Commodity Currencies Rise Amid Risk-on Mood

March 05 2025 - 8:53PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars strengthened against their major currencies in

the Asian session on Thursday amid risk appetite, as traders react

positively to news that the Trump administration announced a

one-month delay on tariffs affecting cars entering the U.S. from

Canada and Mexico, raising hopes for negotiations.

However, the broader 25 percent duties imposed on Canada and

Mexico remain in effect with no resolution in sight and more levies

are set to begin in April.

The U.S. economic calendar remains light today, with reports on

weekly jobless claims and the trade deficit likely to garner some

attention ahead of the all-important jobs report due Friday.

The White House confirmed the exemption for automakers, noting

the move came after US President Donald Trump spoke with heads of

General Motors (GM), Ford Motor (F) and Stellantis (STLA). The

White House also indicated that Trump is open to further tariff

concessions, easing concerns about potential economic fallout.

Closer home, the European Central Bank and its counterpart in

Turkey will deliver their interest-rate decisions today.

EU leaders are meeting in Brussels for a special summit to

discuss continued support for Ukraine and European defense.

In economic news, Australia's trade surplus on goods increased

to A$5.62 billion in January 2025, up from a downwardly revised A$

4.92 billion in November, slightly higher than market expectations

of a gain of A$5.50 billion.

Preliminary data showed that the seasonally adjusted estimate

for total dwellings approved in Australia increased by 6.3 percent

on month to 16,579 units in January 2025, sharply accelerating from

an upwardly revised 1.7 percent growth in December 2024.

Meanwhile, private house approvals in Australia rose by 1.1

percent on month to 9,042 units in January 2025, following a

downwardly revised 2.8 percent decline in December, preliminary

data showed.

In the Asian trading today, the Australian dollar rose to a

9-day high of 0.6357 against the U.S. dollar and an 8-day high of

94.72 against the yen and more than a 1-month high of 0.9097

against the Canadian dollar, from yesterday's closing quotes of

0.6337, 94.35 and 0.9086, respectively. If the aussie extends its

uptrend, it is likely to find resistance around 0.65 against the

greenback, 97.00 against the yen and 0.91 against the loonie.

Against the euro, the aussie edged up to 1.7015 from Wednesday's

closing value of 1.7035. The aussie may test resistance around the

1.63 region.

The NZ dollar rose to a 10-day high of 0.5746 against the U.S.

dollar and a 9-day high of 85.64 against the yen, from yesterday's

closing quotes of 0.5728 and 85.28, respectively. If the kiwi

extends its uptrend, it is likely to find resistance around 0.58

against the greenback and 87.00 against the yen.

Against the euro and the Australian dollar, the kiwi edged up to

1.8814 and 1.1050 from Wednesday's closing quotes of 1.8845 and

1.1063, respectively. The kiwi may test resistance around 1.84

against the euro and 1.09 against the aussie.

The Canadian dollar rose to an 8-day high of 1.4310 against the

U.S. dollar, from yesterday's closing value of 1.4340. The loonie

is likely to find resistance around the 1.41 region.

Against the yen and the euro, the loonie edged up to 104.24 and

1.5455 from Wednesday's closing quotes of 103.84 and 1.5478,

respectively. If the loonie extends its uptrend, it is likely to

find resistance around 108.00 against the yen and 1.48 against the

euro.

Looking ahead, S&P Global publishes Germany and U.K.

construction PMI data for February and Eurostat publishes Eurozone

retail sales data for January are slated for January in the

European session.

In the New York session, U.S. and Canada trade data for January,

U.S. weekly jobless data and Canada Ivey PMI data for February are

set to be published.

At 8:15 am ET, the European Central Bank will announce its

monetary policy decision. The ECB is likely to cut its interest

rates on Thursday as inflation softened amid weaker economic

growth.

Markets expect the bank to lower the policy rates by 25 basis

points. The deposit facility rate is likely to be reduced to 2.50

percent from 2.75 percent.

Half-an-hour later, ECB President Christine Lagarde will hold

customary press conference.

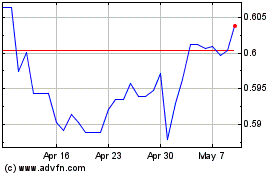

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Feb 2025 to Mar 2025

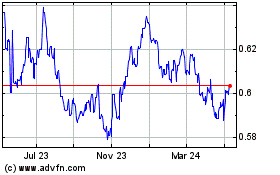

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Mar 2025