CNOVA NV 2024 Second Quarter Activity & First Half Financial

Performance

CNOVA N.V.

First Half Financial performance & Second Quarter 2024

activity

Update on Casino group situation

Cnova pursues its path towards operational profitability

with an improving

EBITDA after rents by +€2m and free cash-flows improving by

+€101m vs. 23 |

|

|

- Product

GMV1 gradually

improving month after month:

- Marketplace: -5%

in 1Q24, -4% in April, -1% in May, +2% in June and +7% in

July2

- Direct sales:

-28% in 1Q24, -26% in April, -28% in May, -18% in June and -9% in

July2

- Product

GMV1 declining by -12% in 1H24 vs. 23, improving

compared to FY23 trend

-

Like-for-like3

Overall GMV declining by -11% in 1H24 vs. 23,

improving compared to FY23 trend (-14% vs. 22). With the successful

implementation of the transformation plan, Cnova is now gradually

recovering in 2Q24 (-9% vs. 23) compared to 1Q24 (-12% vs. 23) in a

challenging environment for Cdiscount’s core markets such as Home

(-6% vs. 23) & Technical goods (-3% vs. 23)4

-

Like-for-like3

Net sales decreasing by -19% in 1H24 vs. 23, as a

result of declining GMV and the strategic shift to Marketplace

representing 65% of Product GMV in 1H24 (+7pts vs. 23)

- Services

revenues5 amounting to

€158m in 1H24, increasing by +5% vs. 23,

representing 33% of overall like-for-like3 net sales,

growing by +8pts vs. 23, mostly supported by B2B

revenues increasing by +87% vs. 23

- Gross

margin rate growing by +7pts vs. 23 and EBITDA

after rents growing by +€2m in 1H24 (+10% vs. 23), thanks

to Cnova’s turnaround towards more operational profitability

- Free-cash

flows improving by +€101m in 1H24 vs. 23, thanks to

consistent payments to suppliers and a thorough monitoring, whilst

1H23 had been impacted by conciliation proceedings

- Cnova

continuously pursuing the development of its CSR strategy

with “More sustainable

products” representing 22.7% of

Product GMV in the 2nd quarter 2024 (+6.9pts vs.

23)

- Strong

NPS growing by +2.1pts in 1H24 vs. 23, with

Marketplace NPS increasing by +3.4pts vs. 23

|

AMSTERDAM – July 26, 2024, 18:00 CET Cnova N.V.

(Euronext Paris: CNV; ISIN: NL0010949392) (“Cnova”) today announced

its second quarter activity and first half unaudited financial

results for 2024.

Thomas Métivier, Cnova’s CEO,

commented:

“After two years of transformation where we

drastically improved our operational profitability by developing

our marketplace, retail media and B2B activities, refocusing our

direct sales business and streamlining our costs’ structure, we are

now focusing our efforts on our commercial bounce back. Our

immediate priority is to reinforce our commercial promise on

prices, choice and responsible consumption with a new and modern

brand identity. Proving the market fit of our value proposition for

French customers, new customer acquisition is growing again, and

commercial trend is improving month on month despite adverse market

conditions.

We keep enhancing our Artificial

Intelligence and Technology leadership to improve the experience we

offer to our B2C consumers, merchants and B2B customers with a

clear focus on projects supporting growth.”

Financial highlights

Financial performance

(€m)

