Vopak reports on FY 2022 and Q4 2022 financial results

February 15 2023 - 12:00AM

Vopak reports on FY 2022 and Q4 2022 financial results

The Netherlands,15 February 2023

Vopak reports FY 2022 and Q4 2022 results and

demonstrates good progress towards its strategic goals

Key highlights 2022:

- Improve: We reported financial results in line

with 2022 expectations. FY 2022 EBITDA of EUR 887 million and

operating cash return of 11.4%. Occupancy improved to 90% by the

end of Q4 2022. We continued to actively manage our portfolio by

divesting our Canadian oil terminals, Agencies business and started

a strategic review of Vopak’s three chemical terminals in the Port

of Rotterdam.

- Grow: We strengthened our leading position in

China and India through an expansion in Caojing and the completion

of the joint venture in India with Aegis. Gate LNG terminal

continues to fulfill an important role in the energy security of

Northwest Europe.

- Accelerate: We are repurposing oil capacity in

Los Angeles to sustainable aviation fuel and renewable diesel and

taking a share in the electricity storage company Elestor. In

addition, we will redevelop a prime location in the Port of Antwerp

for new energies and sustainable feedstocks and we are investing in

hydrogen logistics in Europe.

|

Q4 2022 |

Q3 2022 |

Q4 2021 |

In EUR millions |

2022 |

2021 |

|

|

|

|

|

|

|

|

355.3 |

349.6 |

315.2 |

Revenues |

1,367.0 |

1,227.9 |

|

|

|

|

|

|

|

|

|

|

|

Results -excluding

exceptional items- |

|

|

|

227.8 |

226.9 |

212.5 |

Group operating profit / (loss) before depreciation and

amortization (EBITDA) |

887.2 |

826.6 |

|

150.3 |

140.3 |

121.9 |

Group operating profit / (loss) (EBIT) |

547.3 |

494.8 |

|

88.5 |

77.7 |

69.1 |

Net profit / (loss) attributable to holders of ordinary shares |

294.4 |

298.3 |

|

0.71 |

0.62 |

0.55 |

Earnings per ordinary share (in EUR) |

2.35 |

2.38 |

|

|

|

|

|

|

|

|

|

|

|

Results -including

exceptional items- |

|

|

|

226.2 |

229.7 |

206.5 |

Group operating profit / (loss) before depreciation and

amortization (EBITDA) |

424.0 |

741.5 |

|

148.7 |

143.1 |

115.9 |

Group operating profit (loss) (EBIT) |

84.1 |

409.7 |

|

86.9 |

80.5 |

64.1 |

Net profit / (loss) attributable to holders of ordinary shares |

-168.4 |

214.2 |

|

0.70 |

0.64 |

0.51 |

Earnings per ordinary share (in EUR) |

-1.34 |

1.71 |

|

|

|

|

|

|

|

|

316.9 |

197.9 |

313.1 |

Cash flows from operating activities (gross excluding

derivatives) |

897.9 |

786.2 |

|

341.2 |

191.3 |

312.2 |

Cash flows from operating activities (gross) |

872.1 |

741.2 |

|

- 100.7 |

- 117.9 |

- 139.7 |

Cash flows from investing activities (including derivatives) |

- 489.4 |

- 588.4 |

|

|

|

|

|

|

|

|

|

|

|

Additional

performance measures |

|

|

|

269.6 |

277.4 |

250.6 |

Proportional EBITDA -excluding exceptional items- |

1,067.8 |

999.6 |

|

22.1 |

22.2 |

22.5 |

Proportional capacity end of period (in million cbm) |

22.1 |

22.5 |

|

90% |

89% |

86% |

Proportional occupancy rate |

88% |

88% |

|

36.6 |

36.6 |

36.2 |

Storage capacity end of period (in million cbm) |

36.6 |

36.2 |

|

90% |

88% |

86% |

Subsidiary occupancy rate |

87% |

87% |

|

|

|

|

|

|

|

|

9.3% |

11.2% |

8.0% |

Proportional operating cash return |

11.4% |

10.2% |

|

10.6% |

10.4% |

9.6% |

Return on Capital Employed (ROCE) |

9.8% |

10.2% |

|

5,319.4 |

5,344.3 |

5,150.2 |

Average capital employed |

5,408.1 |

4,755.1 |

|

3,050.8 |

3,278.7 |

2,925.1 |

Net interest-bearing debt |

3,050.8 |

2,925.1 |

|

2.65 |

2.82 |

2.93 |

Senior net debt : EBITDA |

2.65 |

2.93 |

|

2.85 |

3.02 |

3.16 |

Total net debt : EBITDA |

2.85 |

3.16 |

Note: Proportional operating cash return is defined as

proportional operating cash flow over average proportional capital

employed and reflects the increased importance of free cash flow

and joint ventures in our portfolio. Proportional operating cash

flow is defined as proportional EBITDA minus IFRS 16 lessee minus

proportional operating capex, which is defined as sustaining and

