Mercialys Successfully Places a Euro 300 Million Bond Issue With a 7-Year Maturity

September 03 2024 - 11:24AM

Business Wire

Regulatory News:

Mercialys (Paris:MERY), the leading REIT for accessible retail

in France, has today successfully placed a new bond issue for a

nominal total of Euro 300 million, with a 7-year maturity and 4.0%

coupon, based on a 165 bp spread.

The issue was 7.3 times oversubscribed, reflecting investors’

confidence in the Company’s credit profile.

This issue will contribute to Mercialys’ general requirements

and will enable it to fully exercise its make-whole call option for

the early redemption of its bond maturing in July 2027, with a

residual nominal total of Euro 200 million and a 4.625% coupon.

These operations will help extend the average maturity of

Mercialys’ drawn debt, with 3.3 years at end-June 2024, and further

strengthen its liquidity.

Mercialys is rated BBB / outlook stable by Standard &

Poor’s.

BNP Paribas and Crédit Agricole CIB were the global coordinators

and bookrunners for this operation, while CIC, La Banque Postale,

Natixis and Société Générale were bookrunners.

Not for distribution in the United States, Australia, Canada or

Japan. This press release does not constitute an offer of

securities in the United States or in any other country. The bonds

cannot be offered or sold in the United States of America unless

they are registered or exempt from registration under the U.S.

Securities Act of 1933 (amended). Mercialys does not intend to

register all or part of the offering in the United States or to

conduct a public offering in the United States.

This press release is available on

www.mercialys.com.

About Mercialys

Mercialys is one of France’s leading real estate companies. It

is specialized in the holding, management and transformation of

retail spaces, anticipating consumer trends, on its own behalf and

for third parties. At June 30, 2024, Mercialys had a real estate

portfolio valued at Euro 2.9 billion (including transfer taxes).

Its portfolio of 1,955 leases represents an annualized rental base

of Euro 178.3 million. Mercialys has been listed on the stock

market since October 12, 2005 (ticker: MERY) and has “SIIC” real

estate investment trust (REIT) tax status. Part of the SBF 120 and

Euronext Paris Compartment B, it had 93,886,501 shares outstanding

at June 30, 2024.

IMPORTANT INFORMATION

This press release contains certain forward-looking statements

regarding future events, trends, projects or targets. These

forward-looking statements are subject to identified and

unidentified risks and uncertainties that could cause actual

results to differ materially from the results anticipated in the

forward-looking statements. Please refer to Mercialys’ Universal

Registration Document available at www.mercialys.com for the year

ended December 31, 2023 for more details regarding certain factors,

risks and uncertainties that could affect Mercialys’ business.

Mercialys makes no undertaking in any form to publish updates or

adjustments to these forward-looking statements, nor to report new

information, new future events or any other circumstances that

might cause these statements to be revised.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240903013824/en/

Analyst and investors Olivier Pouteau Tel: +33 (0)6 30 13

27 31 Email: opouteau@mercialys.com

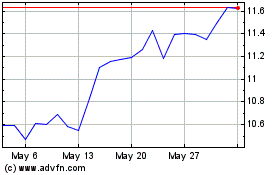

Mercialys (EU:MERY)

Historical Stock Chart

From Dec 2024 to Jan 2025

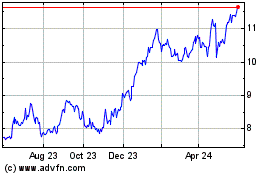

Mercialys (EU:MERY)

Historical Stock Chart

From Jan 2024 to Jan 2025