|

|

2023

Half year

|

2024

Half year

|

|

Change vs. 23 |

| |

|

Reported |

L-f-L6 |

|

Overall GMV (including VAT) |

|

1,380.6 |

1,195.0 |

|

-13.4% |

-10.9% |

|

E-commerce platform |

|

1,338.4 |

1,140.2 |

|

-14.8% |

-12.2% |

|

o/w Direct sales |

|

463.6 |

336.5 |

|

-27.4% |

|

o/w Marketplace |

|

647.4 |

628.0 |

|

-3.0% |

|

Marketplace share |

|

58.3% |

65.1% |

|

+6.8pts |

|

o/w B2C services |

|

80.8 |

83.4 |

|

+3.2% |

|

o/w Other revenues |

|

146.6 |

92.3 |

|

-37.0% |

-13.4% |

| B2B

activities |

|

42.2 |

54.8 |

|

+29.8% |

|

o/w Octopia B2B revenues |

|

11.4 |

18.0 |

|

+58.9% |

|

o/w Octopia Retail & others |

|

24.2 |

21.1 |

|

-12.9% |

|

o/w C-Logistics |

|

6.7 |

15.7 |

|

x2 |

|

Net sales |

|

612.5 |

471.0 |

|

-23.1% |

-18.9% |

|

EBITDA7 |

|

33.9 |

31.3 |

|

-€2.6m |

|

% of Net sales |

|

5.5% |

6.6% |

|

+1.1pt |

|

EBITDA7 after

rents |

|

16.7 |

18.2 |

|

+€1.6m |

|

% of Net sales |

|

2.7% |

3.9% |

|

+1.2pt |

|

Operating EBIT |

|

-14.3 |

-14.9 |

|

-€0.6m |

|

% of Net sales |

|

-2.3% |

-3.2% |

|

-0.8pt |

| Net Financial

Result |

|

-26.8 |

-28.7 |

|

-€1.9m |

|

Net loss from continuing operations |

|

-65.4 |

-52.4 |

|

+€13.0m |

| Free

cash-flows |

|

2023

Half year

|

2024

Half year

|

|

Change |

|

(€m) |

|

|

vs. 23 |

| EBITDA

after rents |

|

16.7 |

18.2 |

|

+1.6 |

| (-) Capital

expenditures |

|

-32.3 |

-28.0 |

|

+4.3 |

| (-) CB4X

financial costs |

|

-11.1 |

-9.3 |

|

+1.8 |

| (+/-)

Non-recurring items |

|

-5.1 |

-9.1 |

|

-4.0 |

| Free

cash-flows before change in WC & taxes |

|

-31.7 |

-28.2 |

|

+3.5 |

| (+/-) Change

in working capital and taxes |

|

-170.7 |

-73.5 |

|

+97.3 |

|

Free cash-flows8 |

|

-202.4 |

-101.6 |

|

+100.7 |

|

|

|

|

|

|

|

|

Change in Net Financial Debt |

|

-209.9 |

-121.6 |

|

+88.3 |

1st

semester activity

Overall GMV decreased by -10.9%

like-for-like9 in the 1st semester 2024,

confirming Cnova’s strategic choice to develop its service

activities in order to improve operational profitability.

Services revenues stood at

€158m in the 1st semester 2024, improving by

+4.6% vs. 23, representing 33.5% of

like-for-like9 net sales (+7.5pts vs. 23), with:

-

Marketplace generating €90m revenues10

in the 1st semester 2024, with Marketplace GMV share

standing at 65.1% (+6.8pts vs. 23, +26.8pts vs. 19)

- Advertising

services net revenues11 reaching €33m in the

1st semester 2024, with growing Retail Media (+2.9% vs.

23), driven by Marketplace sellers (+5.0% vs. 23) with an expanding

number of active sellers (+4.0% vs. 23). Advertising GMV take rate

stood at 4.5% in the 1st semester 2024 (+0.4pt vs. 23,

+3.1pts vs. 19) despite declining Product GMV

- B2C

services12

revenues decreasing by -4.4% vs. 23, with negative volume impact on

direct sales associated services (guarantees extension and cards),

while Travel and Mobile services performed

well, improving by +10.4% vs. 23

- B2B

services13

revenues increasing by +87.2% vs. 23, standing at €28m in the

1st semester 2024, mainly driven by the dynamic of

logistic services. Over the 1st semester 2024,

C-Logistics has launched two clients, respectively specialized in

luxury goods and pet food

|

Business KPIs |

|

2023

Half Year |

2024

Half year |

|

Change

vs. 23 |

|

Marketplace10 |

|

94.6 |

89.5 |

|

(5.4)% |

|

Advertising11 |

34.1 |

33.2 |

|

(2.4)% |

|

B2C12 |

7.2 |

6.9 |

|

(4.4)% |

|

B2B13 |

15.0 |

28.1 |

|

+87.2% |

|

Services revenues |

|

150.9 |

157.7 |

|

+4.6% |

|

|

|

|

|

|

|

|

Services revenues share in net

sales9 |

|

26.0% |

33.5% |

|

+7.5pts |

|

Marketplace GMV share |

|

58.3% |

65.1% |

|

+6.8pts |

2nd

quarter highlights

|

GMV |

2Q24 vs. 23 |

| Total GMV

like-for-like14 evolution |

(9.2)% |

| Marketplace

GMV evolution |

(1.8)% |

|

Marketplace GMV share growth |

+6.5pts |

In the 2nd quarter 2024, Cnova’s overall GMV

decreased by -9.2% like-for-like14. This year-on-year

evolution was mainly driven by:

-

Direct sales contributing -8.4pts (-25.7% y-o-y),

following Cnova’s business model shift and assortment

rationalization, especially for products with low contribution

margins

-

Marketplace contributing -0.9pt (-1.8% y-o-y),

with Marketplace GMV share growing by +6.5pts, standing at 66.5% in

the 2nd quarter 2024

-

C-Logistics B2B contributing +0.7pt (+93.9% y-o-y)

with an increasing number of shipped parcels for external clients

(+31.9% vs. 23)

