false

0001800637

0001800637

2024-08-30

2024-08-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

August 30, 2024

AGRIFY CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-39946 |

|

30-0943453 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

2468 Industrial Row Dr.

Troy, MI |

|

48084 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (617) 896-5243

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

AGFY |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry Into

a Material Definitive Agreement.

As previously reported, effective as of October

18, 2023, Agrify Corporation (the “Company”) entered into a Modification and Settlement Agreement (the “Modification

Agreement”) with Mack Molding Company (“Mack”). Pursuant to the Modification Agreement, the Company and Mack agreed

to settle an outstanding dispute of approximately $8.24 million under the Supply Agreement between the parties dated December 7, 2020

(the “Supply Agreement”) by reducing the aggregate amount due to Mack and extending the timeline for payment. The Modification

Agreement required the Company to make payments of $500,000 and $250,000 to Mack on or before November 1, 2023 and February 15, 2024,

respectively. Following the November 1, 2023 payment, the Company was entitled to take possession of certain Vertical Farming Units (“VFUs”)

that were assembled under the Supply Agreement. The Modification Agreement also required the Company to purchase from Mack a minimum of

25 VFUs per quarter for each quarter during 2024 and a minimum of 50 VFUs per quarter for the six quarters beginning with the first quarter

of 2025. The Company is required to pay a storage fee of $25,000 per month for VFUs subject to the Modification Agreement. Additionally,

as part of the Modification Agreement, the Company agreed to issue to Mack a warrant (the “Mack Warrant”) to purchase 750,000

shares of the Company’s common stock at an exercise price of $4.00 per share.

On August 30, 2024, the Company and Mack entered into

an amendment to the Modification Agreement (the “Amendment”), which modified the payment terms and VFU purchase requirements

under the Modification Agreement. Pursuant to the Amendment, the Company agreed to make payments of $1.0 million prior to October 31,

2024 and an additional $1.0 million prior to December 31, 2024. The Company also agreed to purchase at least 25 VFUs prior to October

31, 2024 and a further 25 VFUs between November 1, 2024 and December 31, 2024. Upon payment in accordance with the terms of the Amendment,

the Company will be entitled to certain residual inventory in the possession of Mack, and the Mack Warrant will be terminated.

The foregoing summary

of the Amendment does not purport to be complete, and is qualified in its entirety by reference to a copy of the Amendment that is filed

as Exhibit 10.1 hereto.

Item

5.07. Submission of Matters to a Vote of Security Holders.

Effective September 3,

2024, the holders of a majority of the voting power of the capital stock of the Company executed a written consent (i) authorizing, for

purposes of complying with Nasdaq Listing Rule 5635(d), the issuance of up to $15.0 million in shares of the Company’s common stock

pursuant to the previously disclosed purchase agreement, dated August 28, 2024 the (“Purchase Agreement”), with Ionic Ventures,

LLC (“Ionic”), in an amount equal to or in excess of 20% of the number of shares of common stock outstanding immediately prior

to the execution of the Purchase Agreement (the “Ionic Share Issuance”), and (ii) approving a grant of discretionary authority

to the board of directors of the Company (the “Board”) to, without further stockholder approval, effect a reverse stock split

of the Company’s issued and outstanding common stock within a range of between 1-for-2 and 1-for-20 (the “Reverse Stock Split”)

by filing an amendment (the “Amendment”) to the Company’s Articles of Incorporation, as amended, with the Secretary

of State of the State of Nevada, with the final determination of whether to proceed, the effective time, and the exact ratio of the Reverse

Stock Split to be determined by the Board.

On August 30, 2024, CP Acquisitions,

LLC, an entity affiliated with and controlled by Raymond Chang, the Company’s Chairman and Chief Executive Officer, and I-Tseng

Jenny Chan, a member of the Board, elected to exercise pre-funded warrants for 5,746,900 shares of common stock, and assigned its rights

to receive such shares to entities affiliated with Mr. Chang and Ms. Chan. Following the exercise, there were 19,977,347 shares of common

stock outstanding.

