GTT FY 2023 Results: Revenue and EBITDA in the upper half of the

guidance range; continuation of good order intake momentum,

offering very good visibility; strong growth expected in 2024

FY 2023

Results:Revenue and EBITDA in the

upper half of the guidance range; continuation of good order intake

momentum, offering very good visibility; strong growth expected in

2024

Key figures for the 2023 financial

year

- Consolidated

revenues: 428 million euros, up 39.2% compared to 2022

- Consolidated

EBITDA: 235 million euros, up 45.6% compared to 2022

- Proposed dividend: 4.36 euros per

share1, up 40.6% compared to 2022

Highlights

- Order book at a

record level with 311 units for the core business and 76 units for

the LNG as fuel business

- Numerous

approvals in principle, notably in the field of liquid hydrogen

transport and for the innovative three-tank LNG carrier concept,

highlighting the dynamism of the Group’s R&D

- Construction of

the Elogen gigafactory commenced in early 2024

Outlook

- Very good visibility on core

business, with 1,815 million euros in cumulated revenues over the

period from 2024 to 2029

- 2024 guidance:

- 2024 consolidated revenues between

600 million euros and 640 million euros;

- Consolidated EBITDA for 2024

between 345 and 385 million euros;

- 2024 dividend payout of at least

80% of consolidated net income.

Paris – February 26, 2024. GTT,

the technological expert in membrane containment systems used to

transport and store liquefied gases, today announces its results

for the 2023 financial year.

Commenting on the results, Philippe

Berterottière, Chairman and CEO of GTT, said: “With a

total of 73 LNG carrier orders, two ethane carrier orders, and

one FLNG unit order in the financial year 2023, the commercial

performance of our core business remains buoyant. Demand for LNG

remains particularly high and sustainable, as borne out by the

number of final investment decisions for new liquefaction plants –

involving substantial volumes – that were confirmed at the

beginning of the financial year. Continued strong demand for LNG,

coupled with the construction of new liquefaction plants, will

continue to fuel further demand for LNG carriers. In addition, with

the ageing of fleets and the introduction of new environmental

regulations, the replacement market is expected to grow in the

coming years.

For LNG as fuel, GTT booked 15 orders in 2023,

with commercial momentum benefitting from a return to normal LNG

spot prices.

In 2023, Ascenz Marorka was awarded several

major contracts with leading ship-owners, highlighting the

relevance of our digital solutions. Furthermore, we are also

announcing today the acquisition of VPS, a Danish company

specialising in ship performance management.

Finally, Elogen, our subsidiary specialising in

PEM electrolysers for green hydrogen production, posted a strong

increase in revenues. With the January 2024 launch of construction

of its gigafactory in Vendôme, Elogen also achieved a major

milestone in its move towards mass production.

The GTT Group continues to pursue its ongoing

efforts in R&D and innovation, as evidenced by the numerous new

approvals obtained from classification societies in 2023, notably

in the fields of alternative fuels and liquid hydrogen

transport.

On the financial front, revenues rose

significantly in the financial year 2023 – up 39% compared to 2022

– driven by the progressive increase in the number of LNG carriers

under construction, Elogen’s growth, and the services business

line. EBITDA increased by 46% in 2023 to stand at 235 million

euros, due to sound cost management and the absence of significant

delays in shipbuilding schedules.

GTT benefits from very strong visibility on its

core business over the coming years, with cumulated revenues for

the period from 2024 to 2029 amounting to 1,815 million euros.

Regarding our outlook for the current year, considering the

distribution of order book over time, we estimate that consolidated

revenues for 2024 should be within the range of 600 to 640 million

euros, and consolidated EBITDA within the range of 345 to 385

million euros, and we maintain our commitment to distribute at

least 80% of the Group’s net income2 for the 2024 financial year.”

Group business activity in 2023

- LNG carriers: Order momentum

continues

After a record year in 2022 in terms of order

intake, GTT booked 73 LNG carrier orders in the financial year

2023, 21 of which were booked in the fourth quarter. Their delivery

is scheduled between the first quarter of 2026 and the third

quarter of 2029.

An order for two very large ethane carriers was

booked in the fourth quarter of 2023, with delivery scheduled

between the fourth quarter of 2026 and the second quarter of

2027.