In the 2nd quarter 2024, Cnova has

enhanced its customer value proposition, as

illustrated by:

- A strong overall

NPS standing at 56.3pts in the 2nd quarter 2024 (+3.3pts

vs. 23), mostly driven by Marketplace NPS reaching 55.0pts in the

2nd quarter 2024 (+4.5pts vs. 23)

- Increasing share of

reactivated clients by +3.6pts in the 2nd quarter 2024

vs. 23

- Loyalty actions and

reward mechanisms dedicated to Cdiscount à

Volonté (CDAV) members

- An artificial

intelligence-powered chat dedicated to customer relationships

On June 24th, 2024,

Cdiscount.com launched its new brand identity, as

part of the strategic transformation undertaken since 2021: expand

its marketplace, offering more choice and ensuring attractive

prices, while pursuing the development of its sustainable offer.

Cdiscount’s new brand platform relies on three pillars:

-

“Moins cher”

(Less expensive): increase purchasing power amidst

inflation, offering discounts and hundreds of thousands of products

every day that are more than 10% less expensive than the

competition

-

“Malin”

(Clever): allow customers to meet their needs, to equip

themselves and to cope with unforeseen events thanks to 4X payment

installments, personalized delivery solutions and a loyalty program

that allows them to save money

-

“Engagé”

(Committed): support customers with their more responsible

consumption offering “More sustainable products”, which

represent 22.7% of Product GMV in 2Q24 (+6.9pts vs. 23)

|

Marketplace KPIs |

2Q24 |

vs. 23 |

| Marketplace

GMV share |

66.5% |

+6.5pts |

| Total express

delivery GMV share |

51.2% |

(1.0)pt |

|

o/w Cdiscount Express Seller GMV share |

12.0% |

(4.1)pts |

|

o/w Fulfilment by Cdiscount GMV share |

39.2% |

+3.2pts |

In the 2nd quarter 2024, Marketplace GMV

declined by -1.8%, while generating well-oriented KPIs:

- Marketplace GMV share growing by

+6.5pts vs. 23

- Advertising services provided to

Marketplace sellers generating steady and resilient net revenues in

the 2nd quarter 2024 vs. 23, with an expanding number of

active sellers (+1.8% vs. 23), boosted by “Discover”

offers aiming to recruit new sellers

- Fulfilment by Cdiscount GMV share

increasing by +3.2pts vs. 23, standing at 39.2% in the

2nd quarter 2024. Cdiscount Express Seller program,

dedicated to sellers able to offer express delivery to CDAV

customers, covered 12.0% of Marketplace GMV and focused on

profitability

- Marketplace NPS reaching 55.0pts in

the 2nd quarter 2024, growing by +4.5pts vs. 23

Generative Artificial Intelligence

(“GenAI”) supporting Cnova’s customer-centric approach

Artificial intelligence-powered algorithms were

implemented all along the customer journey, enabling to enhance the

relevance of the Cdiscount.com search engine (+4.6pts in search

engine click rate in the 2nd quarter 2024 vs. 23).

Through the development of numerous GenAI use

cases, Cnova seeks to generate more value, enrich customer

experience and improve internal efficiency. These initiatives also

enable Cnova to support its Marketplace sellers in promoting their

products.

To improve its product catalog and

marketability, Cnova has internally developed and deployed specific

GenAI use cases since May 2023, such as:

- Product features enrichment: to

date, c. 6 million products with features improved by GenAI

- Product reclassification: to date,

c. 27 million products reclassified and increase by c. 30% in

conversion for products reclassified through GenAI

- Product headlines and descriptives

improvement: to date, c. 10 million products processed by GenAI

Cnova pursues the development of its CSR

strategy

In April 2024, Cnova signed the Sustainable

Consumption Pledge, a voluntary initiative carried out by the

European Commission to promote sustainable consumption beyond legal

requirements. This initiative allowed Cnova to reaffirm its

commitments, including identifying and reducing its carbon

footprint, minimizing the environmental impact of its products,

increasing circularity in its operations, and ensuring social

sustainability throughout its value chain. Accelerating the

transition to sustainable daily consumption is at the core of

Cnova's strategy and a cornerstone of Cdiscount's new brand

identity, launched in June 2024.

To reduce its carbon footprint and drive

customers towards a more responsible consumption, Cnova launched a

program in 2021 focused on "more sustainable products". In

the 2nd quarter 2024, “more sustainable

products” GMV increased by +19.8% vs. 23, accounting for 22.7%

of Cdiscount's Product GMV (+6.9pts vs. 23).

