Canadian Dollar Weakens As Oil Prices Fall

March 05 2025 - 8:34AM

RTTF2

The Canadian dollar declined against its most major counterparts

in the New York session on Wednesday amid lower oil prices, as U.S.

crude oil inventories increased unexpectedly last week.

Crude oil inventories climbed by 3.6 million barrels last week

after falling by 2.3 million barrels in the previous week,

according to a report released by the Energy Information

Administration. Economists had expected crude oil inventories to

edge down by 0.3 million barrels.

Meanwhile, gasoline inventories fell by 1.4 million barrels and

distillate fuel inventories decreased by 1.3 million barrels last

week.

The prospect of higher supplies from OPEC+ further weighed on

oil prices.

There are concerns about possible excess supply in the market

after OPEC and its allies signaled plans to increase production

next month.

The loonie fell to more than a 4-week low of 0.9092 against the

aussie and more than a 4-year low of 1.5539 against the euro. The

currency may challenge support around 0.92 against the aussie and

1.56 against the euro.

The loonie retreated to 103.02 against the yen, from an early

2-day high of 104.28. The currency is likely to locate support

around the 101.00 level.

In contrast, the loonie advanced to a 6-day high of 1.4340

against the greenback. If the currency continues its uptrend, 1.38

is possibly seen as its next resistance level.

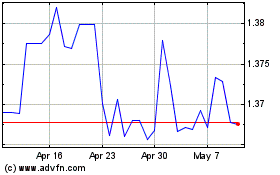

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Feb 2025 to Mar 2025

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Mar 2025