Addus HomeCare Corporation (NASDAQ: ADUS), a provider of home

care services, today announced its financial results for the fourth

quarter and year ended December 31, 2024.

Fourth Quarter 2024 Highlights:

- Net Service Revenues Grow 7.5% to $297.1 Million

- Net Income of $19.5 Million, or $1.07 per Diluted Share

- Adjusted Net Income per Diluted Share Increases 4.6%

year-over-year to $1.38

- Adjusted EBITDA Increases 10.3% year-over-year to $37.8

Million

- Cash Flow from Operations of $10.4 Million

- Completed acquisition of Gentiva personal care operations

Overview

Net service revenues were $297.1 million for the fourth quarter

of 2024, a 7.5% increase compared with $276.4 million for the

fourth quarter of 2023. Net income was $19.5 million for the fourth

quarter of 2024, compared with $19.6 million for the fourth quarter

of 2023, while net income per diluted share was $1.07 compared with

$1.20 for the same period a year ago. Adjusted EBITDA increased

10.3% to $37.8 million for the fourth quarter of 2024 from $34.3

million for the fourth quarter of 2023. Adjusted net income was

$25.2 million for the fourth quarter of 2024 compared with $21.6

million for the prior-year period, while adjusted net income per

diluted share was $1.38 compared with $1.32 for the fourth quarter

of 2023. Adjusted net income per diluted share for the fourth

quarter of 2024 excludes gain on sale of assets of ($0.15), impact

of lease impairment of $0.20, impact of retroactive New York rate

increase of ($0.14), acquisition expenses of $0.29 and stock-based

compensation expense of $0.11 (See the end of press release for a

reconciliation of all non-GAAP and GAAP financial measures.)

For the full year 2024, net service revenues increased 9.1% to

$1.15 billion from $1.06 billion for the prior-year period. Net

income was $73.6 million for 2024 compared with $62.5 million for

2023, and net income per diluted share was $4.23 compared with

$3.83 per diluted share. Adjusted EBITDA increased 15.9% to $140.3

million for 2024 from $121.0 million for 2023. Adjusted net income

was $91.4 million for 2024 compared with $74.8 million for 2023,

while adjusted net income per diluted share was $5.26 compared with

$4.58 for the prior-year period.

Commenting on the results, Dirk Allison, Chairman and Chief

Executive Officer, said, “Our fourth quarter financial and

operating performance marked a strong finish to another successful

year for Addus. We achieved top-line revenue growth of 7.5%, and

adjusted EBITDA was 10.3% higher for the fourth quarter of 2024

compared with the same period last year. For the year, revenues

were up 9.1% to reach $1.15 billion, a new annual high for Addus.

These results reflect robust demand for our home-based care

services and our ability to meet this demand with our proven

operating model across the care continuum.

“Our personal care services have been the key driver of our

business, accounting for 74.1% of our revenue for the fourth

quarter. We achieved a 5.8% organic revenue growth rate in personal

care over the fourth quarter last year, and our annual organic

growth was 7.7%, reflecting both higher volumes and favorable

reimbursement trends. Results for the fourth quarter included one

month from our acquisition of the personal care operations of

Gentiva, which closed on December 2, 2024. The consolidated

financial results for the fourth quarter excluded the Company’s

operations in New York, in connection with our previously announced

agreement with HCS-Girling to divest the Company’s New York

personal care operations and exit the state.

“Our hospice services accounted for 19.9% of our business with

solid organic revenue growth of 7.8% over the fourth quarter last

year. We are pleased with the steady improvement in average daily

census, patient days and revenue per patient day compared with the

same period last year. We implemented changes to our sales

leadership late in the third quarter which we believe will result

in continued improvement in admission volumes. Our home health

services, which is our smallest business segment, accounted for

6.0% of total revenue for the fourth quarter,” added Allison.

Cash and Liquidity

As of December 31, 2024, the Company had cash of $98.9 million

and bank debt of $223.0 million, with capacity and availability

under its revolving credit facility of $577.7 million and $346.6

million, respectively. Net cash provided by operating activities

was $10.4 million for the fourth quarter of 2024, and $116.4

million for the full year 2024, inclusive of a net $2.4 million in

ARPA funds utilization and $5.5 million in ARPA funds proceeds,

respectively.