In the 1st half 2024, Cnova pursued

its actions towards more sustainable logistics. The company took

part in revising the "Charte logistique e-commerce

responsable," an initiative aimed at reducing the

environmental impact of e-commerce logistics by raising consumer

awareness, reducing packaging, and making transportation greener.

With over 15 years of commitment to this cause, Cnova achieved a

new milestone, with 88.4% of its parcels targeted by void reduction

actions.

First Half 2024 financial performance

Cnova N.V.

(€m)

|

Half year |

Change |

|

2023 |

2024 |

vs. 2023 |

|

Overall GMV (including VAT) |

1,380.6 |

1,195.0 |

-13.4% |

| Net

sales |

612.5 |

471.0 |

-23.1% |

| Gross

margin |

181.7 |

172.5 |

-5.1% |

|

As a % of Net sales |

29.7% |

36.6% |

+7.0pts |

|

As a % of GMV (excluding VAT) |

15.8% |

17.3% |

+1.5pt |

| SG&A

(excluding D&A) |

-147.8 |

-141.2 |

+€6.6m |

|

As a % of Net sales |

-24.1% |

-30.0% |

-5.8pts |

|

As a % of GMV (excluding VAT) |

-12.8% |

-14.2% |

-1.3pts |

|

EBITDA |

33.9 |

31.3 |

-€2.6m |

|

As a % of Net sales |

5.5% |

6.6% |

+1.1pt |

|

As a % of GMV (excluding VAT) |

2.9% |

3.1% |

+0.2pt |

| Depreciation

& Amortization |

-48.2 |

-46.2 |

+€2.0m |

|

Operating EBIT |

-14.3 |

-14.9 |

-€0.6m |

| Other

non-current operating income / (expenses) |

-3.0 |

-7.3 |

-€4.2m |

| Net financial

income / (expenses) |

-26.8 |

-28.7 |

-€1.9m |

| Profit

before tax |

-44.1 |

-50.9 |

-€6.8m |

| Income

taxes |

-21.3 |

-1.4 |

+€19.9m |

| Net

loss |

-65.6 |

-53.8 |

+€11.7m |

|

Net loss from continuing operations |

-65.4 |

-52.4 |

+€13.0m |

Net sales amounted to €471m in

the 1st semester 2024, a -23.1% reported decrease

compared to 2023 and a -18.9% like-for-like15 decrease.

Net sales evolution has mostly been impacted by decreasing direct

sales revenues, impacted by Cnova’s voluntary business shift

towards more service activities, as illustrated by Marketplace GMV

share growing by +6.8pts vs. 23. B2B revenues have increased by

+87.2% vs. 23, supported by Octopia B2B (+58.9%) and C-Logistics

B2B (x2).

Gross margin stood at €172m in

the 1st semester 2024, representing 36.6% of net sales.

Thanks to Cnova’s business model turnaround towards high-margin

services, gross margin rate has increased by +7.0pts vs. 23, with

accretive effects mainly from Marketplace activities (including

fulfilment services provided to Marketplace sellers), Advertising

services and B2B activities.

SG&A (excluding D&A)

costs amounted to €-141m in the 1st semester 2024,

representing -30.0% of net sales (-5.8pts vs. 23), improving by €7m

compared to the 1st semester 2023, with:

-

Fulfilment costs (excluding D&A) deteriorating by €3m compared

to the 1st semester 2023, mostly due to growing B2B

fulfilment activities, notably with C-Logistics’ existing clients

ramp-up and new clients launched, partly offset by decreasing

variable costs due to lower business volumes. Considering rents,

Fulfilment costs are improving by €1m thanks to optimized

warehouses capacities

-

Marketing costs (excluding D&A) improving by €2m compared to

the 1st semester 2023, mostly due to the reduction in

headcount, as part of the Efficiency Plan, along with rationalized

marketing costs on specific activities, partly offset by growing

acquisition costs along with higher media-brand costs, with the

launch of Cnova’s new brand identity, in the 2nd quarter

2024

-

Technology & Content costs (excluding D&A) improving by €5m

compared to the 1st semester 2023, mostly due to

headcount optimization for Cdiscount, with the voluntary shift from

Direct sales to Marketplace, along with Octopia’s staff costs and

external services rationalization, partly offset by inflation

effects

-

General & Administrative costs (excluding D&A) improving by

€3m compared to the 1st semester 2023, mostly impacted

by the reduction in headcount, as part of the Efficiency Plan

Consequently, EBITDA stood at €31m in the

1st semester 2024, representing 6.6% of net sales

(+1.1pt vs. 23). EBITDA after rents amounted to

€18m, increasing by +€2m in the 1st semester 2024 (+9.5%

vs. 23) compared to the 1st semester 2023.

