Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule

14A

Proxy Statement Pursuant to Section

14(a) of the Securities Exchange Act of 1934

| Filed by the Registrant |

☒ |

| |

|

| Filed by a party other than the Registrant |

☐ |

Check the appropriate box:

| ☒ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-(e)(2)) |

| |

|

| ☐ |

Definitive Proxy Statement |

| |

|

| ☐ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material under § 240.14a-12 |

Aclarion,

Inc.

(Name of Registrant as Specified

In Its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11 |

Aclarion, Inc.

8181 Arista Place, Suite 100

Broomfield, Colorado 80021

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on February [***], 2025

Dear Stockholder:

We are pleased to invite you

to attend the special meeting of stockholders (the “Special Meeting”) of Aclarion, Inc., which will be held on February [***],

2025 at 9:30 a.m. Mountain Time. The Special Meeting will be held at the offices of Aclarion, Inc., 8181 Arista Place, Suite 100, Broomfield,

Colorado 80021.

Further details regarding

the Special Meeting are included in the accompanying proxy statement. At the Special Meeting, the holders of our outstanding common stock

and Series A preferred stock will act on the following matter:

| |

1. |

To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of common stock, par value $0.00001

per share (the “common stock”) issuable by the Company upon exercise of the Series A Common Warrants and the Series B Common

Warrants (as defined in the Proxy Statement) (the “Issuance Proposal” or “Proposal 1”);

|

| |

|

|

| |

2. |

To grant discretionary authority to our board of directors to (i) amend

Article IV of the Company’s Certificate of Incorporation to increase the number of our authorized shares of common stock from 200,000,000

shares to 300,000,000 shares and (ii) effect such amendment, if at all, within one year of the date the proposal is approved by stockholders

(the “Charter Amendment Proposal” or “Proposal 2”); |

| |

|

|

| |

3. |

To

adopt and approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and

vote of proxies if it is determined by the Company that more time is necessary or appropriate to approve the Issuance Proposal and the

Charter Amendment Proposal at the Special Meeting (the “Adjournment Proposal” or “Proposal 3”); and |

| |

|

|

| |

4. |

To

transact such other business as may properly come before the Special Meeting. |

Stockholders also will transact any other

business that may properly come before the Special Meeting or any adjournment or postponement of the Special Meeting.

Our board of directors has

fixed January 6, 2025 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of,

and to vote at, the Special Meeting and at any adjournment or postponement of the meeting.

You can find more information

on each of the matters to be voted on at the Special Meeting in the accompanying proxy statement. The board of directors recommends a

vote “FOR” the Issuance Proposal, “FOR” the Charter Amendment Proposal, and “FOR” the Issuance Proposal.

This Proxy Statement is available

at www.aclarion.com.

Your vote is important.

Whether or not you are able to attend the Special Meeting in person, it is important that your shares be represented. To ensure that your

vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Special Meeting in person, by submitting your

proxy via the Internet at the address listed on the proxy card.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| January [***], 2025 |

/s/ Brent Ness |

| |

Brent Ness |

| |

Chief Executive Officer |

Aclarion, Inc.

8181 Arista Place, Suite 100

Broomfield, Colorado 80021

PROXY STATEMENT FOR THE

SPECIAL MEETING OF STOCKHOLDERS

To be held on February [***], 2025

The board of directors of

Aclarion, Inc. is soliciting your proxy to vote at the Special Meeting of Stockholders (the “Special Meeting”) to be held

on February [***], 2025, at 9:30 a.m. Mountain Time. The Special Meeting will be held at the offices of Aclarion, Inc., 8181 Arista Place,

Suite 100, Broomfield, Colorado 80021. Unless the context requires otherwise, references to “Aclarion,” “the Company,”

“we,” “our,” and “us” in this Proxy Statement refer to Aclarion, Inc.

This proxy statement contains

information relating to the Special Meeting.

You may only attend the Special

Meeting at the Company’s offices in person.

The Notice of Meeting and

Proxy Statement are being mailed to our stockholders of record entitled to vote at the Special Meeting on or about January [***], 2025.

Only stockholders who owned

our common stock on January 6, 2025 are entitled to vote at the Special Meeting.

In accordance with the bylaws

of the Company (as they may be amended, supplemented or otherwise modified from time to time, the “Bylaws”), the Special Meeting

has been called for the following purposes:

| 1. | To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of

common stock, par value $0.00001 per share (“common stock”) issuable by the Company upon exercise of the Series A Warrants

and the Series B Warrants (as defined below) (the “Issuance Proposal” or “Proposal 1”); |

| | | |

| 2. | To grant discretionary authority to our board of directors to (i) amend Article IV of the Company’s Certificate

of Incorporation to increase the number of our authorized shares of common stock from 200,000,000 shares to 300,000,000 shares and (ii)

effect such amendment, if at all, within one year of the date the proposal is approved by stockholders (the “Charter Amendment Proposal”

or “Proposal 2”); and |

| | | |

| 3. | To adopt and approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary,

to permit further solicitation and vote of proxies if it is determined by the Company that more time is necessary or appropriate to approve

the Issuance Proposal and the Charter Amendment Proposal at the Special Meeting (the “Adjournment Proposal” or “Proposal

3”); and |

| | | |

| 4. | To transact such other business as may properly come before the Special Meeting. |

Stockholders of record at

the close of business on January 6, 2025, are entitled to notice of, and to attend and to vote at, the Special Meeting and any postponement

or adjournment thereof. We intend to mail this Proxy Statement, together with a proxy card, on or about January [***], 2025, to all stockholders

entitled to vote at the Special Meeting.

ACLARION, INC.

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT

AND VOTING

What is a proxy?

A proxy is the legal designation

of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written

document, that document is also called a proxy or a proxy card. By completing, signing and returning the accompanying proxy card, you

are designating Brent Ness, Chief Executive Officer, and John Lorbiecki, Chief Financial Officer, as your proxies for the Special Meeting

and you are authorizing Mr. Ness and Mr. Lorbiecki to vote your shares at the Special Meeting as you have instructed on the proxy card.

This way, your shares will be voted whether or not you attend the Special Meeting. Even if you plan to attend the Special Meeting, we

urge you to vote in one of the ways described below so that your vote will be counted even if you are unable or decide not to attend the

Special Meeting.

What is a proxy statement?

A proxy statement is a document

that we are required by regulations of the U.S. Securities and Exchange Commission, or “SEC,” to give you when we ask you

to sign a proxy card designating Mr. Ness and Mr. Lorbiecki as proxies to vote on your behalf.

Why did you send me this proxy statement?

We sent you this proxy statement

and the enclosed proxy card because our board of directors is soliciting your proxy to vote at the Special Meeting and any adjournment

and postponement thereof. This proxy statement summarizes information related to your vote at the Special Meeting. All stockholders who

find it convenient to do so are cordially invited to attend the Special Meeting at the Company’s offices in person. However, you

do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the proxy card or vote over the

Internet, by phone, or by fax.

