5G smartphone cycle,

recovering automotive and computing end-user markets and increased

investment by Chinese customers

- Orders of € 939.1 million grew €

467.0 million (+98.9%) as a result of broad-based demand across

Besi’s principal end-user markets, customers and geographies

- Gross margin reached 59.6%, equal

to 2020. Upward growth limited by inventory impairment charge and

adverse forex movements of USD and Chinese yuan vs. euro

- Net income of € 282.4 million grew € 150.1 million (+113.5%).

Net margin also rose to 37.7% vs. 30.5%

- Proposed dividend of € 3.33 per

share, up 95.9% vs. 2020. Represents pay-out ratio of 92%

Outlook

- Q1-22 revenue estimated to rise 15%

(+/- 5%) vs. Q4-21 and 38% vs. Q1-21 (at midpoint of guidance).

Timing of Q1-22 quarterly shipments influenced by supply chain

issues affecting production at Besi and customer manufacturing

sites. Gross margin anticipated to range between 59%-61%

|

(€ millions, except EPS) |

Q4-2021 |

Q3-2021 |

Δ |

Q4-2020 |

Δ |

FY2021 |

FY2020 |

Δ |

|

Revenue |

171.7 |

208.3 |

-17.6% |

109.7 |

+56.5% |

749.3 |

433.6 |

+72.8% |

| Orders |

202.6 |

209.2 |

-3.2% |

157.3 |

+28.8% |

939.1 |

472.1 |

+98.9% |

| Operating

Income |

67.2 |

95.4 |

-29.6% |

40.7 |

+65.1% |

317.6 |

149.9 |

+111.9% |

| EBITDA |

72.0 |

99.7 |

-27.8% |

45.5 |

+58.2% |

335.1 |

169.0 |

+98.3% |

| Net

Income |

67.1 |

84.2 |

-20.3% |

44.6 |

+50.4% |

282.4 |

132.3 |

+113.5% |

| EPS

(basic) |

0.86 |

1.08 |

-20.4% |

0.62 |

+38.7% |

3.70 |

1.82 |

+103.3% |

| EPS

(diluted) |

0.80 |

1.00 |

-20.0% |

0.55 |

+45.5% |

3.39 |

1.67 |

+103.0% |

| Net Cash and

Deposits |

370.4 |

287.8 |

+28.7% |

198.7 |

+86.4% |

370.4 |

198.7 |

+86.4% |

Richard W. Blickman, President and Chief

Executive Officer of Besi, commented:"Besi reported strong

results in 2021 which exceeded many of our key strategic planning

targets three years ahead of schedule. Revenue, orders and net

income rose to € 749.3 million, € 939.1 million and € 282.4

million, increases of 72.8%, 98.9% and 113.5%, respectively, versus

2020. Such accomplishments were realized in the face of substantial

headwinds from pandemic related disruptions to global supply

chains, ongoing US-China trade tensions and a flood at one of our

Malaysian production facilities which adversely affected fourth

quarter results. Even despite such challenges, net margins rose

solidly from 30.5% to 37.7% in 2021 and return on average equity

increased from 39.5% to 57.0%.

Strong revenue and order growth this year

benefited from increased demand across Besi’s principal end-user

markets, geographies and customers. It was also supported by

favorable market conditions driven by an underinvestment in

assembly capacity over the past decade, a new 5G smartphone product

cycle, continued investment in advanced packaging applications to

support digital infrastructure growth and increased investment from

Chinese customers for mobile and mainstream electronics

applications. In addition, Besi received initial orders for hybrid

bonding systems from two leading semiconductor producers with

initial shipments made in Q4-21. Quarterly revenue patterns during

the year varied by end-user market with a substantial build by

mobile customers in the first half year followed by strength in the

second half from automotive, high-performance computing and data

center applications.

During the year, Besi continued to execute

strategic initiatives to drive profitability and shareholder

returns. Substantial growth in profit levels and efficiency were

aided by operating leverage in Besi’s business model as we limited

expense development to 18.9% relative to a 72.8% revenue increase.

As such, operating expense margins declined from 25.1% to 17.2%.

Expense trends were even more favorable given that reported and

gross R&D spending increased by 10.6% and 25.8%, respectively,

as we accelerated investment in Besi’s wafer level assembly

portfolio. We also refined the strategic plan for 2021-2025 and

initiated changes to our organization and management structure to

better realize its potential while maintaining the exciting growth

opportunities available for Besi’s existing products.

Besi ended 2021 with a solid liquidity base

consisting of cash, cash equivalents and deposits aggregating

€ 672.2 million, or € 8.62 per basic share. Further, net cash

of € 370.4 million increased by € 171.7 million, or 86.4%, versus

year end 2020. Given profits earned in 2021, continued strong cash

flow generation and our solid financial position, we propose to pay

a cash dividend of € 3.33 per share for approval at Besi’s 2022

AGM. The proposed distribution is the twelfth consecutive annual

dividend paid and reflects a pay-out ratio relative to net income

of 92%. Including such dividend, Besi will have returned

approximately € 1.2 billion to shareholders over the past 11 years,

or approximately 25% of cumulative revenue during this period.

