SFL – First-Quarter 2022 Financial Information

April 19 2022 - 11:31AM

Business Wire

Regulatory News:

SFL (Paris:FLY):

Rental income: €46.4 million (up 5.0%)

Consolidated

revenue by business segment (€000's)

Q1 22

Q1 21

Rental income

46,364

44,172

o/w

Paris Central Business District

37,985

36,159

Paris Other

7,780

7,479

Western Crescent

599

534

Other revenue

0

0

Total consolidated

revenue

46,364

44,172

First-quarter 2022 consolidated rental income amounted to €46.4

million, up by €2.2 million or 5.0% from the €44.2 million reported

for the same period in 2021:

- On a like-for-like basis (excluding all changes in the

portfolio affecting period-on-period comparisons), rental income

was €0.2 million higher, an increase of 0.5%,

- Rental income from spaces being redeveloped was up by €2.5

million, positively impacted in particularly by delivery of the 83

Marceau building in the second half of 2021, after two years of

redevelopment,

- The early-2021 sale of the 112 Wagram and 9 Percier buildings

led to a €0.5 million contraction in rental income.

The overall rent recovery rate for the first quarter of 2022

stands at 99%.

Business review

In the first quarter of 2022, letting activity in the greater

Paris rental market once again signaled a return to normal levels,

with transaction volumes in line with historic averages and rents

for prime properties in Paris' CBD remaining at record highs.

Against this backdrop, the SFL Group signed leases on around

7,000 sq.m. of mainly office space on very good terms in

first-quarter 2022. The new leases were signed at an average

nominal rent of €761 per sq.m., corresponding to an effective rent

of €654 per sq.m.

The physical occupancy rate for buildings in use reached a

historic high, at 98.6% as of 31 March 2022 (versus 98.0% as of 31

December 2021), while the EPRA vacancy rate was 1.1%.

No properties were purchased or sold during the first quarter of

2022. However, in February, SFL signed an agreement to acquire the

Pasteur building (91-93 boulevard Pasteur in Paris), a nearly

40,000-sq.m. property that is fully occupied by Amundi (see press

release of 28 February 2022).

Contracts are expected to be exchanged by the end of April

2022.

Financing

SFL’s consolidated net debt at 31 March 2022 amounted to €1,819

million, compared with €1,792 million at 31 December 2021,

representing a loan-to-value ratio of 22.3% based on the

portfolio’s appraisal value at 31 December 2021. The average cost

of debt after hedging was 1.1% and the average maturity was 4.5

years. At end-March 2022, the interest coverage ratio stood at

6.0x.

The Company’s liquidity position at 31 March 2022 was excellent,

with €1,240 million in undrawn confirmed lines of credit.

About SFL

Leader in the prime segment of the Parisian commercial real

estate market, Société Foncière Lyonnaise stands out for the

quality of its property portfolio, which is valued at

€7.6 billion and is focused on the Central Business District

of Paris (#cloud.paris, Edouard VII, Washington

Plaza, etc.), and for the quality of its client portfolio,

which is composed of prestigious companies in the consulting,

media, digital, luxury, finance and insurance sectors. As France’s

oldest property company, SFL demonstrates year after year an

unwavering commitment to its strategy focused on creating a high

value in use for users and, ultimately, substantial appraisal

values for its properties.

Stock market: Euronext Paris Compartment A – Euronext Paris ISIN

FR0000033409 – Bloomberg: FLY FP – Reuters: FLYP PA

S&P rating: BBB+ stable outlook

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220419005893/en/

SFL - Thomas Fareng - Phone +33 (0)1 42 97 27 00 -

t.fareng@fonciere-lyonnaise.com www.fonciere-lyonnaise.com

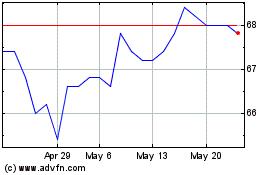

Fonciere Lyonnaise (EU:FLY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Fonciere Lyonnaise (EU:FLY)

Historical Stock Chart

From Dec 2023 to Dec 2024