Low Interest Rates Make High Yield REITs Irresistible

December 01 2010 - 10:25AM

Marketwired

Real Estate Investment Trusts or "REITs" for short have become

darlings of Wall Street this year and have been one the strongest

performing segments of the financial sector. The Vanguard REIT

Index ETF which holds nearly 100 different REITs, has increased

close to 24% this year in contrast to the Financial sector for the

S&P 500, which has hardly moved in 2010. REITs' ability to

generate this significant capital appreciation is an added bonus,

as most investors flock to REITs for their hefty dividends and

stability. The Bedford Report examines the outlook for diversified

REITs and provides research reports on American Capital Agency

Corporation (NASDAQ: AGNC) and Annaly Capital Management, Inc.

(NYSE: NLY). Access to the full company reports can be found at:

www.bedfordreport.com/2010-12-AGNC

www.bedfordreport.com/2010-12-NLY

Most of the success of the industry in the last year can be

attributed to low interest rates. When interest rates get this low

the return on dividends can far exceed that of bonds. Following

last month's $600 billion "QE2" announcement, consensus is that

interest rates will remain at low levels for the foreseeable

future.

The Bedford Report releases regular market updates on various

REITs so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us for free at www.bedfordreport.com and get

exclusive access to our numerous analyst reports and industry

newsletters.

Another reason low interest rates make REITs appealing is how

some of them make their money. Companies such as American Capital

Agency and Annaly earn their money on the spread between

low-interest short-term borrowing and purchasing high-interest

long-term securities, which leads to solid profits given the

current conditions. Solid profits for a REIT keep those dividend

payments stable because in order to be classified as a REIT, a

company must distribute at least 90 percent of its taxable income

to shareholders annually in the form of dividends.

The Bedford Report provides Analyst Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

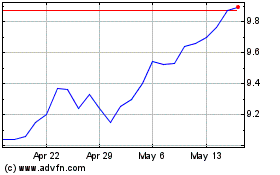

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jul 2023 to Jul 2024