0000926282false00009262822024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 05, 2024 |

ADTRAN Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41446 |

87-2164282 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

901 Explorer Boulevard |

|

Huntsville, Alabama |

|

35806-2807 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 256 963-8000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, Par Value $0.01 per share |

|

ADTN |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 5, 2024, ADTRAN Holdings, Inc. (“ADTRAN”) announced its financial results for the fiscal quarter ended June 30, 2024.

A copy of ADTRAN’s press release announcing its financial results is attached as Exhibit 99.1 hereto and incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

Executives from ADTRAN will review the financial results via a live audio webcast on Tuesday, August 6, 2024, at 9:30 a.m. Central Time, or 4:30 p.m. Central European Summer Time. A copy of the investor presentation provided in connection with that review is attached as Exhibit 99.2 and incorporated by reference herein. An archived recording of the webcast will be available for a limited time on ADTRAN's Investor Relations page at investors.adtran.com.

The information included in, or furnished with, Item 2.02 and 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ADTRAN Holdings, Inc. |

|

|

|

|

Date: |

August 6, 2024 |

By: |

/S/ Ulrich Dopfer |

|

|

|

Ulrich Dopfer

Chief Financial Officer

(Duly Authorized Officer and Principal Financial Officer) |

ADTRAN Holdings, Inc. reports second quarter 2024 financial results

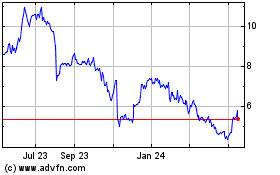

Huntsville, Alabama, USA. — August 05, 2024 — ADTRAN Holdings, Inc. (NASDAQ: ADTN and FSE: QH9) (“ADTRAN Holdings” or the “Company”) today announced its unaudited financial results for the second quarter of 2024.

oGAAP gross margin: 36.1%; Non-GAAP gross margin: 41.9%

oGAAP operating margin negative 17.0%; Non-GAAP operating margin positive 0.7%

oGAAP net loss attributable to the Company: $49.9 million; Non-GAAP net loss attributable to the Company: $18.8 million

•Earnings (Loss) per share:

oGAAP diluted loss per share attributable to the Company: $0.63; Non-GAAP diluted loss per share attributable to the Company: $0.24.

ADTRAN Holdings’ Chairman and Chief Executive Officer Tom Stanton stated, "We had a solid second quarter, during which we saw improvements across all our major operating metrics, including profitability and working capital. During the quarter, we saw growth in our customer base across the U.S. and Europe as customers continue to adopt our latest fiber networking solutions”.

For the third quarter of 2024, the Company expects revenue in a range of $215.0 million to $235.0 million. Non-GAAP operating margin is expected in a range of -1.0% to +3.0%.

Furthermore, non-GAAP operating margin (which is calculated as non-GAAP operating loss divided by revenue) is a non-GAAP financial measure. The Company has provided third quarter guidance with regard to non-GAAP operating margin. This measure excludes from the corresponding GAAP financial measure the effect of adjustments as described below. The Company has not provided a reconciliation of such non-GAAP guidance to guidance presented on a GAAP basis because it cannot predict and quantify without unreasonable effort all of the adjustments that may occur during the period due to the difficulty of predicting the timing and amounts of various items within a reasonable range. In particular, non-GAAP operating margin excludes certain items, including continued restructuring and integration expenses that will continue to evolve as our business efficiency program is implemented, that the Company is unable to quantitatively predict. Depending on the materiality of these items, they could have a significant impact on the Company's GAAP financial results.

The Company will hold a conference call to discuss its second quarter results on Tuesday, August 06, 2024, at 9:30 a.m. Central Time, or 4:30 p.m. Central European Summer Time. The Company will webcast this conference call. To listen, simply visit our Investor Relations site at investors.adtran.com approximately 10 minutes prior to the start of the call, click on the event “ADTRAN Holdings Releases 2nd Quarter 2024 Financial Results and Earnings Call”, and click on the webcast link.

An online replay of the Company’s conference call, as well as the transcript of the Company's conference call, will be available on the Investor Relations site approximately 24 hours following the call and will remain available for at least 12 months. For more information, visit investors.adtran.com or email investor.relations@adtran.com.

Cautionary Note Regarding Forward-Looking Statements

Statements contained in this press release which are not historical facts, such as those relating to expectations regarding future revenues; ADTRAN Holdings ability to reduce its inventory levels; ADTRAN Holdings’ potential funding opportunities; and ADTRAN Holdings’

strategy and outlook, outlook and financial guidance, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can also generally be identified by the use of words such as “believe,” “expect,” “intend,” “estimate,” “anticipate,” “will,” “may,” “could” and similar expressions. In addition, ADTRAN Holdings, through its senior management, may from time to time make forward-looking public statements concerning the matters described herein. All such projections and other forward-looking information speak only as of the date hereof, and ADTRAN Holdings undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise, except to the extent as may be required by law. All such forward-looking statements are necessarily estimates and reflect management’s best judgment based upon current information. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which have caused and may in the future cause actual events or results to differ materially from those estimated by ADTRAN Holdings include, but are not limited to: (i) risks and uncertainties relating to ADTRAN Holdings’ ability to continue to reduce expenditures and the impact of such reductions on its financial results and financial condition; (ii) the risk of fluctuations in revenue due to lengthy sales and approval processes required by major and other service providers for new products, as well as ongoing tighter inventory management of ADTRAN Holdings’ customers ; (iii) risks and uncertainties relating to ongoing material weaknesses in our internal control over financial reporting; (iv) our ability to comply with the covenants set forth in our credit facility; (v) risks posed by potential breaches of information systems and cyber-attacks; (vi) the risk that ADTRAN Holdings may not be able to effectively compete, including through product improvements and development; and (vii) other risks set forth in ADTRAN Holdings’ public filings made with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the year ended December 31, 2023, its Quarterly Report on Form 10-Q for the first quarter ended March 31, 2024, and risks to be disclosed in its Form 10-Q for the quarterly period ended March 31, 2024.

