false

0001173313

0001173313

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 14, 2024

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On November 14, 2024, ABVC BioPharma, Inc. (the

“Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2024,

which were disclosed in the Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission on November 14, 2024.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information reported under this Item 2.02

of Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of

such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Neither this Current Report on Form 8-K, nor any

exhibit attached hereto, is an offer to sell or the solicitation of an offer to buy the Securities described herein. Such disclosure does

not constitute an offer to sell, or the solicitation of an offer to buy nor shall there be any sales of the Company’s securities

in any state in which such an offer, solicitation or sale would be unlawful. The securities mentioned herein have not been registered

under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or

an applicable exemption from the registration requirements under the Securities Act and applicable state securities laws.

Item 9.01 Exhibits

(d) Exhibits

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release |

| 104 |

|

Cover Page Interactive Data File, formatted in Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| November 14, 2024 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

Exhibit 99.1

ABVC BioPharma Inc. Reports Q3 2024 Financial

Results

and Operational Milestones

| ● | ABVC BioPharma Achieved its First Operational Profit, with a 102% Improvement

over the Third Quarter of Last Year. |

| ● | Incremental

Payments Received based on Executed Global Licensing Agreements that could provide up to $292 million in income |

| ● | Received Cash Milestone Incomes of $496,000 for the nine months ended

September 30, 2024 |

Fremont, CA (November 14, 2024) – ABVC BioPharma, Inc. (NASDAQ:

ABVC), a clinical-stage biopharmaceutical company developing therapeutic solutions in oncology/hematology, CNS, and ophthalmology, is

pleased to announce its financial results and key operational highlights for the third quarter ended September 30, 2024.

Key Financial and Operational Highlights:

1. Financial Performance:

| ● | Impressive

Revenue Growth: ABVC reported a significant increase in revenue, reaching $389,276 in Q3 2024, from $15,884 in the third quarter of 2023.

This growth reflects the growing demand for our CNS and oncology R&D services and highlights the positive potential of our strategic

partnerships. |

| ● | Continued

Improvement in Earnings: The Company’s net loss for Q3 2024 decreased substantially to $134,272 from $3.37 million in Q3 2023.

This positive net loss reduction trend results from disciplined financial management and focused R&D investments, underscoring our

commitment to building a sustainable growth pathway. |

| ● | Earnings

Per Share (EPS): EPS improved year-over-year, with a basic and diluted net loss per share of $(0.02) for Q3 2024, a significant advancement

from $(0.82) per share in Q3 2023. This achievement demonstrates our effective cost management and operational efficiency gains. |

| ● | Improved

Cash Position: The Company’s cash and cash equivalents reached $137,344 as of September 30, 2024, up from $60,155 at the end of

2023. Through strategic financing and operational efficiencies, ABVC has strengthened its liquidity to support upcoming anticipated clinical

milestones and expansion efforts. |

| ● | Shareholders’

Equity: As of September 30, 2024, shareholders’ equity stood at $7.98 million, maintaining a solid financial foundation despite challenging

macroeconomic conditions. |

2. Strategic and Operational Milestones:

Advances in Clinical Development:

ABVC completed Phase II trials for ABV-1504 in

Major Depressive Disorder (MDD) and is preparing for an FDA End-of-Phase 2 meeting to finalize the Phase III protocol.

Progress continues in our ADHD program with Phase

IIb trials at multiple prominent sites. We aim to have an interim report by Q4 2024.

Additionally, ABVC’s first-in-class vitreous

substitute, Vitargus®, for retinal detachment surgery, is advancing through regulatory stages with approvals for further trials in

Australia.

3. Strengthening Partnerships:

ABVC has secured multiple long-term licensing

agreements, notably with ForSeeCon Eye Corporation for Vitargus®, which could potentially generate $187 million in revenue

over time.

In Q3, ABVC’s continued collaboration with OncoX

expanded the oncology pipeline, positioning the Company for strong future growth in partnership-driven revenue streams.

Expanded Intellectual Property Portfolio: ABVC

has been granted multiple patents in the U.S., Taiwan, and Australia, covering a range of CNS and ophthalmology treatments. These patents

reflect our innovative R&D approach and commitment to protecting our groundbreaking therapies.

ABVC will continue working closely together with

its strategic partners, AiBtl BioPharma Inc., ForSeeCon Eye Corporation, and OncoX BioPharma Inc., on international business and clinical

developments of CNS new drugs, Ophthalmology products and Oncology new drugs, respectively.