Allison continued, “We are fortunate to have the financial

flexibility to invest in our business and pursue our strategic

growth initiatives. Acquisitions continue to be an important part

of our growth strategy, allowing us to expand our coverage

capabilities and build scale in strategic markets. The Gentiva

personal care operations represent the largest acquisition in our

history, adding approximately $280 million in annualized revenues

and significantly expanding our market coverage in seven states,

including Arizona, Arkansas, California, and Tennessee, as well as

Texas, Missouri, and North Carolina, which are new personal care

markets for Addus. Notably, we are now the largest provider of

personal care services in the state of Texas and the state of

Arkansas. Our respective teams have done an exceptional job in

planning for the operational changes associated with this

acquisition, and we are pleased that the integration process is on

schedule as we continue to provide quality home care services to

clients of those operations.

“We are optimistic that we will see additional acquisition

opportunities in 2025. We will maintain our disciplined approach to

acquisitions by identifying prospects that are a good strategic fit

for Addus, and our primary focus will be on markets where we can

leverage our personal care network and add clinical services. We

believe having three levels of care provides a distinct competitive

advantage for Addus in our markets and benefits the clients we

serve and strengthens our ability to negotiate more effectively

with payers.

“We are extremely proud of the important work we are doing and

our ability to execute our strategy with positive results. Addus

has a strong value proposition that meets the growing demand for

home-based care. We have significantly enhanced our market position

in 2024 through both organic growth and strategic acquisitions, and

we are well positioned for continued growth. We are especially

grateful for our dedicated team of caregivers, who support our

mission and continue to provide outstanding care and support for a

growing number of patients and clients in the home. Working

together, we look forward to the opportunities ahead for Addus in

2025 as we extend our market reach and deliver greater value to our

shareholders,” said Allison.

Non-GAAP Financial Measures

The information provided in this release includes adjusted net

income, adjusted EBITDA, adjusted net income per diluted share and

adjusted net service revenue, which are non-GAAP financial

measures. The Company defines adjusted net income as net income

before acquisition expense, stock-based compensation expense,

restructure and other non-recurring costs, gain or loss on the sale

of assets, impairment of operating lease assets, retroactive rate

increases from New York and the retroactive impact from collective

bargaining negotiations. The Company defines adjusted EBITDA as

earnings before net interest expense, taxes, depreciation,

amortization, acquisition expense, stock-based compensation

expense, restructure and other non-recurring costs, gain or loss on

the sale of assets, impairment of operating lease assets,

retroactive rate increases from New York and the retroactive impact

from collective bargaining negotiations. The Company defines

adjusted net income per diluted share as net income per share,

adjusted for acquisition expense, stock-based compensation expense,

restructure and other non-recurring costs, gain or loss on the sale

of assets, impairment of operating lease assets, retroactive rate

increases from New York and the retroactive impact from collective

bargaining negotiations. The Company defines adjusted net service

revenues as revenue adjusted for the closure of certain sites. The

Company has provided, in the financial statement tables included in

this press release, a reconciliation of adjusted net income to net

income, a reconciliation of adjusted EBITDA to net income, a

reconciliation of adjusted diluted net income per share to net

income per share, and a reconciliation of adjusted net service

revenues to net service revenues, in each case, the most directly

comparable GAAP measure. Management believes that adjusted net

income, adjusted EBITDA, adjusted diluted net income per share, and

adjusted net service revenues are useful to investors, management

and others in evaluating the Company’s operating performance, to

provide investors with insight and consistency in the Company’s

financial reporting and to present a basis for comparison of the

Company’s business operations among periods, and to facilitate

comparison with the results of the Company’s peers.

Conference Call

Addus will host a conference call on Tuesday, February 25, 2025,

at 9:00 a.m. Eastern time. To access the live call, dial (833)

629-0620 (international dial-in number is (412) 317-1805) and ask

to join the Addus HomeCare earnings call. A telephonic replay of

the conference call will be available through midnight on March 4,

2025, by dialing (877) 344-7529 (international dial-in number is

(412) 317-0088) and entering pass code 3644763.

