RUBIS: Q1 2024 trading update: solid operating performance on the

back of a high comparable base

Paris, 7 May 2024, 5:45pm

- Energy

Distribution

- Retail

& Marketing - Solid volume growth at +4%, gross margin at €209m

(+2% adjusted1)

- Strong momentum of the aviation

business in Africa and in the Caribbean region

- Robust operating performance in

Africa fuel distribution network

- Decrease in the Bitumen activity in

Nigeria

- Support

& Services - Gross margin (excl. SARA) down 16%, after a strong

Q1 2023

- High level of vessel utilisation in

the Caribbean

- Renewable

Electricity Production

- Secured

portfolio up +5% vs Dec-2023 at 936 MWp

- Corporate

PPAs: Signing of major partnership agreements with Data4

and another large corporate representing a total of 105 MWp

- 2024

Guidance reiterated

- Sale of

Rubis Terminal signed

- Final agreement

reached with ISQ - Closing expected mid-year

- Related dividend

payment of €0.75 per share to take place after closing

SALES BREAKDOWN BY SEGMENT AND

BY REGION

|

(in €m) |

Q1 2024 |

Q1 2023 |

Q1 2024 vs Q1 2023 |

|

Energy Distribution |

1,652 |

1,731 |

-5% |

|

Retail & Marketing |

1,392 |

1,431 |

-3% |

|

Europe |

209 |

218 |

-4% |

|

Caribbean |

590 |

577 |

+2% |

|

Africa |

593 |

636 |

-7% |

|

Support & Services |

260 |

300 |

-13% |

|

Renewable Electricity Production |

8 |

9 |

-5% |

|

TOTAL |

1,660 |

1,740 |

-5% |

On 7 May 2024, Clarisse Gobin-Swiecznik,

Managing Partner, commented on the Q1 2024 activity: "I'm pleased

to report that Q1 2024 delivered solid operating performance. Our

legacy businesses performed as anticipated, continuing to be a

strong foundation for the Company. We're particularly encouraged by

the continued development of Photosol, which is showing great

promise for future growth.

In line with our strategic focus, we also

announced the divestment of Rubis Terminal during the quarter. This

decision allows us to crystallise the value generated and allocate

resources more effectively towards the future of the Company.

Looking ahead, we remain confident in the

guidance we provided during full year 2023 earnings release and are

excited about the momentum we're building across the Group.”

ENERGY DISTRIBUTION

Retail & Marketing

Q1 2024 has seen volume increasing by 4% vs Q1

2023, which was particularly strong. When excluding exceptional

items and FX effect in Nigeria from Q1 2023, gross margin increased

by 2%.

VOLUME AND GROSS MARGIN BY

PRODUCT

|

|

Volume(in '000

m3) |

Gross margin(in €m) |

Adjusted gross margin*(in

€m) |

|

|

Q1 2024 |

Q1 2023 |

Q1 2024 vs Q1 2023 |

Q1 2024 |

Q1 2023 |

Q1 2024 vs Q1 2023 |

Q1 2024 |

Q1 2023 |

Q1 2024 vs Q1 2023 |

|

|

LPG |

343 |

336 |

2% |

84 |

83 |

1% |

84 |

83 |

1% |

|

|

Fuel |

1,048 |

978 |

7% |

103 |

116 |

-11% |

103 |

105 |

-2% |

|

|

Bitumen |

100 |

117 |

-15% |

23 |

36 |

-38% |

23 |

18 |

25% |

|

|

TOTAL |

1,491 |

1,432 |

4% |

209 |

235 |

-11% |

209 |

|

2% |

|

* Adjusted for exceptional items and FX effects

in 2023.

LPG growth in Q1 2024 was

underpinned by the continued high demand in bulk product in Morocco

and South Africa. Autogas saw a strong growth in Spain notably in

Q1 (+31% in volume), following the same momentum as previous years.

Gross margin remained stable at +1%.

As regards fuel:

- resilience

in the retail business (service stations, representing 48%

of fuel volume and 50% of fuel gross margin in Q1 2024) with stable

volume at +0% vs Q1 2023. Facing challenges including economic

downturn, high fuel price and fierce competition in Kenya, the

African business proved its robustness with a slight decrease in

volume at -2%. In the Caribbean region, volume grew by +3%, with

the ongoing strong performance of Jamaica. Gross margin decreased,

impacted by unexpected Kenyan shilling appreciation;

- +7% volume

growth in commercial and industrial business (C&I,

representing 28% of fuel volume and 26% of fuel gross margin in Q1

2024). The strong performance of the Caribbean region, where Guyana

activity maintained its dynamic pace, explains most of this growth.

Gross margin increased accordingly yoy;

- the strong

volume growth momentum observed in the aviation segment

(representing 21% of fuel volume and 19% of fuel gross margin in Q1

2024) since the beginning of 2023 continued in Q1 2024, landing at

+39% yoy. This increase was driven by Kenya, where total volume for

the quarter almost doubled (unit margin increased by +145% on this

market), and the Caribbean region where activity was particularly

strong. The significant increase in volumes elevated the gross

margin accordingly.

Bitumen volume was down 15%

yoy. This decrease is mainly explained by the lower volume in

Nigeria after a few road contractors decided to put their projects

on hold, waiting for the FX turmoil to stabilise. Senegal and

Cameroon showed good dynamics, with volume and margins increasing.

Overall, adjusted gross margin increased by €5m yoy.

