Maurel & Prom : Entry of Maurel & Prom into Angola

October 23 2018 - 11:32AM

Paris, 23 October

2018

No. 13-18

Entry of Maurel

& Prom into Angola

Maurel & Prom

announces the signature of an SPA for the acquisition of AJOCO's

20% interest in two producing and development blocks in shallow

waters offshore Angola

-

New milestone in Maurel &

Prom's growth strategy in Africa

-

Established assets with long

track record of production and upside potential

-

Purchase consideration of $80

million funded on M&P's existing cash

resources

FINANCIAL COMMUNICATION

The 9-month

revenue 2018 press release will be published on Wednesday 24

October 2018 before the opening of the markets.

Following this

publication, Maurel & Prom will hold an analyst / investor

presentation via an audio webcast, tomorrow

at 9:30 am CEST, followed by a question and

answer session.

https://edge.media-server.com/m6/p/hwyr66qf/lan/en

Etablissements

Maurel & Prom (Euronext Paris: MAU, ISIN FR0000051070)

announces the signature of a sale and purchase agreement (the

"SPA") for the acquisition of the 20% working interest owned by

Angola Japan Oil Co., Ltd. ("AJOCO"), a majority owned subsidiary

of Mitsubishi Corporation ("Mitsubishi"), in two blocks offshore

Angola, Block 3/05 and Block 3/05A (the "Transaction").

Michel Hochard, Chief Executive

Officer of Maurel & Prom, declared: "This

transaction is an important milestone for Maurel & Prom's

growth strategy, and it highlights our capacity to react to M&A

opportunities. This provides immediate production diversification

in proven assets, with a strong track record and upside potential.

We are very happy to start a new chapter of M&P's history in

Angola, a major oil and gas jurisdiction in Africa with exciting

opportunities ahead as the local oil industry is undergoing a major

regulatory and institutional reshaping. Finally, this transaction

initiates the value creative M&A strategy of M&P as the

international development platform of Pertamina."

Transaction terms

and timeline

The transaction consideration is

$80 million, funded from M&P's existing cash resources, with an

additional contingent consideration of up to $25 million subject to

oil price performance and resources development.

Closing of the acquisition remains

subject to a number of conditions, in particular the obtainment of

the required government approvals and waiver of applicable

pre-emption rights. A further announcement will be made in due

course.

Strong strategic

rationale for M&P

The Transaction fits M&P's

strategy of development through value creative M&A:

-

Marks the entry of M&P into

Angola, a major oil jurisdiction with significant opportunities

ahead

-

Reinforcement of M&P's position in the Congo

basin, its historic region of expertise

-

Future cooperation opportunities expected in the

oil industry in the country

-

Complements M&P's existing

producing asset base

-

Provides upside potential

through field optimisation and resources development

Established

assets with long track record of production and upside

potential

Blocks 3/05 and 3/05A are located

in shallow water (c.100m depth) in the Congo Basin, a region where

M&P has extensive current and historical presence. The two

blocks are located c.30km from the Angolan shore and operated by

national oil company Sonangol Pesquisa e Produção ("Sonangol

P&P"). The blocks are contiguous and share processing and

export facilities.

Block 3/05

has been producing since the mid-1980s and consists in eight mature

fields (Bufalo, Cobo, Impala, Impala SE, Oombo, Pacassa, Palanca,

and Pambi) and the net production to the 20% working interest in

2018 estimated by M&P is c.4,600 bopd. Current licence runs

until June 2025, with a possibility to extend.

Block 3/05A

includes two commercial fields (Caco and Gazela), and offers

optionality through the Punja field, a large discovery in

pre-development stage.

For more information, visit

www.maureletprom.fr

Contacts

MAUREL &

PROM

Press, shareholder and investor relations

Tel: +33 (0)1 53 83 16

45

ir@maureletprom.fr

NewCap

Financial communications and investor

relations

Julie Coulot/Louis-Victor Delouvrier

Tel: +33 (0)1 44 71 98

53

maureletprom@newcap.eu

Media relations

Nicolas Merigeau

Tel: +33 (0)1 44 71 94 98

maureletprom@newcap.eu

This document may

contain forward-looking statements regarding the financial

position, results, business and industrial strategy of Maurel &

Prom. By their very nature, such forward-looking statements

consider risks and uncertainties based on events and circumstances

that may or may not occur in the future. These projections are

based on assumptions that we believe to be reasonable, but that may

prove to be incorrect and that depend on a number of risk factors,

such as fluctuations in crude oil prices, changes in exchange

rates, uncertainties related to the valuation of our oil reserves,

actual rates of oil production and related costs, operational

problems, political stability, legislative or regulatory reforms,

or even wars, terrorism and sabotage.

Maurel & Prom is listed for

trading on Euronext Paris

CAC All-Share - CAC Oil & Gas - Next 150 - PEA-PME and SRD

eligible

Isin FR0000051070 / Bloomberg MAU.FP / Reuters MAUP.PA

MAP_PR_Angola_23102018

This

announcement is distributed by West Corporation on behalf of West

Corporation clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Maurel & Prom via Globenewswire

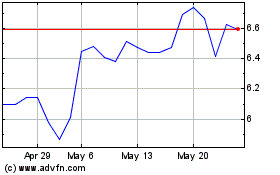

Maurel Et Prom (EU:MAU)

Historical Stock Chart

From Oct 2024 to Nov 2024

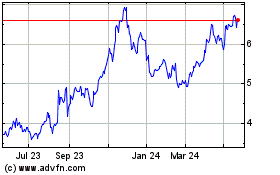

Maurel Et Prom (EU:MAU)

Historical Stock Chart

From Nov 2023 to Nov 2024