Besi performed solidly in Q4-21 despite the

adverse impact of the flood on our financial performance. For the

quarter, revenue and net income rose by 56.5% and 50.4%,

respectively, versus Q4-20 while gross margin excluding a one-time,

flood related inventory impairment charge, increased to 61.0%

versus 60.4% in Q3-21 and 58.3% in Q4-20. Revenue for the quarter

was aided by continued growth for automotive and high performance

computing applications in a quarter which is typically the seasonal

low point in smartphone demand. Orders of € 202.6 million were

above December guidance (€ 180 - € 190 million) reflecting strength

by IDMs for automotive and mobile applications. Profit efficiency

also remained at elevated levels with net margins reaching 39.1% in

Q4-21 versus 40.4% in Q3-21 despite lower shipments.

Many industry analysts expect the current market

upturn to continue in 2022. We also have a favorable outlook as

evidenced by Besi’s strong order intake and backlog at year end of

€ 327 million and by increased capex spending announced by many of

the leading semiconductor producers recently. It also reflects

ongoing investment by IDMs in high end, advanced packaging

solutions, capacity shortages in a number of Besi’s end-user

markets and favorable order trends to date in Q1-22 relative to

Q4-21.

We can also report significant progress in the

development and build-out of Besi’s wafer level assembly portfolio.

We began shipping hybrid bonding systems to a customer in Q4-21

with additional orders and shipments expected in the upcoming

quarters to support their H2-22 production objectives. The

introduction of hybrid bonding cluster tools is also on track for

introduction in H1-2022. In addition, significant interest has been

expressed by the industry’s largest customers for Besi’s hybrid

bonding systems for the 2023/2024 period as well as our TCB chip to

wafer and embedded bridge die attach systems as investment

increases in 3D, chiplet-based architectures.

For Q1-22, we forecast that revenue will

increase by 15% (+/- 5%) versus Q4-21 and approximately 38% (at

midpoint of guidance) versus Q1-21. At present, the timing of Q1-22

shipments is being influenced by supply chain issues affecting

production at Besi and customer manufacturing sites. As such, our

backlog at the end of Q1-22 is expected to increase versus year end

levels. In addition, we estimate that Besi’s gross margin will

range between 59-61%. Further, we estimate that baseline operating

expenses will increase by 0-5% versus Q4-21 and for overall

operating expenses to increase by 35-40% versus Q4-21 due to

approximately € 9 million of non-cash, share based compensation

expense.

Fourth Quarter Results of Operations

|

€ millions |

Q4-2021 |

Q3-2021 |

Δ |

Q4-2020 |

Δ |

|

Revenue |

171.7 |

208.3 |

-17.6% |

109.7 |

+56.5% |

|

Orders |

202.6 |

209.2 |

-3.2% |

157.3 |

+28.8% |

|

Book to Bill Ratio |

1.2x |

1.0x |

+0.2 |

1.4x |

-0.2 |

Revenue in Q4-21 decreased by € 36.6 million, or

17.6%, versus Q3-21 due primarily to a flood at one of Besi’s

Malaysian production facilities, which resulted in an approximate €

20-25 million deferral of system shipments into subsequent

quarters. The sequential revenue decrease was also related to lower

shipments for mobile applications due to typical seasonal factors

partially offset by higher revenue for automotive and

high-performance computing applications. Besi’s 56.5% revenue

growth versus Q4-20 primarily reflected increased demand for

automotive and computing end-user markets and more favorable market

conditions.

Orders of € 202.6 million decreased slightly

versus Q3-21 and resulted in a book to bill ratio of 1.2x.

Sequential quarterly order trends reflected strength by IDM

customers for automotive and mobile applications partially offset

by lower orders for high-performance computing applications. Orders

increased by 28.8% versus Q4-20 reflecting growth across Besi’s

principal end-user markets. Per customer type, IDM orders increased

€ 4.7 million, or 3.5%, versus Q3-21 and represented 68% of total

orders. Subcontractor orders decreased by € 11.3 million, or

15.0%, versus Q3-21 and represented 32% of total orders.

|

€ millions |

Q4-2021 |

Q3-2021 |

Δ |

Q4-2020 |

Δ |

|

Gross Margin |

56.7% |

60.4% |

-3.7 |

58.3% |

-1.6 |

|

Gross Margin - adjusted* |

61.0% |

60.4% |

+0.6 |

58.3% |

+2.7 |

|

Operating Expenses |

30.3 |

30.4 |

-0.3% |

23.3 |

+30.0% |

|

Financial Expense, net |

3.0 |

3.4 |

-11.8% |

3.8 |

-21.1% |

|

EBITDA |

72.0 |

99.7 |

-27.8% |

45.5 |

+58.2% |

* Adjusted gross margin excludes one-time, € 7.4

million inventory impairment charge.

Besi’s gross margin of 56.7% in Q4-21 was

adversely affected by a one-time, € 7.4 million inventory

impairment charge. Excluding such charge, Besi’s gross margin rose

to 61.0%, an increase of 0.6 points and 2.7 points, respectively,

versus Q3-21 and Q4-20, primarily due to a more favorable product

mix and increased labor efficiencies.

Q4-21 operating expenses of € 30.3 million were

roughly equal to Q3-21 and in line with prior guidance, as higher

R&D spending was offset by decreased overhead costs. Versus

Q4-20, operating expenses increased by € 7.0 million, or 30.0%,

primarily due to (i) € 4.5 million higher SG&A expenses

associated with increased headcount in support of significant

revenue growth as well as higher strategic consulting expenses and

(ii) € 2.5 million higher R&D spending related to expanded

wafer level assembly activities. Operating expenses as percentage

of revenue decreased to 17.6% in Q4-21 versus 21.2% in Q4-20.