On or about January [***],

2025, we intend to begin mailing to each stockholder of record entitled to vote at the Special Meeting the Notice of Meeting and Proxy

Statement. Only stockholders who owned our common stock on January 6, 2025 are entitled to vote at the Special Meeting.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one

set of proxy materials, your shares may be registered in more than one name or in different accounts. Please complete, sign, and return

each proxy card to ensure that all of your shares are voted.

How do I attend the Special Meeting?

The Special Meeting will be

held on February [***], 2025, at 9:30 a.m. Mountain Time. The Special Meeting will be held at the offices of Aclarion, Inc., 8181 Arista

Place, Suite 100, Broomfield, Colorado 80021. You may only attend the Special Meeting in person. Information on how to vote your shares

in connection with the Special Meeting is discussed below.

Who is entitled to vote?

The board of directors has

fixed the close of business on January 6, 2025 as the record date (the “Record Date”) for the determination of stockholders

entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. On the Record Date, there were

[********] shares of common stock outstanding.

Each share of common stock

represents one vote that may be voted on each proposal that may come before the Special Meeting.

What is the difference between holding shares as a record holder

and as a beneficial owner (holding shares in street name)?

If your shares are registered

in your name with our transfer agent, VStock Transfer, LLC, you are the “record holder” of those shares. If you are a record

holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in

a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held

in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization.

The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. As

the beneficial owner, you have the right to instruct this organization on how to vote your shares. See “How will my shares be voted

if I give no specific instruction?” below for information on how shares held in street name will be voted without instructions provided.

Who may attend the Special Meeting?

Only record holders and beneficial

owners of our common stock, or their duly authorized proxies, may attend the Special Meeting. You may only attend the Special Meeting

in person. If your shares of common stock are held in street name, you will need to provide a copy of a brokerage statement or other documentation

reflecting your stock ownership as of the Record Date.

What am I voting on?

There are three matters scheduled

for a vote:

| 1. | To approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of

common stock, par value $0.00001 per share (the “common stock”) issuable by the Company upon exercise of the Series A Common

Warrants and the Series B Common Warrants (as defined in the Proxy Statement) (the “Issuance Proposal” or “Proposal

1”); |

| | | |

| 2. | To grant discretionary authority to our board of directors to (i) amend Article IV of the Company’s Certificate

of Incorporation to increase the number of our authorized shares of common stock from 200,000,000 shares to 300,000,000 shares and (ii)

effect such amendment, if at all, within one year of the date the proposal is approved by stockholders (the “Charter Amendment Proposal”

or “Proposal 2”); |

| | | |

| 3. | To adopt and approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary,

to permit further solicitation and vote of proxies if it is determined by the Company that more time is necessary or appropriate to approve

the Issuance Proposal and the Charter Amendment Proposal at the Special Meeting (the “Adjournment Proposal” or “Proposal

3”). |

What if another matter is properly brought before the Special Meeting?

The board of directors knows

of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before

the Special Meeting, it is the intention of the person named in the accompanying proxy to vote on those matters in accordance with their

best judgment.

How do I vote?

If you are a stockholder of

record, there are several ways for you to vote your shares.

| |

· |

By Internet (before the Special Meeting). You may vote at www.vstocktransfer.com/proxy, 24 hours a day, seven days a week, by following the instructions at that site for submitting your proxy electronically. You will be required to enter the 16-digit control number provided in the Notice of Availability or the proxy card. Votes submitted through the Internet must be received by 11:59 p.m. Eastern Time on February [***], 2025. |

| |

· |

By Mail. If you requested and received a printed copy of the proxy materials, you may vote by mail by completing, signing and dating the enclosed proxy card and returning it in the enclosed prepaid envelope. Votes submitted through the mail must be received prior to February [***], 2025. |

| |

· |

During the Special Meeting. If you are a stockholder of record as of the record date, you may vote in person by attending the Special Meeting in person. Submitting a proxy prior to the Special Meeting will not prevent stockholders from attending the Special Meeting, revoking their earlier-submitted proxy, and voting in person at the Special Meeting. |

If the Special Meeting is

adjourned or postponed, the deadlines above may be extended.

Stockholders of record

If you are a registered stockholder,

you may vote by mail, Internet, phone, or online at the Special Meeting by following the instructions in these proxy materials. You also

may submit your proxy by mail by following the instructions included with your proxy card. The deadline for submitting your proxy by Internet

is 11:59 p.m. Mountain Time on February [***], 2025. Our Board’s designated proxies, Mr. Ness and Mr. Lorbiecki, will vote your

shares according to your instructions.

Beneficial owners of shares held in street name

If you are a street name holder,

your broker or nominee firm is the legal, registered owner of the shares, and it may provide you with these proxy materials. These materials

include a voting instruction card so that you can instruct your broker or nominee how to vote your shares. Please check the proxy materials

and voting instruction card or contact your broker or other nominee to determine whether you will be able to deliver your voting instructions

by Internet in advance of the meeting.

All shares entitled to vote

and represented by a properly completed and executed proxy received before the Special Meeting and not revoked will be voted at the Special

Meeting as instructed in a proxy delivered before the Special Meeting. We provide Internet proxy voting to allow you to vote your shares

online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware

that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone

companies.

How many votes do I have?

Holders of record of shares

of the Company’s common stock will be entitled to one vote for each share of common stock held by them on the Record Date and have

the right to vote on all matters brought before the Special Meeting.

Is my vote confidential?

Yes, your vote is confidential.

Only the inspector of elections, individuals who help with processing and counting your votes and persons who need access for legal reasons

will have access to your vote. This information will not be disclosed, except as required by law.

What constitutes a quorum?

To carry on business at the

Special Meeting, we must have a quorum. A quorum is present when one-third of the voting power of the outstanding shares entitled to vote

at the Special Meeting, as of the Record Date, are represented in person or by proxy.

Your shares of common stock

will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other

nominee) or if you vote in person at the Special Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

Shares owned by the Company are not considered outstanding or considered to be present at the Special Meeting. If there is not a quorum

at the Special Meeting, either the chairperson of the Special Meeting or our stockholders entitled to vote at the Special Meeting may

adjourn the Special Meeting.

How will my shares be voted if I give no specific instruction?

