UPDATE: Boskalis To Acquire Smit For EUR1.35 Billion In Cash

November 12 2009 - 4:44AM

Dow Jones News

Royal Boskalis Westminster NV (BOKA.AE) will acquire Smit

Internationale NV (SMIT.AE) for EUR1.35 billion in cash in a deal

that will create a major Dutch player in the maritime services

industry.

Smit's biggest shareholders, Delta Lloyd NV (DL.AE) and Janivo

Beleggingen, have confirmed they will accept the intended offer.

Together with Boskalis' own shareholding in Smit, this accounts for

about 44% of the outstanding shares.

Boskalis said it will finance the deal through a combination of

debt and equity and intends to issue EUR200 million new Boskalis

shares. HAL Holding (HAL.AE), which holds 31.75% of Boskalis,

already has indicated it would take part in the share issue.

The deal values Smit at EUR60 per share and will enhance

Boskalis' earnings per share as of 2010, Boskalis Chief Executive

Peter Berdowski told journalists.

Analysts said the offer was low, offering a premium of only 8%

based on Smit's closing price Wednesday.

A Fortis Bank Netherlands analyst said there were synergies

between the two companies, but they were limited. The analyst said

that it was positive that Boskalis intended to acquire Smit as a

whole, including the harbour towage division. Fortis Bank

Netherlands rates both shares hold.

At 0915 GMT, shares of Boskalis traded down EUR0.63, or 2.5%, at

EUR25.48 and Smit shares traded up EUR3.70, or 6.7%, at EUR59.30

while the benchmark AEX index traded up 0.2%. Boskalis' shares have

gained 4% in value in the past the year while Smit's shares have

gained 18% during the same period.

In September last year Boskalis first announced its intention to

make an offer for Smit, excluding the harbour towage division. Its

EUR62.50 per share offer was rejected by Smit as too low.

Boskalis provides dredging, maritime infrastructure and maritime

services worldwide. It has a fleet of 300 vessels and a work force

of about 10,000 in more than 50 countries. It posted net profit in

2008 of EUR249.1 million on revenue of EUR2.1 billion.

In addition to harbour towage, Smit offers maritime services

such as salvage and transport and heavy lifting. It posted net

profit last year of EUR107.8 million on revenue of EUR704.8

million. It employs 3,590 workers.

The two companies in a joint statement said the implications of

the acquisition on their combined work force would be limited

because of the complementary nature of their businesses.

"I see significant opportunities for synergies between our

companies complemented with a close competence and cultural fit,"

Berdowski said.

Smit CEO Ben Vree added: "This merger offers an excellent

opportunity for Smit."

The two companies expect to complete the deal in the first half

of 2010.

-By Anna Marij van der Meulen, Dow Jones Newswires; +31 20 571

5201; annamarij.vandermeulen@dowjones.com

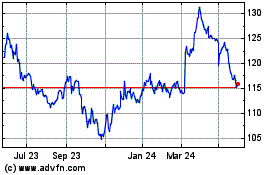

Hal (EU:HAL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hal (EU:HAL)

Historical Stock Chart

From Feb 2024 to Feb 2025