Financial expense, net, decreased by € 0.4

million versus Q3-21 primarily related to favorable forex

influences and by € 0.8 million versus Q4-20 primarily due to lower

interest expense associated with the conversion during 2021 of

substantially all of the 2016 Convertible Notes.

|

€ millions |

Q4-2021 |

Q3-2021 |

Δ |

Q4-2020 |

Δ |

|

Net Income |

67.1 |

84.2 |

-20.3% |

44.6 |

+50.4% |

|

Net Margin |

39.1% |

40.4% |

-1.3 |

40.7% |

-1.6 |

|

Tax Rate |

-4.6% |

8.4% |

-13.0 |

-21.2% |

+16.6 |

|

|

|

|

|

|

|

|

Net Income – adjusted* |

64.7 |

80.5 |

-19.6% |

33.4 |

+93.7% |

|

Net Margin – adjusted* |

37.7% |

38.7% |

-1.0 |

30.5% |

+7.2 |

|

Tax Rate – adjusted* |

9.5% |

12.5% |

-3.0 |

9.2% |

+0.3 |

* Adjusted to exclude € 7.4 million inventory

impairment charge in Q4-21 and tax benefits realized of € 8.9

million, € 3.7 million and € 11.2 million in Q4-21, Q3-21

and Q4-20, respectively.

Net income of € 67.1 million in Q4-21 decreased

by € 17.1 million, or 20.3% versus Q3-21 principally as a result of

the flood at Besi’s Malaysian production facilities partially

offset by € 5.2 million of increased tax benefits recognized at

Besi’s Swiss operations. Versus Q4-20, net income increased by €

22.5 million, or 50.4%, primarily due to significantly higher

revenue levels combined with lower operating expense margins due to

successful efforts to limit personnel and overhead development

relative to revenue growth.

Full Year Results of Operations

|

€ millions |

FY 2021 |

FY 2020 |

Δ |

|

Revenue |

749.3 |

433.6 |

+72.8% |

|

Orders |

939.1 |

472.1 |

+98.9% |

|

Gross Margin |

59.6% |

59.6% |

- |

|

Operating Income |

317.6 |

149.9 |

+111.9% |

|

Net Income* |

282.4 |

132.3 |

+113.5% |

|

Net Margin* |

37.7% |

30.5% |

+7.2 |

|

Tax Rate * |

7.1% |

3.8% |

+3.3 |

* Excluding inventory impairment charge in Q4-21

and tax benefits, Besi’s net income, net margin and effective tax

rate would have been € 273.9 million, 36.6% and 12.0% in 2021

versus € 121.1 million, 27.9% and 12.0% in 2020.

Besi’s revenue of € 749.3 million in 2021

increased by € 315.7 million, or 72.8%, versus 2020. Revenue growth

reflected increased shipments for mobile applications due to a new

5G smartphone cycle, recovering automotive and computing end-user

markets, increased investment by Chinese customers and improved

industry conditions generally. Similarly, orders increased by 98.9%

versus 2020 as demand expanded across all principal end-user

markets and geographies, including initial orders for hybrid

bonding systems. In 2021, bookings by IDMs and subcontractors

represented approximately 55% and 45%, respectively, of Besi’s

total orders versus 45% and 55%, respectively, in 2020.

Operating income rose to € 317.6 million in

2021, an increase of 111.9% versus 2020 principally as a result of

significantly higher revenue levels combined with ongoing cost

controls of fixed personnel and overhead which limited operating

expense development. As a result, operating expense margins

declined from 25.1% in 2020 to 17.2% in 2021.

Besi’s net income was € 282.4 million in 2021,

representing growth of € 150.1 million, or 113.5%, versus 2020.

Similarly, Besi’s net margin rose strongly to 37.7% versus 30.5% in

2020. The profit improvement was primarily due to significantly

higher revenue growth combined with reduced operating expense

margins partially offset by a 3.3 point increase in Besi’s

effective tax rate.

Financial Condition

|

€ millions |

Q42021 |

Q32021 |

Δ |

Q42020 |

Δ |

FY2021 |

FY2020 |

Δ |

|

Total Cash and Deposits |

672.2 |

590.5 |

+13.8% |

598.7 |

+12.3% |

672.2 |

598.7 |

+12.3% |

|

Net Cash and Deposits |

370.4 |

287.8 |

+28.7% |

198.7 |

+86.4% |

370.4 |

198.7 |

+86.4% |

|

Cash flow from Ops. |

101.8 |

98.6 |

+3.2% |

51.7 |

+96.9% |

277.9 |

162.0 |

+71.5% |

At the end of Q4-21, Besi had a strong liquidity

position with total cash and deposits aggregating € 672.2 million,

an increase of € 73.5 million, or 12.3% versus year end 2020.

On a quarterly sequential basis, cash and deposits grew by 13.8%

versus Q3-21 primarily due to € 101.8 million of cash flow

generated from operations which was used to fund (i) € 15.7 million

of share repurchases and (ii) € 6.7 million of capitalized

development spending.

Similarly, net cash and deposits grew to € 370.4

million at year end 2021, an increase of € 82.6 million, or 28.7%,

as compared to Q3-21. Versus year end 2020, net cash and deposits

grew by € 171.7 million (+86.4%) which included the conversion into

equity of € 110.2 million of Convertible Notes during the year.

During Q4-21, € 2.3 million principal amount of the 2016

Convertible Notes were converted into 118,274 ordinary shares which

reduced their principal amount outstanding to € 2.4

million.

Share Repurchase ActivityDuring

Q4-21, Besi repurchased 209,944 of its ordinary shares at an

average price of € 74.75 per share for a total of € 15.7 million.