Additionally, in early 2023, an order was booked

for an LNG liquefaction unit (FLNG), which is scheduled for

delivery in the first quarter of 2027.

Also, in the first two months of 2024, GTT

booked two orders for a total of 23 LNG carriers – including

eight very-large capacity carriers – as well as an order for three

very large ethane carriers.

- LNG as fuel

In July 2023, GTT received an order from the

Chinese shipyard Yangzijiang to design the cryogenic tanks for ten

LNG-powered very large container ships.

In September 2023, a new order for

five large container ships was received from HD Hyundai Heavy

Industries on behalf of Yang Ming, a Chinese ship-owner.

Delivery of these container ships is scheduled

between the second quarter of 2026 and the first quarter of

2028.

- Two new agreements with

shipyards

In November 2023, GTT signed a Technical

Assistance and Licensing Agreement with COSCO Shipping (Qidong)

Offshore, a subsidiary of COSCO Shipping Corporation, and, in

December 2023, a strategic cooperation agreement with the Chinese

shipbuilding group, CSSC.

- Services to vessels in

operation

In May 2023, GTT signed a Technical Service

Agreement with the maritime transportation company Eastern Pacific

Shipping and its subsidiary Coolco to support them with the

maintenance and operation of a fleet of 33 vessels (24 LNG

carriers, six ethane carriers and three container ships).

In October 2023, GTT announced that it had

signed a service contract with the ship-owner CMA CGM for the

maintenance and operation of 49 LNG-powered container ships. The

contract includes on-site technical support from GTT teams during

inspections, maintenance, repairs, operations and engineering

services, as well as training and access to the HEARS® emergency

hotline. The contract also includes solutions provided by

Ascenz Marorka (see below).

- Ascenz Marorka: New contracts and

launch of new innovative solutions

During 2023, GTT pursued its strategy of

developing new digital solutions for ship-owners and signed a

number of important contracts, highlighting the increasing needs of

ship-owners in this area.

The innovative solutions and new services

developed by Ascenz Marorka include:

- A

maintenance-optimisation solution for LNG membrane tanks, known as

the “Sloshing Virtual Sensor”, which has received an approval in

principle from Lloyd’s Register. This solution is designed to

extend the period between tank inspections by two years, while

maintaining strict safety standards.

- The

vessel-propeller Shaft Power Limitation (ShaPoLi) solution3, which

has obtained conformity certification from DNV and Bureau Veritas.

This solution aims to help ship-owners and operators comply with

International Maritime Organization (IMO) regulations.

- The setting up

of the Real-Time Fleet Performance Monitoring Centre, which brings

together a team of maritime experts with in-depth knowledge of

navigation, meteorology, performance management, LNG operations and

offshore operations, to provide a holistic approach to optimise

vessel operations.

Notable contracts signed by Ascenz Marorka in

2023 include:

- A contract with

two major European LNG ship-owners to equip three vessels with its

“Sloshing Virtual Sensor” predictive maintenance solution, which is

designed to optimise tank maintenance, while ensuring compliance

with strict safety standards, thereby improving operational

flexibility and achieving substantial savings.

- Four contracts

for its Smart Shipping solution: the first with a European

ship-owner, to equip 30 container ships; the second with GasLog, to

equip its entire fleet of more than 35 LNG carriers; the third,

with Global Ship Lease, to equip its entire fleet of container

ships; and the fourth, with Brunei Gas Carriers, to equip the first

vessel in its fleet. The Smart Shipping solution developed by

Ascenz Marorka comprises automatic data collection systems and

smart software designed to manage and optimise vessels’ energy and

environmental performance.

- A contract to

equip the entire Clean Products Tankers Alliance (CPTA) fleet –

i.e. approximately 20 vessels – with its advanced weather routing

solution.

- A contract to

equip 49 CMA CGM LNG-powered vessels with high-frequency data

collection systems, with access to Ascenz Marorka online

platform.

- Elogen

In terms of sales, Elogen continues to implement

its selective approach to projects, while posting strong growth in

revenues (up 117% to 10.1 million euros at December 31, 2023). In

the past financial year, EBITDA showed a controlled level of loss,

given the increase in headcounts (+50 employees over the period),

to stand at -19.7 million euros, compared to -14.7 million euros in

2022. The Group notes that Elogen’s EBITDA is expected to break

even from mid-decade.

