Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 26 2023 - 3:15PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of July 2023

ANTELOPE

ENTERPRISE HOLDINGS LTD.

(Translation

of registrant’s name into English)

Room

1802, Block D, Zhonghai International Center,

Hi-Tech

Zone, Chengdu, Sichuan Province, PRC

Telephone

+86 (28) 8532 4355

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

On

July 25, 2023, Antelope Enterprise Holdings Limited (the “Company”) received a deficiency notice from the Listing

Qualifications Department (the “Staff”) of the Nasdaq Stock Market (“NASDAQ”) informing the Company

that its Class A ordinary shares failed to maintain a minimum bid price of $1.00 over the previous 30 consecutive business days as required

by the Listing Rules 5550(a)(2) of the NASDAQ. The Notification Letter does not impact the Company’s listing on the Nasdaq Capital

Market at this time.

In

accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has been provided 180 calendar days, or until January 22, 2024 (the “Compliance

Date”), to regain compliance with Nasdaq Listing Rule 5550(a)(2). To regain compliance, the Company’s Class A ordinary

shares must have a closing bid price of at least US$1.00 for a minimum for 10 consecutive business days, and must not have a closing

bid price of $0.10 or less for over 10 consecutive trading days by the Compliance Date. In the event the Company does not regain compliance

by the Compliance Date, the Company may be eligible for additional time to regain compliance or may face delisting.

If

the Company does not regain compliance with the minimum bid price requirement as set forth in Nasdaq Listing Rule 5550(a)(2) by

the Compliance Date and is not eligible for an additional compliance period at that time, the Staff will provide written notification

to the Company that its Class A ordinary shares may be delisted. The Company would then be entitled to appeal the Staff’s determination

to a NASDAQ Listing Qualifications Panel and request a hearing. There can be no assurance that, if the Company does appeal the delisting

determination by the Staff to the NASDAQ Listing Qualifications Panel, that such appeal would be successful.

The

Company intends to monitor the closing bid price of its Class A ordinary shares and may, if appropriate, consider available options to

regain compliance with the minimum bid price requirement, which could include effecting a reverse stock split. However, there

can be no assurance that the Company will be able to regain compliance with the minimum bid price requirement.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

ANTELOPE

ENTERPRISE HOLDINGS LTD. |

| |

|

|

| |

By: |

/s/

Hen Man Edmund |

| |

|

Hen

Man Edmund |

| |

|

Chief

Financial Officer |

Date:

July 26, 2023

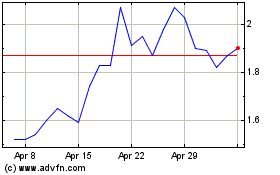

Antelope Enterprise (NASDAQ:AEHL)

Historical Stock Chart

From Jun 2024 to Jul 2024

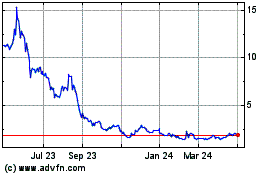

Antelope Enterprise (NASDAQ:AEHL)

Historical Stock Chart

From Jul 2023 to Jul 2024