For the full year, a total of approximately 700,000 shares were

repurchased at an average price of € 69.84 per share for a total of

€ 50.1 million. Cumulatively, as of December 31, 2021 approximately

4.2 million shares have been repurchased under the current € 185.0

million share repurchase program at an average price of

€ 31.77 per share for a total of € 134.8 million. At year

end 2021, Besi held approximately 600,000 shares in treasury, equal

to 0.8% of its shares outstanding.

Dividend for 2021Given its

earnings, cash flow generation and prospects, Besi’s Board of

Management has proposed a cash dividend for 2021 equal to € 3.33

per share for approval at its AGM on April 29, 2022. The proposed

dividend is the twelfth consecutive annual dividend paid to

shareholders. It also reflects a pay-out ratio of 92%, an increase

of 95.9% versus 2020 and will be payable from May 6, 2022.

OutlookBased on its December

31, 2021 backlog and feedback from customers, Besi forecasts for

Q1-22 that:

- Revenue will increase by 15% (+/-

5%) versus the € 171.7 million reported in Q4-21.

- Gross margin will range between

59-61% versus the 56.7% realized in Q4-21.

- Baseline operating expenses are

expected to increase by 0-5% from € 30.3 million in Q4-21

- Total operating expenses are

expected to increase by approximately 35-40% versus Q4-21 primarily

due to approximately € 9 million of non-cash, share based

compensation expense.

|

Investor and media conference callA conference

call and webcast for investors and media will be held today at 4:00

pm CET (10:00 am EST). The dial-in for the conference call is (31)

20 531 5851. To access the audio webcast and webinar slides, please

visit www.besi.com. |

|

Important Dates 2022 |

|

| • Publication Annual Report

2021 |

February 23, 2022 |

| • Publication Q1

results |

April 29, 2022 |

| • Annual General Meeting

of Shareholders |

April 29, 2022, (10:30 am

CET) |

| • Publication

Q2/Semi-annual results |

July 21, 2022 |

| • Publication

Q3/Nine-month results |

October 20, 2022 |

| • Publication Q4/Full

year results |

February 2023 |

| |

|

| Dividend

Information* |

|

| • Proposed ex-dividend

date |

May 3, 2022 |

| • Proposed record

date |

May 4, 2022 |

| • Proposed payment of

2021 dividend *Subject to approval at Besi’s AGM on April 29,

2022 |

Starting May 6, 2022 |

About BesiBesi is a

leading supplier of semiconductor assembly equipment for the global

semiconductor and electronics industries offering high levels of

accuracy, productivity and reliability at a low cost of ownership.

The Company develops leading edge assembly processes and equipment

for leadframe, substrate and wafer level packaging applications in

a wide range of end-user markets including electronics, mobile

internet, cloud server, computing, automotive, industrial, LED and

solar energy. Customers are primarily leading semiconductor

manufacturers, assembly subcontractors and electronics and

industrial companies. Besi’s ordinary shares are listed on Euronext

Amsterdam (symbol: BESI). Its Level 1 ADRs are listed on the OTC

markets (symbol: BESIY) and its headquarters are located in Duiven,

the Netherlands. For more information, please visit our website at

www.besi.com.

Contacts:Richard W. Blickman,

President & CEOHetwig van Kerkhof, SVP FinanceLeon Verweijen,

VP FinanceClaudia Vissers, Executive Secretary/IR coordinatorEdmond

Franco, VP Corporate Development/US IR coordinatorTel. (31) 26 319

4500investor.relations@besi.com

Statement of ComplianceThe

accounting policies applied in the condensed consolidated financial

statements included in this press release are the same as those

applied in the Annual Report 2021 and were authorized for issuance

by the Board of Management and Supervisory Board on February 17,

2022. In accordance with Article 393, Title 9, Book 2 of the

Netherlands Civil Code, Ernst & Young Accountants LLP has

issued an unqualified auditor’s opinion on the Annual Report 2021.

The Annual Report 2021 will be published on our website on February

23, 2022 and proposed for adoption by the Annual General Meeting on

April 29, 2022.

The condensed financial statements included in

this press release have been prepared in accordance with

International Financial Reporting Standards (IFRS), as adopted by

the European Union but do not include all of the information

required for a complete set of IFRS financial statements.

Caution Concerning Forward Looking StatementsThis

press release contains statements about management's future

expectations, plans and prospects of our business that constitute

forward-looking statements, which are found in various places

throughout the press release, including, but not limited to,

statements relating to expectations of orders, net sales, product

shipments, expenses, timing of purchases of assembly equipment by

customers, gross margins, operating results and capital

expenditures. The use of words such as “anticipate”, “estimate”,

“expect”, “can”, “intend”, “believes”, “may”, “plan”, “predict”,

“project”, “forecast”, “will”, “would”, and similar expressions are

intended to identify forward looking statements, although not all

forward looking statements contain these identifying words. The

financial guidance set forth under the heading “Outlook” contains

such forward looking statements. While these forward looking

statements represent our judgments and expectations concerning the

development of our business, a number of risks, uncertainties and

other important factors could cause actual developments and results

to differ materially from those contained in forward looking

statements, including any inability to maintain continued demand

for our products; failure of anticipated orders to materialize or

postponement or cancellation of orders, generally without charges;