A live broadcast of Addus HomeCare’s conference call will be

available under the Investor Relations section of the Company’s

website: www.addus.com. An online replay will also be available on

the Company’s website for one month, beginning approximately two

hours following the conclusion of the live broadcast.

Forward-Looking Statements

Certain matters discussed in this press release constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements may be identified by words such as “preliminary,”

“continue,” “expect,” and similar expressions. These

forward-looking statements are based on our current expectations

and beliefs concerning future developments and their potential

effect on us. Forward-looking statements involve a number of risks

and uncertainties that may cause actual results to differ

materially from those expressed or implied by such forward-looking

statements, including discretionary determinations by government

officials, the consummation and integration of acquisitions,

transition to managed care providers, our ability to successfully

execute our growth strategy, unexpected increases in SG&A and

other expenses, expected benefits and unexpected costs of

acquisitions and dispositions, management plans related to

dispositions, the possibility that expected benefits may not

materialize as expected, the failure of the business to perform as

expected, changes in reimbursement, changes in government

regulations, changes in Addus HomeCare’s relationships with

referral sources, increased competition for Addus HomeCare’s

services, changes in the interpretation of government regulations,

the uncertainty regarding the outcome of discussions with managed

care organizations, changes in tax rates, the impact of adverse

weather, higher than anticipated costs, lower than anticipated cost

savings, estimation inaccuracies in future revenues, margins,

earnings and growth, whether any anticipated receipt of payments

will materialize, any security breaches, cyber-attacks, loss of

data or cybersecurity threats or incidents, and other risks set

forth in the Risk Factors section in Addus HomeCare’s Annual Report

on Form 10-K filed with the Securities and Exchange Commission on

February 27, 2024, which is available at www.sec.gov. The financial information described herein and

the periods to which they relate are preliminary estimates that are

subject to change and finalization. There is no assurance that the

final amounts and adjustments will not differ materially from the

amounts described above, or that additional adjustments will not be

identified, the impact of which may be material. Addus HomeCare

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. In addition, these forward-looking statements

necessarily depend upon assumptions, estimates and dates that may

be incorrect or imprecise and involve known and unknown risks,

uncertainties, and other factors. Accordingly, any forward-looking

statements included in this press release do not purport to be

predictions of future events or circumstances and may not be

realized. (Unaudited tables and notes follow).

About Addus HomeCare

Addus HomeCare is a provider of home care services that

primarily include personal care services that assist with

activities of daily living, as well as hospice and home health

services. Addus HomeCare’s consumers are primarily persons who,

without these services, are at risk of hospitalization or

institutionalization, such as the elderly, chronically ill and

disabled. Addus HomeCare’s payor clients include federal, state,

and local governmental agencies, managed care organizations,

commercial insurers, and private individuals. Addus HomeCare

currently provides home care services to approximately 62,000

consumers through 257 locations across 23 states. For more

information, please visit www.addus.com.

ADDUS HOMECARE CORPORATION AND

SUBSIDIARIES

Condensed Consolidated

Statements of Income

(amounts and shares in

thousands, except per share data)

(Unaudited)

Income Statement Information:

For the Three Months Ended

December 31,

For the Twelve Months Ended

December 31,

2024

2023

2024

2023

Net service revenues

$

297,144

$

276,351

$

1,154,599

$

1,058,651

Cost of service revenues

195,662

183,938

779,578

718,775

Gross profit

101,482

92,413

375,021

339,876

34.2

%

33.4

%

32.5

%

32.1

%

General and administrative expenses

71,356

60,766

258,800

234,794

Depreciation and amortization

3,214

3,677

13,530

14,126

Total operating expenses

74,570

64,443

272,330

248,920

Operating income

26,912

27,970

102,691

90,956

Total interest expense, net

698

2,616

3,338

9,630

Income before income taxes

26,214

25,354

99,353

81,326

Income tax expense

6,688

5,776

25,755

18,810

Net income

$

19,526

$

19,578

$

73,598

$

62,516

Net income per diluted share:

$

1.07

$

1.20

$

4.23

$

3.83

Weighted average number of common shares outstanding:

Diluted

18,294

16,307

17,380

16,311

Cash Flow Information:

For the Three Months Ended

December 31,

For the Twelve Months Ended

December 31,

2024

2023

2024

2023

Net cash provided by operating activities

$

10,418

$

30,049

$

116,434

$

112,247

Net cash (used in) investing activities

(354,486

)