In early 2023, Elogen won a flagship contract

with CrossWind – a joint venture between Shell and Eneco – to build

a 2.5 MW electrolyser for an offshore wind farm off the coast of

the Netherlands.

In July 2023, Elogen signed its first contract

with its Korean partner Valmax for the construction of a

2.5 MW electrolyser. In September 2023, Elogen signed a new

contract with Valmax for the construction of a second 2.5 MW

electrolyser. With a production capacity of up to one tonne of

hydrogen per day each, these two electrolysers will be integrated

into mobility projects in Korea.

In December 2023, Elogen, the CNRS and the

University of Paris-Saclay announced the creation of a joint

laboratory to facilitate the large-scale production of green

hydrogen by improving existing electrolysis processes and

conducting research on the use of different materials.

Elogen continues to implement its strategy

around three imperatives: “Be efficient, be reliable, be ready”.

Within this framework, Elogen is developing its R&D activities

to improve the competitiveness and energy efficiency of its

solutions, diversifying its technologies to produce large-scale

electrolysers and continuing the development of its network of

local partners for Balance-Of-Plant assembly and maintenance. The

company is also strengthening its teams, particularly those

involved in technical fields and project management. Finally,

Elogen is gearing up for industrial scale-up with its Vendôme

gigafactory project (part of the Hydrogen IPCEI). Construction

began in January 2024.

- Development of new

technologies

Innovations in the field of LNG carriers

At the start of 2023, GTT obtained several

approvals in principle for the adoption of new technologies in the

LNG carrier field. A notable example was from Lloyd’s Register

for a new LNG carrier design in collaboration with Samsung Heavy

Industries, incorporating the three-tank concept developed by GTT

and equipped with the Mark III Flex membrane containment

system.

Innovations in the field of LNG-fuelled

vessels/alternative fuels

In 2023, GTT obtained numerous approvals in

principle from classification societies, especially in the area of

alternative fuels. The approvals cover the following concepts:

- A dual-fuel,

LNG-powered supertanker (ABS, ClassNK, Bureau Veritas, DNV and

Lloyd’s’ Register);

- A dual-fuel LNG-powered Suezmax

supertanker (ABS, DNV);

- An LNG tank with an

“NH3 ready” rating (ClassNK, DNV);

- An LNG tank allowing a pressure of

up to one barg for LNG-as-fuel applications (ABS);

- And the RecycoolTM

system, applied to LNG-powered vessels, which reliquefies excess

boil-off gas to reduce greenhouse gas emissions and improve

economic performance (ClassNK).

The Group also obtained a 4.66 million euros

subsidy from Bpifrance for the design of an on-board CO2 capture

system for vessels, and the development of smart digital

ship-management solutions by OSE Engineering4 (a subsidiary of the

GTT Group), as part of the MerVent project5.

Developments in the field of liquid hydrogen

transportation

In July 2023, GTT received an approval in

principle from ClassNK for a new membrane containment system

concept for the transport of liquefied hydrogen.

As previously announced in April 2023, GTT,

TotalEnergies, LMG Marin and Bureau Veritas signed an

agreement for a joint development project aimed at developing a

concept for a liquid hydrogen carrier with a capacity of

150,000 m3, equipped with GTT’s membrane containment system.

In January 2024, this project received two approvals in principle

from Bureau Veritas: one for the design of a cryogenic membrane

containment system for liquefied hydrogen, and the other for the

preliminary design of the hydrogen carrier. These approvals mark

the first major achievement in the development of a liquid hydrogen

transport sector.

In 2023, the GTT Group filed 64 patents.

- GTT Strategic Ventures

In September 2023, the GTT Group’s investment

fund, GTT Strategic Ventures, announced an investment in the

technology company ‘bound4blue’ to support the development of

wind-assisted propulsion technology for ships. After Tunable and

Sarus, bound4blue is the third minority stake of GTT Strategic

Ventures, whose ambition is to contribute to the growth of Climate

Tech champions.