Explanation of Use of Non-GAAP Financial Measures

Set forth in the tables below are reconciliations of gross profit, gross margin, operating expenses, operating loss, other (expense) income, net loss inclusive of the non-controlling interest, net loss attributable to the Company, net income attributable to the non-controlling interest, and loss per share - basic and diluted, attributable to the Company, and net cash provided by (used in) operating activities, in each case as reported based on generally accepted accounting principles in the United States (“GAAP”), to non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income (loss), non-GAAP other expense, non-GAAP net loss inclusive of the non-controlling interest, non-GAAP net loss attributable to the Company, non-GAAP net income attributable to the non-controlling interest, non-GAAP loss per share - basic and diluted, attributable to the Company, respectively, and non-GAAP free cash flow. Such non-GAAP measures exclude acquisition-related expenses, amortization and adjustments (consisting of intangible amortization of backlog, developed technology, customer relationships, and trade names acquired in connection with business combinations and amortization of inventory fair value adjustments as well as legal and advisory fees related to a potential significant transaction), stock-based compensation expense, amortization of pension actuarial losses, deferred compensation adjustments, integration expenses, restructuring expenses, goodwill impairments, the tax effect of these adjustments to net loss and purchases of property, plant and equipment. These measures are used by management in our ongoing planning and annual budgeting processes. Additionally, we believe the presentation of these non-GAAP measures, when combined with the presentation of the most directly comparable GAAP financial measure, is beneficial to the overall understanding of ongoing operating performance of the Company.

These non-GAAP financial measures are not prepared in accordance with, or an alternative for, GAAP and therefore should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP. Additionally, our calculation of non-GAAP measures may not be comparable to similar measures calculated by other companies.

About Adtran

ADTRAN Holdings, Inc. (NASDAQ: ADTN and FSE: QH9) is the parent company of Adtran, Inc., a leading global provider of open, disaggregated networking and communications solutions that enable voice, data, video and internet communications across any network infrastructure. From the cloud edge to the subscriber edge, Adtran empowers communications service providers around the world to manage and scale services that connect people, places and things. Adtran solutions are used by service providers, private enterprises, government organizations and millions of individual users worldwide. ADTRAN Holdings, Inc. is also the largest shareholder of Adtran Networks SE, formerly ADVA Optical Networking SE. Find more at Adtran, LinkedIn and Twitter.

Published by

ADTRAN Holdings, Inc.

www.adtran.com

For media

Gareth Spence

+44 1904 699 358

public.relations@adtran.com

For investors

Rhonda Lambert

investor@adtran.com

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

Current Assets |

|

|

|

|

|

Cash and cash equivalents |

$ |

111,185 |

|

|

$ |

87,167 |

|

Accounts receivable, net |

|

186,176 |

|

|

|

216,445 |

|

Other receivables |

|

11,436 |

|

|

|

17,450 |

|

Income tax receivable |

|

13,050 |

|

|

|

7,933 |

|

Inventory, net |

|

287,860 |

|

|

|

362,295 |

|

Prepaid expenses and other current assets |

|

58,612 |

|

|

|

45,566 |

|

Total Current Assets |

|

668,319 |

|

|

|

736,856 |

|

Property, plant and equipment, net |

|

134,578 |

|

|

|

123,020 |

|

Deferred tax assets |

|

24,931 |

|

|

|

25,787 |

|

Goodwill |

|

54,897 |

|

|

|

353,415 |

|

Intangibles, net |

|

290,793 |

|

|

|

327,985 |

|

Other non-current assets |

|

87,105 |

|

|

|

87,706 |

|

Long-term investments |

|

30,159 |

|

|

|

27,743 |

|

Total Assets |

$ |

1,290,782 |

|

|

$ |

1,682,512 |

|

|

|

|

|

|

|

Liabilities, Redeemable Non-Controlling Interest and Equity |

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

Accounts payable |

$ |

158,550 |

|

|

$ |

162,922 |

|

Unearned revenue |

|

55,107 |

|

|

|

46,731 |

|

Accrued expenses and other liabilities |

|

36,307 |

|

|

|

37,607 |

|

Accrued wages and benefits |

|

37,520 |

|

|

|

27,030 |

|

Income tax payable, net |

|

2,228 |

|

|

|

5,221 |

|

Total Current Liabilities |

|

289,712 |

|

|

|

279,511 |

|

Non-current revolving credit agreement outstanding |

|

190,273 |

|

|

|

195,000 |

|

Deferred tax liabilities |

|

21,077 |

|

|

|

35,655 |

|

Non-current unearned revenue |

|

26,584 |

|

|

|

25,109 |

|

Non-current pension liability |

|

11,505 |

|

|

|

12,543 |

|

Deferred compensation liability |

|

30,601 |

|

|

|

29,039 |

|

Non-current lease obligations |

|

26,613 |

|

|

|

31,420 |

|

Other non-current liabilities |

|

34,445 |

|

|

|

28,657 |

|

Total Liabilities |

|

630,810 |

|

|

|

636,934 |

|

Redeemable Non-Controlling Interest |

|

439,743 |

|

|

|

451,756 |

|

Equity |

|

|

|

|

|

Common stock |

|

791 |

|

|

|

790 |

|

Additional paid-in capital |

|

802,737 |

|

|

|

795,304 |

|

Accumulated other comprehensive income |

|

28,274 |

|

|

|

47,461 |

|

Retained deficit |

|

(606,375 |

) |

|

|

(243,908 |

) |

Treasury stock |

|

(5,198 |

) |

|

|

(5,825 |

) |

Total Equity |

|

220,229 |

|

|

|

593,822 |

|

Total Liabilities, Redeemable Non-Controlling Interest and Equity |

$ |

1,290,782 |

|

|

$ |

1,682,512 |

|

Condensed Consolidated Statements of Loss

(Unaudited)