the volatility in the demand for semiconductors and our products

and services; the extent and duration of the COVID-19 pandemic

and measures taken to contain the outbreak, and the associated

adverse impacts on the global economy, financial markets, global

supply chains and our operations as well as those of our customers

and suppliers; failure to develop new and enhanced products

and introduce them at competitive price levels; failure to

adequately decrease costs and expenses as revenues decline; loss of

significant customers, including through industry consolidation or

the emergence of industry alliances; lengthening of the sales

cycle; acts of terrorism and violence; disruption or failure

of our information technology systems; consolidation activity and

industry alliances in the semiconductor industry that may result in

further increased customer concentration, inability to

forecast demand and inventory levels for our products; the

integrity of product pricing and protection of our intellectual

property in foreign jurisdictions; risks, such as changes in trade

regulations, conflict minerals regulations, currency fluctuations,

political instability and war, associated with substantial foreign

customers, suppliers and foreign manufacturing operations,

particularly to the extent occurring in the Asia Pacific region

where we have a substantial portion of our production facilities;

our ability to mitigate the dislocations caused by the flood at one

of our Malaysian production facilities, potential instability in

foreign capital markets; the risk of failure to successfully manage

our diverse operations; any inability to attract and retain skilled

personnel, including as a result of restrictions on immigration,

travel or the availability of visas for skilled technology workers

as a result of the COVID-19 pandemic; those additional risk factors

set forth in Besi's annual report for the year ended December

31, 2020 and other key factors that could adversely affect our

businesses and financial performance contained in our filings and

reports, including our statutory consolidated statements. We

expressly disclaim any obligation to update or alter our

forward-looking statements whether as a result of new information,

future events or otherwise.

