Canadian Dollar Slides As Crude Oil Prices Drop

November 14 2024 - 10:06PM

RTTF2

The Canadian dollar weakened against other major currencies in

the European session on Friday, as crude oil prices declined amid

worries about oversupply by growing U.S. crude stocks.

Data from the Energy Information Administration (EIA) showed

crude oil inventories in the U.S. climbed by 2.1 million barrels

last week, matching the increase seen in the previous week.

Economists had expected crude oil inventories to edge up by 1

million barrels.

Brent crude futures were down 24 cents, or 0.3% at $72.04 a

barrel. U.S. West Texas Intermediate crude futures (WTI) were down

27 cents, or 0.4% at $68.15.

Meanwhile, the report said gasoline inventories tumbled by 4.4

million barrels last week and are about 4% below the five-year

average for this time of year.

The International Energy Agency's monthly oil market report

released on Thursday predicts a significant discrepancy between

global oil demand and supply by 2025.

According to IEA, the world's demand for oil will fall short of

supply by more than 1 million barrels per day (bpd) in 2025 even if

OPEC+ cuts remain in place.

European stocks traded lower after Federal Reserve Chair Jerome

Powell signaled a cautious approach on rate cuts, given persistent

inflationary pressures.

Trading later in the day may be impacted by reaction to the

latest U.S. economic data, including reports on retail sales and

industrial production.

In the European trading today, the Canadian dollar fell to a

4-1/2-year low of 1.4070 against the U.S. dollar, from an early

high of 1.4052. The loonie may test support near the 1.41

region.

Against the euro and the yen, the loonie slid to 2-day lows of

1.4848 and 110.73 from early highs of 1.4804 and 111.44,

respectively. If the loonie extends its downtrend, it is likely to

find support around 1.51 against the euro and 109.00 against the

yen.

The loonie edged down to 0.9095 against the Australian dollar,

from an early high of 0.9068. On the downside, 0.92 is seen as the

next support level for the loonie.

Looking ahead, Canada manufacturing sales, new motor vehicle

sales and wholesale sales data, all for September, U.S. retail

sales data for October, import and export prices for October, U.S.

NY Empire State manufacturing index for November, U.S. industrial

and manufacturing production for October, business inventories for

September and U.S. Baker Hughes oil rig count data are slated for

release in the New York session.

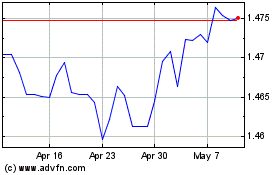

Euro vs CAD (FX:EURCAD)

Forex Chart

From Nov 2024 to Dec 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Dec 2023 to Dec 2024