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

Network Solutions |

|

$ |

179,194 |

|

|

$ |

283,002 |

|

|

$ |

360,467 |

|

|

$ |

565,420 |

|

|

Services & Support |

|

|

46,797 |

|

|

|

44,376 |

|

|

|

91,697 |

|

|

|

85,870 |

|

|

Total Revenue |

|

|

225,991 |

|

|

|

327,378 |

|

|

|

452,164 |

|

|

|

651,290 |

|

|

Cost of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

Network Solutions |

|

|

124,457 |

|

|

|

216,960 |

|

|

|

250,783 |

|

|

|

436,090 |

|

|

Network Solutions - inventory write-down and other charges |

|

|

143 |

|

|

|

— |

|

|

|

8,925 |

|

|

|

— |

|

|

Services & Support |

|

|

19,816 |

|

|

|

17,865 |

|

|

|

38,626 |

|

|

|

34,839 |

|

|

Total Cost of Revenue |

|

|

144,416 |

|

|

|

234,825 |

|

|

|

298,334 |

|

|

|

470,929 |

|

|

Gross Profit |

|

|

81,575 |

|

|

|

92,553 |

|

|

|

153,830 |

|

|

|

180,361 |

|

|

Selling, general and administrative expenses |

|

|

59,493 |

|

|

|

66,583 |

|

|

|

118,593 |

|

|

|

133,980 |

|

|

Research and development expenses |

|

|

60,388 |

|

|

|

70,598 |

|

|

|

120,639 |

|

|

|

140,741 |

|

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

292,583 |

|

|

|

— |

|

|

Operating Loss |

|

|

(38,306 |

) |

|

|

(44,628 |

) |

|

|

(377,985 |

) |

|

|

(94,360 |

) |

|

Interest and dividend income |

|

|

366 |

|

|

|

358 |

|

|

|

763 |

|

|

|

662 |

|

|

Interest expense |

|

|

(6,906 |

) |

|

|

(4,064 |

) |

|

|

(11,504 |

) |

|

|

(7,351 |

) |

|

Net investment gain |

|

|

872 |

|

|

|

1,262 |

|

|

|

3,125 |

|

|

|

2,514 |

|

|

Other (expense) income, net |

|

|

(901 |

) |

|

|

2,494 |

|

|

|

409 |

|

|

|

2,191 |

|

|

Loss Before Income Taxes |

|

|

(44,875 |

) |

|

|

(44,578 |

) |

|

|

(385,192 |

) |

|

|

(96,344 |

) |

|

Income tax (expense) benefit |

|

|

(2,136 |

) |

|

|

8,363 |

|

|

|

16,511 |

|

|

|

19,676 |

|

|

Net Loss |

|

$ |

(47,011 |

) |

|

$ |

(36,215 |

) |

|

$ |

(368,681 |

) |

|

$ |

(76,668 |

) |

|

Less: Net Income attributable to non-controlling interest |

|

|

2,854 |

|

|

|

2,882 |

|

|

|

5,734 |

|

|

|

2,512 |

|

|

Net Loss attributable to ADTRAN Holdings, Inc. |

|

$ |

(49,865 |

) |

|

$ |

(39,097 |

) |

|

$ |

(374,415 |

) |

|

$ |

(79,180 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding – basic |

|

|

78,852 |

|

|

|

78,366 |

|

|

|

78,803 |

|

|

|

78,364 |

|

|

Weighted average shares outstanding – diluted |

|

|

78,852 |

|

|

|

78,366 |

|

|

|

78,803 |

|

|

|

78,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per common share attributable to ADTRAN Holdings, Inc. – basic |

|

$ |

(0.63 |

) |

|

$ |

(0.50 |

) |

|

$ |

(4.75 |

) |

|

$ |

(1.01 |

) |

|

Loss per common share attributable to ADTRAN Holdings, Inc. – diluted |

|

$ |

(0.63 |

) |

|

$ |

(0.50 |

) |

|

$ |

(4.75 |

) |

|

$ |

(1.01 |

) |

|

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(368,681 |

) |

|

$ |

(76,668 |

) |

Adjustments to reconcile net loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

45,156 |

|

|

|

67,467 |

|

Goodwill impairment |

|

|

292,583 |

|

|

|

— |

|

Amortization of debt issuance cost |

|

|

1,013 |

|

|

|

291 |

|

Gain on investments, net |

|

|

(2,867 |

) |

|

|

(4,530 |

) |

Net loss on disposal of property, plant and equipment |

|

|

185 |

|

|

|

— |

|

Stock-based compensation expense |

|

|

7,793 |

|

|

|

8,103 |

|

Deferred income taxes |

|

|

(13,684 |

) |

|

|

(31,962 |

) |

Other, net |

|

|

(126 |

) |

|

|

130 |

|

Inventory write down - business efficiency program |

|

|

4,135 |

|

|

|

— |

|

Inventory reserves |

|

|

3,722 |

|

|

|

20,885 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable, net |

|

|

26,913 |

|

|

|

40,975 |

|

Other receivables |

|

|

6,279 |

|

|

|

561 |

|

Income taxes receivable, net |

|

|

(5,653 |

) |

|

|

— |

|

Inventory |

|

|

62,151 |

|

|

|

(6,920 |

) |

Prepaid expenses, other current assets and other assets |

|

|

(14,731 |

) |

|

|

7,105 |

|

Accounts payable |

|

|

(3,966 |

) |

|

|

(67,923 |

) |

Accrued expenses and other liabilities |

|

|

19,152 |

|

|

|

110 |

|

Income taxes payable, net |

|

|

(2,878 |

) |

|

|

6,216 |

|

Net cash provided by (used in) operating activities |

|

|

56,496 |

|

|

|

(36,160 |

) |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(29,369 |

) |

|

|

(20,118 |

) |

Proceeds from sales and maturities of available-for-sale investments |

|

|

956 |

|

|

|

2,074 |

|

Purchases of available-for-sale investments |

|

|

(121 |

) |

|

|

(580 |

) |

Proceeds from beneficial interests in securitized accounts receivable |

|

|

— |

|

|

|

1,156 |

|

Net cash used in investing activities |

|

|

(28,534 |

) |

|

|

(17,468 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Tax withholdings related to stock-based compensation settlements |