Consolidated Statements of

Operations

| (€

thousands, except share and per share data) |

Three Months EndedDecember

31,(unaudited) |

Year EndedDecember

31,(audited) |

|

|

2021 |

|

2020 |

|

2021 |

2020 |

|

|

|

|

|

|

| Revenue |

171,732 |

|

109,674 |

|

749,297 |

433,623 |

| Cost of sales |

74,287 |

|

45,717 |

|

302,475 |

175,056 |

| |

|

|

|

|

| Gross profit |

97,445 |

|

63,957 |

|

446,822 |

258,567 |

| |

|

|

|

|

| Selling, general and

administrative expenses |

20,387 |

|

15,832 |

|

92,859 |

75,802 |

| Research and development

expenses |

9,906 |

|

7,448 |

|

36,380 |

32,905 |

| |

|

|

|

|

| Total operating expenses |

30,293 |

|

23,280 |

|

129,239 |

108,707 |

| |

|

|

|

|

| Operating income |

67,152 |

|

40,677 |

|

317,583 |

149,860 |

| |

|

|

|

|

| Financial expense, net |

3,023 |

|

3,843 |

|

13,743 |

12,343 |

| |

|

|

|

|

| Income before taxes |

64,129 |

|

36,834 |

|

303,840 |

137,517 |

| |

|

|

|

|

| Income tax expense

(benefit) |

(2,980 |

) |

(7,812 |

) |

21,421 |

5,242 |

| |

|

|

|

|

| Net

income |

67,109 |

|

44,646 |

|

282,419 |

132,275 |

|

|

|

|

|

|

| Net income per share –

basic |

0.86 |

|

0.62 |

|

3.70 |

1.82 |

| Net income per share –

diluted |

0.80 |

|

0.55 |

|

3.39 |

1.67 |

|

Number of shares used in computing per share amounts:- basic-

diluted 1 |

77,978,09085,148,148 |

72,591,53385,440,188 |

76,309,74985,358,296 |

72,501,38683,773,385 |

Consolidated Balance Sheets

|

(€ thousands) |

December 31,

2021(audited) |

September30, 2021(unaudited) |

June 30,

2021(unaudited) |

March 31,2021(unaudited) |

December 31,2020(audited) |

|

ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

| Cash and cash

equivalents |

451,395 |

455,267 |

298,802 |

347,979 |

375,406 |

| Deposits |

195,789 |

135,204 |

212,575 |

257,847 |

223,299 |

| Trade

receivables |

174,942 |

213,641 |

217,725 |

147,737 |

93,218 |

| Inventories |

94,399 |

85,172 |

78,100 |

61,709 |

51,645 |

| Other current

assets |

19,623 |

14,630 |

17,165 |

17,655 |

11,964 |

| |

|

|

|

|

|

| Total

current assets |

936,148 |

903,914 |

824,367 |

832,927 |

755,532 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Property, plant

and equipment |

29,884 |

27,838 |

27,344 |

27,739 |

27,840 |

| Right of use

assets |

10,606 |

10,560 |

10,280 |

8,958 |

9,873 |

| Goodwill |

45,170 |

44,966 |

44,732 |

44,851 |

44,484 |

| Other intangible

assets |

68,746 |

61,747 |

57,450 |

54,078 |

50,660 |

| Deferred tax

assets |

27,436 |

19,947 |

20,086 |

21,177 |

21,924 |

| Deposits |

25,000 |

- |

- |

- |

- |

| Other non-current

assets |

1,051 |

1,034 |

1,084 |

1,078 |

1,043 |

| |

|

|

|

|

|

| Total

non-current assets |

207,893 |

166,092 |

160,976 |

157,881 |

155,824 |

| |

|

|

|

|

|

|

Total assets |

1,144,041 |

1,070,006 |

985,343 |

990,808 |

911,356 |

|

|

|

|

|

|

|

| |

|

|

| |

|

|

|

|

|

| Trade

payables |

74,711 |

84,342 |

91,472 |

65,351 |

44,017 |

| Other current

liabilities |

112,867 |

102,349 |

87,337 |

83,155 |

57,469 |

| |

|

|

|

|

|

| Total

current liabilities |

187,578 |

186,691 |

178,809 |

148,506 |

101,486 |

| |

|

|

|

|

|

| Long-term

debt |

301,802 |

302,637 |

304,647 |

389,614 |

399,956 |

| Lease

liabilities |

7,198 |

7,307 |

6,963 |

6,348 |

6,952 |

| Deferred tax

liabilities |

10,970 |

11,312 |

11,448 |

12,905 |

12,840 |

| Other non-current

liabilities |

17,219 |

16,251 |

15,947 |

18,887 |

18,895 |

| |

|

|

|

|

|

| Total

non-current liabilities |

337,189 |

337,507 |

339,005 |

427,754 |

438,643 |

| |

|

|

|

|

|

| Total

equity |

619,274 |

545,808 |

467,529 |

414,548 |

371,227 |

| |

|

|

|

|

|

|

Total liabilities and equity |

1,144,041 |

1,070,006 |

985,343 |

990,808 |

911,356 |

Consolidated Cash Flow

Statements

| (€

thousands) |

Three Months EndedDecember

31,(unaudited) |

Year Ended December 31,

(audited) |

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

| |

|

|

|

|

| Income before income tax |

64,129 |

|

36,834 |

|

303,840 |

|

137,517 |

|

| |

|

|

|

|

| Depreciation and

amortization |

4,847 |

|

4,833 |

|

17,564 |

|

19,176 |

|

| Share based payment

expense |

1,617 |

|

1,456 |

|

16,409 |

|

10,470 |

|

| Financial expense, net |

3,023 |

|

3,843 |

|

13,743 |

|

12,343 |

|

| |

|

|

|

|

| Changes in working

capital |

26,938 |

|

8,856 |

|

(59,733 |

) |

(1,341 |

) |

| Income tax (paid)

received |

2,429 |

|

(2,106 |

) |

(9,651 |

) |

(11,080 |

) |

| Interest paid |

(1,148 |

) |

(2,019 |

) |

(4,318 |

) |

(5,064 |

) |

| |

|

|

|

|

| Net cash provided by operating

activities |

101,835 |

|

51,697 |

|

277,854 |

|

162,021 |

|

| |

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

| Capital expenditures |

(1,266 |

) |

(1,642 |

) |

(5,337 |

) |

(4,242 |

) |

| Proceeds from sale of

property |

- |

|

345 |

|

54 |

|

345 |

|

| Capitalized development

expenses |

(6,738 |

) |

(5,353 |

) |

(23,015 |

) |

(17,621 |

) |

| Repayments of (investments in)

deposits |

(85,791 |

) |

1,207 |

|

3,453 |

|

(93,920 |

) |

| |

|

|

|

|

| Net cash used in investing

activities |

(93,795 |

) |

(5,443 |

) |

(24,845 |

) |

(115,438 |

) |

| |

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

| Payments of bank lines of

credit |

- |

|

- |

|

- |

|

(434 |

) |

| Proceeds from (payments of)

debt |

- |

|

(92 |

) |

1,021 |

|

(507 |

) |

| Proceeds from convertible

notes |

- |

|

- |

|

- |

|

147,756 |

|

| Payments of lease

liabilities |

(899 |

) |

(1,078 |

) |

(3,638 |

) |

(3,700 |

) |

| Dividends paid to

shareholders |

- |

|

- |

|

(129,357 |

) |

(73,486 |

) |

| Purchase of treasury

shares |

(15,724 |

) |

(8,324 |

) |

(50,096 |

) |

(17,781 |

) |

| |

|

|

|

|

| Net cash provided by (used in)

financing activities |

(16,623 |

) |

(9,494 |

) |

(182,070 |

) |

51,848 |

|

| |

|

|

|

|

| Net increase (decrease) in

cash and cash equivalents |

(8,583 |

) |

36,760 |

|

70,939 |

|

98,431 |

|

| Effect of changes in exchange

rates on cash and cash equivalents |

4,711 |

|

(813 |

) |

5,050 |

|

(1,423 |

) |

| Cash and cash equivalents at

beginning of the period |

455,267 |

|

339,459 |

|

375,406 |

|

278,398 |

|

| |

|

|

|

|

| Cash

and cash equivalents at end of the period |

451,395 |

|

375,406 |

|

451,395 |

|

375,406 |

|

Supplemental Information

(unaudited) (€ millions, unless stated otherwise)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

REVENUE |

Q1-2020 |

Q2-2020 |

Q3-2020 |

Q4-2020 |

Q1-2021 |

Q2-2021 |

Q3-2021 |

Q4-2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per geography: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

77.6 |

|

85 |

% |

105.7 |

|

85 |

% |

86.6 |

|

80 |

% |

91.1 |

|

83 |

% |

113.4 |

|

79 |

% |

175.7 |

|

78 |

% |

164.3 |

|

79 |

% |

129.1 |

|

75 |

% |

|

| |

EU / USA |

13.7 |

|

15 |

% |

18.6 |

|

15 |

% |

21.7 |

|

20 |

% |

18.6 |

|

17 |

% |

29.8 |

|

21 |

% |

50.4 |

|

22 |

% |

44.0 |

|

21 |

% |

42.6 |

|

25 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

91.3 |

|

100 |

% |

124.3 |

|

100 |

% |

108.3 |

|

100 |

% |

109.7 |

|

100 |

% |

143.2 |

|

100 |

% |

226.1 |

|

100 |

% |

208.3 |

|

100 |

% |

171.7 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

ORDERS |

Q1-2020 |

Q2-2020 |

Q3-2020 |

Q4-2020 |

Q1-2021 |

Q2-2021 |

Q3-2021 |

Q4-2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per geography: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