The written consent was signed

by the holders of 10,000,000 shares of the Company’s issued and outstanding common stock. Accordingly, the holders of approximately

50.1% of the voting power of the Company’s capital stock as of September 3, 2024 signed the written consent approving the Ionic

Share Issuance, the Reverse Stock Split, and the Amendment. The Board also previously approved the Ionic Share Issuance, the Reverse Stock

Split, and the Amendment.

Pursuant to rules adopted

by the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended, a definitive information statement on

Schedule 14C will be filed with the Securities and Exchange Commission and sent or provided to the stockholders of the Company.

Item 9.01. Financial

Statements and Exhibits.

(d)

Exhibits.

| † | Certain confidential portions of this exhibit were omitted pursuant to Item 601(b)(2)(ii) of Regulation S-K because the identified

confidential portions (i) are not material and (ii) are customarily and actually treated as private or confidential by the Company. |

| * | Schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The registrant hereby undertakes to furnish

copies of any of the omitted schedules and exhibits upon request by the U.S. Securities and Exchange Commission. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

AGRIFY CORPORATION |

| |

|

|

| Date: September 4, 2024 |

By: |

/s/ Raymond Nobu Chang |

| |

|

Raymond Nobu Chang |

| |

|

Chief Executive Officer |

3

Exhibit 10.1

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED

FROM THIS EXHIBIT

BECAUSE IT IS BOTH (I) NOT MATERIAL TO THE REGISTRANT AND (II) THE

REGISTRANT CUSTOMARILY AND ACTUALLY TREATS SUCH INFORMATION

AS

PRIVATE OR CONFIDENTIAL. REDACTED PORTIONS OF THIS EXHIBIT ARE MARKED

BY [***].

FIRST AMENDMENT TO MODIFICATION AND SETTLEMENT

AGREEMENT

This First Amendment to Modification

and Settlement Agreement (the “Amendment”) is hereby entered into by and between Agrify Corporation and its affiliates

and subsidiaries (“Agrify”) on the one hand, and Mack Molding Company and its affiliates and subsidiaries (“Mack”)

on the other hand, as of the date that all parties have signed the Agreement (the “Effective Date”). Agrify and Mack

are referred to herein individually as a “Party,” and collectively, as the “Parties.” As used herein,

the phrases “this Amendment,” “hereto,” “hereunder,” and phrases of like import shall mean this Amendment.

All capitalized terms not otherwise defined herein shall have the meanings ascribed to them in the Modification Agreement (as defined

below).

WHEREAS, the Parties entered

into a certain Supply Agreement effective December 7, 2020 (the “Supply Agreement”); and

WHEREAS, certain disputes

arose thereafter between the Parties concerning the Supply Agreement; and

WHEREAS, on October 18, 2023,

the Parties entered into that certain Modification and Settlement Agreement (the “Modification Agreement”) in order

to reach a resolution with respect to the aforementioned disputes under the Supply Agreement; and

WHEREAS, the Parties wish

to amend the Modification Agreement as set forth herein;

NOW, THEREFORE, the Parties,

in return for the mutual promises and consideration contained herein, the sufficiency of which is expressly acknowledged, agree as follows:

1. Recitals.

The foregoing recitals are incorporated into and form a part of this Amendment.

2. Settlement

Consideration. Notwithstanding anything contained in the Modification Agreement, in full settlement of the Claimed Outstanding Balance,

the Parties agree to the following payments (in addition to all payments already made under the Modification Agreement) and commitments:

| A. | Payment. Agrify agrees to pay Mack and Mack agrees to accept the following cash payments: (1) a

first payment of $1,000,000 on or before October 31, 2024 and (2) a second payment of $1,000,000 on or before December 31, 2024 (items

(1) and (2), collectively, the “Settlement Payment”). Agrify shall tender such payments pursuant to the following instructions: |

Wire transfer to:

[***]

[***]

[***]

[***]

[***]

[***]

| a. | Attached hereto as Exhibit 1 is the inventory and related materials that Mack intends to use to

construct the 50 VFUs described in Section 2.B.c below (the “Designated Inventory”). Attached hereto as Exhibit

