U.S. Dollar Rebounds After Jobless Claims Data

September 19 2024 - 9:15AM

RTTF2

The U.S. dollar recovered against its major counterparts in the

New York session on Thursday, after a data showed that first-time

claims for unemployment benefits unexpectedly fell to a nearly

four-month low in the week ended September 14.

Data from the Labor Department showed that initial jobless

claims slid to 219,000, a decrease of 12,000 from the previous

week's revised level of 231,000.

Economists had expected jobless claims to come in unchanged

compared to the 230,000 originally reported for the previous

week.

With the unexpected decline, jobless claims fell to their lowest

level since hitting 216,000 in the week ended May 18th.

The greenback rebounded to 143.76 against the yen, 0.8506

against the franc and 1.1116 against the euro. This may be compared

to nearly a 2-week high of 143.94 against the yen, 6-day high of

0.8515 against the franc and a 1-week high of 1.1068 against the

euro it had touched in the previous session. The currency is seen

finding resistance around 147.00 against the yen, 0.92 against the

franc and 1.06 against the euro.

The greenback recovered to 1.3600 against the loonie, 0.6786

against the aussie and 0.6218 against the kiwi, from an early

nearly 2-week low of 1.3533, multi-month low of 0.6839 and a

multi-week low of 0.6268, respectively. In the Asian session, the

greenback appreciated to a multi-week high of 1.3647 against the

loonie, 3-day high of 0.6737 against the aussie and a 2-day high of

0.6181 against the kiwi. The currency is likely to locate

resistance around 1.38 against the loonie, 0.63 against the aussie

and 0.60 against the kiwi.

The greenback bounced off to 1.3219 against the pound, from an

early 2-1/2-year low of 1.3314. Immediate resistance for the

currency is seen around the 1.27 level.

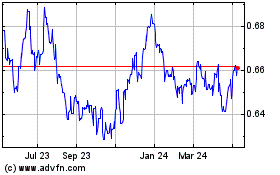

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Aug 2024 to Sep 2024

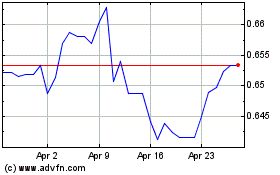

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Sep 2023 to Sep 2024