|

|

(189 |

) |

|

|

(6,315 |

) |

Proceeds from stock option exercises |

|

|

219 |

|

|

|

163 |

|

Dividend payments |

|

|

— |

|

|

|

(14,156 |

) |

Proceeds from receivables purchase agreement |

|

|

68,556 |

|

|

|

— |

|

Repayments on receivables purchase agreement |

|

|

(66,399 |

) |

|

|

— |

|

Proceeds from draw on revolving credit agreements |

|

|

— |

|

|

|

163,729 |

|

Repayment of revolving credit agreements |

|

|

(5,000 |

) |

|

|

(49,155 |

) |

Payment of redemption of redeemable non-controlling interest |

|

|

(25 |

) |

|

|

(1,202 |

) |

Payment of debt issuance cost |

|

|

(1,994 |

) |

|

|

— |

|

Repayment of notes payable |

|

|

— |

|

|

|

(24,885 |

) |

Net cash (used in) provided by financing activities |

|

|

(4,832 |

) |

|

|

68,179 |

|

|

|

|

|

|

|

|

Net increase in cash and cash equivalents |

|

|

23,130 |

|

|

|

14,551 |

|

Effect of exchange rate changes |

|

|

888 |

|

|

|

1,099 |

|

Cash and cash equivalents, beginning of period |

|

|

87,167 |

|

|

|

108,644 |

|

Cash and cash equivalents, end of period |

|

$ |

111,185 |

|

|

$ |

124,294 |

|

|

|

|

|

|

|

|

Supplemental disclosure of cash financing activities: |

|

|

|

|

|

|

Cash paid for interest |

|

$ |

6,554 |

|

|

$ |

4,719 |

|

Cash paid for income taxes |

|

$ |

7,433 |

|

|

$ |

— |

|

Cash used in operating activities related to operating leases |

|

$ |

4,780 |

|

|

$ |

5,082 |

|

Supplemental disclosure of non-cash investing activities: |

|

|

|

|

|

|

Right-of-use assets obtained in exchange for lease obligations |

|

$ |

1,999 |

|

|

$ |

515 |

|

Purchases of property, plant and equipment included in accounts payable |

|

$ |

1,059 |

|

|

$ |

2,662 |

|

Supplemental Information

Reconciliation of Gross Profit and Gross Margin to

Non-GAAP Gross Profit and Non-GAAP Gross Margin

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Six Months Ended |

|

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

|

June 30,

2023 |

|

|

|

June 30,

2024 |

|

|

June 30,

2023 |

|

Total Revenue |

|

$ |

225,991 |

|

|

$ |

226,173 |

|

|

$ |

327,378 |

|

|

|

$ |

452,164 |

|

|

$ |

651,290 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Revenue |

|

$ |

144,416 |

|

|

$ |

153,918 |

|

|

$ |

234,825 |

|

|

|

$ |

298,334 |

|

|

$ |

470,929 |

|

Acquisition-related expenses, amortizations and adjustments(1) |

|

|

(10,064 |

) |

|

|

(10,177 |

) |

|

|

(33,439 |

) |

|

|

|

(20,241 |

) |

|

|

(66,017 |

) |

Stock-based compensation expense |

|

|

(280 |

) |

|

|

(275 |

) |

|

|

(335 |

) |

|

|

|

(555 |

) |

|

|

(575 |

) |

Restructuring expenses(2) |

|

|

(2,788 |

) |

|

|

(11,247 |

) |

|

|

— |

|

|

|

|

(14,035 |

) |

|

|

(76 |

) |

Integration expenses(3) |

|

|

(35 |

) |

|

|

(35 |

) |

|

|

— |

|

|

|

|

(70 |

) |

|

|

— |

|

Non-GAAP Cost of Revenue |

|

$ |

131,249 |

|

|

$ |

132,184 |

|

|

$ |

201,051 |

|

|

|

$ |

263,433 |

|

|

$ |

404,261 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit |

|

$ |

81,575 |

|

|

$ |

72,255 |

|

|

$ |

92,553 |

|

|

|

$ |

153,830 |

|

|

$ |

180,361 |

|

Non-GAAP Gross Profit |

|

$ |

94,742 |

|

|

$ |

93,989 |

|

|

$ |

126,327 |

|

|

|

$ |

188,731 |

|

|

$ |

247,029 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Margin |

|

|

36.1 |

% |

|

|

31.9 |

% |

|

|

28.3 |

% |

|

|

|

34.0 |

% |

|

|

27.7 |

% |

Non-GAAP Gross Margin |

|

|

41.9 |

% |

|

|

41.6 |

% |

|

|

38.6 |

% |

|

|

|

41.7 |

% |

|

|

37.9 |

% |

(1) Includes intangible amortization of backlog, inventory fair value adjustments, developed technology, customer relationships, and trade names acquired in connection with business combinations.

(2) Includes expenses for restructuring program designed to optimize the assets and business processes following the business combination with Adtran Networks SE. These expenses include inventory write down and other charges of $8.9 million for the six months ended June 30, 2024, incurred as a result of a strategy shift which included discontinuance of certain product lines in connection with the Business Efficiency Program. The restructuring program commenced upon the closing of the business combination with Adtran Networks SE and is expected to be substantially completed in late 2024. Additionally, as part of the Business Efficiency Program, management determined to close a facility in Greifswald, Germany. These expenses include restructuring wage charges of $2.3 million for the three and six months ended June 30, 2024, respectively. The closure of the facility is expected to be completed by December 31, 2024.

(3) Includes expenses related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks SE. Includes fees incurred for the expansion of internal controls at Adtran Networks SE and the implementation of the DPTLA.

Supplemental Information

Reconciliation of Operating Expenses to Non-GAAP Operating Expenses

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

|

June 30, |

|

|

June 30, |

|

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

|

Operating Expenses |

|

$ |

119,881 |

|

|

$ |

411,934 |

|

|

$ |

137,181 |

|

|

|

$ |

531,815 |

|

|

$ |

274,721 |

|

|

Acquisition-related expenses, amortizations and adjustments |

|

|

(7,233 |

) |

(1) |

|

(4,881 |

) |

(6) |

|

(4,398 |

) |

(11) |

|

|

(12,114 |

) |

(15) |

|

(8,982 |

) |

(19) |

Stock-based compensation expense |

|

|

(3,321 |

) |

(2) |

|

(3,447 |

) |

(7) |

|

(3,974 |

) |

(12) |

|

|

(6,768 |

) |

(16) |

|

(7,432 |

) |

(20) |

Restructuring expenses |

|

|

(14,742 |

) |

(3) |

|

(5,862 |

) |

(8) |

|

(5,868 |

) |

(13) |

|

|

(20,604 |

) |

(17) |

|

(8,229 |

) |

(21) |

Integration expenses |

|

|

(531 |

) |

(4) |

|

(480 |

) |

(9) |

|

(563 |

) |

(14) |

|

|

(1,011 |

) |

(18) |

|

(1,412 |

) |

(22) |

Deferred compensation adjustments(5) |

|

|

(848 |

) |

|

|

(1,940 |

) |

|

|

307 |

|

|

|

|

(2,788 |

) |

|

|

(87 |

) |

|

Goodwill impairment |

|

|

— |

|

|

|

(292,583 |

) |

(10) |

|

— |

|

|

|

|

(292,583 |

) |

(10) |

|

— |

|

|

Non-GAAP Operating Expenses |

|

$ |

93,206 |

|

|

$ |

102,741 |

|

|

$ |

122,685 |

|

|

|

$ |

195,947 |

|

|

$ |

248,579 |

|

|

(1) Includes $3.9M of intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations and $2.8 million of legal and advisory fees related to a potential strategic transaction which are both included in selling, general and administrative expenses and $0.5 million is included in research and development expenses on the condensed consolidated statements of loss.

(2) $2.4 million is included in selling, general and administrative expenses and $0.9 million is included in research and development expenses on the condensed consolidated statements of loss.

(3) $3.5 million is included in selling, general and administrative expenses and $11.3 million is included in research and development expenses on the condensed consolidated statements of loss. Includes expenses of $13.5 million of wage related and other charges due to the Greifswald facility closure of which $2.6 million is included in selling, general and administrative and $10.9 million is included in research and development expenses on the condensed consolidated statements of loss.