2 is all inventory and related materials that (x) are owned by Agrify and consigned to Mack and (y) are not being used by Mack to

construct the 50 VFUs described in Section 2.B.c below (the “Residual Agrify Inventory”). As of the Effective Date,

the Residual Agrify Inventory shall be made available by Mack to Agrify either (i) to be removed from the Premises by Agrify (at Agrify’s

sole cost and expense) or (ii) to remain at the Premises, subject to Agrify’s continued timely payment of the Storage Fee (as described

below). Attached hereto as Exhibit 3 is a list of all remaining materials owned by Mack (the “Residual Mack Inventory”),

which shall remain Mack’s property until Mack’s indefeasible receipt of the Release Payments. |

| b. | Agrify covenants that all cash proceeds generated by Agrify’s sale of the Residual Agrify Inventory

shall be applied first to pay any amounts owed to Mack pursuant to Section 2.A, 2.B or 2.C of this Amendment. Agrify’s ability (or

inability) to sell the Residual Agrify Inventory and generate cash proceeds therefrom shall in no way limit or otherwise modify Agrify’s

payment obligations under this Amendment. |

| c. | Agrify agrees to purchase from Mack a minimum of 25 VFUs between the Effective Date and October 31, 2024

(such period, “Time Period 1”), and a minimum of 25 VFUs between November 1, 2024, and December 31, 2024 (such period,

“Time Period 2”). The purchase price per unit is $[***]. Payments for all orders shall be due 15 days after shipment

from Mack to Agrify’s designated location and Agrify’s receipt of an invoice for such product shipped provided, however, if

Agrify does not place orders for the minimum VFUs for each of Time Period 1 and Time Period 2, Agrify shall pay on the last business

day of each of Time Period 1 and Time Period 2 the difference between the required minimum order and the actual order placed for said

time period. By way of example only, $[***] of orders is due with respect to Time Period 1 and if Agrify only orders $[***] of VFUs during

Time Period 1, payment of $[***] shall be due within 15 days of shipment and the balance of $[***] shall be due on October 15, 2024.

For the avoidance of doubt and consistent with the Modification Agreement, if there is any shortfall in materials, Agrify will provide

the necessary materials and failure by Agrify or third-party suppliers to provide these parts, unless due to a Force Majeure Event (as

such term is defined in the Supply Agreement) shall not excuse Agrify from paying for the VFUs committed to and agreed upon in this Amendment. |

| d. | With respect to any VFUs that Agrify purchases from Mack pursuant to this Amendment, the provisions contained

in Sections 1, 2(c), 2(f), 5, 6(b)-(d), 8, 10, 12, 13, 14, 15, 16, 18, and 19 of the Supply Agreement shall apply to such transactions,

mutatis mutandis, to the extent not expressly inconsistent with any provision in this Amendment or the Modification Agreement.

All VFUs subject hereto must meet Agrify’s original design standards. |

| e. | If, and only if, Agrify timely and indefeasibly makes all payments required to Mack under (i) Section

2A, (ii) Section 2B, and (iii) Section 2C of this Amendment (excluding such payments under Section 2C that come due after indefeasible

payment in full in cash of all payments under Section 2A and Section 2B) (items (i) to (iii) together, collectively, the “Release

Payments”), following the receipt of such payments, (a) Mack shall release to Agrify (which Agrify may either retrieve at its

sole cost and expense or continue to store on the Premises, subject to continued Storage Fee payments) the Residual Agrify Inventory and

the Residual Mack Inventory, including parts and assemblies free and clear of all liens, claims and encumbrances, (b) all liens and security

interests granted to Mack pursuant to the Modification Agreement and this Amendment (including pursuant to Section 2E herein) shall be

deemed immediately and irrevocably terminated and (c) the Parties agree that the Stipulated Amount owed by Agrify to Mack shall be reduced

to $0. |

Pursuant to Section 2.C of the Modification

Agreement, Agrify shall continue to pay Mack the monthly Storage Fee to store those VFUs and related materials subject to this Amendment

and the Modification Agreement, which are stored at the Premises. Payment of the Storage Fee will not reduce the Stipulated Amount in

the event of an Amendment Termination Event (as defined below). For the avoidance of doubt, Agrify may continue to store any VFUs and

related materials on the Premises beyond December 31, 2024, subject to payment of the Storage Fee.

