China Retains Loan Prime Rates As Expected

January 19 2025 - 7:04PM

RTTF2

The People's Bank of China maintained its interest rates for the

third straight session on Monday as policymakers await the stance

of new US administration. The PBoC left its one-year loan prime

rate at 3.10 percent. Similarly, the five-year LPR, the benchmark

for mortgage rates, was held at 3.60 percent. The decision matched

expectations.

The bank had reduced its both LPRs by 25 basis points each in

October 2024.

The PBoC fixes the LPR monthly based on the submission of 18

designated banks. However, Beijing has influence over the fixing.

The LPR replaced the traditional benchmark lending rate in August

2019.

Although the ability to manoeuvre the monetary policy is limited

due to the weakness of yuan, the central bank is likely to lower

policy rates amid trade tariff hike threats by US President-elect

Donald Trump.

Beijing has unveiled a range of fiscal and monetary easing

measures last year, which helped the economy to achieve its around

5 percent growth target in 2024. However, economic growth is

expected to weaken this year as a whole.

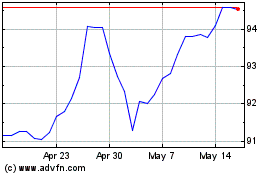

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Dec 2024 to Jan 2025

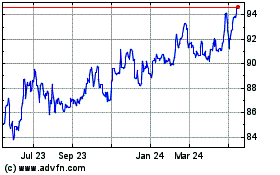

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Jan 2024 to Jan 2025