Management Commentary:

Dr. Uttam Patil, ABVC Chief Executive Officer,

commented, “Our third-quarter results showcase the impact of our strategic direction and dedicated team. Our strengthened financial

position and exciting progress in CNS and oncology programs should enable us to drive future shareholder value. We thank our investors

for their continued confidence as we advance ABVC’s growth trajectory. For the first time in its history, ABVC BioPharma achieved an operational

profit in the third quarter of 2024, marking a transformative milestone for the Company and underscoring the effectiveness of our strategic

approach. This significant achievement is a testament to our dedicated focus on operational efficiency, robust cost management, and the

strength of our pipeline. The company receiving licensing income has successfully turned an operational loss into operational income for

the first time. However, due to higher interest expenses arising from the accounting treatment of amortization expenses related to convertible

debt, the EPS stands at -$0.02. Despite this slight negative EPS, the core business has achieved profitability, reflecting strong operational

improvements driven by the licensing income. This milestone demonstrates the company’s ability to generate income, positioning us

toward sustained financial growth as we manage these interest-related expenses. We believe ABVC is poised to maintain this upward growth

trajectory through its global licensing agreements, which are anticipated to deliver a strong and recurring income stream. These partnerships

have the potential to fortify our financial position and enable ABVC to expand its reach in key therapeutic markets, which should pave

the way for sustained, long-term growth and increased shareholder value.”

Board of Directors Statement:

“With a stronger financial foundation, strategic

partnerships, and a promising pipeline, we believe that ABVC is well-positioned for continued growth. The Company anticipates further

revenue growth through strategic collaborations, ongoing clinical developments, and new market entries. ABVC remains committed to advancing

its high-potential CNS, oncology, and ophthalmology programs to bring life-changing therapies to patients worldwide.”

Operational Highlights

Patents and FDA Approvals

The Company received a US patent (US 16/936,032),

valid until September 04, 2040, a Taiwanese (TW I821593) Patent, valid until July 22, 2040, and an Australian (AU2021314052B2) Patent,

valid until April 09, 2041, for Polygala extract for the treatment of major depressive disorder. The Company received a US (US17/120,965),

valid until December 20, 2040, and Taiwanese (TW 110106546), valid until February 24, 2041, Patent for Polygala Extract for treating Attention

Deficit Hyperactive Disorder. A Taiwanese Patent (TW I792427) for Storage Media for the Preservation of Corneal Tissue was obtained on

February 11, 2023, and is valid till July 19, 2041. As we work towards expanding our patent map into global coverage, we eagerly await

the results of patent applications in the European Union, China, Japan, and others.

On December 30, 2022, the Company received US

FDA approval for the IND ABV-1519 to proceed with the Combination therapy for treating Advanced Inoperable or Metastatic EGFR Wild-type

Non-Small Cell Lung Cancer was approved and the study can proceed. The IND was then submitted to the Taiwan FDA, and the approval was

received on January 04, 2024. The United States Food & Drug Administration (US FDA) has approved four INDs, ABV-1501 for Triple Negative

Breast Cancer (TNBC), ABV-1519 for Non-Small Cell Lung Cancer (NSCLC), ABV-1702 for Myelodysplastic Syndrome (MDS), and ABV-1703 for Pancreatic

Cancer Therapy.

Neurology

The MDD Phase II trials for ABV-1504 were completed

successfully with good tolerance to the drug, and no serious adverse effects were reported. The product is ready for an End-of-Phase 2

meeting with the FDA to finalize the protocol for Phase III trials. At the same time, we commenced the ADHD Phase IIb trials at the University

of California, San Francisco (UCSF) and five other sites in Taiwan. The trials are heading for the interim report, which we expect to

complete by the end of Q3 2024. ABV-1601 for MDD in cancer patients has completed Phase I study preparation, including the Site Initiation

Visit (SIV). The study is set to initiate by the end of 2024.

On July 31, 2023, ABVC signed a legally binding

term sheet with a Chinese pharmaceutical company, Xinnovation Therapeutics Co., Ltd, for the exclusive licensing of ABV-1504 for Major

Depressive Disorder (MDD) and ABV-1505 for Attention-Deficit Hyperactivity Disorder in mainland China. Under this agreement, Xinnovation

will hold exclusive rights to develop, manufacture, market, and distribute our innovative drugs for MDD and ADHD in the Chinese market

and shall bear the costs for clinical trials and product registration in China. We are negotiating definitive agreements with Xinnovation

and are excited that the licensing deal carries a possible aggregate income of $20 million for ABVC if all expected sales are made, of

which there can be no guarantee. This transaction remains subject to the negotiation of definitive documents and therefore there is no

guarantee that this transaction will occur.

In November 2023, each of ABVC and one of its

subsidiaries, BioLite, Inc. (“BioLite”), entered a multi-year, global licensing agreement with AIBL for the Company and BioLite’s

CNS drugs with the indications of MDD (Major Depressive Disorder) and ADHD (Attention Deficit Hyperactivity Disorder). The potential license

will cover the licensed products’ clinical trials, registration, manufacturing, supply, and distribution rights. The licensed products

for MDD and ADHD, owned by ABVC and BioLite, were valued at $667M by a third-party evaluation. The parties are determined to collaborate

on the global development of the licensed products. The parties are also working to strengthen new drug development and business collaboration,

including technology, interoperability, and standards development. As per each of the respective agreements, each of ABVC and BioLite

shall receive 23 million shares of AIBL stock that the parties value at $10 per share (not independently validated) and if certain milestones

are met, $3,500,000 and royalties equaling 5% of net sales, up to $100 million, which is not guaranteed.