- CSR strategy

In February 2024, the Group published its

2024-2026 CSR roadmap6, and submitted its CO2 emission reduction

targets to the SBTi. The roadmap translates today’s priorities into

future concrete actions to achieve a better future that is aligned

with the interests of GTT’s customers and employees, as well as

those of the wider community and the planet. This roadmap was

designed as a performance and progress monitoring tool and will

evolve over time.

The GTT Group’s CSR strategy is structured

around three fundamental axes:

- Fighting against

global warming

- Responsible

employer

- Corporate citizen

In March 13, 2023, GTT also announced that it

had joined the United Nations Global Compact, thereby committing

itself to promoting the “Ten Principles” on human rights, labour

standards, the environment and anti-corruption, and to implementing

the 17 Sustainable Development Goals (SDGs)7 in its environmental,

social and governance policy.

Order book at December 31, 2023

As of January 1, 2023, GTT’s order book,

excluding LNG as fuel, comprised 274 units. The following changes

have occurred since January 1:

- Deliveries: 33 LNG carriers, 2

ethane carriers, 2 FSUs and 2 onshore storage tanks;

- Orders received: 73 LNG carriers, 2

ethane carriers, 1 FLNG.

As of December 31, 2023, the order book, excluding LNG as fuel,

stood at 311 units, breaking down as follows:

- 296 LNG carriers;

- 4 ethane carriers;

- 1 FSRU;

- 1 FLNG;

- 9 onshore

storage tanks.

Regarding LNG as fuel, with the delivery of nine

vessels and orders for 15 container ship tanks, the number of

vessels on order stood at 76 units on December 31, 2023.

Consolidated revenue

|

(in thousands of euros) |

2022 |

2023 |

Change |

|

Revenues |

307,294 |

427,704 |

+39.2% |

|

|

|

|

|

|

New builds |

279,526 |

389,464 |

+39.3% |

|

LNG carriers/ethane carriers |

242,294 |

353,378 |

+45.7% |

|

FSU |

16,195 |

2,422 |

-85.0% |

|

FSRU |

- |

- |

ns |

|

FLNGs |

1,218 |

- |

-100.0% |

|

Onshore storage tanks and GBSs |

13,014 |

4,126 |

-68.3% |

|

LNG-powered vessels |

6,805 |

29,539 |

+334.1% |

|

Electrolysers |

4,653 |

10,080 |

+116.6% |

|

Services |

23,116 |

28,159 |

+21.8% |

Consolidated revenues for the financial year

2023 stood at 427.7 million euros, up 39.2% compared to 2022,

benefitting from the progressive increase in the number of LNG

carriers under construction, the growth of Elogen and the services

business.

- Revenues from

new builds amounted to 389.5 million euros, up 39.3% compared to

revenues in 2022.

- Royalties from

LNG and ethane carriers amounted to 353.4 million euros,

2.4 million euros for FSUs and 4.1 million euros for

onshore storage tanks.

- Royalties

generated by the LNG-as-fuel business

(29.5 million euros, up 334.1%) are now reflecting the

large number of orders received in 2021 and 2022.

- Revenues from

Elogen’s electrolyser business line amounted to

10.1 million euros in the financial year 2023, up

116.6%.

- Revenues from

services were up by 21.8% to stand at 28.2 million euros in

the financial year 2023, with income from assistance services for

vessels in operation and the growth in Ascenz Marorka’s activity

more than offsetting the decrease in pre-project studies, for which

demand is fluctuating by nature.