We must vote your shares as

you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally

to vote the shares, they will be voted as follows:

| 1. | “For” the approval, for purposes of complying with Nasdaq Listing Rule 5635(d), of the full

issuance of shares of common stock, par value $0.00001 per share (the “common stock”) issuable by the Company upon exercise

of the Series A Common Warrants and the Series B Common Warrants (as defined in the Proxy Statement) (the “Issuance Proposal”

or “Proposal 1”); |

| 2. | “For” the approval of a proposal to grant discretionary authority to our board

of directors to (i) amend Article IV of the Company’s Certificate of Incorporation to increase the number of our authorized shares

of common stock from 200,000,000 shares to 300,000,000 shares and (ii) effect such amendment, if at all, within one year of the date the

proposal is approved by stockholders (the “Charter Amendment Proposal” or “Proposal 2”); |

| | | |

| 3. | “For” the adoption and approval of a proposal to adjourn the Special Meeting to a later date

or dates, if necessary, to permit further solicitation and vote of proxies if it is determined by the Company that more time is necessary

or appropriate to approve the Issuance Proposal and the Charter Amendment Proposal at the Special Meeting (the “Adjournment Proposal”

or “Proposal 3”) |

This authorization would exist,

for example, if a stockholder of record merely signs, dates and returns the proxy card but does not indicate how its shares are to be

voted on one or more proposals. If other matters properly come before the Special Meeting and you do not provide specific voting instructions,

your shares will be voted at the discretion of Mr. Ness and Mr. Lorbiecki, the board of directors’ designated proxies.

If your shares are held in

street name, see “What is a broker non-vote?” below regarding the ability of banks, brokers and other such holders of record

to vote the uninstructed shares of their customers or other beneficial owners in their discretion.

How are votes counted?

Votes will be counted by the

inspector of election appointed for the Special Meeting, who will separately count, with respect to Proposal 1, Proposal 2 and Proposal

3, votes “For” and “Against,” abstentions and broker non-votes. Broker non-votes, if any, will not be included

in the tabulation of the voting results of any of the proposals.

Under Delaware law, Proposal

2 will only be approved if the affirmative vote of a majority of the votes cast by the stockholders entitled to vote on the matter vote

in favor of such action. Because of the voting standard applicable to Proposal 2, abstentions and broker non-votes will have no effect

on the approval or disapproval of Proposal 2.

Under our Bylaws, Proposal

1 and Proposal 3 will only be approved if the affirmative vote of a majority of shares present in person, by remote communication, if

applicable, or represented by proxy at the Special Meeting and entitled to vote on the subject matter vote in favor of such action. Because

of the voting standards applicable to Proposal 1 and Proposal 3, broker non-votes will have no effect on the approval or disapproval of

Proposal 1 and Proposal 3. Abstentions will count as an AGAINST vote for Proposal 1 and Proposal 3.

What is a broker non-vote?

A “broker non-vote”

occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because

(1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the

authority to vote the shares at their discretion.

Our common stock is listed

on the Nasdaq Capital Market. However, under current New York Stock Exchange (“NYSE”) rules and interpretations that govern

broker non-votes, Proposal 1 and Proposal 3 are considered “non-routine” matters. A broker, therefore, will not be permitted

to exercise its discretion to vote uninstructed shares on Proposal 1 and Proposal 3.

Under NYSE rules and interpretations

that govern broker non-votes, Proposal 2 is considered a “routine” or “discretionary” matter. A broker, therefore,

will be permitted to exercise its discretion to vote uninstructed shares on Proposal 2. Because NYSE rules apply to all brokers that are

members of the NYSE, these NYSE rules on broker voting apply to the Special Meeting even though our common stock is listed on the Nasdaq

Capital Market.

Under Delaware law, Proposal

2 will only be approved if the affirmative vote of a majority of the votes cast by the stockholders entitled to vote on the matter vote

in favor of such action. Because of this voting standard applicable to Proposal 2 broker non-votes will have no effect on the approval

or disapproval of Proposal 2.

Under our Bylaws, Proposal

1 and Proposal 3 will only be approved if the affirmative vote of a majority of shares present in person, by remote communication, if

applicable, or represented by proxy at the Special Meeting and entitled to vote on the subject matter vote in favor of such action. Because

of the voting standard applicable to Proposal 1 and Proposal 3 broker non-votes will have no effect on the approval or disapproval of

Proposal 1 and Proposal 3.

What is an Abstention?

An abstention is a stockholder’s

affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted as shares present and entitled to vote

at the Special Meeting.

Under Delaware law, Proposal

2 will only be approved if the affirmative vote of a majority of the votes cast by the stockholders entitled to vote on the matter vote

in favor of such action. Because of this voting standard applicable to Proposal 2 abstentions will have no effect on the approval or disapproval

of Proposal 2.

Under our Bylaws, Proposal

1 and Proposal 3 will only be approved if the affirmative vote of a majority of shares present in person, by remote communication, if

applicable, or represented by proxy at the Special Meeting and entitled to vote on the subject matter vote in favor of such action. Because

of the voting standard applicable to Proposal 1 and Proposal 3 abstentions will count as an AGAINST vote for Proposal 1 and Proposal 3.

How many votes are required to approve each proposal?

The table below summarizes

the proposals that will be voted on, the vote required to approve each item and how votes are counted:

| Proposal |

Vote Required |

Voting Options |

Impact of “Abstain” Votes |

Impact of Broker Non-Votes |

Broker Discretionary Voting Allowed |

| Proposal 1 --- Issuance Proposal |

The affirmative vote of a majority of shares present in person, by remote communication, if applicable, or represented by proxy at the Special Meeting and entitled to vote on the subject matter vote in favor of such action. |

“For”

“Against”

“Abstain” |

Abstentions count as an AGAINST vote for Proposal 1 –included in the denominator. |

Broker non-votes will have no effect on the approval or disapproval of Proposal 1. |

No. |

| Proposal 2 – Charter Amendment Proposal |

The affirmative vote of a majority of the votes cast by the stockholders entitled to vote on the matter |

“For”

“Against”

“Abstain” |

Abstentions will have no effect on the approval or disapproval of Proposal 2. |

Broker non-votes will have no effect on the approval or disapproval of Proposal 2. |

Yes. |

|

Proposal 3 –

Adjournment Proposal |

The affirmative vote of a majority of shares present in person, by remote communication, if applicable, or represented by proxy at the Special Meeting and entitled to vote on the subject matter vote in favor of such action. |

“For”

“Against”

“Abstain” |

Abstentions count as an AGAINST vote for Proposal 1 –included in the denominator. |

Broker non-votes will have no effect on the approval or disapproval of Proposal 3. |

No. |

What are the voting procedures?

In voting by proxy with regard

to the proposals, you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should specify

your respective choices on the accompanying proxy card or your vote instruction form.

Is my proxy revocable?

You may revoke your proxy

and reclaim your right to vote at any time before your proxy is voted by giving written notice to the Secretary of the Company by delivering

a properly completed, later-dated proxy card or vote instruction form or by voting in person at the Special Meeting. All written notices

of revocation and other communications with respect to revocations of proxies should be addressed to: Aclarion, Inc., 8181 Arista Place,

Suite 100, Broomfield, Colorado 80021, Attention: Secretary. Your most current proxy card or Internet proxy is the one that will be counted.

Who is paying for the expenses involved in preparing and mailing

this proxy statement?

All of the expenses involved

in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by us. In addition to the

solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons will receive

no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians,

nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and

we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials.

