- Cash position of €10.3 million as of June 30, 2024

- Continuation of partnership discussions on M1Pram with

Sanofi

- BioChaperone® Lispro Phase 3 study is on track for completion

in December, milestone associated with a payment of $10

million

- Post-period events:

- Cash position increased to nearly €13 million as of today, with

the receipt of €3.4 million from the reimbursement of the 2023

Research tax credit

- Termination of the BioChaperone® Combo program by Tonghua

Dongbao for strategic reasons

Regulatory News:

Adocia (Euronext Paris: FR0011184241 – ADOC, the “Company”), a

clinical-stage biopharmaceutical company focused on the research

and development of innovative therapeutic solutions for the

treatment of diabetes and obesity, reports financial results for

the second quarter of 2024 and provides a business update.

"I am confident about signing future partnerships because our

product portfolio fully aligns with the rapidly growing markets of

obesity and diabetes cell therapy," declares Olivier Soula, CEO of

Adocia. "After M1Pram, our technologies AdoGel, AdOral, and

BioChaperone, perfectly address the formulation challenges of new

obesity molecules: reducing the number of injections or even

eliminating them, and combining hormones to improve the

effectiveness and quality of weight loss."

"In a challenging financial environment for Biotechs, Adocia

managed to maintain its cash position at close to €13 million as of

July 24, 2024, allowing us to carry out all the activities defined

in our ambitious operational plan," added Valérie Danaguezian,

Chief Financial Officer of Adocia. "Indeed, the PACEO entrusted to

Vester Finance, Adocia's second-largest shareholder, has worked as

anticipated with €6 million raised to date, at an average share

price of €8 and controlled dilution of 5%. The conditions set by

the PACEO offer great flexibility in its management, but we are

prioritizing the signing of partnerships.”

Second quarter 2024 financial results

Financial highlights for the quarter include the following:

DETAIL OF THE REVENUE

In thousands of euros, IFRS

standards (unaudited)

06/30/2024 (3 months)

06/30/2023 (3 months)

06/30/2024 (6 months)

06/30/2023 (6 months)

Licensing revenues

0

52

0

161

Research and collaboration

agreements

0

763

0

1 466

Revenue

0

815

0

1 627

Adocia did not recognize any sales in the first half of

2024.

Last year, over the same period, sales of €1.6 million reflected

revenues linked to the ongoing feasibility study on AdOral® as well

as services provided by Adocia as part of the collaboration signed

with Tonghua Dongbao for the conduct of three clinical studies in

Europe on the BioChaperone® Combo project.

Net Cash Position

The Company's cash position stood at €10.3 million as of June

30, 2024, compared with €13.0 million as of December 31, 2023. This

position includes €2 million received from the private placement in

March 2024, and €5.9 million from the use of the PACEO (via the

issuance of 745,000 shares out of the maximum 1.7 million shares

set in the contract).

Cash used to fund operations during the first half of 2024

amounted to €10.6 million, similar to last year's figure for the

same period and at comparable basis (restated for the receipt of

the Research Tax Credit).

Net debt (excluding IFRS 16 impacts) was €5.7 million as of June

30, 2024, unchanged from December 31, 2023. Debt consists of

State-Guaranteed Loan (PGE), the next repayments of which will take

place from the third quarter of 2024, with a maturity date of

August 2026.

The Company cash position of €10.3 million as of June 30, 2024,

is sufficient to finance the currently planned operations through

the third quarter of 2025, excluding any potential income from

existing or future partnerships, but assuming the full utilization

of the equity financing line (“PACEO”) signed in March 2024 with

Vester Finance1.

Adocia remains in exclusive negotiations with Sanofi for a

global partnership on M1Pram, and is expecting a milestone payment

of €10 million linked to progress of its BioChaperone® Lispro

project in partnership with Tonghua Dongbao.

Post-period highlight

On July 10, 2024, Adocia received the full amount of its

Research Tax Credit (CIR) due for 2023, amounting to €3.4 million.

This brings Adocia's cash position as of July 24, 2024 to nearly

€13 million.

Second quarter 2024 Highlights

Strengthening management

Mathieu-William Gilbert has been appointed Chief Operating

Officer. He previously held Vice President and General Management

positions at Novo Nordisk. He will strengthen Adocia's management

team as part of the company's strategic transformation project. He

will oversee Adocia's operations and help to accelerate its

development and growth.

M1Pram

Following the July 2023 agreement between Sanofi and Adocia,

negotiations are continuing to structure a global partnership. The

exclusivity agreement is still in force. M1Pram is a fixed-dose

combination of insulin and amylin analogues designed to address the

unmet medical need of obesity in people with insulin-dependent

diabetes. Preparations for the phase 2b clinical program in the

United States, which will enroll 140 patients with type 1 diabetes

and a BMI >30kg/m², are continuing.

BioChaperone® Lispro - in partnership with Tonghua

Dongbao

The pipeline review carried out by Tonghua Dongbao confirmed the

important place occupied by BioChaperone® Lispro. The phase 3

program, led in China on 1,500 people with type 1 or type 2

diabetes, is on track, with the last patient last visit (LPLV)

currently expected for the second half of 2024. The successful

achievement of this important milestone will trigger a payment of

$10 million to the Company. The license agreement also provides for

an additional $20 million payment triggered by the regulatory

approval of BioChaperone® Lispro, as well as double-digit royalties

on net product sales.