| a. | Issuance of Warrant. Upon indefeasible payment in full in cash of the Release Payments, the Warrant

(and all of Mack’s rights with respect thereto) shall terminate immediately. |

| E. | Security Interest / Intercreditor. |

As collateral security

for the full, prompt, complete and final payment and performance when due of all of Agrify’s obligations under the Modification

Agreement as modified by this Amendment, Agrify hereby grants to Mack a subordinate second lien security interest in all of Agrify’s

right, title and interest in, to and under all of Agrify’s assets, including, all of its goods, accounts, equipment, inventory,

the Property, contract rights or rights to payment of money, leases, license agreements, franchise agreements, general intangibles, commercial

tort claims, documents, instruments (including any promissory notes), chattel paper (whether tangible or electronic), cash, deposit accounts,

fixtures, securities, and all other investment property, supporting obligations, and financial assets, whether now owned or hereafter

acquired, wherever located (all of which being collectively referred to herein as the “Collateral”). Agrify hereby

irrevocably authorizes Mack at any time and from time to time to file in any relevant jurisdiction any financing statements (including

fixture filings) and amendments thereto that contain the information required by Article 9 of the Uniform Commercial Code of each applicable

jurisdiction for the filing of any financing statement or amendment relating to the Collateral and may provide a description of the Collateral

as “all assets now owned or hereafter acquired by the debtor” or similar verbiage. The parties intend for Mack’s

security interest to be a second priority lien on all of the Collateral, subject to that certain Intercreditor Agreement by and between

Mack and High Trail Special Situations LLC and its successors and assigns (the “Senior Lender”). Agrify hereby represents

and warrants that Mack’s security interest is the only second priority lien on all of the Collateral. In the event that the loan

with the Senior Lender is refinanced with a new lender, Mack shall execute a new intercreditor agreement substantially in the form of

Exhibit 2 of the Modification Agreement for the benefit of such new lender.

At the request of

Mack, Agrify shall take such further actions, and execute and/or deliver to Mack such additional financing statements, amendments, assignments,

agreements, supplements, powers and instruments, as Mack may in its reasonable judgment deem necessary or appropriate in order to perfect,

preserve and protect the security interest in the Collateral as provided in the Modification Agreement and this Amendment and the rights

and interests granted to Mack thereunder and hereunder, and enable Mack to exercise and enforce its rights, powers and remedies thereunder

and hereunder with respect to any Collateral.

| F. | Agrify hereby agrees and acknowledges that the liens and security interests granted in favor of Mack under

the terms of the Modification Agreement are perfected, effective, enforceable and valid, and such liens and security interests are, in

each case, a second priority lien and security interest. Agrify further agrees and acknowledges that, as of the date hereof, Mack has

fully and timely performed all of its obligations and duties in compliance with the Modification Agreement and applicable law, and has

acted reasonably, in good faith, and appropriately under the circumstances. |

| G. | Agrify stipulates and agrees that the Release Payments must be made timely and that no grace periods apply.

In the event of a default under this Amendment by Agrify, including but not limited to Agrify’s failure to timely make any Release

Payments when due, this Amendment shall, upon Mack’s written notice to Agrify via email at raymond.n.chang@gmail.com, immediately

terminate (such event, an “Amendment Termination Event”) and be of no further force and effect, and the Modification

Agreement shall immediately go back into effect as of the Amendment had never been in effect, except that Agrify shall receive dollar

for dollar credit against the Stipulated Amount for any indefeasible payments made under Sections 2.A and 2.B of this Amendment. Additionally,

notwithstanding the foregoing or anything contained herein to the contrary, Section 2.F and Section 5 shall survive an Amendment Termination

Event (the “Surviving Provisions”). |

3. Authorization.

Each Party warrants and represents to the other Party that its execution of this Amendment, and performance of its obligations hereunder,

has been duly authorized by all necessary corporate action of such Party.