Do I have dissenters’ rights of appraisal?

Stockholders do not have appraisal

rights under Delaware law or under the Company’s governing documents with respect to the matters to be voted upon at the Special

Meeting.

How can I find out the results of the voting at the special meeting?

Preliminary voting results

will be announced at the Special Meeting. In addition, final voting results will be disclosed in a Current Report on Form 8-K that we

expect to file with the SEC within four business days after the Special Meeting. If final voting results are not available to us in time

to file a Form 8-K with the SEC within four business days after the Special Meeting, we intend to file a Form 8-K to publish preliminary

results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

PROPOSAL 1:

TO APPROVE, FOR PURPOSES OF COMPLYING WITH

NASDAQ LISTING RULE 5635(D), THE FULL ISSUANCE OF SHARES OF COMMON STOCK ISSUABLE BY THE COMPANY UPON EXERCISE OF THE COMMON WARRANTS

Overview

Underwriting Agreement and Offering

On January 15, 2025, the

Company entered into an underwriting agreement (the “Underwriting Agreement”) with Dawson James Securities, Inc., as representative

of the underwriter (the “Underwriter”), pursuant to which the Company sold in a public offering (the “Offering”),

pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”), an aggregate

of (i) 100,000 shares (the “Shares”) of its common stock (ii) 143,900,000 pre-funded warrants (the “Pre-Funded Warrants”)

to purchase up to an aggregate of 143,900,000 shares of common stock in lieu of Shares, (iii) 144,000,000 Series A Warrants (the “Series

A Warrants”) to purchase up to 144,000,000 shares of common stock (the “Series A Warrant Shares”) and (iv) 144,000,000

Series B Warrants (the “Series B Warrants” and, together with the Series A Warrants, the “Common Warrants”) to

purchase up to 144,000,000 shares of common stock (the “Series B Warrant Shares” together with the Series A Warrant Shares,

the “Warrant Shares”).

In addition, the Company

granted to the underwriter a 45 day option to purchase up to an additional 21,000,000 shares of its common stock (or pre-funded warrants),

at the public offering price, less underwriting discounts and commissions, and up to an additional 21,000,000 Series A Warrants and up

to an additional 21,000,000 Series B Common Warrants at a nominal price to cover over-allotment sales. The Underwriter has exercised its

option to purchase 21,000,000 Series A Common Warrants and 21,000,000 Series B Common Warrants.

The Offering, including the

issuance of the Common Warrants is hereinafter referred to as the “Transaction.”

Each Series A Common Warrant

has an exercise price per share of $0.20 and will be exercisable beginning on the date on which Stockholder Approval (as defined below)

is received and deemed effective (the “Initial Exercise Date” or the “Stockholder Approval Date”). The Series

A Warrants will expire on the five-year anniversary of the Initial Exercise Date. The Series B Warrants will have an exercise price per

share of $0.20 and will be exercisable beginning on the Initial Exercise Date. The Series B Warrants will expire on the two and one-half

year anniversary of the Initial Exercise Date. The issuance of Common Warrant Shares upon exercise of the Common Warrants is subject to

stockholder approval under Nasdaq Listing Rule 5635(d) of The Nasdaq Stock Market LLC (“Nasdaq”) (“Stockholder Approval”

and the date on which Stockholder Approval is received and deemed effective, the “Stockholder Approval Date”).

The following adjustments

are contained within the Common Warrants:

a. The reduction of the Common

Warrants’ exercise price to a price equal to the lesser of (i) the then exercise price and (ii) the lowest volume weighted average

price (“VWAP”) during the period commencing five trading days immediately preceding and the five trading days commencing on

the date the Company effects a reverse stock split in the future with a proportionate increase in the number of shares underlying the

Common Warrants;

b. The adjustment contained

within the Series A Warrants, providing for a reduction to the exercise price and a proportionate increase in the number of shares underlying

the Series A Warrants upon issuance of the common stock or common stock equivalents at a price per share that is less than the exercise

price of each Series A Warrant;

c. A reduction to the exercise

price to equal the lowest of (i) the exercise price then in effect, (ii) the lowest daily VWAP for the 10-trading day period commencing

on the first trading day following the Shareholder Approval Date, and ending following the close of trading on the 10th trading day thereafter,

and (iii) the lowest VWAP during the period commencing five (5) consecutive trading days immediately preceding the eleventh (11th) trading

day following the Stockholder Approval Date;

d. The provision contained

within the Series B Warrants providing for an alternative cashless exercise feature pursuant to which the holder of the Series B Warrant

has the right to receive an aggregate number of shares of common stock equal to the product of (x) the aggregate number of shares of common

stock that would be issuable upon a cashless exercise of the Series B Warrant and (y) 3.0; and

e. Upon the Stockholder Approval

Date any Adjustment to the Warrants will be subject to a floor price of $0.02 (collectively (a)-(e), the “Adjustments” and,

each an “Adjustment”).

Pursuant to the Purchase

Agreement, the Company has agreed to call a Special Meeting of its stockholders to approve the Transaction, including, without limitation,

the issuance of all of the Warrant Shares underlying the Common Warrants issued in the Offering.

Why We are Seeking Stockholder Approval of

the Issuance Proposal

Our Common Stock is listed

on The Nasdaq Capital Market, and as a result, we are subject to Nasdaq’s Listing Rules, including Nasdaq Listing Rule 5635(d).

Nasdaq Listing Rule 5635(d)

requires stockholder approval of transactions, other than public offerings, resulting in the issuance of greater than 20% of the outstanding

common stock at a price less than the “Minimum Price.” Because (i) no additional consideration was paid by the Purchaser and

the Investor for the Common Warrants, and (ii) the exercise in full of the Common Warrants (including shares of common stock issuable

in connection with any Adjustment), taken together with the sale of the Shares and Pre-Funded Warrants to the Purchasers and Investor

in the Offering and the Concurrent Private Offering, would have resulted in the issuance of more than 20% of our outstanding shares of

common stock, Nasdaq Listing Rule 5635(d) is implicated by the issuance of the Common Warrants. Accordingly, in order to comply with Nasdaq

Listing Rule 5635(d), the Common Warrants include a provision under which they may not be exercised until we have obtained Stockholder

Approval.

Accordingly, we are seeking

stockholder approval pursuant to Nasdaq Listing Rule 5635(d) to permit the issuance of the maximum number of Warrant Shares issuable pursuant

to the terms of the Common Warrants.

If the Company does not obtain

stockholder approval at the Special Meeting, the Company will not be able to issue to the Purchasers and Investor the number of shares

to which they would otherwise be entitled upon full exercise of the Common Warrants and the Company shall cause an additional Special

Meeting to be held on or prior to the ninetieth (90th) calendar day following the failure to obtain shareholder approval. If, despite

the Company’s reasonable best efforts the shareholder approval is not obtained after such subsequent stockholder meetings, the Company

shall cause an additional shareholder meeting to be held every ninety days thereafter until (i) such shareholder approval is obtained,

or (ii) December 31, 2025, whichever is sooner.