AdoShell® Islets

The AdoShell platform, an immunoprotective biomaterial for cell

therapy, is attracting interest from potential pharmaceutical

partners, with whom discussions are ongoing. Over the second

quarter of 2024, the teams attended several international

congresses to share preclinical data: the American Diabetes

Association (ADA) in Orlando, and the European Islet Study Group

2024 (EISG) in Helsinki. The AdoShell® program has also been

selected for an oral presentation at the European Association for

the Study of Diabetes (EASD) to be held on September 9-13 in

Madrid. Adocia is working with the regulatory authorities to

validate the first clinical trial, which could take place as early

as 2025.

AdOral®

Adocia has developed an oral peptide delivery technology, making

it possible to switch from injectable to oral forms. This program

was also highlighted at the American Diabetes Association (ADA)

meeting for its application to semaglutide (GLP-1). The only GLP-1

currently marketed in oral form, Rybelsus®, achieved sales of 2.7

billion in 20232. Oral delivery is a key factor in increasing

patient adherence to these treatments, for both diabetes and

obesity. The AdOral® technology is currently being tested on

peptides from two pharmaceutical partners. The encouraging results

obtained are enabling discussions to move forward to determine the

next steps in these collaborations.

AdoGel®

Designed for the long-acting delivery of peptides, AdoGel® is

currently being studied on semaglutide (GLP-1). GLP-1s, which

generated sales of over $37 billion in 20233, are almost

exclusively formulated as weekly injections. AdoGel®'s unique

technology makes it possible to envisage monthly or even quarterly

injections. Promising pre-clinical results were presented at the

American Diabetes Association (ADA) congress in June and the

Controlled Release Society (CRS) congress in July in Bologna.

Post-period event

BioChaperone® Combo

On July 10, 20244, Tonghua Dongbao announced its decision to

terminate the BioChaperone® Combo program after re-evaluating its

R&D projects and considering recent changes in the regulatory

and competitive environment. Adocia thus regains full ownership, at

no cost, of the rights to BioChaperone® Combo, which had

demonstrated positive results in three clinical trials (CT046,

CT047, CT048)5.

The $40 million received upon signature of the license agreement

on April 26, 2018 is vested and non-refundable. Tonghua Dongbao and

Adocia teams are currently working on the operational and legal

closing of the file.

About Adocia

Adocia is a biotechnology company specializing in the discovery

and development of therapeutic solutions in the field of metabolic

diseases, primarily diabetes and obesity.

The Company has a broad portfolio of drug candidates based on

four proprietary technology platforms: 1) The BioChaperone®

technology for the development of new generation insulins and

products combining different hormones; 2) AdOral®, an oral peptide

delivery technology; 3) AdoShell®, an immunoprotective biomaterial

for cell transplantation, with an initial application in pancreatic

cells transplantation; and 4) AdoGel®, a long-acting drug delivery

platform.

Adocia holds more than 25 patent families. Based in Lyon, the

company has about 80 employees. Adocia is listed on the regulated

market of Euronext™ Paris (Euronext: ADOC; ISIN: FR0011184241).

Disclaimer

This press release contains certain forward-looking statements

concerning Adocia and its business. Such forward-looking statements

are based on assumptions that Adocia considers as being reasonable.

However, there can be no guarantee that the estimates contained in

such forward-looking statements will be achieved, as such estimates

are subject to numerous risks including those set forth in the

“Risk Factors” section of the universal registration document that

was filed with the French Autorité des marchés financiers on April

29, 2024, available at www.adocia.com.

Those risks include uncertainties inherent in Adocia's short- or

medium-term working capital requirements, in research and

development, future clinical data, analyses and the evolution of

economic conditions, the financial markets and the markets in which

Adocia operates, which could impact the Company's short-term

financing requirements and its ability to raise additional funds.

The forward-looking statements contained in this press release are

also subject to risks not yet known to Adocia or not considered as

material by Adocia at this time. The occurrence of all or part of

such risks could cause the actual results, financial conditions,

performances, or achievements of Adocia be materially different

from those mentioned in the forward-looking statements.

1 Calculated on the basis of a theoretical share price of

7€, corresponding to the average Adocia share price over the last

30 days, applied to all the shares remaining in the PACEO. 2

Source: Global Data, based on Novo Nordisk’s consolidated sales

3 Source: Global Data, based on consolidated sales 4

Press Release, July 10, 2024, ADOCIA Announces that Tonghua Dongbao

is Discontinuing one of the two Partnership Programs: BioChaperone

Combo 5 Press Release, October 23, 2023, ADOCIA’s Partner

Tonghua Dongbao Announces Positive Results of Three Clinical Trials

on BioChaperoneCombo

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724573234/en/

Adocia Olivier Soula CEO

contactinvestisseurs@adocia.com +33 (0)4 72 610 610

www.adocia.com

Ulysse Communication Adocia Press & Investor

Relations Bruno Arabian Nicolas Entz

adocia@ulysse-communication.com + 33 (0)6 87 88 47 26

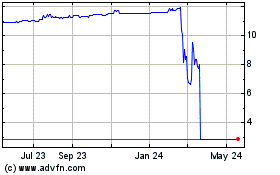

Edoc Acquisition (NASDAQ:ADOC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Edoc Acquisition (NASDAQ:ADOC)

Historical Stock Chart

From Mar 2024 to Mar 2025