Australian Dollar Falls As RBA Keeps Key Rate Unchanged

May 06 2024 - 9:23PM

RTTF2

The Australian dollar weakened against other major currencies in

the Asian session on Tuesday, after the Reserve Bank of Australia

left its benchmark interest rates unchanged, as widely

expected.

The policy board of the RBA, led by Governor Michele Bullock,

decided to maintain the cash rate target at 4.35 percent. The board

also retained the interest rate paid on Exchange Settlement

balances at 4.25 percent.

"The Board expects that it will be some time yet before

inflation is sustainably in the target range and will remain

vigilant to upside risks," the bank said.

In the Asian trading now, the Australian dollar fell to 4-day

low of 0.6597 against the U.S. dollar, 1.6315 against the euro and

0.9026 against the Canadian dollar, from an early 4-day high of

0.6646, a 4-month high of 1.6217 and nearly a 1-year high of

0.9077, respectively. If the aussie extends its downtrend, it is

likely to find support around 0.64 against the greenback, 1.66

against the euro, and 0.87 against the loonie.

Against the NZ dollar, the aussie slid to a 6-day low of 1.0983

from an early 5-day high of 1.1031. The aussie may test support

near the 1.08 region.

The aussie edged down to 101.95 against the yen, from an early

6-day high of 102.47. On the downside, 99.00 is seen as the next

support level for the aussie.

Looking ahead, Germany and U.K. construction PMI for April and

euro area retail sales figures for March are due to be released in

the European session.

In the New York session, U.S. Redbook report, Canada Ivey's PMI

for April and U.S. consumer credit for March are slated for

release.

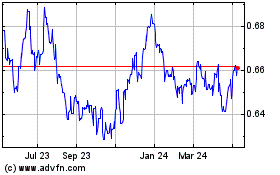

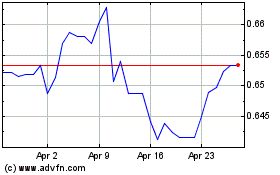

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Oct 2024 to Oct 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Oct 2023 to Oct 2024