Additional Information

This summary is intended

to provide you with basic information concerning the Purchase Agreement and the Common Warrants. The full texts of the Common Warrants

were included as exhibits to our Current Report on Form 8-K filed with the SEC on January 17, 2025.

Effect on Current Stockholders if the Issuance

Proposal is Approved

Each additional share of

common stock that would be issuable to the Purchasers and the Investor would have the same rights and privileges as each share of our

currently outstanding common stock. The issuance of shares of common stock to the Purchasers and Investor pursuant to the terms of the

Common Warrants will not affect the rights of the holders of our outstanding common stock, but such issuances will have a dilutive effect

on the existing stockholders, including the voting power and economic rights of the existing stockholders, and may result in a decline

in our stock price or greater price volatility.

If approved, the outstanding

Common Warrants are exercisable for a maximum of an aggregate of up to 6.6 billion shares of common stock, prior to giving effect to the

reverse stock split the Company plans to implement in the near future (as further described below).

Effect on Current Stockholders if the Issuance

Proposal is Not Approved

The Company is not seeking

the approval of its stockholders to authorize its entry into the Purchase Agreement or the Common Warrants, as the Company has already

done so, and such documents already are binding obligations of the Company . The failure of the Company’s stockholders to approve

the Issuance Proposal will not negate the existing terms of the documents, which will remain binding obligations of the Company.

Pursuant to the Purchase

Agreement, if the Company does not obtain Stockholder Approval of the Issuance Proposal at the Special Meeting, the Company shall cause

an additional Special Meeting to be held on or prior to the ninetieth (90th) calendar day following the failure to obtain shareholder

approval. If, despite the Company’s reasonable best efforts the shareholder approval is not obtained after such subsequent stockholder

meetings, the Company shall cause an additional Shareholder Meeting to be held every ninety days thereafter until (i) such shareholder

approval is obtained, or (ii) December 31, 2025, whichever is sooner.

Required Vote of Stockholders

The approval of the Issuance

Proposal requires that a quorum exist, and the affirmative vote of the majority of shares present in person or represented by proxy at

the Special Meeting and entitled to vote on the subject matter shall be required to approve the Issuance Proposal. Abstentions are considered

votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote “AGAINST” the Issuance

Proposal. Under rules applicable to securities brokerage firms, brokers are not permitted to vote shares held for a customer on “non-routine”

matters (such as the Issuance Proposal) without specific instructions from the customer. Therefore, broker non-votes are not entitled

to vote and will also have no effect on the outcome of the Issuance Proposal.

Recommendation of our Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT STOCKHOLDERS VOTE “FOR” APPROVAL, OF (I) THE ISSUANCE, IN ACCORDANCE WITH NASDAQ RULE 5635(D), OF 20% OR

MORE OF OUR COMMON STOCK INCLUDING THE ISSUANCE OF THE COMMON WARRANTS AND SUBJECT TO THE TERMS OF THE COMMON WARRANTS, ANY RESULTING

ISSUANCE OF WARRANT SHARES INCLUSIVE OF THE TERMS OF THE ADJUSTMENT, PURSUANT TO THAT CERTAIN UNDERWRITING AGREEMENT, DATED JANUARY 15,

2025, BY AND BETWEEN US AND DAWSON JAMES SECURITIES, INC. AND (II) THE FOLLOWING ADJUSTMENTS CONTAINED WITHIN THE SERIES A WARRANTS AND

SERIES B WARRANTS: (A) The reduction of the Common Warrants’ exercise price to a price equal

to the lesser of (i) the then exercise price and (ii) lowest vwap during the period commencing five trading days immediately preceding

and the five trading days commencing on the date the Company effects a reverse stock split in the future with a proportionate increase

in the number of shares underlying the Common Warrants; (B) The adjustment contained within

the Series A Warrants, providing for a reduction to the exercise price and a proportionate increase in the number of shares underlying

the Series A Warrants upon issuance of the common stock or common stock equivalents at a price per share that is less than the exercise

price of each Series A Warrant; (C) A reduction to the exercise price to equal the lowest

of (X) the exercise price then in effect, (Y) the lowest daily VWAP for the 10-trading day period commencing on the first trading day

following the Shareholder Approval Date, and ending following the close of trading on the 10th trading day thereafter, and (Z) the lowest

VWAP during the period commencing five (5) consecutive Trading Days immediately preceding the eleventh (11th) trading day following the

Stockholder Approval Date; AND (D) THE PROVISION CONTAINED WITHIN THE SERIES B WARRANTS PROVIDING FOR AN ALTERNATIVE CASHLESS EXERCISE

FEATURE PURSUANT TO WHICH THE HOLDER OF THE SERIES B WARRANT HAS THE RIGHT TO RECEIVE AN AGGREGATE NUMBER OF SHARES OF COMMON STOCK EQUAL

TO THE PRODUCT OF (X) THE AGGREGATE NUMBER OF SHARES OF COMMON STOCK THAT WOULD BE ISSUABLE UPON A CASHLESS EXERCISE OF THE SERIES B WARRANT

AND (Y) 3.0. AND (III) UPON THE STOCKHOLDER APPROVAL DATE ANY ADJUSTMENT TO THE EXERCISE PRICE OF AND NUMBER OF SHARES UNDERLYING THE

WARRANTS WILL BE SUBJECT TO A FLOOR PRICE OF $0.02.

PROPOSAL 2

APPROVAL OF A PROPOSAL TO GRANT DISCRETIONARY

AUTHORITY TO OUR BOARD OF DIRECTORS TO (I) AMEND ARTICLE IV OF THE COMPANY’S CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER

OF OUR AUTHORIZED SHARES OF COMMON STOCK FROM 200,000,000 SHARES TO 300,000,000 SHARES AND (II) EFFECT SUCH AMENDMENT, IF AT ALL, WITHIN

ONE YEAR OF THE DATE THE PROPOSAL IS APPROVED BY STOCKHOLDERS

Overview

Our Board has approved, subject

to shareholder approval, an amendment to our Certificate of Incorporation to increase our authorized shares of common stock from 200,000,000

to 300,000,000 (the “Charter Amendment”). The increase in our authorized shares of common stock will become effective upon

the filing of the Charter Amendment with the Secretary of State of the State of Delaware.

If approved by the stockholders

as proposed, the board of directors would have the sole discretion to effect the Charter Amendment, if at all, within one (1) year of

the date the proposal is approved by stockholders. The Board reserves the right, notwithstanding stockholder approval of the Charter Amendment

and without further action by our stockholders, not to proceed with the Charter Amendment at any time before it becomes effective.

If approved by our stockholders,

this proposal would permit (but not require) the board of directors to effect the Charter Amendment within one (1) year of the date the

proposal is approved by stockholders.

