JDE Peet’s provides an update on its strategic roadmap and shares preliminary results for FY 22 at its strategic update meeting

January 24 2023 - 8:03AM

JDE Peet’s provides an update on its strategic roadmap and shares

preliminary results for FY 22 at its strategic update meeting

PRESS RELEASEAmsterdam, 24 January 2023Key

Highlights

- JDE Peet’s has made

significant progress

on its growth

and

purpose-led

strategy that was introduced in

March 2021,

and which supported

a strong set of

quality results since

the company entered the public

market

- The company

has successfully accelerated

growth in the US and in emerging markets, while

strengthening capabilities and competitiveness in Digital

Commerce and

Single-Serve

appliances

- JDE Peet’s’ ESG

performance and ambitions

substantially increased in 2022. The company has

defined the roadmap of initiatives that

will enable a new commitment to

net-zero, and

built an

integrated new carbon accounting

platform to track and

accelerate the delivery of its

ESG objectives

- The company

announced the

launch of a

new,

fully compostable

coffee capsule in

2023, which allows for

an uncompromising high-quality

in-cup experience

- JDE Peet’s

confirmed

FY 22 results

to be in line with its

outlook,

provided its

outlook for FY 23 and

reiterated its medium-

to long-term targets

JDE Peet’s (EURONEXT: JDEP), the world’s leading pure-play

coffee and tea company by revenue, is hosting its Strategic Update

Meeting for institutional investors and analysts in Amsterdam

today. During this event, the company provided, among other things,

an update on its achievements and progress versus its strategic

roadmap, a selection of preliminary financial results for FY 22 as

well as its outlook for 2023.

“I am very pleased with the progress we have made since we

introduced our updated strategy two years ago,” said Fabien Simon,

CEO of JDE Peet’s. “In spite of the challenging macro-economic

environment, we are delivering on our commitments to build a

stronger, more productive, and more inclusive enterprise. We kept

high-quality standards for our consumers and customers,

meaningfully reinvested in core assets, rebuilt employee pride and

engagement, transformed from a laggard to a leader in ESG, while

resuming cost competitiveness and achieving our financial

commitments. Strengthening our fundamentals, our brands and our

innovation capabilities elevates our growth trajectory and our

ability to create a sustaining long-term shareholder return and

societal value.”

Launch of a

new, compostable

coffee capsule to

accelerate the

sustainability agendaThe company

will launch a fully compostable capsule in 2023, which will

contribute to a circular economy. This new-to-the-world technology

allows for a high-quality in-cup experience that was not achievable

in existing compostable alternatives to date. This innovation will

be introduced in selected markets throughout 2023 under L’OR, the

global leading grocery brand in espresso capsules.

ESG performance & ambitions substantially increased

in 2022 and a company-wide carbon accounting system has

been implemented to

track and support a

net-zero futureIn line with the company’s

purpose to unleash the possibilities of coffee and tea to create a

better future, JDE Peet’s has made significant progress on its

sustainability agenda over the last two years. In addition to the

reduction of its scope 1 & 2 green-house-gases by 17% since

2020, one of the key achievements in 2022 was the increase in

responsibly sourced coffee from 30% in 2021 to 77%. In 2023, JDE

Peet’s will submit its stronger and new SBTi ambition to

net-zero.

Preliminary FY 22

financial

results1At the

occasion of its Strategic Update Meeting, JDE Peet’s confirms its

2022 outlook and shares the following preliminary, unaudited

results related to FY 22:

- Sales increased by 16.4%, driven by organic growth of

11.3%

- Gross profit increased by 3.3%

- SG&A increased by 10.6%, driven by working-media and other

growth-related investments

- Adj. EBIT decreased by 5.9%, and organically by -9.3%, as

SG&A increased

- Underlying EPS increased to EUR 1.91

- Free cash flow of more than EUR 1.3 bn with a net leverage of

2.65x

The company will publish its FY 22 financial statements as

scheduled on 22 February 2023, which may slightly deviate from the

preliminary results set out in this release.

Outlook FY 2023The company shared the following

outlook for FY 23:

- Organic sales growth at the high end of its medium-term range

of 3 – 5%

- Low single-digit organic adjusted EBIT growth, with a moderate

increase in SG&A

- A stable dividend

Medium- to

Long-Term Targets

reiteratedFor the medium- to long-term, JDE Peet's

continues to target organic sales growth of 3 to 5% and mid-single

digit organic adjusted EBIT growth, a free cash flow conversion of

approximately 70% and stable to increasing dividends over time.