Analysis of the 2023 consolidated income

statement

|

(in thousands of euros; earnings per share in euros) |

2022 |

2023 |

Change |

|

Revenues |

307,294 |

427,704 |

+39.2% |

|

Operating income before depreciation of non-current assets

(EBITDA8) |

161,124 |

234,545 |

+45.6% |

|

EBITDA margin (on revenues, %) |

52.4% |

54.8% |

|

|

Operating income (EBIT) |

152,218 |

223,527 |

+46.8% |

|

EBIT margin (on revenues, %) |

49.5% |

52.3% |

|

|

Net income |

128,291 |

201,372 |

+57.0% |

|

Net margin (on revenues, %) |

41.7% |

47.1% |

|

|

Net earnings per share9 (in euros) |

3.48 |

5.45 |

|

In 2023, Earnings Before Interest, Tax,

Depreciation and Amortisation (EBITDA) amounted to 234.5 million

euros, up 45.6% compared with 2022. This is mainly due to the

absence of significant delays in shipbuilding schedules, the

increase in revenues from GTT’s core business, and sound cost

management. The EBITDA margin on revenues was 54.8% in 2023, up

compared to 2022. External expenses were up +42.4% compared to

2022, due in particular to the rise in subcontracting and travel

costs linked to the increase in activity. Personnel expenses were

up by +41.3%, reflecting the increase in headcount at GTT SA and in

the subsidiaries (Elogen, OSE Engineering, GTT China) to support

the growth in activity, as well as the overhaul of the compensation

scheme (rebalancing between collective and individual components,

adjustment of certain remuneration packages to the benchmark) which

takes into account the impact of inflation.

Operating income amounted to 223.5 million euros

in 2023, i.e. a margin on revenues of 52.3%.

Net income for the 2023 financial year amounted to 201.4 million

euros, up 57.0% over the previous year.

Other 2023 consolidated financial

data

|

(in thousands of euros) |

2022 |

2023 |

Change |

|

Capital expenditures(including investment subsidies) |

9,006 |

44,048 |

+388.9% |

|

Dividends paid |

121,783 |

125,640 |

+3.2% |

|

Cash position |

212,803 |

267,529 |

+25.7% |

The Group’s capital expenditure increased

sharply, mainly as a result of the PIIEC subsidies received in 2022

and expended in 2023. The Group has, moreover, demonstrated good

control of working capital requirements (WCR) in a context of

strong growth in activity. As of December 31, 2023, GTT held a

positive net cash position of 267.5 million euros, up 25.7%

compared to December 31, 2022.

Acquisition of VPS in the smart shipping

sector

GTT announces today the acquisition of the

Danish company VPS (Vessel Performance Solutions), specialized in

vessel performance management. VPS is based in Copenhagen, with a

sales office in Athens (Greece). This company, founded in 2014 by

specialists in naval architecture and data science, today counts 12

employees.

This acquisition completes the Group's expertise

in the field of smart shipping, with its innovative solutions based

notably on the analysis of operational data from vessels, without

the need to add data acquisition systems or sensors on-board. Among

the various solutions marketed by VPS, its flagship software,

VESPER, enjoys a very solid reputation on the market. The systems

designed by VPS are used by 1,200 ships around the world and

complement Ascenz Marorka's range of solutions. VPS’s customers

include a variety of leading shipowners and operators.

The combination of VPS and Ascenz Marorka

features will create a comprehensive solution for vessel

performance management. Also, the combined customer bases should

generate important commercial synergies. Financed from GTT's cash

position, the acquisition of this profitable company will have no

significant impact on the Group's balance sheet.

Dividend for financial year

2023

On February 26, 2024, the Board of Directors,

after approving the financial statements, decided to propose the

distribution of a dividend of 4.36 euros per share for the

financial year 2023, up 40.6% compared to 2022. Payable in cash,

this dividend will be subject to approval by the Shareholders’

Meeting to be held on June 12, 2024. As an interim dividend of 1.85

euro per share was paid out on December 14, 2023 (in accordance

with the Board decision on July 27, 2023), the cash payment of the

balance of the dividend, amounting to 2.51 euros per share, will

take place on June 20, 2024 (ex-dividend date: June 18, 2024). This

proposed dividend corresponds to a payout ratio of 80% of

consolidated net income.

In addition, the Company plans to pay out an

interim dividend for 2024 in December 2024.

Governance

As part of the separation of functions, the

Board of Directors has worked actively over the past few months to

identify a new Chief Executive Officer. The process is underway and

a communication will be made in the coming weeks.

Outlook

At the end of December 2023, the Group had very

strong visibility on its revenues, thanks to the order book for its

core business. This corresponds to a record 1,815 million

euros in future cumulated revenues over the period 2024-2029

(516 million euros 2024, 628 million euros in 2025,

464 million euros in 2026, and 206 million euros from

2027 to 2029).

In the absence of any significant order delays

or cancellations, GTT announces its targets for 2024, namely:

- 2024 consolidated revenues of

between 600 million euros and 640 million euros,

- 2024 consolidated EBITDA of between

345 million euros and 385 million euros,

- a 2024 dividend payout target

corresponding to a minimum payout of 80% of consolidated net

income10.

