false000150175600015017562024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

November 4, 2024

Date of Report (Date of earliest event reported)

Adverum Biotechnologies, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-36579 | 20-5258327 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

100 Cardinal Way

Redwood City, CA 94063

(Address of principal executive offices, including zip code)

(650) 656-9323

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a–12 under the Exchange Act (17 CFR 240.14a–12)

☐ Pre-commencement communications pursuant to Rule 14d–2(b) under the Exchange Act (17 CFR 240.14d–2(b))

☐ Pre-commencement communications pursuant to Rule 13e–4(c) under the Exchange Act (17 CFR 240.13e–4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock | | ADVM | | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 4, 2024, Adverum Biotechnologies, Inc. issued a press release announcing its financial results for the quarter ended September 30, 2024, and providing a corporate update. A copy of such press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this report, including the exhibit hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this report and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Adverum Biotechnologies, Inc., whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | The cover page of this report has been formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Adverum Biotechnologies, Inc. |

| | |

Date: November 4, 2024 | By: | /s/ Laurent Fischer |

| | Laurent Fischer, M.D.

President and Chief Executive Officer |

Exhibit 99.1

Adverum Biotechnologies Reports Third Quarter 2024 Financial Results, Provides Corporate Highlights and Updates Anticipated Milestones

- 52-week LUNA and 4-year OPTIC data, alongside Phase 3 trial design updates, anticipated in Q4 2024

- Appointed Jason Mitchell as chief commercial officer

- On-track to initiate pivotal program in 1H 2025

- $153.2 million in cash, cash equivalents and short-term investments expected to fund operations into late 2025

REDWOOD CITY, Calif., November 4, 2024 -- Adverum Biotechnologies, Inc. (Nasdaq: ADVM), a clinical-stage company pioneering the use of gene therapy as a new standard of care for highly prevalent ocular diseases, today reported financial results for the third quarter of 2024 and provided updates to anticipated milestones.

“We remain laser focused on initiating our Phase 3 program and progressing Ixo-vec toward approval and commercialization,” stated Laurent Fischer, M.D., president and chief executive officer of Adverum Biotechnologies. “Over the past year we’ve presented LUNA clinical data supporting what I believe to be the best-in-class product candidate for wet AMD patients. These data echo, and even improve upon, Ixo-vec’s robust and durable efficacy and favorable long-term safety profile which have been demonstrated out to 3 years. Later this quarter we look forward to presenting the LUNA 52-week data alongside the 4-year OPTIC data. We are closing in on our goal to bring a potentially transformational gene therapy to wet AMD patients, who suffer from a life-long disease that, even with the best available agents, requires frequent injections into the eye.”

Corporate Highlights

•Appointed Jason Mitchell as Chief Commercial Officer

◦In October 2024, we announced the appointment of Jason L. Mitchell as chief commercial officer. Mr. Mitchell brings to Adverum over 20 years of commercial experience, including most recently in retinal disease, where he oversaw the successful launch of SYFOVRE®, the first treatment approved for geographic atrophy (GA). In his new role, Mr. Mitchell will be responsible for setting the launch strategy and building the commercial infrastructure for Ixo-vec, Adverum’s one-time intravitreal injection for the treatment of neovascular or wet AMD.

Upcoming Anticipated Milestones

•4Q 2024: LUNA 52-week data update, including all-available safety follow-up

•4Q 2024: OPTIC 4-year clinical data update

•4Q 2024: Phase 3 pivotal trial design update

•H1 2025: Planned initiation of Phase 3 trial

Financial Results for the Three Months Ended September 30, 2024

•Cash, cash equivalents and short-term investments were $153.2 million as of September 30, 2024, compared to $96.5 million as of December 31, 2023. Adverum expects its cash, cash equivalents and short-term investments to fund operations into late 2025.

•Research and development expenses were $20.4 million for the three months ended September 30, 2024, compared to $20.7 million for the same period in 2023. Research and development expenses decreased due to lower facilities related expenses partially offset by higher spending on Ixo-vec clinical development and higher compensation expenses. Stock-based compensation expense included in research and development expenses was $1.1 million for the third quarter of 2024.

•General and administrative expenses were $9.8 million for the three months ended September 30, 2024, compared to $13.8 million for the same period in 2023. General and administrative expenses decreased due to lower facilities related expenses, lower depreciation expense, and lower compensation expenses due lower stock-based compensation expense. Stock-based compensation expense included in general and administrative expenses was $1.9 million for the third quarter of 2024.

•Net loss was $27.1 million, or $1.30 per basic and diluted share, for the three months ended September 30, 2024, compared to $32.9 million, or $3.26 per basic and diluted share for the same period in 2023.

About Wet Age-Related Macular Degeneration

Wet AMD, also known as neovascular AMD or nAMD, is a VEGF-driven advanced form of age-related macular degeneration (AMD) associated with the build-up of fluid in the macula and the retina. Wet AMD is a leading cause of blindness in people over 65 years of age, with approximately 20 million individuals worldwide living with this condition. New cases of wet AMD are expected to grow significantly worldwide as populations age. AMD is expected to impact 288 million people worldwide by 2040, with wet AMD accounting for approximately 10% of those cases. Additionally, wet AMD is a bilateral disease, and incidence of nAMD in the second eye is up to 42% in the first two to three years. The current standard of care requires frequent life-long bolus injections of anti-VEGF in the eye. Intravitreal (IVT) gene therapy has the promise to preserve vision and reduce most or all injections for the life of the patient by delivering stable therapeutic levels of anti-VEGF to control fluid associated with the disease.