Depreciation & Amortization stood at

€-46m in the 1st semester 2024. In accordance with IFRS

16, D&A include the amortization of the right-of-use asset

which represents lessees’ right to exploit leased elements over the

duration of a lease agreement, which were impacted by warehousing

capacities rationalization.

Operating EBIT amounted to €-15m,

deteriorating by €-1m vs. 23, mostly due to EBITDA deteriorating

by

-€3m, partly offset by decreasing Depreciation

& Amortization compared to the 1st semester

2023.

Other non-current operating expenses

stood at €-7m in the 1st semester 2024, deteriorating by

€-4m compared to the 1st semester 2023. The

1st half 2023 was mostly impacted by conciliation,

transformation and restructuring costs. The 1st half

2024 was mainly impacted by restructuring costs notably warehouses

early termination costs.

Financial result amounted to €-29m,

deteriorating by €-2m vs. 23, mostly driven by higher financial

costs mainly due to higher drawings, notably on cash pooling,

partly offset by lower CB4X financial costs in line with the

decreasing Product GMV on Cdiscount.com over the 1st

semester 2024.

Net loss stood at €-54m, improving by

€12m compared to the 1st semester 2023, mainly driven by

decreasing income taxes as an exceptional write-off in deferred tax

assets at C-Logistics level for -€18m was booked in June 2023.

| Free

cash-flows |

|

2023

Half year

|

2024

Half year

|

|

Change |

|

(€m) |

|

|

vs. 23 |

| EBITDA

after rents |

|

16.7 |

18.2 |

|

+€1.6m |

| (-) Capital

expenditures |

|

-32.3 |

-28.0 |

|

+€4.3m |

| (-) CB4X

financial costs |

|

-11.1 |

-9.3 |

|

+€1.8m |

| (+/-)

Non-recurring items |

|

-5.1 |

-9.1 |

|

-€4.0m |

| Free

cash-flows before change in WC & taxes |

|

-31.7 |

-28.2 |

|

+€3.5m |

| (+/-) Change

in working capital and taxes |

|

-170.7 |

-73.5 |

|

+€97.3m |

|

Free cash-flows16 |

|

-202.4 |

-101.6 |

|

+€100.7m |

|

|

|

|

|

|

|

|

Change in Net Financial Debt |

|

-209.9 |

-121.6 |

|

+€88.3m |

Free cash-flows amounted to

€-102m in the 1st semester 2024, improving by +€101m vs.

23, with:

-

Increasing free cash-flows before working capital & taxes,

driven by a greater EBITDA after rents (+€2m) together with

rationalized capital expenditures (+€4m) and optimized CB4X

financial costs (+€2m), partly offset by non-recurring items

(-€4m), related to restructuring and warehouses early termination

costs

-

Enhanced working capital (+€97m) thanks to consistent payments to

suppliers and a thorough monitoring, whilst the 1st half

2023 had been impacted by conciliation proceedings, especially

payables reduction following credit insurers guarantees

shrinkage

Update on Casino group situation – Main

events

On March

28th, 2024,

Casino announced the effective completion of its financial

restructuring, resulting in a change of control of Casino group to

France Retail Holdings S.à.r.l. ("FRH"), a special purpose vehicle

set up by a consortium consisting of EP Equity Investment III

S.à.r.l. ("EP"), Fimalac and Attestor, controlled by EP, a company

controlled by Mr. Daniel Křetínský.

Pursuant to the completion of the financial

restructuring of Casino group on March 27th, 2024,

France Retail Holdings S.à.r.l. has acquired indirectly (via Casino

Guichard-Perrachon S.A.) 99.27% of the voting rights in Cnova, thus

acquiring predominant control (overwegende zeggenschap)

over Cnova.

On April

30th, 2024,

following the agreements reached on January 24th, 2024,

with Auchan Retail France and Groupement Les Mousquetaires as well

as on February 8th, 2024 with Carrefour to sell a

combined total of 287 stores, Casino group announced the sale of

121 stores.

On May

7th, 2024,

Casino group announced that FRH and Casino have jointly submitted a

petition to the Enterprise Chamber of the Amsterdam Court of

Appeal, the Netherlands, for an exemption of the obligation to make

a mandatory tender offer. If the exemption is granted, Casino will

within three months initiate a buy-out procedure

(uitkoopprocedure) in which the Enterprise Chamber will

determine the price to be paid for shares of minority shareholders

of Cnova N.V., whereby Casino will claim a buy-out price similar to

the price that would be paid in a mandatory tender offer.