The form of Charter Amendment

is set forth as Appendix A to this Proxy Statement (subject to any changes required by applicable law.

Outstanding Shares and Purpose of the Proposal

Our Certificate of Incorporation

currently authorizes us to issue a maximum of 200,000,000 shares of common stock, par value $0.00001 per share, and 20,000,000 shares

of preferred stock, $0.00001 par value per share. As of the Record Date, we had 1,930 shares of preferred stock issued and outstanding

and the Charter Amendment does not affect the number of authorized shares of preferred stock. Our issued and outstanding securities, as

of the record date, are as follows:

| |

· |

20,626,124 shares of our common stock; |

| |

|

|

| |

· |

0 shares of our common stock issuable upon the exercise of Pre-Funded Warrants; |

| |

|

|

| |

•· |

330,000,000 shares of our common stock issuable upon the exercise of

the Common Warrants, assuming Stockholder Approval, but not accounting for any Adjustments; |

| |

|

|

| |

· |

15,616,289 shares of our common stock issuable upon the exercise of

other outstanding warrants (excluding the Common Warrants); and |

| |

|

|

| |

· |

169,457 shares of our common stock issuable upon the exercise of outstanding options. |

The approval of the Charter

Amendment to increase our authorized shares of common stock is important for our ongoing business. Our Board believes it would be prudent

and advisable to have the additional shares available to provide additional flexibility regarding the potential use of shares of common

stock for business and financial purposes in the future. Having an increased number of authorized but unissued shares of common stock

would allow us to take prompt action with respect to corporate opportunities that develop, without the delay and expense of convening

a special meeting of stockholders for the purpose of approving an increase in our authorized shares. The additional shares could be used

for various purposes without further stockholder approval. These purposes may include: (i) raising capital, if we have an appropriate

opportunity, through offerings of common stock or securities that are convertible into common stock; (ii) expanding our business through

potential strategic transactions, including mergers, acquisitions, licensing transactions and other business combinations or acquisitions

of new product candidates or products; (iii) establishing strategic relationships with other companies; (iv) exchanges of common stock

or securities that are convertible into common stock for other outstanding securities; (v) providing equity incentives pursuant to the

Aclarion, Inc. 2022 Equity Incentive Plan (the “2022 Plan”), or another plan we may adopt in the future, to attract and retain

employees, officers or directors; and (vi) other general corporate purposes. We intend to use the additional shares of common stock that

will be available to undertake any such issuances described above. Because it is anticipated that our directors and executive officers

will be granted additional equity awards under our 2022 Plan, or another plan we adopt in the future, they may be deemed to have an indirect

interest in the Charter Amendment. Further, as discussed above, if the Issuance Proposal is approved, the outstanding Common Warrants

would be exercisable for an aggregate of up to a maximum of 6.6 billion shares of common stock (accounting for the maximum amount of Adjustments,

but prior to giving effect to the reverse stock split the Company plans to implement in the near future).

The Company plans to implement

a reverse stock split of its common stock in the near future.

On September 23, 2024, our

stockholders approved a proposal to grant discretionary authority to our board of directors to (i) amend our certificate of incorporation

to combine outstanding shares of our Common Stock into a lesser number of outstanding shares, or a “reverse stock split,”

at a specific ratio within a range of one-for-five (1-for-5) to a maximum of a one-for-fifty (1-for-50 split, with the exact ratio to

be determined by our board of directors in its sole discretion; and (ii) effect the reverse stock split, if at all, within one year of

the date the proposal was approved by stockholders. In addition, on December 31, 2024, our stockholders approved a separate proposal to

grant discretionary authority to our board of directors to (i) amend our certificate of incorporation to combine outstanding shares of

our Common Stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range

of one-for-five (1-for-5) to a maximum of a one-for-four hundred (1-for-400) split, with the exact ratio to be determined by our board

of directors in its sole discretion; and (ii) effect the reverse stock split, if at all, within one year of the date the proposal was

approved by stockholders.

Under the reverse stock split

proposals previously approved by our stockholders, the number of shares of our common stock issued and outstanding will be reduced, depending

upon the ratio determined by the board of directors. Under our charter, the Company currently is authorized to issue 200,000,000 shares

of common stock. These reverse stock split proposals would have no effect on the number of common shares that we are authorized to issue

under our charter. By reducing the number of common shares outstanding without reducing the number of available but unissued common stock,

these reverse stock split proposals would increase the number of authorized but unissued shares. The amount of this increase will vary

depending on which final reverse stock split ratio is selected by the Board immediately prior the implementation of a reverse stock split.

Following the completion

of the Transaction, we have only minimal authorized but unissued or reserved shares of our common stock. Currently, we do not have

a sufficient number of authorized shares to permit exercise of the Common Warrants or to undertake the additional equity financing that

we will need to fund development of our product pipeline. We anticipate that this authorized share shortfall will be resolved by effecting

a reverse stock split in the near future.

The proposed Charter Amendment,

therefore, would likely only be implemented if the Company in the future would need to create additional authorized but unissued shares

beyond what would be created by effecting a reverse stock split.

The increase in authorized

shares of our common stock under the Charter Amendment (if implemented) will not have any immediate effect on the rights of existing stockholders.

However, because the holders of our common stock do not have any preemptive rights, future issuance of shares of common stock or securities

exercisable for or convertible into shares of common stock could have a dilutive effect on our earnings per share, book value per share,

voting rights of stockholders and could have a negative effect on the price of our common stock.

Disadvantages to an increase

in the number of authorized shares of our common stock may include:

| |

· |

Stockholders may experience further dilution of their ownership; |

| |

|

|

| |

· |

Stockholders will not have any preemptive or similar rights to subscribe for or purchase any additional shares of common stock that may be issued in the future, and therefore, future issuances of common stock, depending on the circumstances, will have a dilutive effect on the earnings per share, voting power and other interests of our existing stockholders; |

| |

|

|

| |

· |

The additional shares of common stock for which authorization is sought in this proposal would be part of the existing class of common stock and, if and when issued, would have the same rights and privileges as the shares of common stock presently outstanding; and |

| |

|

|

| |

· |

The issuance of authorized but unissued shares of common stock could be used to deter a potential takeover of us that may otherwise be beneficial to stockholders by diluting the shares held by a potential suitor or issuing shares to a stockholder that will vote in accordance with the Board’s desires. A takeover may be beneficial to independent stockholders because, among other reasons, a potential suitor may offer such stockholders a premium for their shares of stock compared to the then-existing market price. We do not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover consequences. |

Except as disclosed in this

proxy statement, we have no specific plan, commitment, arrangement, understanding or agreement, either oral or written, regarding the

issuance of the proposed new authorization of common stock subsequent to this proposed increase in the number of authorized shares at

this time, and we have not allocated any specific portion of the proposed increase in the authorized number of shares to any particular

purpose. However, we have in the past conducted certain public and private offerings of common stock and warrants, and we will continue

to require additional capital in the near future to fund our operations. As a result, it is foreseeable that we will seek to issue such

additional shares of common stock in connection with any such capital raising activities, or any of the other activities described above.

