Canadian Dollar Rises As Crude Oil Prices Traded Higher

December 24 2024 - 8:43PM

RTTF2

The Canadian dollar strengthened against other major currencies

in the Asian session on Wednesday, as the crude oil prices moved

higher on expectations the Chinese government will announce

additional stimulus revive growth in the world's second largest

economy.

There is optimism over solid U.S. fuel demand after separate set

of data released the previous day showed new home sales rebounded,

and core capital goods orders increased in November.

West Texas Intermediate crude oil futures for February closed

higher by $0.86 or about 1.25% at $70.10 a barrel.

Brent crude futures settled higher by $0.95 or about 1.3% at

$73.58 a barrel.

China's Finance Ministry announced on Tuesday that the

government will increase public spending with a greater focus on

promoting domestic demand growth next year.

Possibility of supply disruptions due to persisting geopolitical

tensions, and the passage of a stop-gap spending bill by the U.S.

Senate to avert a government shutdown also supported oil

prices.

Kazakhstan's decision to shelve its plans to raise oil

production by 190,000 bpd next year contributed as well to oil's

upside. In the Asian trading today, the Canadian dollar rose to

more than a 4-1/2-month high of 0.8943 against the Australian

dollar, from yesterday's closing value of 0.8955. The loonie may

test resistance near the 0.87 region.

Against the U.S. dollar, the loonie advanced to 1.4348 from

yesterday's closing value of 1.4360. On the upside, 1.42 is seen as

the next resistance level for the loonie.

Against the euro and the yen, the loonie edged up to 1.4932 and

109.58 from early lows of 1.4965 and 109.42, respectively. The next

possible upside target for the loonie is seen around 1.48 against

the euro and 111.00 against the yen.

Most of the markets are off for the Christmas Day holiday.

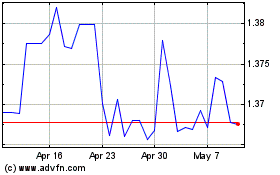

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Nov 2024 to Dec 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Dec 2023 to Dec 2024