service capex plus IT capex. Proportional operating cash flow is

pre-tax, excludes growth capex and derivative and working capital

movements. Proportional capital employed is defined as proportional

total assets less current liabilities, excluding IFRS 16 lessee. As

of Q4 2022, Operating Cash Return includes the cash flow from

lessor accounting.

Royal Vopak Chief Executive Officer

Dick Richelle, comments on the FY 2022

results

“During 2022, we made good progress in our

strategy to improve our financial and sustainability performance,

to grow our base in industrial and gas terminals, and to accelerate

towards new energies and sustainable feedstocks.

We improved our performance in 2022, captured

growth opportunities and accelerated towards the company we want to

be in the future. EBITDA and cash flow generation increased during

the fourth quarter allowing us to meet the expectations for the

full year as we captured market opportunities in many locations

despite cost pressures due to surging energy prices and higher

personnel expenses. Today we announced that we have started a

strategic review of Vopak’s three chemical terminals in the Port of

Rotterdam. We also progressed our sustainability performance by

reducing our CO2 emissions by 10% during 2022 compared to the

baseline of 2021.

The deployment of growth capex towards our

strategic priorities is going well with growth in industrial and

gas terminals, for example in Caojing, China we are expanding our

industrial terminal capacity.

We are accelerating towards new energies. We

accessed a prime location in Europe’s leading petrochemical

cluster, the Port of Antwerp. This offers a unique opportunity to

implement our strategy, forge new partnerships and support the

industry in its decarbonization by developing critical

infrastructure. In addition, together with Hydrogenious LOHC

Technologies we are jointly taking hydrogen logistics to the next

level to push LOHC market solutions and large-scale pilot projects

forward.

As a result of our improve, grow and accelerate

strategy, Vopak will be a different company in 2030. Society will

need new, sustainable products that we will handle. We will forge

new partnerships and transform our company gradually but

decisively, leveraging our strengths and capabilities. We will

contribute to a low-carbon future by providing infrastructure

solutions for new energies and sustainable feedstocks, by helping

leading customers decarbonize, and by reducing our own

environmental and carbon footprint.”

Financial highlights for FY 2022 -

excluding exceptional items

- Revenue increased to EUR 1.4 billion, driven

by favorable storage demand indicators in chemical markets,

contribution from growth projects and a steady recovery during the

year in oil markets as well as positive currency translation

effects.

- Proportional occupancy rate

FY 2022 was 88% (FY 2021: 88%). Proportional occupancy improved to

90% in Q4 2022 from 89% in Q3 2022 driven mainly by higher

occupancy in Europe.

- Costs increased by EUR 85 million to EUR 713

million (FY 2021: EUR 628 million) mainly due to surging energy

prices (EUR 35 million), currency translation effects (EUR 29

million), personnel expenses (EUR 7 million) and cost of growth

projects and business development. During 4Q 2022, EUR 12 million

of non-recurring costs were recorded in the Europe & Africa

division related to soil provision.

- EBITDA increased to EUR 887 million (FY 2021:

EUR 827 million) supported by business conditions, currency

translation effects (EUR 58 million) and growth projects’

contribution (EUR 23 million). The positive trend was offset by the

divestment impact of EUR 12 million, higher costs and non-recurring

provision of EUR 12 million in Europe & Africa division.

- EBIT was EUR 547 million (FY 2021: EUR 495

million), an increase of EUR 52 million including EUR 43 million of

positive currency translation effects. The divestments during 2022

had an impact of EUR 2 million on EBIT. Depreciation charges were

broadly in line with prior year as the increase in commissioned

growth assets was offset by the impact of impairment charges on

depreciation of EUR 18 million.