Additional informationThe

presentation slides of the event can be found here and a video

replay of the event, including synchronised slides, will be made

available on the same webpage the next day.

1This press release contains certain non-IFRS financial measures

and ratios, which are not recognised measures of financial

performance or liquidity under IFRS. For a reconciliation of these

non-IFRS financial measures to the most directly comparable IFRS

financial measures, see page 7 of the H1 22 Earnings Release.

Organic sales and organic adjusted EBIT are adjusted for new

business ventures.

# # #

Forward-looking StatementsThese materials

contain forward-looking statements as defined in the United States

Private Securities Litigation Reform Act of 1995 concerning the

financial condition, results of operations and businesses of the

Group. These forward-looking statements and other statements

contained in these materials regarding matters that are not

historical facts and involve predictions. No assurance can be given

that such future results will be achieved. Actual events or results

may differ materially as a result of risks and uncertainties facing

the Group. Such risks and uncertainties could cause actual results

to vary materially from the future results indicated, expressed or

implied in such forward-looking statements. There are a number of

factors that could affect the Group’s future operations and could

cause those results to differ materially from those expressed in

the forward-looking statements including (without limitation): (a)

competitive pressures and changes in consumer trends and

preferences as well as consumer perceptions of its brands; (b)

fluctuations in the cost of green coffee, including premium Arabica

coffee beans, tea or other commodities, and its ability to secure

an adequate supply of quality or sustainable coffee and tea; (c)

global and regional economic and financial conditions, as well as

political and business conditions or other developments; (d)

interruption in the Group's manufacturing and distribution

facilities; (e) its ability to successfully innovate, develop and

launch new products and product extensions and on effectively

marketing its existing products; (f) actual or alleged

non-compliance with applicable laws or regulations and any legal

claims or government investigations in respect of the Group's

businesses; (g) difficulties associated with successfully

completing acquisitions and integrating acquired businesses; (h)

the loss of senior management and other key personnel; and (i)

changes in applicable environmental laws or regulations. The

forward-looking statements contained in these materials speak only

as of the date of these materials. The Group is not under any

obligation to (and expressly disclaim any such obligation to)

revise or update any forward-looking statements to reflect events

or circumstances after the date of these materials or to reflect

the occurrence of unanticipated events. The Group cannot give any

assurance that forward-looking statements will prove correct and

investors are cautioned not to place undue reliance on any

forward-looking statements. Further details of potential risks and

uncertainties affecting the Group are described in the Company’s

public filings with the Netherlands Authority for the Financial

Markets (Stichting Autoriteit Financiële Markten) and other

disclosures.

Market Abuse RegulationThis press release

contains information within the meaning of Article 7(1) of the EU

Market Abuse Regulation.

Enquiries

Media Khaled Rabbani+31 20 558

1753Media@JDEPeets.comInvestors &

AnalystsRobin Jansen+31 20 55 81212IR@JDEPeets.com

About JDE Peet’s

JDE Peet’s is the world's leading pure-play coffee

and tea company, serving approximately 4,500 cups of coffee or tea

per second. JDE Peet's unleashes the possibilities of coffee and

tea in more than 100 markets, with a portfolio of over 50 brands

including L’OR, Peet’s, Jacobs, Senseo, Tassimo, Douwe Egberts,

OldTown, Super, Pickwick and Moccona. In 2021, JDE Peet’s generated

total sales of EUR 7 billion and employed a global workforce of

more than 19,000 employees. Read more about our journey towards a

coffee and tea for every cup at www.jdepeets.com.

-

jde-peets-provides-an-update-on-its-strategic-roadmap-and-shares-preliminary-results-for-FY22-at-its-strategic-update-meeting

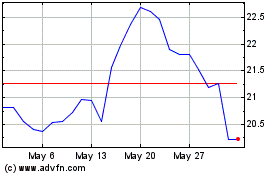

JDE Peets NV (EU:JDEP)

Historical Stock Chart

From Jan 2025 to Feb 2025

JDE Peets NV (EU:JDEP)

Historical Stock Chart

From Feb 2024 to Feb 2025