Antipodean Currencies Fall Amid Risk Aversion

June 23 2024 - 11:09PM

RTTF2

The antipodean currencies such as the Australia and the New

Zealand dollars weakened against their major currencies in the

Asian session on Monday, as traders remain cautious and remained

reluctant to pick up stocks amid a lack of significant

triggers.

Crude oil prices settled lower, weighed down by concerns about

the outlook for global oil demand and a firm greenback. West Texas

Intermediate crude oil futures for July shed $0.56 or 0.7 percent

at $80.73 a barrel for the week but gained 3 percent for the

week.

In economic news, data from Statistics New Zealand showed that

New Zealand posted a merchandise trade surplus of NZ$204 million in

May. That exceeded expectations for a surplus of NZ$155 million

following the downwardly revised NZ$3 million shortfall in

April.

Exports were up 2.9 percent on month to NZ$7,18 billion - up

from the downwardly revised NZ$6.31 billion in the previous month.

Imports came in at NZ$6.95 billion, up from NZ$6.32 billion a month

earlier.

In the Asian trading today, the Australian dollar fell to a

5-day low of 1.6125 against the euro, from Friday's closing value

of 1.6101. The EUR/AUD pair may test support near the 1.64

region.

Against U.S. and the Canadian dollars, the aussie slipped to

6-day lows of 0.6626 and 0.9083 from last week's closing quotes of

0.6641 and 0.9093, respectively. If the aussie extends its

downtrend, it is likely to find support around 0.64 against the

greenback and 0.89 against the loonie.

The aussie edged down to 105.81 against the yen, from an early

17-year high of 106.17. On the downside, 103.00 is seen as the next

support level for the aussie.

The NZ dollar fell to a 6-day low of 0.6105 against the U.S.

dollar and a 4-day low of 1.7510 against the euro, from last week's

closing quotes of 0.6119 and 1.7476, respectively. If the kiwi

extends its downtrend, it is likely to find support around 0.59

against the greenback and 1.76 against the euro.

Against the yen, the kiwi dropped to 97.49 from Friday's closing

value of 97.98. The NZD/JPY pay may test support near the 95.00

region.

The kiwi edged down to 1.0867 against the Australian dollar,

from last week's closing value of 1.0855. On the downside, 1.10 is

seen as the next support level for the kiwi.

Looking ahead, Germany's ifo business confidence survey data for

June and the Confederation of British Industry's Industrial Trends

survey data for June are due to be released in the European

session.

In the New York session, U.S. Dallas Fed manufacturing business

index for June is slated to release.

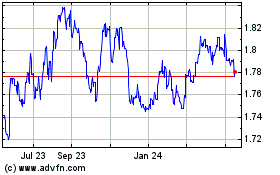

Euro vs NZD (FX:EURNZD)

Forex Chart

From May 2024 to Jun 2024

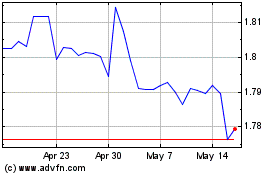

Euro vs NZD (FX:EURNZD)

Forex Chart

From Jun 2023 to Jun 2024