- Growth investments in FY 2022 were EUR 313

million (FY 2021: EUR 269 million), reflecting the completion of

our joint venture in India with Aegis in Q2 2022 and higher growth

capex in Europe & Africa and America divisions. Proportional

growth investments in FY 2022 were EUR 349 million (FY 2021: EUR

316 million).

- Operating capex, which includes sustaining and

IT capex, in FY 2022 was EUR 291 million (FY 2021: EUR 316 million)

while proportional operating capex was EUR 315 million (FY 2021:

EUR 355 million) due to lower operating capex spend in Europe and

Africa division and lower IT spend.

- Cash flow from operating activities increased

by EUR 112 million to EUR 898 million, driven by strong EBITDA

performance and dividend receipts from joint ventures and

associates which increased to EUR 208 million (FY 2021: EUR 133

million).

- Proportional operating cash flow in FY 2022

was EUR 684 million (FY 2021 EUR 553 million) driven mainly by

strong proportional EBITDA performance and currency exchange impact

(EUR 68 million) and lower operating capex (EUR 40 million).

Proportional operating cash return in FY 2022 was 11.4% compared to

10.2% in FY 2021. The impairments in HY1 2022 led to an increase of

the FY operating cash return by 0.4 percentage points. Proportional

operating cash return in FY 2022 includes lessor accounting,

excluding the impact of lessor accounting (0.6 percentage points),

the increase in operating cash return was 0.2 percentage points.

The change in the methodology of calculating proportional operating

cash return provides better insight into the cash generation of the

business.

- Total impairment charges in FY 2022

were EUR 481 million (FY 2021: EUR 71 million),

including the impairments of Europoort, Botlek and SPEC LNG as

announced in the first half 2022 report. An asset impairment charge

of EUR 17 million was recorded in the fourth quarter of 2022 for

the cash-generating unit Vopak Colombia, primarily related to

weakening of the business environment in which the terminal

currently operates and forecasted competition.

- Net profit attributable to holders of ordinary

shares was EUR 294 million (FY 2021: EUR 298 million). Tax

charges increased as a result of the derecognition of the deferred

tax assets in the Netherlands in Q2 2022.

- The senior net debt : EBITDA ratio is 2.65x at

the end of year 2022 (FY 2021: 2.93x), within our previously

communicated ambition to keep senior net debt to EBITDA ratio in

the range of around 2.5-3.0x. Average interest rate on total debt

at the end of FY 2022 was 3.9% (FY 2021: 3.8%). Interest coverage

ratio at the end of FY 2022 stood at 8.4x (FY 2021: 8.4x), well

above the financial covenant of 3.5x.

- Proposed dividend of EUR 1.30 (2021: EUR 1.25)

per ordinary share, payable in cash, will be proposed during the

Annual General Meeting on 26 April 2023. This represents an

increase of 4% year on year, in line with Vopak’s progressive

dividend policy which aims to maintain or grow the annual dividend

subject to market conditions.

For more information please

contact:

Vopak Press: Liesbeth

Lans - Manager External

Communication,e-mail: global.communication@vopak.com

Vopak Analysts and

Investors: Fatjona Topciu - Head of Investor

Relations,e-mail: investor.relations@vopak.com

The analysts’ presentation will be given via an

on-demand video webcast on Vopak’s corporate website, starting

at 10:00 AM CET on 15 February 2023.

Auditor’s

involvementThis press release and

enclosure 3 are based on the 2022 financial statements. The

financial statements are published in accordance with statutory

provisions. The auditor has issued an unqualified auditor’s report

on the Financial Statements.

This press release contains

inside information as meant in clause 7 of the Market Abuse

Regulation.

For Vopak's full press release refer to

the attached document

- Press Release - Vopak reports on FY 2022

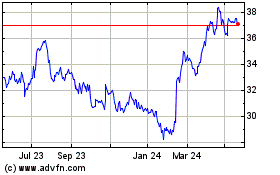

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

From Nov 2024 to Dec 2024

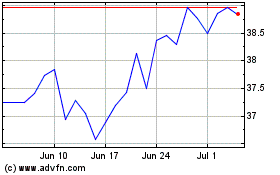

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

From Dec 2023 to Dec 2024