Form 8-K - Current report

May 14 2024 - 10:23AM

Edgar (US Regulatory)

false0000008177NASDAQ00000081772024-05-142024-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of report (Date of earliest event reported)

|

May 14, 2024

|

|

ATLANTIC AMERICAN CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

Georgia

|

0-3722

|

58-1027114

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

4370 Peachtree Road, N.E., Atlanta, Georgia

|

30319

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone number, including area code

|

(404) 266-5500

|

|

N/A

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $1.00 per share

|

|

AAME

|

|

The Nasdaq Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. |

Results of Operations and Financial Condition

|

On May 14, 2024, Atlantic American Corporation (the “Registrant”) reported its results of operations for its first quarter ended March 31, 2024. A copy of the press

release issued by the Registrant concerning the foregoing results is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits

|

(d) Exhibits

|

Exhibit

Number

|

|

Description of Exhibit

|

|

|

|

Press release dated May 14, 2024.

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing of the Registrant, whether made before or after

the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing. The information in this report, including the exhibit hereto, shall not be deemed to be “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, hereunto duly authorized.

| |

ATLANTIC AMERICAN CORPORATION

|

| |

|

| |

By:

|

/s/ J. Ross Franklin

|

| |

|

J. Ross Franklin

|

| |

|

Vice President, Chief Financial Officer and Secretary

|

| |

|

|

Date: May 14, 2024

|

|

Exhibit 99.1

ATLANTIC AMERICAN CORPORATION REPORTS

FIRST QUARTER RESULTS FOR 2024

ATLANTA, Georgia, May 14, 2024 - Atlantic American Corporation (Nasdaq- AAME) today reported net loss of $2.0 million, or ($0.10) per common share, in the first quarter

of 2024 compared to net loss of $1.4 million, or ($0.08) per common share, in the first quarter of 2023. The increase in net loss for the first quarter of 2024 was primarily the result of a decrease in premium revenue in the life and health

operations coupled with unfavorable loss experience in the life and health operations. Premium revenue for the three month period ended March 31, 2024 decreased $1.5 million, or 3.4%, to $44.6 million from $46.1 million in the three month period

ended March 31, 2023.

The Company reported operating loss (as defined below) of $2.4 million in the three month period ended March 31, 2024 compared to operating income of $0.6 million in the

three month period ended March 31, 2023. The operating loss was primarily due to a decrease in premium revenue and unfavorable loss experience in the Company’s life and health operations.

Commenting on the results, Hilton H. Howell, Jr., Chairman, President and Chief Executive Officer, stated, “During the first quarter of 2024 our property and casualty

operations performed quite well, increasing insurance premiums over prior year while maintaining a relatively flat level of benefits and losses incurred. Although we did experience a decline in premiums in the life and health operations, we are

enthusiastic about our new business initiatives and have recently launched sales activities in additional markets within our Atlantic Capital Life Assurance Company.”

Atlantic American Corporation is an insurance holding company involved through its subsidiary companies in specialty markets of the life, health, and

property and casualty insurance industries. Its principal insurance subsidiaries are American Southern Insurance Company, American Safety Insurance Company, Bankers Fidelity Life Insurance Company, Bankers Fidelity Assurance Company and Atlantic

Capital Life Assurance Company.

Note regarding non-GAAP financial measure: Atlantic American Corporation presents its consolidated financial statements in accordance with U.S.

generally accepted accounting principles (GAAP). However, from time to time, the Company may present, in its public statements, press releases and filings with the Securities and Exchange Commission, non-GAAP financial measures such as operating

income (loss). We define operating income (loss) as net income (loss) excluding: (i) income tax expense (benefit); (ii) realized investment (gains) losses, net; and (iii) unrealized (gains) losses on equity securities, net. Management believes

operating income (loss) is a useful metric for investors, potential investors, securities analysts and others because it isolates the “core” operating results of the Company before considering certain items that are either beyond the control of

management (such as income tax expense (benefit), which is subject to timing, regulatory and rate changes depending on the timing of the associated revenues and expenses) or are not expected to regularly impact the Company’s operating results (such

as any realized and unrealized investment gains (losses), which are not a part of the Company’s primary operations and are, to a limited extent, subject to discretion in terms of timing of realization). The financial data attached includes a

reconciliation of operating income (loss) to net income (loss), the most comparable GAAP financial measure. The Company’s definition of operating income (loss) may differ from similarly titled financial measures used by others. This non-GAAP

financial measure should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP.

