Agrify Corporation Announces Plans to Acquire the Señorita Brand of THC Beverages

November 12 2024 - 6:00AM

Agrify Corporation (Nasdaq: AGFY) (“Agrify” or the “Company”), a

leading provider of solutions for the cannabis industry, today

announced that it has signed a non-binding letter of intent to

acquire certain assets from Double or Nothing LLC, the owner and

creator of the Señorita brand of hemp-derived legal THC (“HDLT”)

drinks, in exchange for 530,000 shares of Agrify common stock or

common stock equivalents (the “Transaction”). The Transaction is

expected to close before year end.

“This is an exciting time for Agrify and our

shareholders as our business has fresh energy, a strong balance

sheet and new perspective on finding solutions in the cannabis

industry,” said Agrify Interim CEO Ben Kovler. “We know Americans

are demanding alternatives to alcohol and we believe that HDLT

drinks will be a big part of the solution. I feel lucky to have

found Joel and Charles and their amazing creation of Señorita. The

brand needs capital and energy to handle the tidal wave of demand

and Agrify’s balance sheet and team are ready.”

Señorita was designed and formulated by best

friends and world-class winemakers Charles Bieler and Joel Gott,

who collectively produce over two million cases of wine sold

annually across multiple North American distribution outlets.

Recognizing a growing generational demand for adult beverage

alternatives, they founded Señorita in 2022 and launched the brand

in the U.S. in 2023. Señorita offers consumers HDLT beverages that

mirror well-known cocktails like a margarita – in two flavors –

classic and mango. Known for its clean, fresh flavors and

commitment to high-quality, natural ingredients, Señorita offers a

low-sugar, low-calorie alternative to alcoholic beverages.

Señorita’s HDLT products are currently offered in Canada and nine

U.S. states, including Alabama, Florida, Georgia, Illinois,

Louisiana, Minnesota, Ohio, Tennessee and Wisconsin, with plans for

expansion across additional states. The product is also available

direct to consumer where permissible under state law via the

website senoritadrinks.com.

“We started Señorita because we saw an obvious

need in the market from American consumers demanding alcohol

alternatives that would still provide a great experience,” Señorita

co-founder Charles Bieler commented. “We love margaritas, so we

focused on a small number of high-quality ingredients including

agave, jalapeño and lime to make what we believe is the best

tasting THC beverage on the market. As a result, we can’t keep up

with demand - so when we met Ben and the team at Agrify we knew it

was an amazing opportunity to take Señorita to the next level. We

feel confident that Ben’s team, energy and expertise will guarantee

the brand’s future success.”

“As interim CEO of Agrify, my primary

responsibility is to allocate capital in a way that generates an

attractive return for shareholders,” added Kovler. “The data

indicates a massive opportunity in the HDLT drink market, making

this an attractive area to allocate capital. The good news is that

Agrify’s balance sheet is well positioned to support the growth

that Señorita and this beverage sector are experiencing. Working

with Joel and Charles made sense from the start. They have an

unbeatable entrepreneurial mindset that we need at Agrify to win in

this next chapter of the cannabis story. I am excited for them to

join the team as we work to close this transaction and focus on

growing the business. We agree with Joel, Charles and American

consumers when we say, ‘Más Señorita Por Favor’.”

The Transaction would involve the acquisition of

assets involved in the operation of Señorita’s HDLT business. There

can be no assurances that Agrify will reach a binding agreement and

if it does, the terms could differ from those stated in this press

release. In any event, Agrify will disclose the final deal terms

and binding transaction documents in a future announcement and

applicable filings with the Securities Exchange Commission.

Currently, Agrify has approximately 1.4 million

shares of common stock outstanding and 6.3 million warrants. This

Transaction would increase the shares outstanding through the

issuance of a combination of shares of common stock and pre-funded

warrants totaling 530,000 shares of common stock on a fully-diluted

basis. Agrify currently has approximately $17 million of debt

consisting of $7 million with an entity affiliated with its former

CEO and the recently announced $10 million convertible note issued

to a subsidiary of Green Thumb Industries Inc.

About Agrify (Nasdaq: AGFY)Agrify is a leading

provider of branded innovative solutions for the cannabis industry

in extraction, cultivation and more. Agrify’s proprietary

micro-environment-controlled Vertical Farming Units (VFUs) enable

cultivators to produce the highest quality products with unmatched

consistency, yield, and ROI at scale. Agrify’s comprehensive

extraction product line, which includes hydrocarbon, ethanol,

solventless, post-processing, and lab equipment, empowers producers

to maximize the quantity and quality of extract required for

premium concentrates. For more information, please visit Agrify at

https://agrify.com.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 concerning Agrify

and other matters. All statements contained in this press release

that do not relate to matters of historical fact should be

considered forward-looking statements including, without

limitation, statements regarding the expected benefits to be

derived from the potential Transaction, Agrify’s growth and future

prospects, Agrify’s ability to consummate the Transaction on the

terms and the timeline described in this press release, the degree

and timing of planned growth and geographic expansion of the

Señorita brand, and Agrify’s ability to generate an attractive

return for shareholders. In some cases, you can identify

forward-looking statements by terms such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “could,” “intends,”

“targets,” “projects,” “contemplates,” “believes,” “estimates,”

“predicts,” “potential” or “continue” or the negative of these

terms or other similar expressions. The forward-looking statements

in this press release are only predictions. We have based these

forward-looking statements largely on our current expectations and

projections about future events and financial trends that we

believe may affect our business, financial condition and results of

operations. Forward-looking statements involve known and unknown

risks, uncertainties and other important factors that may cause our

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. You should

carefully consider the risks and uncertainties that affect our

business, including those described in our filings with the

Securities and Exchange Commission (“SEC”), including under the

caption “Risk Factors” in our Annual Report on Form 10-K filed for

the year ended December 31, 2023 with the SEC, which can be

obtained on the SEC website at www.sec.gov. These forward-looking

statements speak only as of the date of this communication. Except

as required by applicable law, we do not plan to publicly update or

revise any forward-looking statements, whether as a result of any

new information, future events or otherwise.

You are advised, however, to consult any further disclosures we

make on related subjects in our public announcements and filings

with the SEC.

Contact

Agrify Investor RelationsIR@agrify.com(857) 256-8110

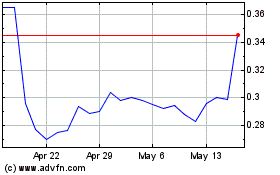

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Agrify (NASDAQ:AGFY)

Historical Stock Chart

From Dec 2023 to Dec 2024