***

Presentation of the 2023 full-year results

Philippe Berterottière, Chairman and Chief

Executive Officer, and Thierry Hochoa, Chief Financial Officer,

will comment on GTT’s results for the financial year 2023, and

answer questions from the financial community at a conference to be

held, in English, on Tuesday, February 27, 2024, at 8.30 a.m.,

Paris time.

This conference will be broadcast live on GTT’s

website (www.gtt.fr/finance). To participate in the conference

call, please dial one of the following numbers five to ten minutes

before the start of the conference:

- France: + 33 1 70 91 87 04

- UK: +44 1 212 818 004

- USA: +1 718 705 87 96

Confirmation code: 140215

The presentation document will be available on

the website on February 27, 2024 from 7:30 a.m.

Financial agenda

- 2024 first-quarter activity update:

April 19, 2024 (after close of trading)

- Shareholders’

Meeting: June 12, 2024

- Publication of

2024 half-year results: July 25, 2024 (after close of

trading)

- 2024 third-quarter activity update:

October 25, 2024 (after close of trading)

About GTT

GTT is a technology and engineering group with

expertise in the design and development of cryogenic membrane

containment systems for use in the transport and storage of

liquefied gases. Over the past 60 years, the GTT Group has designed

and developed, to the highest standards of excellence, some of the

most innovative technologies used in LNG carriers, floating

terminals, onshore storage tanks and multi-gas carriers. As part of

its commitment to building a sustainable world, GTT develops new

solutions designed to support ship-owners and energy providers in

their journey towards a decarbonised future. As such, the Group

offers systems designed to enable commercial vessels to use LNG as

fuel, develops cutting-edge digital solutions to enhance vessels’

economic and environmental performance, and actively pursues

innovation in the field of zero-carbon solutions. Through its

subsidiary, Elogen, which designs and manufactures proton exchange

membrane (PEM) electrolysers, GTT is also actively involved in the

green hydrogen sector.

GTT is listed on Euronext Paris, Compartment A

(ISIN FR0011726835 Euronext Paris: GTT) and is notably included in

SBF 120, Stoxx Europe 600 and MSCI Small Cap indices.

Investor Relations

Contact:information-financiere@gtt.fr / +33 1 30 23 20

87Press Contact: press@gtt.fr / +33 1 30 23 56

37 For more information, visit

www.gtt.fr.

Important notice

The figures presented here are those customarily

used and communicated to the markets by GTT. This message includes

forward-looking information and statements. Such statements include

financial projections and estimates, the assumptions on which they

are based, as well as statements about projects, objectives and

expectations regarding future operations, profits or services, or

future performance. Although GTT management believes that these

forward-looking statements are reasonable, investors and GTT

shareholders should be aware that such forward-looking information

and statements are subject to many risks and uncertainties that are

generally difficult to predict and beyond the control of GTT, and

may cause results and developments to differ significantly from

those expressed, implied or predicted in the forward-looking

statements or information. Such risks include those explained or

identified in the public documents filed by GTT with the French

Financial Markets Authority (AMF – Autorité des Marchés

Financiers), including those listed in the “Risk Factors” section

of the GTT Registration Document filed with the AMF on April 27,

2023, and the half-year financial report released on July 27, 2023.

Investors and GTT shareholders should note that if some or all of

these risks are realised they may have a significant unfavourable

impact on GTT.

Appendices (consolidated IFRS financial

statements)