102.0 |

|

86 |

% |

88.1 |

|

87 |

% |

75.9 |

|

80 |

% |

122.7 |

|

78 |

% |

253.2 |

|

77 |

% |

155.0 |

|

77 |

% |

170.5 |

|

82 |

% |

147.3 |

|

73 |

% |

|

| |

EU / USA |

16.6 |

|

14 |

% |

13.2 |

|

13 |

% |

19.0 |

|

20 |

% |

34.6 |

|

22 |

% |

73.9 |

|

23 |

% |

45.2 |

|

23 |

% |

38.7 |

|

18 |

% |

55.3 |

|

27 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

118.6 |

|

100 |

% |

101.3 |

|

100 |

% |

94.9 |

|

100 |

% |

157.3 |

|

100 |

% |

327.1 |

|

100 |

% |

200.2 |

|

100 |

% |

209.2 |

|

100 |

% |

202.6 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Per customer type: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

IDM |

47.4 |

|

40 |

% |

44.6 |

|

44 |

% |

43.7 |

|

46 |

% |

77.6 |

|

49 |

% |

130.8 |

|

40 |

% |

111.3 |

|

56 |

% |

133.7 |

|

64 |

% |

138.4 |

|

68 |

% |

|

| |

Subcontractors |

71.2 |

|

60 |

% |

56.7 |

|

56 |

% |

51.2 |

|

54 |

% |

79.7 |

|

51 |

% |

196.3 |

|

60 |

% |

88.9 |

|

44 |

% |

75.5 |

|

36 |

% |

64.2 |

|

32 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

118.6 |

|

100 |

% |

101.3 |

|

100 |

% |

94.9 |

|

100 |

% |

157.3 |

|

100 |

% |

327.1 |

|

100 |

% |

200.2 |

|

100 |

% |

209.2 |

|

100 |

% |

202.6 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

HEADCOUNT |

Mar 31, 2020 |

Jun 30, 2020 |

Sep 30, 2020 |

Dec 31, 2020 |

Mar 31, 2021 |

Jun 30, 2021 |

Sep 30, 2021 |

Dec 31, 2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Fixed staff (FTE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

1,071 |

|

70 |

% |

1,067 |

|

70 |

% |

1,054 |

|

70 |

% |

1,060 |

|

70 |

% |

1,070 |

|

70 |

% |

1,096 |

|

70 |

% |

1,132 |

|

70 |

% |

1,154 |

|

70 |

% |

|

| |

EU / USA |

458 |

|

30 |

% |

455 |

|

30 |

% |

459 |

|

30 |

% |

463 |

|

30 |

% |

468 |

|

30 |

% |

473 |

|

30 |

% |

483 |

|

30 |

% |

491 |

|

30 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

1,529 |

|

100 |

% |

1,522 |

|

100 |

% |

1,513 |

|

100 |

% |

1,523 |

|

100 |

% |

1,538 |

|

100 |

% |

1,569 |

|

100 |

% |

1,615 |

|

100 |

% |

1,645 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Temporary staff (FTE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Asia Pacific |

42 |

|

46 |

% |

121 |

|

72 |

% |

95 |

|

63 |

% |

35 |

|

37 |

% |

299 |

|

82 |

% |

581 |

|

90 |

% |

559 |

|

87 |

% |

412 |

|

83 |

% |

|

| |

EU / USA |

50 |

|

54 |

% |

48 |

|

28 |

% |

57 |

|

37 |

% |

60 |

|

63 |

% |

64 |

|

18 |

% |

68 |

|

10 |

% |

80 |

|

13 |

% |

84 |

|

17 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

92 |

|

100 |

% |

169 |

|

100 |

% |

152 |

|

100 |

% |

95 |

|

100 |

% |

363 |

|

100 |

% |

649 |

|

100 |

% |

639 |

|

100 |

% |

496 |

|

100 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total fixed and temporary staff (FTE) |

1,621 |

|

|

1,691 |

|

|

1,665 |

|

|

1,618 |

|

|

1,901 |

|

|

2,218 |

|

|

2,254 |

|

|

2,141 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER FINANCIAL DATA |

Q1-2020 |

Q2-2020 |

Q3-2020 |

Q4-2020 |

Q1-2021 |

Q2-2021 |

Q3-2021 |

Q4-2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gross profit |

51.7 |

|

56.7 |

% |

77.0 |

|

62.0 |

% |

65.9 |

|

60.8 |

% |

64.0 |

|

58.3 |

% |

83.3 |

|

58.2 |

% |

140.3 |

|

62.1 |

% |

125.8 |

|

60.4 |

% |

97.4 |

|

56.7 |

% |

|

| |

Inventory impairment |

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

7.4 |

|

4.3 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gross profit as adjusted |

51.7 |

|

56.7 |

% |

77.0 |

|

62.0 |

% |

65.9 |

|

60.8 |

% |

64.0 |

|

58.3 |

% |

83.3 |

|

58.2 |

% |

140.3 |

|

62.1 |

% |

125.8 |

|

60.4 |

% |

104.8 |

|

61.0 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Selling, general and admin expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As reported |