The petition also includes a request for a

further extension of the period. The Enterprise Chamber previously

extended this period by thirty days in its judgment of April

25th, 2024.

On May

7th, 2024,

Cnova announced that Mrs. Béatrice Davourie was appointed as

replacement non-executive director and Chairman of the Board of

Cnova NV, effective as per May 10th, 2024.

On May

24th, 2024,

Casino group announced that FRH and Casino have received a judgment

of the Enterprise Chamber of the Amsterdam Court of Appeal, the

Netherlands, granting an additional thirty-day extension of the

time period. As a result, the period provided is extended by thirty

days as of May 27th, 2024.

On May

31st, 2024,

following the agreements reached on January 24th, 2024,

with Groupement Les Mousquetaires and Auchan Retail France and as

well as on February 8th, 2024 with Carrefour to sell a

combined total of 287 stores, Casino group announced the sale of 90

stores.

On June

21st, 2024,

Casino group announced that FRH and Casino group have on June

20th, 2024, received a judgment of the Enterprise

Chamber of the Amsterdam Court of Appeal, the Netherlands, granting

an exemption of the obligation to make a mandatory tender offer for

the shares and depositary receipts of Cnova N.V., subject to the

condition that Casino shall within four months initiate statutory

buyout proceedings (uitkooprocedure) in which the price

for Cnova shares is at least equal to the price per share that FRH

would have had to offer in a mandatory tender offer under French

law, and whereby the obligation to make a mandatory tender offer

will revive should Casino not timely initiate the aforementioned

buyout proceedings or the Enterprise Chamber reject the statutory

buyout claim.

On July

2nd, 2024,

Casino group announced the sale of 66 stores following the

agreements reached on January 24th, 2024, with

Groupement Les Mousquetaires and Auchan Retail France.

Casino group also announced that it has sold its

controlling 51% stake in 5 hypermarkets to Groupement les

Mousquetaires. Groupement les Mousquetaires already hold a 49%

stake in these hypermarkets from September 30th, 2023.

***

Cnova publishes today on its website, Friday

July, 26th, its 2024 semi-annual report.

***

About Cnova N.V.

Cnova N.V., the French ecommerce leader,

serves 7.1 million active customers via its state-of-the-art

website, Cdiscount. Cnova N.V.’s product offering provides its B2C

clients with a wide variety of very competitively priced goods,

fast and customer-convenient delivery options, practical and

innovative payment solutions as well as travel and entertainment

services. Cnova N.V. also serves B2B clients internationally

through Octopia (Marketplace-as-a-Service solutions), Cdiscount

Advertising (advertising services for sellers and brands) and

C-Logistics (end-to-end logistic ecommerce solution). Cnova N.V. is

part of Casino group, a global diversified retailer. Cnova N.V.'s

news releases are available at www.cnova.com. Information available

on, or accessible through, the sites referenced above is not part

of this press release.

This press release contains regulated

information (gereglementeerde informatie) within the meaning of the

Dutch Financial Supervision Act (Wet op het financieel toezicht)

which must be made publicly available pursuant to Dutch and French

law. This press release is intended for information purposes

only.

Cnova Investor Relations Contact:

investor@cnovagroup.com

Tel : +33 6 79 74 30 94 |

Media contact:

directiondelacommunication@cdiscount.com

Tel: +33 6 18 33 17 86

cdiscount@vae-solis.com

Tel: +33 6 17 76 79 71 |

***

Appendices

Cnova N.V. Half Year 2024 Consolidated

Financial Statements (unaudited)

|

Consolidated Income Statement |

|

Half year

2023

Revised

|

Half year

2024

|

|

(€m) |

|

|

Net sales |

|

587.6 |

471.0 |

| Cost of

sales |

|

-407.9 |

-298.5 |

| Gross

margin |

|

179.6 |

172.5 |

|

% of net sales |

|

30.6% |

36.6% |

|

SG&A(1) |

|

-193.4 |

-187.4 |

| % of net

sales |

|

-32.9% |

-39.8% |

| Fulfilment

costs |

|

-60.8 |

-62.3 |

| Marketing

costs |

|

-34.1 |

-33.1 |

| Technology

& Content costs |

|

-73.6 |

-69.4 |

|

General & Administrative costs |

|

-24.8 |

-22.6 |

|

Operating EBIT(2) |

|

-13.8 |

-14.9 |

|

% of net sales |

|

-2.3% |

-3.2% |

|

Other expenses |

|

-2.9 |

-7.3 |

|

Operating profit / (loss) |

|

-16.7 |

-22.2 |

|

Net financial income / (expense) |

|

-26.6 |

-28.8 |

|

Profit / (loss) before tax |

|

-43.3 |

-51.0 |

| Income tax

gain / (expense) |

|

-21.3 |

-1.4 |

|

Net profit / (loss) from continued operations |

|

-64.5 |

-52.4 |

|

Net profit /(loss) from discontinued operations(3) |

|

-1.0 |

-1.5 |

| Net

profit/(loss) for the period |

|

-65.6 |

-53.8 |

|

% of net sales |

|

-11.2% |

-11.4% |

| Attributable

to Cnova equity holders(4) |

|

-63.9 |

-53.4 |

|

Attributable to non-controlling interests(4) |

|

-1.6 |

-0.5 |

|

Adjusted EPS

(€)(5) |

|

-0.19 |

-0.15 |

1) SG&A:

selling, general and administrative expenses

2) Operating EBIT: operating

profit/(loss) before other expenses (strategic and restructuring

expenses, litigation expenses and impairment and disposal of assets

expenses)

3) In accordance with IFRS 5

(Non-current Assets Held for Sale and Discontinued Operations), net

loss from discontinued operations is related to Via Varejo

litigation settlement for the period ended June 30, 2024. Net

result generated by Carya is reported under “Net profit/(loss) from

discontinued operations” for the period ended June 30,

2023

4) Including discontinued

5) Adjusted EPS: net profit/(loss)

attributable to equity holders of Cnova before other expenses and

the related tax impacts, divided by the weighted average number of

outstanding ordinary shares of Cnova during the applicable

period

|

Consolidated Balance Sheet |

|

2023

End December

|

2024

End June

|

|

(€m) |

|

ASSETS |

|

|

|

| Cash and cash

equivalents |

|

11.0 |

18.8 |

| Trade

receivables, net |

|

92.7 |

75.6 |

| Inventories,

net |

|

100.5 |

100.5 |

| Current income

tax assets |

|

1.8 |

1.0 |

| Other current

assets, net |

|

144.9 |

173.3 |

|

Total current assets |

|

351.0 |

369.2 |

| Other

non-current assets, net |

|

7.1 |

6.6 |

| Deferred tax

assets |

|

15.0 |

14.0 |

| Right of use,

net |

|

71.4 |

66.5 |

| Property and

equipment, net |

|

16.4 |

15.6 |

| Intangible

assets, net |

|

208.4 |

198.7 |

|

Goodwill |

|

60.7 |

58.2 |

|

Total non-current assets |

|

379.1 |

359.6 |

|

|

|

|

|

|

Assets held for sale |

|

0.0 |

0.0 |

|

|

|

|

|

|

TOTAL ASSETS |

|

730.1 |

728.8 |

| EQUITY

AND LIABILITIES |

|

|

|

| Current

provisions |

|

4.5 |

0.9 |

| Trade

payables |

|

252.9 |

190.6 |

| Current

financial debt |

|

183.6 |

34.7 |

| Current lease

liabilities |

|

31.0 |

24.0 |

| Current taxes

and social liabilities |

|

55.3 |

80.2 |

| Other current

liabilities |

|

205.1 |

186.5 |

|

Total current liabilities |

|

732.4 |

516.9 |

| Non-current

provisions |

|

6.8 |

7.4 |

| Non-current

financial debt |

|

416.9 |

695.1 |

| Non-current

lease liabilities |

|

64.4 |

56.5 |

| Other

non-current liabilities |

|

16.1 |

15.2 |

| Deferred tax

liabilities |

|

0.1 |

0.0 |

|

Total non-current liabilities |

|

504.3 |

774.2 |

| Share

capital |

|

17.3 |

17.3 |

| Reserves,

retained earnings & additional paid-in capital |

|

-591.6 |

-646.6 |

| Equity

attributable to equity holders of Cnova |

|

-574.4 |

-629.3 |

|

Non-controlling interests |

|

67.8 |

67.0 |

|

Total equity |

|

-506.6 |

-562.3 |

|

|

|

|

|

|

TOTAL EQUITY AND LIABILITIES |

|

730.1 |

728.8 |

|

Consolidated Cash Flow Statement |

|

First 6 months

2023

|

First 6 months

2024

|

|

(€m) |

|

|

Net profit (loss) attributable to equity holders of the

Parent |

|

-62.9 |

-51.9 |

|

Net profit (loss) attributable to non-controlling interests |

|

-1.6 |

-0.5 |

|

Net profit (loss) from continuing operations |

|

-64.5 |

-52.4 |

| Depreciation

and amortization expense |

|

48.1 |

46.2 |

| (Gains) losses

on disposal of non-current assets and impairment of assets |

|

0.8 |

3.0 |

| Other non-cash

items |

|

-3.3 |

-0.5 |

| Financial

expense, net |

|

26.6 |

28.8 |

| Current and

deferred tax expenses |

|

21.3 |

1.4 |

| Income tax

paid |

|

-1.7 |

0.6 |

| Change

in operating working capital |

|

-166.9 |

-73.2 |

|

Inventories of products |

|

34.5 |

-0.4 |

|

Trade payables |

|

-198.6 |

-58.4 |

|

Trade receivables |

|

23.4 |

22.8 |

|

Others |

|

-26.3 |

-37.2 |

| Net