Appendix 1: Consolidated balance sheet

|

(in thousands of euros) |

December 31, 2022 |

December 31, 2023 |

|

Intangible assets |

18,493 |

23,062 |

|

Goodwill |

15,365 |

15,365 |

|

Property, plant and equipment |

34,051 |

41,988 |

|

Investments in equity-accounted companies |

2,338 |

5,917 |

|

Non-current financial assets |

4,597 |

3,053 |

|

Deferred tax assets |

5,377 |

8,518 |

|

Non-current assets |

80,221 |

97,903 |

|

Inventories |

13,603 |

19,746 |

|

Trade receivables |

117,936 |

158,098 |

|

Current tax receivable |

40,110 |

54,132 |

|

Other current assets |

19,729 |

18,848 |

|

Current financial assets |

44 |

132 |

|

Cash and cash equivalents |

212,803 |

267,529 |

|

Current assets |

404,224 |

518,486 |

|

TOTAL ASSETS |

484,445 |

616,389 |

| |

|

|

|

In thousands of euros |

December 31, 2022 |

December 31, 2023 |

|

Share capital |

371 |

371 |

|

Share premium |

2,932 |

2,932 |

|

Treasury shares |

(10,818) |

(8,911) |

|

Reserves |

139,049 |

140,536 |

|

Net income |

128,260 |

201,369 |

|

Equity - share attributable to owners of the

parent |

259,794 |

336,297 |

|

Equity - share attributable to non-controlling interests |

41 |

43 |

|

Total equity |

259,835 |

336,340 |

|

Non-current provisions |

13,499 |

5,968 |

|

Financial liabilities - non-current part |

3,586 |

5,962 |

|

Deferred tax liabilities |

52 |

8 |

|

Non-current liabilities |

17,137 |

11,937 |

|

Current provisions |

8,151 |

8,543 |

|

Trade payables |

23,765 |

32,367 |

|

Advance payments of subsidies |

13,833 |

484 |

|

Current tax debts |

6,465 |

7,279 |

|

Current financial liabilities |

460 |

2,382 |

|

Other current liabilities |

154,799 |

217,056 |

|

Current liabilities |

207,473 |

268,112 |

|

TOTAL EQUITY AND LIABILITIES |

484,445 |

616,389 |

Appendix 2: Consolidated income statement

|

(in thousands of euros) |

December 31, 2022 |

December 31, 2023 |

|

Revenues from operating activities |

307,294 |

427,704 |

| Other

operating income |

959 |

1,330 |

|

Total operating income |

308,254 |

429,034 |

|

Costs of sales |

(13,525) |

(17,764) |

|

External expenses |

(60,521) |

(86,186) |

|

Personnel expenses |

(67,623) |

(95,565) |

|

Tax and duties |

(3,597) |

(3,640) |

|

Depreciation and provisions |

(16,140) |

(4,995) |

|

Other current operating income and expenses |

5,370 |

2,643 |

|

Current operating income (EBIT) |

152,218 |

223,527 |

|

EBIT margin on revenues (%) |

49.5% |

52.3% |

|

Other non-current operating income and expenses |

- |

8,850 |

|

Current and non-current operating income |

152,218 |

232,377 |

|

Financial income |

641 |

4,256 |

|

Share in the income of associated entities |

(139) |

(407) |

|

Profit (loss) before tax |

152,719 |

236,225 |

|

Income tax |

(24,428) |

(34,853) |

|

Net income |

128,291 |

201,372 |

| Net income

Group share |

128,260 |

201,369 |

| Net earnings

of non-controlling interests |

32 |

3 |

|

Basic earnings per share (in euros) |

3.48 |

5.45 |

|

Diluted earnings per share (in euros) |

3.46 |

5.43 |

|

Average number of shares outstanding |

36,890,466 |

36,940,976 |

|

Diluted number of shares |

37,037,612 |

37,094,967 |

Appendix 3: Consolidated cash flow

statement

|

(in thousands of euros) |

December 31, 2022 |

December 31, 2023 |

|

Company profit for the year |

128,291 |

201,372 |

|

Removal of income and expenses with no cash

impact: |

|

|

|

Share of net income of equity-accounted companies |

139 |

407 |

|

Allocation (reversal) of amortisation, depreciation, provisions and

impairment |

10,201 |

3,023 |

|

Net carrying amount of intangible assets or property, plant

and equipment sold |

30 |

1,264 |

|

Financial expense (income) |

(641) |

(4256) |

|

Tax expense (income) for the financial year |

24,428 |

34,853 |

|

Free shares |

3,418 |

1,980 |

|

Other operating income and expenses |