(5,302

)

(354,610

)

(119,236

)

Net cash provided by (used in) financing activities

220,127

(39,706

)

272,296

(8,181

)

Net change in cash

(123,941

)

(14,959

)

34,120

(15,170

)

Cash at the beginning of the period

222,852

79,750

64,791

79,961

Cash at the end of the period

$

98,911

$

64,791

$

98,911

$

64,791

ADDUS HOMECARE CORPORATION AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(Amounts in thousands)

(Unaudited)

December 31,

2024

2023

Assets Current assets

Cash

$

98,911

$

64,791

Accounts receivable, net

122,880

115,499

Prepaid expenses and other current assets

38,591

19,714

Total current assets

260,382

200,004

Property and equipment, net

24,703

24,011

Other assets Goodwill

970,558

662,995

Intangible assets, net

109,643

91,983

Operating lease assets

47,348

45,433

Total other assets

1,127,549

800,411

Total assets

$

1,412,634

$

1,024,426

Liabilities and stockholders'

equity Current liabilities Accounts payable

$

27,176

$

26,183

Accrued payroll

62,053

56,551

Accrued expenses

28,959

33,236

Operating lease liabilities - current portion

12,800

11,339

Government stimulus advance

11,239

5,765

Accrued workers compensation

13,644

12,043

Total current liabilities

155,871

145,117

Long-term debt, less current portion, net of debt issuance

costs

218,443

124,132

Long-term lease liability, less current portion

41,883

39,711

Deferred tax liabilities, net

25,820

8,529

Other long-term liabilities

125

243

Total long-term liabilities

286,271

172,615

Total liabilities

442,142

317,732

Total stockholders' equity

970,492

706,694

Total liabilities and stockholders' equity

$

1,412,634

$

1,024,426

ADDUS HOMECARE CORPORATION AND

SUBSIDIARIES

Net Service Revenue by

Segment

(Amounts in thousands)

(Unaudited)

For the Three Months Ended

December 31,

For the Twelve Months Ended

December 31,

2024

2023

2024

2023

Net Service Revenues by Segment Personal Care

$

220,328

$

204,491

$

856,581

$

794,718

Hospice

58,989

54,741

228,191

207,155

Home Health

17,827

17,119

69,827

56,778

Total Revenue

$

297,144

$

276,351

$

1,154,599

$

1,058,651

ADDUS HOMECARE CORPORATION AND

SUBSIDIARIES

Key Statistical and Financial

Data (Unaudited)

For the Three Months Ended

December 31,

For the Twelve Months Ended

December 31,

2024

2023

2024

2023

Personal Care States served at period

end

-

-

23

21

Locations at period end

-

-

196

156

Average billable census - same store (1, 2)

36,342

38,078

37,438

38,521

Average billable census - acquisitions (3)

14,581

-

14,581

-

Average billable census total

50,923

38,078

52,019

38,521

Billable hours (in thousands)

8,210

7,694

31,309

30,658

Average billable hours per census per month (3)