Note regarding forward-looking statements: Except for historical information contained herein, this press release contains forward-looking statements

that involve a number of risks and uncertainties. Actual results could differ materially from those indicated by such forward-looking statements due to a number of factors and risks, including the Company’s ability to remediate the identified

material weakness in its internal control over financial reporting as described in the Company’s most recent Annual Report on Form 10-K and those other risks and uncertainties detailed in statements and reports that the Company files from time to

time with the Securities and Exchange Commission.

|

For further information contact:

|

|

|

J. Ross Franklin

|

Hilton H. Howell, Jr.

|

|

Chief Financial Officer

|

Chairman, President & CEO

|

|

Atlantic American Corporation

|

Atlantic American Corporation

|

|

404-266-5580

|

404-266-5505

|

Atlantic American Corporation

Financial Data

| |

|

Three Months Ended

March 31,

|

|

|

(Unaudited; In thousands, except per share data)

|

|

2024

|

|

|

2023

|

|

|

Insurance premiums

|

|

|

|

|

|

|

|

Life and health

|

|

$

|

26,674

|

|

|

$

|

28,889

|

|

|

Property and casualty

|

|

|

17,878

|

|

|

|

17,211

|

|

|

Insurance premiums, net

|

|

|

44,552

|

|

|

|

46,100

|

|

| |

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

2,556

|

|

|

|

2,541

|

|

|

Unrealized losses on equity securities, net

|

|

|

(114

|

)

|

|

|

(2,375

|

)

|

|

Other income

|

|

|

3

|

|

|

|

3

|

|

| |

|

|

|

|

|

|

|

|

|

Total revenue

|

|

|

46,997

|

|

|

|

46,269

|

|

| |

|

|

|

|

|

|

|

|

|

Insurance benefits and losses incurred

|

|

|

|

|

|

|

|

|

|

Life and health

|

|

|

19,112

|

|

|

|

17,800

|

|

|

Property and casualty

|

|

|

12,813

|

|

|

|

12,660

|

|

|

Commissions and underwriting expenses

|

|

|

12,666

|

|

|

|

12,918

|

|

|

Interest expense

|

|

|

855

|

|

|

|

750

|

|

|

Other expense

|

|

|

4,057

|

|

|

|

3,959

|

|

| |

|

|

|

|

|

|

|

|

|

Total benefits and expenses

|

|

|

49,503

|

|

|

|

48,087

|

|

| |

|

|

|

|

|

|

|

|

|

Loss before income taxes

|

|

|

(2,506

|

)

|

|

|

(1,818

|

)

|

|

Income tax benefit

|

|

|

(508

|

)

|

|

|

(372

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(1,998

|

)

|

|

$

|

(1,446

|

)

|

| |

|

|

|

|

|

|

|

|

|

Loss per common share (basic & diluted)

|

|

$

|

(0.10

|

)

|

|

$

|

(0.08

|

)

|

| |

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP financial measure

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(1,998

|

)

|

|

$

|

(1,446

|

)

|

|

Income tax benefit

|

|

|

(508

|

)

|

|

|

(372

|

)

|

|

Unrealized losses on equity securities, net

|

|

|

114

|

|

|

|

2,375

|

|

| |

|

|

|

|

|

|

|

|

|

Non-GAAP operating income (loss)

|

|

$

|

(2,392

|

)

|

|

$

|

557

|

|

| |

|

March 31,

|

|

|

December 31,

|

|

|

Selected balance sheet data

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

Total cash and investments

|

|

$

|

258,276

|

|

|

$

|

265,368

|

|

|

Insurance subsidiaries

|

|

|

251,014

|

|

|

|

259,253

|

|

|

Parent and other

|

|

|

7,262

|

|

|

|

6,115

|

|

|

Total assets

|

|

|

365,751

|

|

|

|

381,265

|

|

|

Insurance reserves and policyholder funds

|

|

|

203,822

|

|

|

|

212,422

|

|

|

Debt

|

|

|

37,762

|

|

|

|

36,757

|

|

|

Total shareholders' equity

|

|

|

102,803

|

|

|

|

107,275

|

|

|

Book value per common share

|

|

|

4.77

|

|

|

|

4.99

|

|

|

Statutory capital and surplus

|

|

|

|

|

|

|

|

|

|

Life and health

|

|

|

32,638

|

|

|

|

38,299

|

|

|

Property and casualty

|

|

|

52,376

|

|

|

|

51,774

|

|

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

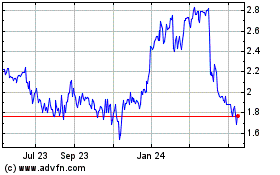

Atlantic American (NASDAQ:AAME)

Historical Stock Chart

From Feb 2025 to Mar 2025

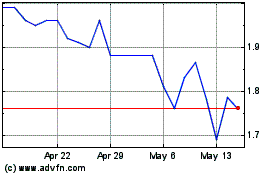

Atlantic American (NASDAQ:AAME)

Historical Stock Chart

From Mar 2024 to Mar 2025