ADOCIA Announces Half Year Report on Adocia’s Liquidity Agreement with Kepler Capital Markets

July 19 2024 - 11:00AM

Business Wire

Regulatory News:

Under the liquidity agreement entrusted by

ADOCIA (Paris:ADOC) to Kepler Capital Markets, the following

resources were listed on the liquidity account on June

30th 2024 :

- Number of shares : 10,329

- Cash balance of the liquidity account: € 208,460.92

During the 1st half of 2024, a total of:

Buy side

158,186 shares

€ 1,462,708.28

928 transactions

Sell side

150,404 shares

€ 1,421,855.74

935 transactions

The following resources appeared on the last half year statement

on December 31, 2023 on the liquidity account:

- Number of shares : 2,547

- Cash balance of the liquidity account: € 245,713.33

The following resources appeared on the liquidity account when

the activity started:

- Number of shares : 15,026

- Cash balance of the liquidity account: € 300,000.00

The liquidity agreement complies with AMF Decision n° 2021-01 of

June 22nd, 2021, renewing the implementation of liquidity contracts

for shares as an accepted market practice.

About Adocia

Adocia is a biotechnology company specializing in the discovery

and development of therapeutic solutions in the field of metabolic

diseases, primarily diabetes and obesity.

The company has a broad portfolio of drug candidates based on

four proprietary technology platforms: 1) The BioChaperone®

technology for the development of new generation insulins and

products combining different hormones; 2) AdOral®, an oral peptide

delivery technology; 3) AdoShell®, an immunoprotective biomaterial

for cell transplantation, with an initial application in pancreatic

cells transplantation; and 4) AdoGel®, a long-acting drug delivery

platform.

Adocia holds more than 25 patent families. Based in Lyon, the

company has about 80 employees. Adocia is listed on the regulated

market of Euronext™ Paris (Euronext: ADOC; ISIN: FR0011184241).

Disclaimer

This press release contains certain forward-looking statements

concerning Adocia and its business. Such forward-looking statements

are based on assumptions that Adocia considers as being reasonable.

However, there can be no guarantee that the estimates contained in

such forward-looking statements will be achieved, as such estimates

are subject to numerous risks including those set forth in the

“Risk Factors” section of the universal registration document that

was filed with the French Autorité des marchés financiers on April

29, 2024, available at www.adocia.com. Those risks include

uncertainties inherent in Adocia's short- or medium-term working

capital requirements, in research and development, future clinical

data, analyses and the evolution of economic conditions, the

financial markets and the markets in which Adocia operates, which

could impact the Company's short-term financing requirements and

its ability to raise additional funds.

The forward-looking statements contained in this press release

are also subject to risks not yet known to Adocia or not considered

as material by Adocia at this time. The occurrence of all or part

of such risks could cause the actual results, financial conditions,

performances, or achievements of Adocia be materially different

from those mentioned in the forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240719170092/en/

Adocia Olivier Soula CEO

contactinvestisseurs@adocia.com +33 (0)4 72 610 610

www.adocia.com

Ulysse Communication Adocia Press & Investor

Relations Bruno Arabian Nicolas Entz

adocia@ulysse-communication.com + 33 (0)6 87 88 47 26

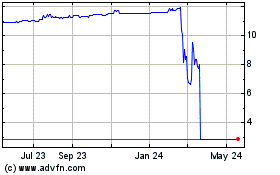

Edoc Acquisition (NASDAQ:ADOC)

Historical Stock Chart

From Nov 2024 to Dec 2024

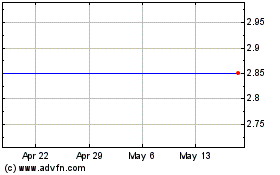

Edoc Acquisition (NASDAQ:ADOC)

Historical Stock Chart

From Dec 2023 to Dec 2024