23.5 |

|

25.7 |

% |

20.1 |

|

16.2 |

% |

16.3 |

|

15.1 |

% |

15.8 |

|

14.4 |

% |

26.7 |

|

18.6 |

% |

24.2 |

|

10.7 |

% |

21.6 |

|

10.4 |

% |

20.4 |

|

11.9 |

% |

|

| |

Share-based compensation expense |

(5.8 |

) |

-6.3 |

% |

(2.2 |

) |

-1.8 |

% |

(1.0 |

) |

-1.0 |

% |

(1.5 |

) |

-1.4 |

% |

(9.8 |

) |

-6.8 |

% |

(3.6 |

) |

-1.6 |

% |

(1.4 |

) |

-0.7 |

% |

(1.6 |

) |

-1.0 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

SG&A expenses as adjusted |

17.7 |

|

19.4 |

% |

17.9 |

|

14.4 |

% |

15.3 |

|

14.1 |

% |

14.3 |

|

13.0 |

% |

16.9 |

|

11.8 |

% |

20.6 |

|

9.1 |

% |

20.2 |

|

9.7 |

% |

18.8 |

|

10.9 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Research and development expenses:: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As reported |

9.4 |

|

10.3 |

% |

8.4 |

|

6.8 |

% |

7.6 |

|

7.0 |

% |

7.4 |

|

6.8 |

% |

8.3 |

|

5.8 |

% |

9.4 |

|

4.2 |

% |

8.8 |

|

4.2 |

% |

9.9 |

|

5.8 |

% |

|

| |

Capitalization of R&D charges |

3.7 |

|

4.1 |

% |

4.3 |

|

3.5 |

% |

4.3 |

|

4.0 |

% |

5.4 |

|

4.9 |

% |

5.9 |

|

4.1 |

% |

4.9 |

|

2.2 |

% |

5.5 |

|

2.6 |

% |

6.7 |

|

3.9 |

% |

|

| |

Amortization of intangibles |

(2.6 |

) |

-2.8 |

% |

(2.1 |

) |

-1.7 |

% |

(2.1 |

) |

-2.0 |

% |

(2.2 |

) |

-2.0 |

% |

(1.7 |

) |

-1.2 |

% |

(1.7 |

) |

-0.8 |

% |

(1.8 |

) |

-0.8 |

% |

(2.1 |

) |

-1.2 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

R&D expenses as adjusted |

10.5 |

|

11.5 |

% |

10.6 |

|

8.5 |

% |

9.8 |

|

9.0 |

% |

10.6 |

|

9.7 |

% |

12.5 |

|

8.7 |

% |

12.6 |

|

5.6 |

% |

12.5 |

|

6.0 |

% |

14.5 |

|

8.5 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Financial expense (income), net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest expense (income), net |

2.6 |

|

|

2.5 |

|

|

3.1 |

|

|

3.6 |

|

|

3.4 |

|

|

2.3 |

|

|

2.4 |

|

|

2.4 |

|

|

|

| |

Hedging results |

0.7 |

|

|

0.5 |

|

|

0.3 |

|

|

0.3 |

|

|

0.7 |

|

|

0.7 |

|

|

0.7 |

|

|

0.8 |

|

|

|

| |

Foreign exchange effects, net |

(0.7 |

) |

|

(0.3 |

) |

|

(0.2 |

) |

|

(0.1 |

) |

|

0.4 |

|

|

(0.2 |

) |

|

0.3 |

|

|

(0.2 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total |

2.6 |

|

|

2.7 |

|

|

3.2 |

|

|

3.8 |

|

|

4.5 |

|

|

2.8 |

|

|

3.4 |

|

|

3.0 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Operating income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

as % of net sales |

18.8 |

|

20.6 |

% |

48.4 |

|

39.0 |

% |

42.0 |

|

38.8 |

% |

40.7 |

|

37.1 |

% |

48.4 |

|

33.8 |

% |

106.7 |

|

47.2 |

% |

95.4 |

|

45.8 |

% |

67.2 |

|

39.1 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

as % of net sales |

24.0 |

|

26.3 |

% |

53.1 |

|

42.7 |

% |

46.5 |

|

42.9 |

% |

45.5 |

|

41.5 |

% |

52.6 |

|

36.7 |

% |

110.9 |

|

49.0 |

% |

99.7 |

|

47.9 |

% |

72.0 |

|

41.9 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

as % of net sales |

13.9 |

|

15.2 |

% |

39.8 |

|

32.0 |

% |

34.0 |

|

31.3 |

% |

44.6 |

|

40.7 |

% |

37.6 |

|

26.3 |

% |

93.5 |

|

41.3 |

% |

84.2 |

|

40.4 |

% |

67.1 |

|

39.1 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Income per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

0.19 |

|

|

0.55 |

|

|

0.47 |

|

|

0.62 |

|

|

0.51 |

|

|

1.23 |

|

|

1.08 |

|

|

0.86 |

|

|

|

| |

Diluted |

0.19 |

|

|

0.50 |

|

|

0.43 |

|

|

0.55 |

|

|

0.47 |

|

|

1.12 |

|

|

1.00 |

|

|

0.80 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

________________________

1) The calculation of diluted income per share assumes the

exercise of equity settled share based payments and the conversion

of all Convertible Notes outstanding

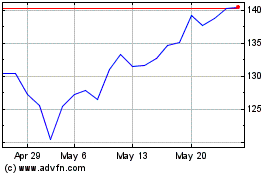

Be Semiconductor Industr... (EU:BESI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Be Semiconductor Industr... (EU:BESI)

Historical Stock Chart

From Jan 2024 to Jan 2025