VOLUME AND GROSS MARGIN BY

REGION

|

|

Volume(in '000

m3) |

Gross margin(in €m) |

Adjusted gross margin*(in

€m) |

|

|

Q1 2024 |

Q1 2023 |

Q1 2024 vs Q1 2023 |

Q1 2024 |

Q1 2023 |

Q1 2024 vs Q1 2023 |

Q1 2024 |

Q1 2023 |

Q1 2024 vs Q1 2023 |

|

|

Europe |

245 |

244 |

0% |

62 |

59 |

6% |

62 |

59 |

6% |

|

|

Caribbean |

573 |

538 |

7% |

80 |

73 |

10% |

80 |

73 |

10% |

|

|

Africa |

674 |

650 |

4% |

67 |

103 |

-35% |

67 |

74 |

-9% |

|

|

TOTAL |

1,491 |

1,432 |

4% |

209 |

235 |

-11% |

209 |

|

2% |

|

* Adjusted for exceptional items and FX effects

in 2023.

Adjusted unit margin came in at

140€/m3, down 2% yoy.

By region, the dynamics of this year were as

follows:

-

Europe remained stable in volume. Gross margin

increased by 6% benefiting from the increase in Autogas sales both

in Spain and France;

- the

Caribbean region remained buoyant, with volume up

7%, following two consecutive years of double-digit growth.

Operating conditions were optimal, with gains in market share and a

sharp rise in margins across the board (+10%). This region is

mainly driven by Guyana, Jamaica, and Suriname;

- lastly, in

Africa, gross margin was down 9%, adjusted for the

sequencing of payment in Q1 2023 by the State of the 2022 revenue

shortfall in Madagascar (€11.3m) and the neutralisation of foreign

exchange losses in Nigeria (€18.3m). Economy in Kenya remains under

pressure, and bitumen activity in Nigeria faces headwinds.

Support &

Services

The Support & Services

activity recorded €260m of revenue (-13% yoy) in Q1 2024, after a

very strong Q1 2023.

Volume and margins were down 28% and 23% yoy

respectively. Q1 2023 had seen significant crude deliveries, while

2024 deliveries should start again only in Q2. Trading activity was

dynamic with +20% in volume and +34% gross margin in the Caribbean,

benefiting from the two vessels acquired in 2023.

SARA refinery and logistics operations present

specific business models with stable earnings profile.

RENEWABLE ELECTRICITY

PRODUCTION

- Secured

portfolio up +5% vs Dec-2023

The level of assets in operation grew by 3% over

Q1 2024 and by 14% over the last 12 months. Despite this increase,

revenue in Q1 2024 is down slightly vs Q1 2023. As a reminder, Q1

2023 saw a significant level of electricity direct sale to the

market, which did not happen again in 2024 as market prices were

not favourable. The secured portfolio reached 936 MWp, up from

893 MWp at the end of Dec-23. As regards pipeline, three new

projects reached the RTB (Ready-to-build2) status, representing a

total of 50 MWp.

FINANCIAL AND OPERATIONAL DATA

|

|

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

|

Assets in operation (MWp) |

394 |

394 |

421 |

435 |

450 |

|

Electricity production (GWh) |

81 |

153 |

167 |

71 |

81 |

|

Sales (in €m) |

9 |

16 |

16 |

8 |

8 |

-

Signing of major corporate PPAs with two large

corporates

End 2023, Photosol signed major partnership

agreements with Data4, a French operator and investor in the data

center sector. These corporate PPAs will enable Rubis Photosol to

provide green electricity from facilities located in the

Alpes-Maritimes and Loir-et-Cher French regions. The two solar

farms will have a cumulated capacity of 50 MWp and the tariff is

secured for 10 years.

In April 2024, Photosol signed another corporate

PPA to provide electricity from two solar farms representing 55

MWp. Tariff is secured for 20 years.

OUTLOOK – FY 2024 GUIDANCE

REITERATED

After a very solid performance in 2023, Rubis

activities maintain their momentum and continue to deliver in line

with expectations.

Although a normalisation was expected, the

Caribbean region continues to deliver strong growth. Europe and

Africa 2023 positive operating momentum also continues, despite a

few headwinds. The Renewable division develops according to

plans.

As a result, the guidance provided to the market

for 2024 is reiterated with a Group EBITDA expected to reach €725m

to €775m. Net income Group share should remain stable despite the

first-time application of the Global Minimum Tax representing an

impact estimated between €20m and €25m.

EXTRA-FINANCIAL RATING

- MSCI: AA

(reiterated in Dec-23)

- Sustainalytics:

30.7 (from 29.7 previously)

- ISS ESG: C (from C-

previously)

- CDP: B (reiterated

in Feb-24)

Webcast for the investors and

analystsDate: 7 May 2024, 6:00pmLinks to register:

https://edge.media-server.com/mmc/p/v78tn9mq/

Participants from Rubis:

- Marc Jacquot, CFO

- Clémence Mignot-Dupeyrot, Head of

IR

Upcoming eventsShareholders’

Meeting: 11 June 2024Q2 & H1 2024 results: 5 September 2024

(after market close)Photosol Day: 17 September 2024

|

Press Contact |

Analyst Contact |

|

RUBIS - Communication department |

RUBIS - Clémence Mignot-Dupeyrot, Head of IR |

|

Tel: +33 (0)1 44 17 95 95presse@rubis.fr |

Tel: +33 (0)1 45 01 87 44investors@rubis.fr |

1 LFL: Like-for-like i.e., excluding exceptional

items and FX effects.

2 RTB: Ready-to-build – Project fully permitted,

land and interconnection secured.

- Rubis Q1 2024 Trading update_uk

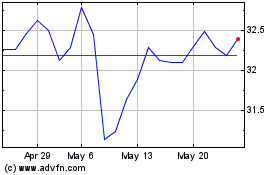

Rubis (EU:RUI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rubis (EU:RUI)

Historical Stock Chart

From Nov 2023 to Nov 2024