About Ixo-vec in Wet AMD

Adverum is developing ixoberogene soroparvovec (Ixo-vec, formerly referred to as ADVM-022), its clinical-stage gene therapy product candidate, for the treatment of wet AMD. Ixo-vec utilizes a proprietary vector capsid, AAV.7m8, carrying an aflibercept coding sequence under the control of a proprietary expression cassette. Unlike other ophthalmic gene therapies that require surgery to administer the gene therapy under the retina (sub-retinal approach), Ixo-vec is designed to be administered as a one-time IVT injection in the physician’s office, deliver long-term efficacy, reduce the burden of frequent anti-VEGF injections into the eye, optimize patient compliance and improve vision outcomes for patients with wet AMD. Ixo-vec is currently being evaluated for the treatment of neovascular or wet AMD in the ongoing LUNA Phase 2 clinical trial (NCT05536973) and the OPTIC Phase 1 extension study (NCT04645212). In recognition of the need for new treatment options for wet AMD, FDA has granted Fast Track and RMAT designations for Ixo-vec for the treatment of wet AMD. Ixo-vec has also received PRIME designation from the European Medicines Agency and the Innovation Passport from the United Kingdom’s Medicines and Healthcare products Regulatory Agency for the treatment of wet AMD.

About Adverum Biotechnologies

Adverum Biotechnologies (NASDAQ: ADVM) is a clinical-stage company that aims to establish gene therapy as a new standard of care for highly prevalent ocular diseases with the aspiration of developing functional cures to restore vision and prevent blindness. Leveraging the capabilities of its proprietary intravitreal (IVT) platform, Adverum is developing durable, single-administration therapies, designed to be delivered in physicians’ offices, to eliminate the need for frequent ocular injections to treat these diseases. Adverum is evaluating its novel gene therapy candidate, ixoberogene soroparvovec (Ixo-vec, formerly referred to as ADVM-022), as a one-time, IVT injection for patients with neovascular or wet age-related macular degeneration. Additionally, by overcoming the challenges associated with current treatment paradigms for debilitating ocular diseases, Adverum aspires to transform the standard of care, preserve vision, and create a profound societal impact around the globe. For more information, please visit www.adverum.com.

Forward-looking Statements

Statements contained in this press release regarding events or results that may occur in the future are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include but are not limited to statements regarding the anticipated timing of clinical data and trial design update for the Phase 3 LUNA trial and initiation of a Phase 3 trial, the Company’s cash sufficiency and runway, expectations concerning the decisions of regulatory bodies, the therapeutic and commercial potential of Ixo-vec, and the favorable safety profile and potential best-in-class product profile of Ixo-vec. Actual results could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, including risks inherent to, without limitation: Adverum’s novel technology, which makes it difficult to predict the timing of commencement and completion of clinical trials; regulatory uncertainties; enrollment uncertainties; the results of early clinical trials not always being predictive of future clinical trials and results; the potential for future complications or side effects in connection with use of Ixo-vec; and risks associated with market conditions. Additional risks and uncertainties facing Adverum are set forth under the caption “Risk Factors” and elsewhere in Adverum’s Securities and Exchange Commission (SEC) filings and reports, including Adverum’s most recent Annual Report on Form 10-K filed with the SEC, as updated by any subsequent reports on Form 10-Q. All forward-looking statements contained in this press release speak only as of the date on which they were made. Adverum undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Corporate, Investor and Media Inquiries

Adverum Biotechnologies, Inc.

E: ir@adverum.com

| | | | | | | | | | | | | | |

Adverum Biotechnologies, Inc. |

Selected Consolidated Balance Sheet Data |

(In thousands) |

| | September 30, | | December 31, |

| | 2024 | | 2023 |

| | (Unaudited) | | (1) |

Cash and cash equivalents, and marketable securities | | $ | 153,241 | | | $ | 96,526 | |

Total assets | | 234,375 | | | 173,010 | |

Total current liabilities | | 27,657 | | | 24,914 | |

| | | | |

Total stockholders' equity | | 144,116 | | | 83,469 | |

| | | | |

(1) Derived from Adverum’s annual audited consolidated financial statements. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Adverum Biotechnologies, Inc. |

Condensed Consolidated Statements of Operations |

(In thousands except per share data) |

| | Three months ended September 30, | | Nine months ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (Unaudited) |

| | | | | | | | |

License revenue | | $ | 1,000 | | | $ | — | | | $ | 1,000 | | | $ | 3,600 | |

| | | | | | | | |

Operating expenses: | | | | | | | | |

Research and development | | 20,439 | | | 20,740 | | | 52,946 | | | 62,398 | |

General and administrative | | 9,782 | | | 13,789 | | | 24,996 | | | 39,035 | |

Total operating expenses | | 30,221 | | | 34,529 | | | 77,942 | | | 101,433 | |

Operating loss | | (29,221) | | | (34,529) | | | (76,942) | | | (97,833) | |

Other income, net | | 2,087 | | | 1,661 | | | 6,545 | | | 4,437 | |

Net loss before income taxes | | (27,134) | | | (32,868) | | | (70,397) | | | (93,396) | |

Income tax provision | | — | | | (17) | | | — | | | (55) | |

Net loss | | (27,134) | | | (32,885) | | | (70,397) | | | (93,451) | |

Net loss per share — basic and diluted | | $ | (1.30) | | | $ | (3.26) | | | $ | (3.63) | | | $ | (9.28) | |

Weighted-average common shares outstanding - basic and diluted | | 20,876 | | 10,100 | | 19,408 | | 10,069 |

| | | | | | | | |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

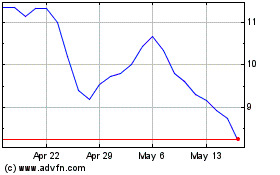

Adverum Biotechnologies (NASDAQ:ADVM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Adverum Biotechnologies (NASDAQ:ADVM)

Historical Stock Chart

From Dec 2023 to Dec 2024