cash from / (used in) continuing operating activities |

|

-139.7 |

-46.1 |

|

Net cash from / (used in) discontinued operating

activities |

|

-2.9 |

-4.9 |

| Purchase of

property, equipment & intangible assets |

|

-31.8 |

-28.0 |

| Purchase of

non-current financial assets |

|

0.2 |

-0.0 |

| Proceeds from

disposal of P&E, intangible assets & non-current fin.

assets |

|

4.7 |

2.9 |

| Acquisitions

of subsidiaries, net of cash acquired |

|

- |

-0.4 |

|

Changes in loans granted (including to related parties) |

|

155.6 |

0.1 |

| Net

cash from / (used in) continuing investing activities |

|

128.6 |

-25.4 |

|

Net cash from / (used in) discontinued investing

activities |

|

-0.5 |

0.0 |

| Additions to

financial debt |

|

79.4 |

198.2 |

| Repayments of

financial debt |

|

-10.2 |

-6.0 |

| Repayments of

lease liability |

|

-13.9 |

-16.6 |

| Interest paid

on lease liability |

|

-3.8 |

-1.9 |

|

Interest paid, net |

|

-27.0 |

33.6 |

| Net

cash from / (used in) continuing financing activities |

|

24.5 |

140.1 |

|

Net cash from / (used in) discontinued financing

activities |

|

-0.6 |

-0.0 |

|

Effect of changes in foreign currency translation adjustments |

|

0.0 |

0.1 |

| Change

in cash and cash equivalents from continuing

operations |

|

13.3 |

68.7 |

|

Change in cash and cash equivalents from discontinued

operations |

|

-4.0 |

-4.9 |

|

Cash and cash equivalents, net, at period

begin |

|

-54.3 |

-58.1 |

|

|

|

|

|

|

Cash and cash equivalents, net, at period end |

|

-45.0 |

5.7 |

1 Placed Direct sales and Marketplace GMV excl. VAT

(before cancellation due to fraud detection and/or customer

non-payment)

2 Evolution of placed GMV as of July 25th,

2024 compared to the same period last year

3 Like-for-like figures exclude Carya

and Neosys (disposed) along with Géant and Cdiscount Pro

(discontinued)

4 Source: Fevad (figures covering from January 2024 to

May 2024 compared to the same period last year)

5 Including Marketplace commissions,

subscription fees and other revenues, Advertising services,

Fulfilment by Cdiscount, warranties extension, CUP cards

commissions, B2C services, Octopia B2B (Fulfilment-as-a-Service,

Merchants-as-a-Service and Marketplace-as-a-Service) and

C-Logistics B2B

6 Like-for-like figures exclude Carya and Neosys

(disposed) along with Géant and Cdiscount Pro (discontinued)

7 EBITDA: operating profit/(loss) from ordinary

activities (EBIT) adjusted for operating depreciation &

amortization

8 Free cash-flows from continuing operations before

financial interest

9 Like-for-like figures exclude Carya and Neosys

(disposed) along with Géant and Cdiscount Pro (discontinued)

10 Including Marketplace commissions after price

discounts, subscription fee and revenues from fulfilment services

to sellers

11 Including both revenues from marketing services to

suppliers and sellers

12 Including Travel, Mobile, CUP cards commissions,

warranty services and others

13 Including Fulfilment-as-a-Service,

Merchants-as-a-Service and Marketplace-as-a-Service (Octopia) and

C-Logistics B2B activities

14 Like-for-like figures exclude Carya and Neosys

(disposed) along with Géant and Cdiscount Pro (discontinued)

15 Like-for-like figures exclude Carya and Neosys

(disposed) along with Géant and Cdiscount Pro (discontinued)

16 Free cash-flows from continuing operations before

financial interest

- 2022 07 26_Cnova Press release_H1 2022 VF

- Cnova NV_Activity Press release_2Q24

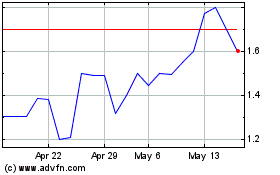

Cnova NV (EU:CNV)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cnova NV (EU:CNV)

Historical Stock Chart

From Jan 2024 to Jan 2025