High Yielding American Capital Agency and Annaly Capital Maintain Safe Haven Appeal

November 08 2011 - 7:16AM

Marketwired

After struggling for most of the summer, shares of high yielding

Mortgage REITs are finally on the upswing as a strong earnings

season and more stable market has restored confidence in the

sector. REITs must pay at least 90 percent of their taxable income

in the form of dividends, and given the strong earnings season

investors are optimistic about future shareholder return. The

Bedford Report examines the outlook for diversified REITs and

provides equity research on American Capital Agency Corporation

(NASDAQ: AGNC) and Annaly Capital Management, Inc. (NYSE: NLY).

Access to the full company reports can be found at:

www.bedfordreport.com/AGNC

www.bedfordreport.com/NLY

REITs were hammered after the SEC announced that it will solicit

public comment to determine if mortgage real estate investment

trusts should be regulated as investment companies and therefore

subject to the Investment Act of 1940. While analysts don't expect

the exemption to be lifted, the SEC review was acting as a cloud

over the industry's future.

Fortunately, this earnings season drew attention away from

potential long term headwinds. Mortgage REITs continued to post

strong numbers as the firms benefitted from favorable interest rate

spreads. Most mREITs earn their money on the spread between

low-interest short-term borrowing and purchasing high-interest

long-term securities. The Federal Reserve has expressed its

intention to keep interest rates low which means that REITs should

enjoy a good spread for the foreseeable future.

The Bedford Report releases stock research on REITs so investors

can stay ahead of the crowd and make the best investment decisions

to maximize their returns. Take a few minutes to register with us

free at www.bedfordreport.com and get exclusive access to our

numerous analyst reports and industry newsletters.

As of September 30, 2011, American Capital Agency's investment

portfolio totaled $42.0 billion of agency securities, at fair

value, comprised of $38.3 billion of fixed-rate securities, $3.2

billion of adjustable-rate securities ("ARMs") and $0.5 billion of

collateralized mortgage obligations ("CMOs") backed by fixed and

adjustable-rate securities, including interest-only strips. The

company reported net income for the third quarter of 2011 of $250.4

million, or $1.39 per share, and net book value of $26.90 per

share. Presently AGNC pays an annual dividend of $5.60 for a yield

of around 20.3 percent.

During the quarter ended September 30, 2011, Annaly Capital

Management disposed of $3.9 billion of mortgage-backed securities

and agency debentures, resulting in a realized gain of $91.7

million. The annualized dividend yield on the company's common

stock for the quarter ended September 30, 2011, based on the

September 30, 2011, closing price of $16.63, was 14.43 percent, as

compared to 15.45 percent for the quarter ended September 30, 2010,

and 14.41% for the quarter ended June 30, 2011.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

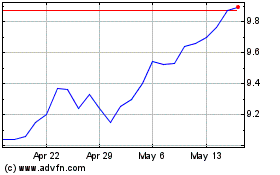

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jun 2024 to Jul 2024

AGNC Investment (NASDAQ:AGNC)

Historical Stock Chart

From Jul 2023 to Jul 2024