69.6

67.2

71.5

66.2

Billable hours per business day

124,397

118,366

119,498

117,915

Revenues per billable hour

$

26.40

$

26.53

$

27.21

$

25.86

Organic growth - Revenue

5.8

%

11.2

%

7.7

%

12.1

%

Hospice Locations served at period end

-

-

38

39

Admissions

3,095

3,326

12,866

12,902

Average daily census

3,472

3,381

3,461

3,415

Average discharge length of stay

97.9

97.8

94.1

94.4

Patient days

319,460

311,015

1,266,701

1,203,522

Revenue per patient day

$

185.95

$

176.01

$

181.08

$

175.43

Organic growth - Revenue

7.8

%

3.5

%

5.9

%

2.0

%

- Average daily census

2.7

%

(1.1

)%

1.3

%

0.3

%

Home Health Locations served at period end

-

-

24

24

New Admissions

4,365

4,654

18,622

16,251

Recertifications

3,249

3,214

13,047

9,030

Total Volume

7,614

7,868

31,669

25,281

Visits

99,803

104,161

422,516

344,919

Organic growth - Revenue

1.6

%

(17.8

)%

(3.1

)%

(7.1

)%

- New admissions

(6.2

)%

(10.3

)%

(3.0

)%

(9.8

)%

- Volume

(3.2

)%

(9.2

)%

(1.9

)%

(7.2

)%

Percentage of Revenues by Payor: Personal

Care State, local and other governmental programs

54.2

%

50.5

%

53.3

%

50.4

%

Managed care organizations

43.1

46.4

44.0

46.2

Private duty

2.0

1.9

1.8

2.0

Commercial

0.5

0.8

0.7

0.8

Other

0.2

%

0.4

%

0.2

%

0.6

%

Hospice Medicare

91.4

%

89.3

%

91.2

%

89.9

%

Commercial

4.9

6.3

5.1

6.0

Managed care organizations

3.5

3.7

3.3

3.4

Other

0.2

%

0.7

%

0.4

%

0.7

%

Home Health Medicare

69.2

%

68.8

%

69.5

%

72.3

%

Managed care organizations

24.2

25.5

25.2

22.2

Commercial

2.9

4.4

3.9

4.4

Other

3.7

%

1.3

%

1.4

%

1.1

%

(1) The average billable census in acquisitions of 85 and 91 for

the three and twelve months ended December 31, 2023, was

reclassified to average billable census - same stores for

comparability purposes. (2) Exited sites would have reduced same

store census for the three and twelve months ended December 31,

2023, by 1,401 and 1,446, respectively. Exited stores would have

reduced same store census for the twelve months ended December 31,

2024, by 964. (3) The average billable census and average billable

hours per census per month for the three and twelve months ended

December 31, 2024, were prorated for the date of the acquisition.

ADDUS HOMECARE CORPORATION AND

SUBSIDIARIES

Reconciliation of Non-GAAP

Financial Measures

(Amounts in thousands, except

per share data)

(Unaudited) (1)

For the Three Months Ended

December 31,

For the Twelve Months Ended

December 31,

2024

2023

2024

2023

Reconciliation of Adjusted EBITDA to Net Income: (1)

Net income

$

19,526

$

19,578

$

73,598

$

62,516

Interest expense, net

698

2,616

3,338

9,630

(Gain) Loss on sale of assets

(3,725

)

3

(3,738

)

(2

)

Income tax expense

6,688

5,776

25,755

18,810

Depreciation and amortization

3,214

3,677

13,530

14,126

Impact of lease impairment

4,968

-

4,968

-

Impact of retroactive New York rate increase

(3,487

)

-

(3,004

)

(868

)

Impact of retroactive collective bargaining negotiations

-

(1,338

)

-

-

Acquisition expenses

7,031

1,428

14,678

6,220

Stock-based compensation expense

2,858

2,488

11,165

10,319

Restructure and other non-recurring costs

-

27

-

269

Adjusted EBITDA

$

37,771

$

34,255

$

140,290

$

121,020

Reconciliation of Adjusted Net Income to Net

Income: (2) Net income

$

19,526

$

19,578

$

73,598

$

62,516

(Gain) Loss on sale of assets

(3,725

)

3

(3,738

)

(2

)

Impact of lease impairment

4,968

-

4,968

-

Impact of retroactive New York rate increase

(3,487

)

-

(3,004

)

(868

)

Impact of retroactive collective bargaining negotiations

-

(1,338

)

-

-

Acquisition expenses

7,031

1,428

14,678

6,219

Stock-based compensation expense

2,858

2,488

11,165

10,319

Restructure and other non-recurring costs

-

27

-

269

Tax Effect

(1,958

)

(594

)

(6,240

)

(3,685

)

Adjusted Net Income

$

25,213

$

21,592

$

91,427

$

74,768

Reconciliation of Net Income per Diluted Share to

Adjusted Net Income per Diluted Share: (3) Net income

per diluted share

$

1.07

$

1.20

$

4.23

$

3.83

(Gain) Loss on the sale of assets per diluted share

(0.15

)

-

(0.16

)

-

Impact of lease impairment per diluted share

0.20

-

0.21

-

Impact of retroactive New York rate increase per diluted share

(0.14

)

-

(0.13

)

(0.04

)

Impact of retroactive collective bargaining negotiations

-

(0.07

)