(4) $0.5 million is included in selling, general and administrative expenses on the condensed consolidated statements of loss, and is primarily related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks SE.

(5) Includes non-cash change in fair value of equity investments held in the ADTRAN Holdings, Inc. Deferred Compensation Program for Employees, all of which is included in selling, general and administrative expenses on the condensed consolidated statement of loss.

(6) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $4.4 million is included in selling, general and administrative expenses and $0.5 million is included in research and development expenses on the condensed consolidated statements of loss.

(7) $2.5 million is included in selling, general and administrative expenses and $1.0 million is included in research and development expenses on the condensed consolidated statements of loss.

(8) $1.8 million is included in selling, general and administrative expenses and $4.1 million is included in research and development expenses on the condensed consolidated statements of loss.

(9) $0.5 million is included in selling, general and administrative expenses and $0.02 million is included in research and development expenses on the condensed consolidated statements of loss, and is primarily related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks SE.

(10) Non-cash impairment of goodwill in our Network Solutions reporting unit, necessitated by factors such as a decrease in the Company's market capitalization, cautious service provider spending due to economic uncertainty and continued elevated customer inventory adjustments.

(11) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $3.9 million is included in selling, general and administrative expenses and $0.5 million is included in research and development expenses on the condensed consolidated statements of loss.

(12) $2.7 million is included in selling, general and administrative expenses and $1.3 million is included in research and development expenses on the condensed consolidated statements of loss.

(13) $1.4 million is included in selling, general and administrative expenses and $4.5 million is included in research and development expenses on the condensed consolidated statements of loss.

(14) $0.6 million is included in selling, general and administrative expenses on the condensed consolidated statements of loss. Includes fees relating to the expansion of internal controls at Adtran Networks SE and the implementation of the DPLTA.

(15) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $11.2 million is included in selling, general and administrative expenses and $0.9 million is included in research and development expenses on the condensed consolidated statements of loss.

(16) $4.9 million is included in selling, general and administrative expenses and $1.9 million is included in research and development expenses on the condensed consolidated statements of loss.

(17) $5.3 million is included in selling, general and administrative expenses and $15.3 million is included in research and development expenses on the condensed consolidated statements of loss. Includes expenses of $13.5 million of wage related and other charges due to the Greifswald facility closure of which $2.6 million is included in selling, general and administrative and $10.9 million is included in research and development expenses on the condensed consolidated statements of loss.

(18) $1.0 million is included in selling, general and administrative expenses and less than $0.1 million is included in research and development expenses on the condensed consolidated statements of loss, and is primarily related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks SE.

(19) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $8.0 million is included in selling, general and administrative expenses and $1.0 million is included in research and development expenses on the condensed consolidated statements of loss.

(20) $5.1 million is included in selling, general and administrative expenses and $2.3 million is included in research and development expenses on the condensed consolidated statements of loss.

(21) $3.5 million is included in selling, general and administrative expenses and $4.7 million is included in research and development expenses on the condensed consolidated statements of loss.

(22) $1.4 million is included in selling, general and administrative expenses on the condensed consolidated statements of loss. Includes fees relating to the expansion of internal controls at Adtran Networks SE and the implementation of the DPLTA.

Supplemental Information

Reconciliation of Operating Loss to Non-GAAP Operating Income (Loss)

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Six Months Ended |

|

|

|

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

|

June 30 |

|

|

June 30 |

|

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

|

Operating Loss |

|

$ |

(38,306 |

) |

|

$ |

(339,679 |

) |

|

$ |

(44,628 |

) |

|

|

$ |

(377,985 |

) |

|

$ |

(94,360 |

) |

|

Acquisition related expenses, amortizations and adjustments(1) |

|

|

17,297 |

|

|

|

15,058 |

|

|

|

37,837 |

|

|

|

|

32,355 |

|

|

|

74,999 |

|

|

Stock-based compensation expense |

|

|

3,601 |

|

|

|

3,722 |

|

|

|

4,309 |

|

|

|

|

7,323 |

|

|

|

8,007 |

|

|

Restructuring expenses(2) |

|

|

17,530 |

|

|

|

17,110 |

|

|

|

5,868 |

|

|

|

|

34,640 |

|

|

|

8,305 |

|

|

Integration expenses(3) |

|

|

566 |

|

|

|

514 |

|

|

|

563 |

|

|

|

|

1,080 |

|

|

|

1,412 |

|

|

Deferred compensation adjustments(4) |

|

|

848 |

|

|

|

1,940 |

|

|

|

(307 |

) |

|

|

|

2,788 |

|

|

|

87 |

|

|

Goodwill impairment(5) |

|

|

— |

|

|

|

292,583 |

|

|

|

— |

|

|

|

|

292,583 |

|

|

|

— |

|

|

Non-GAAP Operating Income (Loss) |

|

$ |

1,536 |

|

|

$ |

(8,752 |

) |

|

$ |

3,642 |

|

|

|

$ |

(7,216 |

) |

|

$ |

(1,550 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes intangible amortization of backlog, inventory fair value adjustments, developed technology, customer relationships, and trade names acquired in connection with business combinations.

(2) Includes expenses for restructuring program designed to optimize the assets and business processes following the business combination with Adtran Networks SE. These expenses include inventory write down and other charges incurred as a result of a strategic shift in certain product lines in connection with the restructuring program. Additionally, includes expenses related to the closure of the Greifswald facility.

(3) Includes expenses related to the Company's one-time integration bonus program in connection with synergy targets as a results of the business combination with Adtran Networks SE. Includes fees incurred for the expansion of internal controls at Adtran Networks SE and the implementation of the DPTLA.

(4) Includes non-cash change in fair value of equity investments held in the ADTRAN Holdings, Inc. Deferred Compensation Program for Employees, all of which is included in selling, general and administrative expenses on the condensed consolidated statement of loss.

(5) Non-cash impairment of goodwill in our Network Solutions reporting unit, necessitated by factors such as a decrease in the Company’s market capitalization, cautious service provider spending due to economic uncertainty and continued customer inventory adjustments.

