Coface SA: Disclosure of trading in own shares (excluding the liquidity agreement) made on February 21, 2025

February 25 2025 - 10:45AM

UK Regulatory

Coface SA: Disclosure of trading in own shares (excluding the

liquidity agreement) made on February 21, 2025

COFACE SA: Disclosure of trading in own

shares (excluding the liquidity agreement) made on February 21,

2025

Paris, 25 February – 17.45

Pursuant to Regulation (EU) No 596/2014

of 16 April 2014 on market abuse1

The main features of the 2024-2025 Share Buyback

Program have been published on the Company’s website

(http://www.coface.com/Investors/Disclosure-requirements, under

“Own share transactions”) and are also described in the 2023

Universal Registration Document.

- Trading session of (Date):

21/02/2025

- Number of shares:

10,000

- Weighted average price:

16.0826 €

- Gross amount: 160,826.70

€

- MIC: XPAR

- Purpose of buyback:

LTIP

CONTACTS

ANALYSTS / INVESTORS

Thomas JACQUET: +33 1 49 02 12 58 – thomas.jacquet@coface.com

Rina ANDRIAMIADANTSOA: +33 1 49 02 15 85 –

rina.andriamiadantsoa@coface.com

FINANCIAL CALENDAR 2025

(subject to change)

Q1-2025 results: 5 May 2025 (after market

close)

Annual General Shareholders’ Meeting: 14 May 2025

H1-2025 results: 31 July 2025 (after market close)

9M-2025 results: 3 November 2025 (after market close)

FINANCIAL INFORMATION

This press release, as well as COFACE SA’s integral regulatory

information, can be found on the Group’s website:

http://www.coface.com/Investors

For regulated information on Alternative

Performance Measures (APM), please refer to our Interim Financial

Report for H1-2024 and our 2023 Universal Registration Document

(see part 3.7 “Key financial performance indicators”).

|

Regulated

documents posted by COFACE SA have been secured and authenticated

with the blockchain technology by Wiztrust.

You can check the authenticity on the website

www.wiztrust.com. |

COFACE: FOR TRADE

As a global leading player in trade credit risk management for more

than 75 years, Coface helps companies grow and navigate in an

uncertain and volatile environment.

Whatever their size, location or sector, Coface provides 100,000

clients across some 200 markets. with a full range of solutions:

Trade Credit Insurance, Business Information, Debt Collection,

Single Risk insurance, Surety Bonds, Factoring.

Every day, Coface leverages its unique expertise and cutting-edge

technology to make trade happen, in both domestic and export

markets.

In 2024, Coface employed ~5,236 people and registered a turnover of

€1.84 billion.

www.coface.com

COFACE SA is listed in Compartment A of Euronext Paris

ISIN: FR0010667147 / Ticker: COFA

|

1 Also in pursuant to Commission Delegated

Regulation (EU) 2016/1052 of 8 March 2016 (and updates); Article

L.225-209 and seq. of the French Commercial Code; Article L.221-3,

Article L.241-1 and seq. of the General Regulation of the French

Market Authority (AMF); AMF Recommendation DOC-2017-04 Guide for

issuers on their own shares transactions and for stabilization

measures.

- 2025 02 25 - Declaration - Own shares transaction

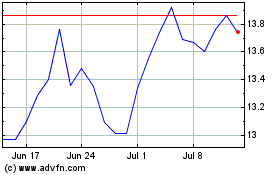

Coface (EU:COFA)

Historical Stock Chart

From Jan 2025 to Feb 2025

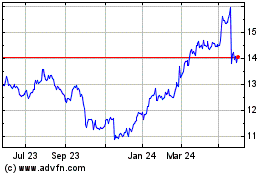

Coface (EU:COFA)

Historical Stock Chart

From Feb 2024 to Feb 2025