Pound Slides Ahead Of BoE Decision

January 14 2016 - 12:55AM

RTTF2

The pound declined against its major rivals in European deals on

Thursday, as traders focus on the Bank of England's interest rate

decision, due shortly, with relentless fall in oil clouding

uncertainty over global growth outlook.

The bank is widely expected to keep its record low 0.50 percent

interest rate and asset purchase program at 375 billion pounds.

Markets expect the BoE to sound dovish, with the plunging oil

prices, stock market rout and lingering worries over global growth

pushing back hopes for a rate hike at least until July.

European markets are weaker, following weak cues from Asia and

Wall Street overnight, ahead of the ECB minutes and the BoE

monetary policy decision.

The pound was slightly higher against most major rivals in the

Asian session.

In European trading now, the pound dropped to a 2-day low of

1.4360 against the greenback and a 3-day low of 1.4392 against the

franc, off its previous highs of 1.4427 and 1.4548,respectively.

The pound is likely to find support around 1.40 against the

greenback and 1.42 against the franc.

The pound depreciated to 0.7607 against the euro, its lowest

since January 2015. If the pound extends slide, 0.77 is possibly

seen as its next support level.

Data from Destatis showed that Germany's wholesale prices

continued to fall in December but the pace of decline slowed

further.

Wholesale prices decreased 1 percent year-on-year in December,

slower than the 1.1 percent drop seen in November. Nonetheless, the

index has been falling since July 2013.

The pound declined to 168.83 against the yen, a level unseen

since October 2014. The next possible support for the pound is

likely seen around the 167.00 zone.

Looking ahead, the minutes of the ECB monetary policy meeting in

December will come out at 7:30 am ET.

The U.S. import price index for December, U.S. weekly jobless

claims for the week ended January 9 and Canada new housing price

index for November are slated for release in the New York

session.

At 8:30 am ET, Federal Reserve Bank of St. Louis President James

Bullard is scheduled to give a presentation on the U.S. Economy and

Monetary Policy before the Economic Club of Memphis at the 2016

Regional Economic Briefing and Breakfast in Memphis.

Shortly after, Federal Reserve Bank of Atlanta President Dennis

Lockhart is set to deliver the welcome remarks before the 2016

Operation Hope Global Forum Annual Meeting in Atlanta.

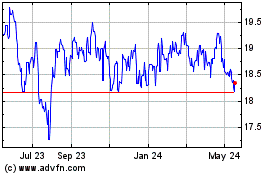

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Jun 2024 to Jul 2024

US Dollar vs ZAR (FX:USDZAR)

Forex Chart

From Jul 2023 to Jul 2024