The Board does not intend to issue any common stock or securities convertible into common stock except on terms that the Board deems to

be in the best interests of us and our stockholders.

Required Vote of Stockholders

Under Delaware law, approval

and adoption of this Proposal 2 requires the affirmative vote of at least a majority of votes actually cast at the meeting. Proposal 2

is generally considered to be a “routine” matter which means that banks, brokers or other nominees will have discretionary

authority to vote on this matter. Accordingly, no “broker non-votes” are expected on Proposal 2. Abstentions and “broker

non-votes”, if any, will not be counted as votes cast and will not affect the outcome of the vote on Proposal 2.

Recommendation of our Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE CHARTER AMENDMENT PROPOSAL.

PROPOSAL 3

ADJOURNMENT PROPOSAL

Holders of Company common

stock are being asked to authorize the holder of any proxy solicited by the Board of Directors to vote in favor of granting discretionary

authority to the Board of Directors to adjourn the Special Meeting to another time and place for the purpose of soliciting additional

proxies. If the stockholders approve this proposal, the Board of Directors could adjourn the Special Meeting and any adjourned session

of the Special Meeting and use the additional time to solicit additional proxies, including the solicitation of proxies from stockholders

who have previously voted.

This Adjournment Proposal

will be presented to stockholders at the Special Meeting to seek their approval of an adjournment to another time or place, if necessary

or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting to approve the Issuance

Proposal or the Charter Amendment Proposal or to constitute a quorum.

If, at the Special Meeting,

the number of shares present or represented and voting to approve the presented Proposals is not sufficient to approve the Issuance Proposal,

the Charter Amendment Proposal or if a quorum is not present, the Board of Directors currently intends to move to adjourn the Special

Meeting to enable the Board of Directors to solicit additional proxies for the approval of the Issuance Proposal and the Charter Amendment

Proposal.

Required Vote of Stockholders

The approval of Proposal

3 requires that holders of a majority of the shares present in person or by proxy at the Special Meeting and entitled to vote thereon

vote “FOR” Proposal 3. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have

the same effect as a vote “AGAINST” the Adjournment Proposal. Because Proposal 3 is considered a “non-routine”

matter under applicable stock exchange rules, we do not expect to receive any broker non-votes on this proposal.

Recommendation of our Board of Directors

THE BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE ADJOURNMENT PROPOSAL.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets

forth information regarding the beneficial ownership of our common stock as of January 6, 2025 by (i) each person who beneficially

owned more than 5% of our outstanding shares of common stock, (ii) each director, (iii) each Named Executive Officer and (iv) all of

our directors and executive officers as a group. Unless otherwise indicated, the address of each executive officer and director is c/o

listed below is c/o Aclarion, Inc., 8181 Arista Place, Suite 100, Broomfield, Colorado 80021.

The number of shares of common

stock “beneficially owned” by each stockholder is determined under rules issued by the SEC regarding the beneficial ownership

of securities. This information is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial

ownership of shares of our common stock includes (1) any shares as to which the person or entity has sole or shared voting power or investment

power, and (2) any shares as to which the person or entity has the right to acquire beneficial ownership within 60 days after January

6, 2025.

The calculations set

forth below are based upon 20,626,124 shares of common stock outstanding at January 6, 2025. Unless otherwise indicated below, and

subject to community property laws where applicable, to our knowledge, all persons named in the table have sole voting and

investment power with respect to their shares of common stock.

| Name of Beneficial Owner |

|

Number of Shares

Beneficially

Owned (10) |

|

|

Percentage of Shares Beneficially Owned |

|

| 5% Stockholders: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| None |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Executive Officers and Directors: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Jeff Thramann (1) |

|

|

86,882 |

|

|

|

* |

|

| Brent Ness (2) |

|

|

24,146 |

|

|

|

* |

|

| John Lorbiecki (3) |

|

|

5,852 |

|

|

|

* |

|

| Ryan Bond (4) |

|

|

4,284 |

|

|

|

* |

|

| David Neal (5) |

|

|

18,201 |

|

|

|

* |

|

| William Wesemann (6) |

|

|

8,330 |

|

|

|

* |

|

| Amanda Williams (7) |

|

|

3,719 |

|

|

|

* |

|

| Stephen Deitsch (7) |

|

|

3,719 |

|

|

|

* |

|

| Scott Breidbart (7) |

|

|

3,719 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

| All directors and executive officers as a group (9 persons) |

|

|

158,852 |

|

|

|

* |

|

__________________________

| * |

Represents beneficial ownership of less than 1%. |

| (1) |

Represents outstanding stock options held by Dr. Thramann. |

| (2) |

Mr. Ness’ beneficial ownership includes 1,281 common shares, 22,802 vested options, and 63 IPO Warrants, and excludes 3,257 unvested options. |

| (3) |

Mr. Lorbiecki’s beneficial ownership includes 1,400 common shares and 4,452 vested options, and excludes 760 unvested options. |

| (4) |

Mr. Bond’s beneficial ownership includes 1,250 common shares, 1,721 vested options, and 1,313 IPO Warrants. |

| (5) |

Mr, Neal’s beneficial ownership includes 11,658 common shares, 2,150 IPO Warrants, and 4,393 vested options. |

| (6) |

Mr. Wesemann’s beneficial ownership includes 3,296 common shares, 4,346 vested stock options, and 688 IPO Warrants, and excludes 219 unvested stock options. |

| (7) |

Includes 3,719 vested stock options and excludes 219 unvested stock options. |

OTHER MATTERS

The board of directors knows

of no other business, which will be presented to the Special Meeting. If any other business is properly brought before the Special Meeting,

proxies will be voted in accordance with the judgment of the persons voting the proxies. The proxies also have discretionary authority

to vote to adjourn the Special Meeting, including for the purpose of soliciting votes in accordance with our board of director’s

recommendations.

We will bear the cost of soliciting

proxies in the accompanying form. In addition to the use of the mails, proxies may also be solicited by our directors, officers or other

employees, personally or by telephone, facsimile or email, none of whom will be compensated separately for these solicitation activities.

If you do not plan to attend

the Special Meeting, in order that your shares may be represented and in order to assure the required quorum, please sign, date and return

your proxy promptly. In the event you are able to attend the Special Meeting in person, at your request, we will cancel your previously

submitted proxy.

HOUSEHOLDING

The SEC has adopted rules

that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and other Special Meeting

materials with respect to two or more stockholders sharing the same address by delivering a proxy statement or other Special Meeting materials

addressed to those stockholders. This process, which is commonly referred to as householding, potentially provides extra convenience for

stockholders and cost savings for companies. Stockholders who participate in householding will continue to be able to access and receive

separate proxy cards.

