Iceland Cuts Key Interest Rate For Fourth Straight Time

March 19 2025 - 1:46AM

RTTF2

Iceland central bank lowered its benchmark rate for the fourth

consecutive meeting on Wednesday, but policymakers stressed on the

need for caution in future as inflationary pressures remain, and in

view of the heighted global economic uncertainty.

The Monetary Policy Committee of the Central Bank of Iceland,

led by Governor Asgeir Jonsson, unanimously reduced the seven-day

term deposit rate by 25 basis points to 7.75 percent.

"Although inflation has eased and inflation expectations have

fallen in the recent term, inflation pressures remain, which calls

for a continued tight monetary stance and caution regarding

decisions going forward," the Reykjavik-based central bank said.

"This is compounded by significant global economic

uncertainty."

The bank had reduced the rate by 50 basis points each in

February and November and 25 basis points in October.

Inflation softened to a four-year low of 4.2 percent in

February. Policymakers said the outlook is for continued

disinflation in coming months.

In line with a tight monetary stance, demand growth subsided,

and housing market activity slowed. However, households ramped up

their consumption spending and wage costs continued to increase

steeply.

"As before, near-term monetary policy formulation will be

determined by developments in economic activity, inflation, and

inflation expectations," the bank said.

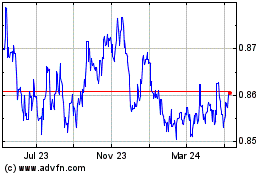

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Feb 2025 to Mar 2025

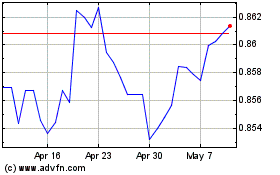

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Mar 2025