4. Taxes.

Each Party shall be responsible for payment of their own taxes in connection with the actions taken in connection herewith.

5. Mutual

General Release. Upon the Parties’ execution hereof (and with respect to the releases in this Section 5 benefiting Agrify and

its Related Parties, subject to Agrify’s indefeasible payment in full of the Release Payments), and in consideration of the mutual

releases and for other good and valuable consideration identified herein, the receipt and sufficiency of which are hereby acknowledged,

the Parties on behalf of (i) themselves and (ii) their respective agents, assigns, attorneys, directors, employees, heirs, insurers, investors,

managers, members, officers, officials, owners, representatives, predecessors and successors in interest and sureties (as well as their

respective parents, subsidiaries, related entities and affiliates, and any of their agents, assigns, attorneys, directors, employees,

heirs, insurers, investors, managers, members, officers, officials, owners, representatives, predecessors and successors in interest and

sureties) (the parties referenced in item (ii) above, collectively the “Related Parties”), to the extent applicable,

hereby completely release, acquit, and forever discharge each other and their respective agents, assigns, attorneys, directors, employees,

heirs, insurers, investors, managers, members, officers, officials, owners, representatives, predecessors and successors in interest and

sureties (as well as their respective parents, subsidiaries, related entities and affiliates, and any of their agents, assigns, attorneys,

directors, employees, heirs, insurers, investors, managers, members, officers, officials, owners, representatives, predecessors and successors

in interest and sureties), to the extent applicable, of and from any and all demands, claims, counterclaims, obligations, causes of actions

and compensation of any nature, type or description whatsoever whether based upon tort, contract, statute, equity, tortious breach of

contract or bad faith, or any other theory of recovery, which any of the Parties hereto may have or has had from the beginning to time

to present date that arise from or relate to the Modification Agreement, the Supply Agreement or Repayment Plans which were or could have

been asserted in any litigation.

The Parties further agree

that they each waive any and all entitlement to relief or compensation, with the exception of what is identified herein, including, but

not limited to, monetary damages or equitable relief, with respect to any claim or cause of action released pursuant to the preceding

paragraph.

This release shall not

apply to the obligations any of the Parties owe under the Modification Agreement as amended by this Amendment, including, without limitation,

the terms of Section 2 herein, under which Agrify has agreed to pay amounts to Mack in the form of cash payments (totaling $2,000,000),

the Storage Fees and VFU purchases (totaling $700,000). The Parties agree that all such obligations owed under this Amendment Agreement

are specifically reserved and exempted from any release under this Amendment. Agrify further acknowledges and agrees that any release

under this Amendment does not in any manner impair or adversely affect or constitute a waiver of any of Mack’s rights against Agrify

to enforce Agrify’s performance of its obligations hereunder. In the event Agrify defaults in performing its obligations under this

Amendment, Agrify acknowledges and agrees that Mack has a claim to payment by Agrify of the Stipulated Amount in accordance with the terms

of the Modification Agreement less any payments already made to Mack by Agrify (other than such payments made pursuant to Section 2.C

of the Modification Agreement or Section 2.C of this Amendment). Agrify hereby waives any defenses, claims, counterclaims, recoupment

or offsets it may have to any such claim by Mack, including under this Paragraph 5.

6. Mutual

Representations. Each Party hereby represents, warrants, and covenants that:

| a. | It has, and throughout the term of this Amendment will have, the full right, power, authority and competence

to enter into and perform its obligations under this Amendment; |

| b. | This Amendment has been duly executed by such Party; |

| c. | This Amendment constitutes a legal, valid and binding obligation of such Party, enforceable against it

in accordance with its terms; |

| d. | The execution and delivery of this Amendment and the performance of such Party’s obligations hereunder

(i) do not conflict with or violate such Party’s corporate charter or bylaws or any requirement of applicable laws or regulations, and