If you share an address with

another stockholder and have received multiple copies of our proxy materials, you may write or call us at the address and phone number

below to request delivery of a single copy of the notice and, if applicable, other proxy materials in the future. We undertake to deliver

promptly upon written or oral request a separate copy of the proxy materials, as requested, to a stockholder at a shared address to which

a single copy of the proxy materials was delivered. If you hold stock as a record stockholder and prefer to receive separate copies of

our proxy materials either now or in the future, please contact us at 8181 Arista Place, Suite 100, Broomfield, Colorado 80021, Attn:

Secretary. If your stock is held through a brokerage firm or bank and you prefer to receive separate copies of our proxy materials either

now or in the future, please contact your brokerage firm or bank.

2023 ANNUAL REPORT

Copies of our Annual Report

on Form 10-K for the fiscal year ended December 31, 2023 may be obtained without charge by writing to the Company’s Secretary, Aclarion,

Inc., 8181 Arista Place, Suite 100, Broomfield, Colorado 80021. The Notice, our Annual Report on Form 10-K and this proxy statement are

also available online at: www.aclarion.com.

| BY ORDER OF THE BOARD OF DIRECTORS |

| |

| |

| /s/ Brent Ness |

| Brent Ness |

| Chief Executive Officer |

APPENDIX A

CERTIFICATE OF AMENDMENT

to the

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

of

ACLARION, INC.

ACLARION, INC., a corporation

organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), does hereby certify

as follows:

FIRST: The name of the Corporation

is Aclarion, Inc. The Amended and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware

(the “Secretary of State”) on April 21, 2022, as amended (the “Certificate of Incorporation”).

SECOND: ARTICLE IV of the

Corporation’s Certificate of Incorporation shall be amended by deleting the first paragraph under Article IV and replacing such

paragraph with the following Subsection “(A)” which shall read as follows:

A. This Company is authorized

to issue two classes of stock to be designated, respectively, "Common Stock" and "Preferred Stock."

The total number of shares which the Company is authorized to issue is three hundred twenty million (320,000,000) shares. Three hundred

million (300,000,000) shares shall be Common Stock, having a par value per share of $0.00001. Twenty million (20,000,000) shares shall

be Preferred Stock, having a par value per share of $0.00001.

THIRD: This Certificate of

Amendment has been duly adopted by the Board of Directors and stockholders of the Corporation in accordance with Section 242 of the General

Corporation Law of the State of Delaware.

FOURTH: All other provisions

of the Certificate of Incorporation shall remain in full force and effect.

FIFTH: This Certificate of

Amendment and the amendment to the Certificate of Incorporation effected hereby shall be effective immediately upon filing.

IN WITNESS WHEREOF, the Corporation

has caused this Certificate of Amendment to be duly adopted and executed in its corporate name and on its behalf by its duly authorized

officer as of the _________ day of _________, 20__.

ACLARION, INC.

By:_______________________

Name:

Title:

PROXY CARD

| |

VOTE ON INTERNET |

| |

|

| |

Go to http://www.vstocktransfer.com/proxy |

| |

Click on Proxy Voter Login and log-on using |

| |

the below control number. Voting will be open |

| |

until 11:59 p.m. Mountain Time on February [***], 2025. |

| |

|

| |

CONTROL # |

| |

|

| |

VOTE IN PERSON |

| * SPECIMEN * |

|

| 1 MAIN STREET |

If you would like to vote in person, please attend the |

| ANYWHERE PA 99999-9999 |

Special Meeting on February [***], 2025, at 9:30 a.m. |

| |

Mountain Time at the offices of Aclarion, Inc., 8181 |

| |

Arista Place, Suite 100, Broomfield, Colorado 80021. |

Special Meeting of Stockholders

Proxy Card - Aclarion, Inc.

THE BOARD OF DIRECTORS UNANIMOUSLY

RECOMMENDS A VOTE "FOR" THE LISTED PROPOSAL.

| 1. |

Proposal to approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of shares of common stock, issuable by the Company upon exercise of the Series A Common Warrants and the Series B Common Warrants. |

| ☐ FOR |

☐ AGAINST |

☐ ABSTAIN |

| 2. |

Proposal to grant discretionary authority to our board of directors to (i) amend

our Certificate of Incorporation to increase the number of our authorized shares of common stock from 200,000,000 shares to 300,000,000

shares and (ii) effect such amendment, if at all, within one year of the date the proposal is approved by stockholders. |

| ☐ FOR |

☐ AGAINST |

☐ ABSTAIN |

| 3. |

Proposal to adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies. |

| ☐ FOR |

☐ AGAINST |

☐ ABSTAIN |

| Date |

|

Signature |

|

Signature, if held jointly |

| |

|

|

|

|

| |

|

|

|

|

Note: This proxy must be signed exactly

as the name appears hereon. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney,

trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by a duly authorized

officer, giving full title as such. If signer is a partnership, please sign in partnership name by an authorized person.

To change the address on your account, please check the box at right

and indicate your new address.

| * SPECIMEN * |

AC:ACCT9999 |

90.00 |

ACLARION, INC.

Special Meeting of Stockholders

February [***], 2025

THIS PROXY IS SOLICITED ON BEHALF OF THE

BOARD OF DIRECTORS

The undersigned hereby appoints, Brent Ness and John Lorbiecki,

as proxies with full power of substitution, to represent and to vote all the shares of common stock of Aclarion, Inc. (the “Company”),

which the undersigned would be entitled to vote, at the Company’s Special Meeting of Stockholders to be held on February [***],

2025 and at any adjournments thereof, subject to the directions indicated on this Proxy Card.

In their discretion, the proxy is authorized to vote upon any other

matter that may properly come before the meeting or any adjournments thereof.

THIS PROXY WILL BE VOTED IN ACCORDANCE WITH THE SPECIFICATIONS MADE,

BUT IF NO CHOICES ARE INDICATED, THIS PROXY WILL BE VOTED BY THE PROXY HOLDERS FOR THE ELECTION OF ALL NOMINEES AND FOR THE PROPOSALS

LISTED ON THE REVERSE SIDE AND IN THEIR DISCRETION ON ANY OTHER MATTERS THAT ARE PROPERLY PRESENTED AT THE MEETING OR ANY ADJOURNMENTS

OR POSTPONEMENTS THEREOF.

PLEASE BE SURE TO SIGN REVERSE SIDE OR PROXY

WILL NOT BE VALID

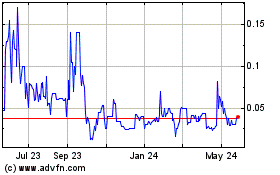

Aclarion (NASDAQ:ACONW)

Historical Stock Chart

From Dec 2024 to Jan 2025

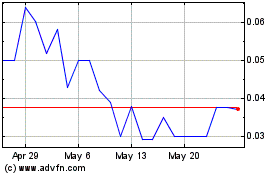

Aclarion (NASDAQ:ACONW)

Historical Stock Chart

From Jan 2024 to Jan 2025