Ophthalmology

Vitargus®, a vitreous substitute,

is a groundbreaking, advanced-staged R&D product that we believe will be the first biodegradable hydrogel used in retinal detachment

surgery. Vitargus® has completed the feasibility study in Australia and was approved by the Australian Therapeutic Goods

Administration (TGA) to initiate the next trial phase in two participating sites. This is vital to obtaining final regulatory approval

for Vitargus® in Australia.

The Science Park Administration in Taiwan approved

ABVC’s plan to set up a pilot Good Manufacturing Practice (GMP) facility to produce Vitargus® and to pursue the process

development work for manufacturing optimization. We are undertaking this project, proposed by ABVC’s Taiwan affiliate and co-development

partner, BioFirst Corporation, to upgrade the Vitargus® manufacturing processes so it can ultimately handle the clinical

trial supply. ABVC and BioFirst Corporation expect to complete the facility’s upgradation in Hsinchu Biomedical Science Park, Taiwan,

in 2024.

Oncology/Hematology

The United States Food & Drug Administration

(US FDA) approved the Investigational New Drug (IND) application for the proposed clinical investigation of BLEX 404, the primary active

ingredient in ABV-1519, for advanced inoperable or metastatic EGFR wild-type non-small cell lung cancer. This treatment is being co-developed

by BioKey, Inc. (“BioKey”) and by the Rgene Corporation, Taiwan. The study received approval from the Taiwan FDA. This is the

fourth IND approved by the US FDA for BLEX 404. The previous three INDs are for the combination therapies of triple-negative breast cancer,

myelodysplastic syndromes (MDS), and pancreatic cancer.

CDMO

BioKey, a wholly-owned subsidiary of the Company

based in Fremont, California, produces dietary supplements derived from the maitake mushroom in tablet and liquid forms. BioKey has entered

the second year of the distribution agreement with Define Biotech Co. Ltd. BioKey is currently set to produce an additional $1 million

worth of products for the global market. We continue to work on distribution for the US and Canadian markets with Shogun Maitake.

On the regulatory services front for our clients,

we received two ANDA approvals from the US FDA. We have a three-year contract, worth up to $3 million, for clinical development services

between BioKey and Rgene Corporation. With this base, we are actively developing BioKey as a contract research, development, and manufacturing

organization (CRDMO) to become a one-stop solution for pharmaceutical services.

About ABVC BioPharma, Inc.

ABVC BioPharma, Inc. is a clinical-stage biopharmaceutical

company focused on utilizing its licensed technology to conduct proof-of-concept trials through Phase II of the clinical development process

at world-famous research institutions (such as Stanford University, University of California at San Francisco, and Cedars-Sinai Medical

Center) and then out-licensing the products to international pharmaceutical companies for pivotal Phase III studies and, eventually, generating

global sales. The Company has an active pipeline of six drugs and one medical device (ABV-1701/Vitargus®) under development.

Forward-looking Statements

This press release contains “forward-looking

statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,”

“expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,”

“hopes,” “potential” or similar words. Forward-looking statements are not guarantees of future performance, are based

on certain assumptions and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control,

and cannot be predicted or quantified and consequently, actual results may differ materially from those expressed or implied by such forward-looking

statements. Such risks and uncertainties include, without limitation, risks and uncertainties associated with (i) our inability to manufacture

our product candidates on a commercial scale on our own, or in collaboration with third parties; (ii) difficulties in obtaining financing

on commercially reasonable terms; (iii) changes in the size and nature of our competition; (iv) loss of one or more key executives or

scientists; and (v) difficulties in securing regulatory approval to proceed to the next level of the clinical trials or market our product

candidates. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements

is set forth in the Company’s filings with the Securities and Exchange Commission (SEC), including the Company’s Annual Report on Form

10-K and its Quarterly Reports on Form 10-Q. Investors are urged to read these documents free of charge on the SEC’s website at http://www.sec.gov.

The Company assumes no obligation to publicly update or revise its forward-looking statements as a result of new information, future events

or otherwise.

This press release does not constitute an offer to sell or the solicitation

of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that state or jurisdiction.

Contact:

Uttam Patil

Email: uttam@ambrivis.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

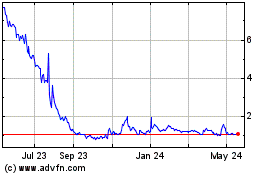

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

From Jan 2025 to Feb 2025

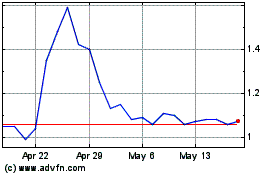

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

From Feb 2024 to Feb 2025