(ii) do not and shall not conflict with, violate or breach or constitute a default or require any consent under, any agreement, contract,

commitment or obligation by which it is bound; |

| e. | All necessary consents, approvals and authorizations of all government authorities and other individuals

and entities required to be obtained by such Party in connection with the execution, delivery and performance of this Amendment have been

obtained; |

| f. | Each of the persons signing this Amendment is duly authorized, with full authority to bind the respective

Party and no signature of any other person or entity is necessary to bind the respective Party; and |

| g. | It has not relied on any matter, statement, representation of any adverse party or counsel, or term not

expressly contained in this Amendment. |

7. Non-Admission.

This Amendment is entered into solely in order to compromise and settle disputed claims, without any acquiescence, acknowledgement, or

agreement by any Party as to the merit of any actions, causes of action, suits, defenses, debts, dues, sums of money, accounts, damages,

expenses, attorney’s fees, costs, punitive damages, penalties, judgments, claims or demands released herein. None of this Amendment,

the Modification Agreement or any part thereof shall be, or be used as, evidence or an admission of liability by anyone, at any time,

for any purpose. Nothing in this Section or this Amendment or the Modification Agreement shall be construed to prohibit a Party from using

this Amendment or the Modification Agreement as evidence of the terms of the Parties’ agreement in a suit to enforce the Modification

Agreement, as amended by this Amendment.

8. Basis

for Settlement. Each Party acknowledges and agrees that the terms of this Amendment are, and have been agreed to, for their mutual

convenience, in part to avoid the expense, distraction, risk and uncertainty of further litigation, and after considering the risks of

litigation and the circumstances of their respective businesses. Each Party also acknowledges and agrees that it has relied entirely on

its own judgment, belief and knowledge (including its judgment, belief and knowledge with respect to the foregoing, the extent and duration

of any litigation pertaining to the Dispute, and the value of settling the Dispute at this time) and the advice and recommendations of

their or its own independently selected counsel, and, accordingly, except as set forth herein, neither it nor anyone acting on its behalf

shall (or shall have the right to) deny or challenge the validity of this Amendment, the Modification Agreement, or any of the obligations

of the Parties hereunder or thereunder.

9. Confidentiality.

The Parties and their attorneys agree that this Amendment and its terms are and shall be kept confidential by the Parties and their attorneys.

Except as set forth above and except to the extent reasonably necessary to enforce the Amendment; or to the extent that any of the Parties

reasonably believes it is required by law to disclose certain of the terms of this Amendment; or to the extent that any of the Parties

is required to disclose the terms of its individual settlement to the taxing authorities, preparers or other with respect to tax matters;

or to the extent required by subpoena or other order of a court or government body of competent jurisdiction; or to the extent required

by corporate governance of any of the Parties, the terms and conditions of this Amendment, including the amount of the payments set forth

herein, shall remain confidential and shall not be disclosed.

10. Construction.

This Amendment has been negotiated by the Parties and shall be interpreted fairly in accordance with its terms and without any construction

in favor of or against any of the Parties. The interpretation and construction of this Amendment shall be subject to the following provisions:

(a) words importing the singular meaning include where the context so admits the plural meaning and vice versa; (b) the terms “and”

and “or” as used herein shall mean both the conjunctive and the disjunctive, so that one word or the other may be taken accordingly

as the one or the other (i.e., “and/or”); (c) the word “any” shall mean “all” or “one out of

several”; (d) references to any person shall include natural persons and partnerships, firms and other incorporated bodies and all

other legal persons of whatever kind and however constituted; (e) the words “include,” “includes” and “including”

are to be construed as if they were immediately followed by the words “without limitation”; and (f) captions and headings

used herein are inserted for convenience only and are in no way intended to describe, interpret, define or limit the scope, extent or

intent of this Amendment.

11. Modification

Agreement Remains in Effect. The Modification Agreement remains in full force and effect, except as modified by this Amendment. In

the event of an Amendment Termination Event, this Amendment shall be of no force and effect going forward (except for the Surviving Provisions),

and the Modification Agreement shall revert to its unamended form as if this Amendment had never gone effective (except for the Surviving

Provisions).