Supplemental Information

Reconciliation of Other (Expense) Income to Non-GAAP Other Expense

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

June 30, 2023 |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

Interest and dividend income |

|

$ |

366 |

|

|

$ |

397 |

|

|

$ |

358 |

|

|

|

$ |

763 |

|

|

$ |

662 |

|

Interest expense |

|

|

(6,906 |

) |

|

|

(4,598 |

) |

|

|

(4,064 |

) |

|

|

|

(11,504 |

) |

|

|

(7,351 |

) |

Net investment gain |

|

|

872 |

|

|

|

2,253 |

|

|

|

1,262 |

|

|

|

|

3,125 |

|

|

|

2,514 |

|

Other (expense) income, net |

|

|

(901 |

) |

|

|

1,310 |

|

|

|

2,494 |

|

|

|

|

409 |

|

|

|

2,191 |

|

Total Other (Expense) Income |

|

$ |

(6,569 |

) |

|

$ |

(638 |

) |

|

$ |

50 |

|

|

|

$ |

(7,207 |

) |

|

$ |

(1,984 |

) |

Deferred compensation adjustments (1) |

|

|

(896 |

) |

|

|

(2,439 |

) |

|

|

(1,254 |

) |

|

|

|

(3,335 |

) |

|

|

(2,504 |

) |

Pension expense (2) |

|

|

7 |

|

|

|

7 |

|

|

|

6 |

|

|

|

|

14 |

|

|

|

13 |

|

Non-GAAP Other Expense |

|

$ |

(7,458 |

) |

|

$ |

(3,070 |

) |

|

$ |

(1,198 |

) |

|

|

$ |

(10,528 |

) |

|

$ |

(4,475 |

) |

(1) Includes non-cash change in fair value of equity investments held in the ADTRAN Holdings, Inc. Deferred Compensation Program for Employees.

(2) Includes amortization of actuarial losses related to the Company's pension plan for employees in certain foreign countries.

Supplemental Information

Reconciliation of Net Loss inclusive of Non-Controlling Interest to

Non-GAAP Net (Loss) Income inclusive of Non-Controlling Interest

(Unaudited)

and

Reconciliation of Net Income attributable to Non-Controlling Interest to

Non-GAAP Net Income attributable to Non-Controlling Interest

(Unaudited)

and

Reconciliation of Net Loss attributable to ADTRAN Holdings, Inc. and

Loss per Common Share attributable to ADTRAN Holdings, Inc. – Basic and Diluted to

Non-GAAP Net Loss attributable to ADTRAN Holdings, Inc. and

Non-GAAP Loss per Common Share attributable to ADTRAN Holdings, Inc. – Basic and Diluted

(Unaudited)

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Six Months Ended |

|

|

|

June 30,

2024 |

|

|

March 31,

2024 |

|

|

June 30,

2023 |

|

|

|

June 30,

2024 |

|

|

June 30,

2023 |

|

Net Loss attributable to ADTRAN Holdings, Inc. |

|

$ |

(49,865 |

) |

|

$ |

(324,550 |

) |

|

$ |

(39,097 |

) |

|

|

$ |

(374,415 |

) |

|

$ |

(79,180 |

) |

Plus: Net Income attributable to non-controlling interest (1) |

|

|

2,854 |

|

|

|

2,880 |

|

|

|

2,882 |

|

|

|

|

5,734 |

|

|

|

2,512 |

|

Net Loss inclusive of non-controlling interest |

|

$ |

(47,011 |

) |

|

$ |

(321,670 |

) |

|

$ |

(36,215 |

) |

|

|

$ |

(368,681 |

) |

|

$ |

(76,668 |

) |

Acquisition related expenses, amortizations and adjustments |

|

|

17,297 |

|

|

|

15,058 |

|

|

|

37,837 |

|

|

|

|

32,355 |

|

|

|

74,999 |

|

Stock-based compensation expense |

|

|

3,601 |

|

|

|

3,722 |

|

|

|

4,309 |

|

|

|

|

7,323 |

|

|

|

8,007 |

|

Deferred compensation adjustments (2) |

|

|

(48 |

) |

|

|

(499 |

) |

|

|

(1,561 |

) |

|

|

|

(547 |

) |

|

|

(2,417 |

) |

Pension adjustments (3) |

|

|

7 |

|

|

|

7 |

|

|

|

6 |

|

|

|

|

14 |

|

|

|

13 |

|

Restructuring expenses |

|

|

17,530 |

|

|

|

17,110 |

|

|

|

5,868 |

|

|

|

|

34,640 |

|

|

|

8,305 |

|

Integration expenses |

|

|

566 |

|

|

|

514 |

|

|

|

563 |

|

|

|

|

1,080 |

|

|

|

1,412 |

|

Goodwill impairment |

|

|

— |

|

|

|

292,583 |

|

|

|

— |

|

|

|

|

292,583 |

|

|

|

— |

|

Tax effect of adjustments to net loss |

|

|

(7,880 |

) |

|

|

(5,614 |

) |

|

|

(13,426 |

) |

|

|

|

(13,494 |

) |

|

|

(25,733 |

) |

Non-GAAP Net (Loss) Income inclusive of non-controlling interest |

|

$ |

(15,938 |

) |

|

$ |

1,211 |

|

|

$ |

(2,619 |

) |

|

|

$ |

(14,727 |

) |

|

$ |

(12,082 |

) |

Less: Non-GAAP Net Income attributable to non-controlling interest (1) |

|

|

2,854 |

|

|

|

2,880 |

|

|

|

2,882 |

|

|

|

|

5,734 |

|

|

|

4,041 |

|

Non-GAAP Net Loss attributable to ADTRAN Holdings, Inc. |

|

$ |

(18,792 |

) |

|

$ |

(1,669 |

) |

|

$ |

(5,501 |

) |

|

|

$ |

(20,461 |

) |

|

$ |

(16,123 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net Income attributable to non-controlling interest (1) |

|

$ |

2,854 |

|

|

$ |

2,880 |

|

|

$ |

2,882 |

|

|

|

$ |

5,734 |

|

|

$ |

2,512 |

|

Acquisition related expenses, amortizations and adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