-

-

Acquisition expenses per diluted share

0.29

0.07

0.63

0.29

Restructure and other non-recurring costs per diluted share

-

-

-

0.01

Stock-based compensation expense per diluted share

0.11

0.12

0.48

0.49

Adjusted net income per diluted share

$

1.38

$

1.32

$

5.26

$

4.58

Reconciliation of Net Service Revenues to Adjusted Net

Service Revenues: (4) Net service revenues

$

297,144

$

276,351

$

1,154,599

$

1,058,651

Revenues associated with the closure of certain sites

(3,447

)

(23,158

)

(71,230

)

(92,877

)

Adjusted net service revenues

$

293,697

$

253,193

$

1,083,369

$

965,774

Footnotes: (1) We define Adjusted EBITDA as earnings before

net interest expense, other non-operating income, taxes,

depreciation, amortization, acquisition expense, stock-based

compensation expense, restructure and other non-recurring costs,

gain or loss on the sale of assets, impairment of operating lease

assets, retroactive rate increases from New York and the

retroactive impact from collective bargaining negotiations.

Adjusted EBITDA is a performance measure used by management that is

not calculated in accordance with generally accepted accounting

principles in the United States (GAAP). It should not be considered

in isolation or as a substitute for net income, operating income or

any other measure of financial performance calculated in accordance

with GAAP. Additionally, our calculation of Adjusted EBITDA may not

be comparable to similarly titled measures reported by other

companies. We believe that Adjusted EBITDA is useful to investors,

management and others in evaluating the Company's operating

performance, to provide investors with insight and consistency in

the Company's financial reporting and to present a basis for

comparison of the Company's business among periods, and to

facilitate comparison with results of the Company's peers.

Additionally, we believe that Adjusted EBITDA is a measure widely

used by securities analysts, investors and others to evaluate the

financial performance of other public companies. The financial

results presented in accordance with U.S GAAP and a reconciliation

of this non-GAAP measure included within our Annual Report on Form

10-K should be carefully evaluated. (2) We define Adjusted Net

Income as net income before acquisition expenses, stock-based

compensation expense, restructure and other non-recurring costs,

gain on the sale of assets, lease impairment, retroactive

collective bargaining negotiations and retroactive rate increases

from New York. Adjusted Net Income is a performance measure used by

management that is not calculated in accordance with generally

accepted accounting principles in the United States (GAAP). It

should not be considered in isolation or as a substitute for net

income, operating income or any other measure of financial

performance calculated in accordance with GAAP. (3) We define

Adjusted diluted earnings per share as earnings per share, adjusted

for acquisition expenses, stock-based compensation expense and

restructure and other non-recurring costs, gain on the sale of

assets, lease impairment, retroactive collective bargaining

negotiations and retroactive rate increases from New York. Adjusted

diluted earnings per share is a performance measure used by

management that is not calculated in accordance with generally

accepted accounting principles in the United States (GAAP). It

should not be considered in isolation or as a substitute for net

income, operating income or any other measure of financial

performance calculated in accordance with GAAP. (4) We define

Adjusted net service revenues as revenue adjusted for the closure

of certain sites. Adjusted net service revenues is a performance

measure used by management that is not calculated in accordance

with generally accepted accounting principles in the United States

(GAAP). It should not be considered in isolation or as a substitute

for net income, operating income or any other measure of financial

performance calculated in accordance with GAAP.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224064978/en/

Brian W. Poff Executive Vice President, Chief Financial Officer

Addus HomeCare Corporation (469) 535-8200

investorrelations@addus.com

Dru Anderson FINN Partners (615) 324-7346

dru.anderson@finnpartners.com

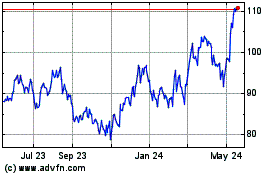

Addus HomeCare (NASDAQ:ADUS)

Historical Stock Chart

From Jan 2025 to Feb 2025

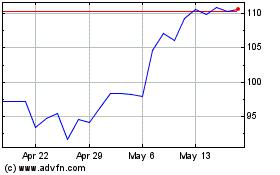

Addus HomeCare (NASDAQ:ADUS)

Historical Stock Chart

From Feb 2024 to Feb 2025