12. Assignability.

No Party may assign this Amendment without the prior written consent of the other Party.

13. Successors

and Assigns. This Amendment shall be binding upon and inure to the benefit of the Parties and their heirs, executors, administrators,

conservators, assigns, successors, beneficiaries, employees and agents, and all other persons asserting claims by, on behalf of, or through

them based or founded upon any of the claims released herein.

14. Waiver.

Failure by any Party to insist upon strict performance of any provision herein by any other Party shall not be deemed a waiver by such

Party of its rights or remedies or a waiver by it of any subsequent default by such other Party, and no waiver shall be effective unless

it is in writing and duly executed by the Party entitled to enforce the provision being waived.

15. Severability.

In the event that any term, covenant, condition, agreement, section or provision hereof shall be deemed invalid or unenforceable, this

Amendment shall not terminate or be deemed void or voidable, but shall continue in full force and effect and there shall be substituted

for such stricken provision a like but legal and enforceable provision which most nearly accomplishes the intention of the Parties hereto.

16. Entire

Agreement. The Modification Agreement, as modified by this Amendment constitutes the entire agreement between the Parties regarding

the subject matter set forth herein, and all prior agreements, statements, negotiations, representations or warranties are expressly merged

herein. Except as set forth in this Amendment, no Party has relied upon the representations of the other Party to induce them to enter

into this Amendment. It is expressly understood and agreed that the Modification Agreement, as amended by this Amendment, expressly replaces

the Supply Agreement in its entirety, and this Amendment may not be altered, amended, waived, modified or otherwise changed in any respect

or particular whatsoever except by writing duly executed by authorized representatives of the Parties. Except to the extent expressly

modified by this Amendment, the Modification Agreement (and all of its terms) shall continue to be in full force and effect, but in the

event of any conflict between the Modification Agreement and this Amendment, this Amendment shall control.

17. Choice

of Law and Forum Selection. This Amendment will be interpreted under and is governed by the laws of the Commonwealth of Massachusetts

without regard to conflicts of laws principles. The Parties (a) hereby irrevocably submit themselves to and consent to the exclusive jurisdiction

of the Commonwealth of Massachusetts for the purposes of any action, claim, suit or proceeding arising from or relating to this Amendment,

and (b) hereby waive, and agree not to assert, by way of motion, as a defense or otherwise, in any such action, claim, suit or proceeding,

any argument that they are not personally subject to the jurisdiction of such court(s), that the action, claim, suit or proceeding is

brought in an inconvenient forum, or that the venue of the action, claim, suit or proceeding is improper.

18. Attorney’s

Fees, Costs, and Expenses. Each Party acknowledges that they shall bear their own respective costs, expenses and attorney’s

fees with respect to the Dispute and the negotiation and documentation of this Amendment.

19. Counterparts.

This Amendment may be executed in separate counterparts, each of which shall constitute an original. Facsimile or electronic signatures

shall be treated as originals.

Remainder of page left blank intentionally

The undersigned acknowledges

that he or she has read and understands the foregoing Amendment, and that the undersigned agrees to the same and voluntarily executes

the same this 30th day of August, 2024.

| |

Raymond Nobu Chang |

| |

|

| |

For Agrify Corporation as its CEO and not individually, |

| |

|

| |

/s/ Raymond Nobu Chang |

| |

Signature |

| |

|

| |

August 28, 2024 |

| |

Date |

The undersigned acknowledges

that he or she has read and understands the foregoing Amendment, and that the undersigned agrees to the same and voluntarily executes

the same this 30th day of August, 2024.

| |

Jeff Somple |

| |

|

| |

For Mack Molding Company, |

| |

|

| |

/s/ Jeff Somple |

| |

Signature |

| |

|

| |

8/30/24 |

| |

Date |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

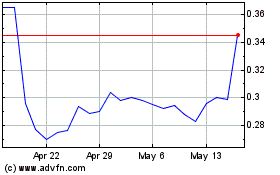

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Nov 2023 to Nov 2024