1,457 |

|

Restructuring expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

29 |

|

Integration expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

6 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

37 |

|

Non-GAAP Net Income attributable to non-controlling interest (1) |

|

$ |

2,854 |

|

|

$ |

2,880 |

|

|

$ |

2,882 |

|

|

|

$ |

5,734 |

|

|

$ |

4,041 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding – basic |

|

|

78,852 |

|

|

|

78,814 |

|

|

|

78,366 |

|

|

|

|

78,803 |

|

|

|

78,364 |

|

Weighted average shares outstanding – diluted |

|

|

78,852 |

|

|

|

78,814 |

|

|

|

78,366 |

|

|

|

|

78,803 |

|

|

|

78,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per common share attributable to ADTRAN Holdings, Inc. – basic |

|

$ |

(0.63 |

) |

|

$ |

(4.12 |

) |

|

$ |

(0.50 |

) |

|

|

$ |

(4.75 |

) |

|

$ |

(1.01 |

) |

Loss per common share attributable to ADTRAN Holdings, Inc. – diluted |

|

$ |

(0.63 |

) |

|

$ |

(4.12 |

) |

|

$ |

(0.50 |

) |

|

|

$ |

(4.75 |

) |

|

$ |

(1.01 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Loss per common share attributable to ADTRAN – basic |

|

$ |

(0.24 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.07 |

) |

|

|

$ |

(0.26 |

) |

|

$ |

(0.21 |

) |

Non-GAAP Loss per common share attributable to ADTRAN – diluted |

|

$ |

(0.24 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.07 |

) |

|

|

$ |

(0.26 |

) |

|

$ |

(0.21 |

) |

(1) Represents the non-controlling interest portion of the Company's ownership of Adtran Networks SE pre-DPLTA and the annual recurring compensation earned by redeemable non-controlling interests and accrued by the Company post-DPLTA.

(2) Includes non-cash change in fair value of equity investments held in deferred compensation plans offered to certain employees.

(3) Includes amortization of actuarial losses related to the Company's pension plan for employees in certain foreign countries.

Supplemental Information

Reconciliation of Net Cash Provided By (Used In) Operating Activities to Free Cash Flow

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

Six Months Ended |

|

|

|

June 30, |

|

|

March 31, |

|

|

June 30, |

|

|

|

June 30, |

|

|

June 30, |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

Net Cash provided by (used in) operating activities |

|

$ |

19,898 |

|

|

$ |

36,598 |

|

|

$ |

(16,234 |

) |

|

|

$ |

56,496 |

|

|

$ |

(36,160 |

) |

Purchases of property, plant and equipment |

|

|

(15,995 |

) |

|

|

(13,374 |

) |

|

|

(11,679 |

) |

|

|

|

(29,369 |

) |

|

|

(20,118 |

) |

Free cash flow |

|

$ |

3,903 |

|

|

$ |

23,224 |

|

|

$ |

(27,913 |

) |

|

|

$ |

27,127 |

|

|

$ |

(56,278 |

) |

Adtran Holdings Investor presentation August 6, 2024

Cautionary note regarding forward-looking statements Statements contained in this investor presentation which are not historical facts, such as those relating to expectations regarding future revenues; ADTRAN Holdings ability to reduce its inventory levels; ADTRAN Holdings’ potential funding opportunities; and ADTRAN Holdings’ strategy and outlook, outlook and financial guidance, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can also generally be identified by the use of words such as “believe,” “expect,” “intend,” “estimate,” “anticipate,” “will,” “may,” “could” and similar expressions. In addition, ADTRAN Holdings, through its senior management, may from time to time make forward-looking public statements concerning the matters described herein. All such projections and other forward-looking information speak only as of the date hereof, and ADTRAN Holdings undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise, except to the extent as may be required by law. All such forward-looking statements are necessarily estimates and reflect management’s best judgment based upon current information. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which have caused and may in the future cause actual events or results to differ materially from those estimated by ADTRAN Holdings include, but are not limited to: (i) risks and uncertainties relating to ADTRAN Holdings’ ability to continue to reduce expenditures and the impact of such reductions on its financial results and financial condition; (ii) the risk of fluctuations in revenue due to lengthy sales and approval processes required by major and other service providers for new products, as well as ongoing tighter inventory management of ADTRAN Holdings’ customers; (iii) risks and uncertainties relating to ongoing material weaknesses in our internal control over financial reporting; (iv) our ability to comply with the covenants set forth in our credit facility; (v) risks posed by potential breaches of information systems and cyber-attacks; (vi) the risk that ADTRAN Holdings may not be able to effectively compete, including through product improvements and development; and (vii) other risks set forth in ADTRAN Holdings’ public filings made with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the year ended December 31, 2023, its Quarterly Report on Form 10-Q for the first quarter ended March 31, 2024, and risks to be disclosed in its Form 10-Q for the quarterly period ended June 30, 2024 to be filed with the SEC.

Introduction and business model 1

OUR VISION is to enable a fully-connected world, �where the power and freedom to communicate �is available to everyone, everywhere, �in a secure, efficient and sustainable environment.

$1.15B FY23 revenue 50 Key differentiators Open, disaggregated platforms with vendor-neutral capability Extensive global design support and supply orchestration capabilities (Supply chain) Customers = NSPs, RSPs, ASPs, SMBs, enterprises, tribal communities, governments and agencies: local, state, federal Simplified pricing structure 1.000+ 35+ Years of experience 3.300+ Employees �worldwide Α — Ω End-to-end solutions portfolio Global technology patents Who is Adtran? Your trusted partner for the fiber everywhere era “Adtran is focused on customer usability, service and support.” Tom Stanton, CEO, Adtran Worldwide locations HQ = Huntsville, AL

Global presence Americas: Canada United States (HQ Global) Brazil APAC: Japan China Hong Kong Singapore India Australia EMEA: Germany (HQ Europe) England Switzerland Poland Finland Sweden France Italy Israel South Africa Saudi Arabia

Business model Adtran is a global vendor with scale and diversity Portfolio differentiation Customer diversity Geographic diversity Strength in focus markets Optical core to customer premise End-to-end automation & insights Enhanced security and assurance More balanced mix of national SPs, regional SPs, enterprise, and ICP customers Continued growth opportunities in each segment Balanced mix of U.S. and non-U.S. business Strong growth opportunities in focus regions Full range of R&D, pre-sales, post-sales and services support in focus regions Strong market share in growth products in focus regions

Business model Optical core to customer premise Metro WDM 5G Optical platforms Access and aggregation platforms Subscriber platforms Open multi-gigabit PON systems, �Carrier Ethernet access, Wi-Fi, routers, switches and more Fiber access platforms, �1/10/25/100G Ethernet aggregation, network timing and synchronization Optical access and transport, �data center interconnect, advanced pluggable optics, assurance and monitoring, encryption and security AI-driven orchestration, management and optimization DCI

Business model Market trends Pandemic accelerated digitalization and capacity demand 5G, work from home, �AI and streaming �drive multi-gigabit fiber access Deglobalization and consolidation impacts vendor selection Open, disaggregated, sustainable and cloud-centric systems Online meetings and �e-commerce have displaced travel Symmetric bandwidth goes from being a luxury to a necessity Selection of trusted suppliers becomes strategic Closed and single vendor systems are no longer desirable