|

|

|

Cash flow |

165,867 |

238,645 |

|

Tax paid in the financial year |

(17,524) |

(51,282) |

|

Change in working capital requirement: |

|

|

|

- Inventories and work in progress |

(4,001) |

(6,144) |

|

- Trade and other receivables |

(46,848) |

(40,162) |

|

- Trade and other payables |

2,425 |

8,586 |

| -

Other operating assets and liabilities |

39,514 |

66,514 |

|

Net cash-flow generated by the business (Total

I) |

139,432 |

216,158 |

|

Investment operations |

|

|

|

Acquisition of non-current assets |

(20,514) |

(43,124) |

|

Investment subsidy |

13,833 |

699 |

|

Disposal of non-current assets |

- |

635 |

|

Control acquired on subsidiaries net of cash and cash equivalents

acquired |

(2,338) |

(4,088) |

|

Control lost on subsidiaries net of cash and cash equivalents

sold |

- |

- |

|

Financial investments |

(41) |

(195) |

|

Disposal of financial assets |

- |

- |

|

Treasury shares |

14 |

40 |

|

Change in other fixed financial assets |

40 |

1,985 |

|

Net cash-flow from investment operations (Total

II) |

(9,006) |

(44,048) |

|

Financing operations |

|

|

|

Dividends paid to shareholders |

(121,783) |

(125,640) |

|

Capital increase |

3 |

(7) |

|

Repayment of financial liabilities |

(776) |

(1,274) |

|

Increase of financial liabilities |

286 |

5,576 |

|

Interest paid |

(6) |

(199) |

|

Interest received |

312 |

5,688 |

|

Change in bank overdrafts |

- |

- |

|

Net cash-flow from financing operations (Total

III) |

(121,965) |

(115,857) |

|

Effect of changes in currency prices (Total IV) |

537 |

(1,526) |

|

Change in cash (I+II+III+IV) |

8,999 |

54,727 |

|

Opening cash |

203,804 |

212,802 |

|

Closing cash |

212,803 |

267,529 |

|

Cash change |

8,999 |

54,727 |

Appendix 4: Estimated 10-year order book

| In units |

|

Order estimates(1) |

|

LNG carriers |

|

More than 450 |

|

Ethane carriers |

|

25-40 |

|

FSRUs |

|

≤10 |

|

FLNGs |

|

≤10 |

|

Onshore storage tanks and GBSs |

|

25-30 |

(1) 2024-2033 period. The Company points out

that the number of new orders may see large-scale variations from

one quarter to another and even from one year to another, without

the fundamentals on which its business model is based being called

into question.

1 Subject to approval by the Shareholders’ Meeting of June 12,

2024.2 Consolidated net income, subject to approval by the

Shareholders’ Meeting and the amount of distributable reserves in

the GTT S.A. corporate financial statements.3 ShaPoLi: Shaft Power

Limitation.4 More information on the website:

https://www.ose-engineering.fr/en/5 See the press release published

by GTT:

https://gtt.fr/fr/actualites/gtt-obtient-une-subvention-de-la-part-de-bpifrance-dans-le-cadre-du-projet-mervent-20256

See the press release published by GTT:

https://gtt.fr/fr/actualites/gtt-publie-sa-feuille-de-route-rse-2024-20267

More information on the 17 SDGs:

https://pactemondial.org/17-objectifs-developpement-durable/8 As of

2023 fiscal year, EBITDA no longer includes provisions for losses

on completion (reversal of 0.458 million euros in 2023). The

impact on EBITDA 2022 was + 3.592 million euros, increasing 2022

EBITDA to 164.7 million euros (vs published 2022 EBITDA figure of

161.1 million euros). Excluding provisions for losses on

completion, the 2022 EBITDA margin stood at 53.6%.

9 Net earnings per share was calculated on the

basis of the weighted average number of shares outstanding, i.e.

36,890,466 shares at December 31, 2022 and 36,940,976 shares at

December 31, 2023.10 Subject to approval by the Shareholders’

Meeting and the amount of distributable net income in the GTT S.A.

corporate financial statements.

- IR-PR-FY 2023 v26022024 final

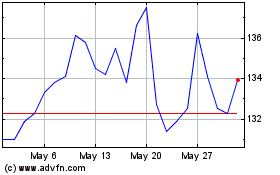

Gaztransport Et Technigaz (EU:GTT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Gaztransport Et Technigaz (EU:GTT)

Historical Stock Chart

From Feb 2024 to Feb 2025