Business model Fiber networking market forecasts CAGR 2023-2028: 3.2% CAGR 2023-2028: 2.4% CAGR 2023-2028: 3.6% Sources: PON OLT+ONT: Dell’Oro 5yr Broadband Access and Home Networking Report (July 2024) Metro WDM: Omdia Optical Network Forecast (November 2023) Carrier Ethernet: Omdia Service Provider Switching and Routing Forecast (October 2023)

Business model Significant tailwinds expected to drive long term growth BEAD* High risk vendor replacement $42.5b in broadband funding to provide service to 7m+ under/unserved homes Expect ~90% to be served with fiber Funds allocated through grant process at state level 32 eligible entities already completed the Initial Proposal stage 4-year implementation timeline for service providers to deliver service Shift away from Chinese vendors is picking up the pace given the geopolitical situation Adtran is one of the key beneficiaries in optical transport and PON in EMEA and already won multiple deals and has several projects in the funnel; we expect to experience the largest impact in 2025 and 2026 given tier 1 integration timelines > $1bn market opportunity in optical networking > $400m market opportunity in broadband access and aggregation *The Broadband Equity, Access, and Deployment (BEAD) Program, is expected to provide USD 42.5 billion to expand high-speed internet access by funding planning, infrastructure deployment and adoption programs in all 50 states, Washington D.C., Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands.

Business model Corporate social responsibility EcoVadis Adtran, Inc. Adtran Networks SE CDP Climate Change 2023 B- A- Adtran, Inc. Adtran Networks SE Environmental Sustainability is integral part of product strategy through process-based product ecodesign and lifecycle assessment (LCA) Involvement of supply chain based on IntegrityNext supplier onboarding and screening ISO certificated (ISO 14001 EMS, ISO 50001 EnMS) External ratings Social Event sponsoring, volunteer hours at non-profit organizations and donations Dedicated human capital management Employee-driven diversity, equity & inclusion (DE&I) task force to support a diverse and inclusive workforce Strictly following ILO requirements Governance Comprehensive ethics and compliance policy, code of conduct and processes Dedicated human rights policy and supplier code of conduct Dedicated engagement in security – ISO 27001-certified 59th percentile 96th percentile Both Electrial and electronic equipment sector and global average are C SBTi Net Zero Commitment SBTi has classified ADTRAN‘s scope 1 and 2 target ambition as in line with a 1.5°C trajectory

Business update 5

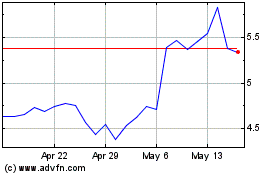

Q2 2024 business update Highlights Q2 2024 Revenue at $226m, above mid-point of guidance range (guidance $215m - 235m) Revenue within guidance range Further improvements in non-GAAP gross Margin. Increased by 37 bps QoQ and 334bps YoY Non-GAAP Gross Margin expansion Working Capital improved, down by $35.1m (-10%) QoQ Net inventory decreased by $34.2m QoQ Significantly reduced Working Capital Achieved positive non-GAAP operating margin. Non-GAAP operating margin at 0.7%, above mid-point of guidance (guidance -3% - +2%) Positive Non-GAAP Operating Margin Note: A reconciliation of each non-GAAP financial measure to the most comparable GAAP measure is included in the appendix of this presentation. Non-GAAP operating margin is calculated as non-GAAP operating profit divided by revenue. Non-GAAP gross margin is calculated as non-GAAP gross profit divided by revenue.

Q2 2024 business update Technology update Subscriber solutions Latest Wi-Fi 6/6E/7 platforms driving growth opportunities Dozens of customers have adopted Intellifi, our SaaS application for cloud-managed Wi-Fi Access and aggregation solutions Continued to scale SDX 6330 deployments across several large service providers in EMEA Increasing demand for SDX OLTs in U.S. regional service providers Optical networking solutions Growing demand for M-Flex800, focused on aggregating 10/100Gig links into 400/800Gig Continued success with securing packet optical wins with traditional Adtran broadband customers Software platforms Well over 400 customers have adopted Mosaic One. Highest growth application is Intellifi. Professional services Scalable in-region services, including planning, deployment, and maintenance

Q2 2024 business update Well diversified across technology, markets and customer base Categories Optical networking solutions Subscriber solutions Access & aggregation solutions Market Customers Large Regionals Enterprise / ICP / OEM Domestic International

Q2 2024 business update Revenue by segment, category and region Category Region Q2 2023 Q2 2024 $327.4 $226.0 Services & Support Network Solutions Q1 2024 Q2 2024 $226.2 $226.0 Y-o-Y Q-o-Q Q2 2023 Q2 2024 $327.4 $226.0 Access & Aggregation Subscriber Solutions Optical Networking Solutions Q1 2024 Q2 2024 $226.2 $226.0 Q2 2023 Q2 2024 $327.4 $226.0 International Domestic Q1 2024 Q2 2024 $226.2 $226.0 In $m Segments

Q2 2024 business update Financial information Q2 2023 Q2 2024 -31% Q2 2023 Q2 2024 38.6% 41.9% +334bps Q2 2023 Q2 2024 -24% Q2 2023 Q2 2024 Q2 2023 Q2 2024 Q1 2024 Q2 2024 0% Q1 2024 Q2 2024 41.6% 41.9% +37bps Q1 2024 Q2 2024 -9% Q1 2024 Q2 2024 Q1 2024 Q2 2024 Revenue ($m) Non-GAAP gross margin Non-GAAP OPEX ($m) Non-GAAP operating margin Non-GAAP diluted EPS ($) Year-over-year Quarter-over-quarter Note: A reconciliation of each non-GAAP financial measure to the most comparable GAAP measure is included in the appendix of this presentation. Non-GAAP operating margin is calculated as non-GAAP operating loss divided by revenue.

Q2 2024 business update Balance sheet and cash flow highlights In $m Q1 24 Q2 24 Trade accounts receivables $187.6 $186.2 Inventories $322.1 $287.9 Accounts payables $159.1 $158.6 Net working capital $350.6 $315.5 Operating cash flow generated $36.6 $19.9 Non-GAAP free cash flow * $23.2 $3.9 Cash $106.8 $111.2 Q2 23 60 Q3 23 67 Q4 23 59 Q1 24 60 Q2 24 DSO DPO Working capital and cash flow metrics Rolling DSO vs. DPO development Note: A reconciliation of each non-GAAP financial measure to the most comparable GAAP measure is included in the appendix of this presentation. *Non-GAAP free cash flow is operating cash flow less purchase of property, plant and equipment Days

GAAP to non-GAAP reconciliation 6