Aimfinity Investment Corp. I (NASDAQ: AIMAU) (the “Company”),

a blank check company incorporated as a Cayman Islands exempted

company, today announced it has concluded an extraordinary general

meeting of the shareholders (the “Extraordinary General Meeting”)

in lieu of an annual general meeting on January 9, 2025, which

previously adjourned from December 30, 2024.

At the Extraordinary General Meeting, the

shareholders of the Company approved, by special resolution, to

amend the Company’s Third Amended and Restated Memorandum and

Articles of Association (the “Charter”) to allow the Company until

January 28, 2025 to consummate an initial business combination and

may elect to extend the period to consummate an initial business

combination up to nine times, each by an additional one-month

period, for a total of up to nine months to October 28, 2025, by

depositing to the Company’s trust account (the “Trust Account”)

$0.05 for each public share for each one-month extension (each such

deposit, a “Monthly Extension Payment”).

In addition, the shareholders, by ordinary

resolutions, also re-elected Mr. Kevin D. Vassily, an independent

director and chair of the audit committee, to a three-year term,

and ratified the appointment of MaloneBailey, LLP as the Company’s

independent registered public accounting firm for the fiscal years

ended December 31, 2023 and 2024.

Pursuant to the shareholders’ approval, the

Company may extend on monthly basis from January 28, 2025 to

October 28, 2025, or such an earlier date as may be requested by

the sponsor of the Company, Aimfinity Investment LLC (the

“Sponsor”), and authorized by its board, to complete a business

combination by depositing the Monthly Extension Payment for each

month into the Trust Account.

About Aimfinity Investment Corp. I

Aimfinity Investment Corp. I is a blank

check company incorporated as a Cayman Islands exempted company for

the purpose of effecting a merger, share exchange, asset

acquisition, share purchase, reorganization or similar business

combination with one or more businesses or entities. The Company

has not selected any business combination target and has not, nor

has anyone on its behalf, initiated any substantive discussions,

directly or indirectly, with any business combination target with

respect to an initial business combination with it. While the

Company will not be limited to a particular industry or geographic

region in its identification and acquisition of a target company,

it will not complete its initial business combination with a target

that is headquartered in China (including Hong Kong and Macau) or

conducts a majority of its business in China (including Hong Kong

and Macau).

Additional Information and Where to Find It

As previously disclosed, on October 13, 2023, the Company

entered into that certain Agreement and Plan of Merger (as may be

amended, supplemented or otherwise modified from time to time, the

“Merger Agreement”), by and between the Company, Docter Inc., a

Delaware corporation (the “Company”), Aimfinity Investment Merger

Sub I, a Cayman Islands exempted company and wholly-owned

subsidiary of Parent (“Purchaser”), and Aimfinity Investment Merger

Sub II, Inc., a Delaware corporation and wholly-owned subsidiary of

Purchaser (“Merger Sub”), pursuant to which the Company is

proposing to enter into a business combination with Docter

involving an reincorporation merger and an acquisition merger. This

press release does not contain all the information that should be

considered concerning the proposed business combination and is not

intended to form the basis of any investment decision or any other

decision in respect of the business combination. AIMA’s

stockholders and other interested persons are advised to read, when

available, the proxy statement/prospectus and the amendments

thereto and other documents filed in connection with the proposed

business combination, as these materials will contain important

information about AIMA, Purchaser or Docter, and the proposed

business combination. When available, the proxy

statement/prospectus and other relevant materials for the proposed

business combination will be mailed to stockholders of AIMA as of a

record date to be established for voting on the proposed business

combination. Such stockholders will also be able to obtain copies

of the proxy statement/prospectus and other documents filed with

the Securities and Exchange Commission (the “SEC”), without charge,

once available, at the SEC’s website at www.sec.gov, or by

directing a request to AIMA’s principal office at 221 W 9th St, PMB

235 Wilmington, Delaware 19801.

Forward-Looking Statements

This press release contains certain “forward-looking statements”

within the meaning of the Securities Act of 1933 and the Securities

Exchange Act of 1934, both as amended. Statements that are not

historical facts, including statements about the pending

transactions described herein, and the parties’ perspectives and

expectations, are forward-looking statements. Such statements

include, but are not limited to, statements regarding the proposed

transaction, including the anticipated initial enterprise value and

post-closing equity value, the benefits of the proposed

transaction, integration plans, expected synergies and revenue

opportunities, anticipated future financial and operating

performance and results, including estimates for growth, the

expected management and governance of the combined company, and the

expected timing of the transactions. The words “expect,” “believe,”

“estimate,” “intend,” “plan” and similar expressions indicate

forward-looking statements. These forward-looking statements are

not guarantees of future performance and are subject to various

risks and uncertainties, assumptions (including assumptions about

general economic, market, industry and operational factors), known

or unknown, which could cause the actual results to vary materially

from those indicated or anticipated.

Such risks and uncertainties include, but are not limited to:

(i) risks related to the expected timing and likelihood of

completion of the pending business combination, including the risk

that the transaction may not close due to one or more closing

conditions to the transaction not being satisfied or waived, such

as regulatory approvals not being obtained, on a timely basis or

otherwise, or that a governmental entity prohibited, delayed or

refused to grant approval for the consummation of the transaction

or required certain conditions, limitations or restrictions in

connection with such approvals; (ii) risks related to the ability

of AIMA and Docter to successfully integrate the businesses; (iii)

the occurrence of any event, change or other circumstances that

could give rise to the termination of the applicable transaction

agreements; (iv) the risk that there may be a material adverse

change with respect to the financial position, performance,

operations or prospects of AIMA or Docter; (v) risks related to

disruption of management time from ongoing business operations due

to the proposed transaction; (vi) the risk that any announcements

relating to the proposed transaction could have adverse effects on

the market price of AIMA’s securities; (vii) the risk that the

proposed transaction and its announcement could have an adverse

effect on the ability of Docter to retain customers and retain and

hire key personnel and maintain relationships with their suppliers

and customers and on their operating results and businesses

generally; (viii): risks relating to the medical device industry,

including but not limited to governmental regulatory and

enforcement changes, market competitions, competitive product and

pricing activity; and (ix) risks relating to the combined company’s

ability to enhance its products and services, execute its business

strategy, expand its customer base and maintain stable relationship

with its business partners.

A further list and description of risks and uncertainties can be

found in the prospectus filed on April 26, 2022 relating to AIMA’s

initial public offering, the annual report of AIMA on Form 10-K for

the fiscal year ended on December 31, 2022, filed on April 17,

2023, and in the Registration Statement/proxy statement that will

be filed with the SEC by AIMA and/or its affiliates in connection

with the proposed transactions, and other documents that the

parties may file or furnish with the SEC, which you are encouraged

to read. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those indicated or

anticipated by such forward-looking statements. Accordingly, you

are cautioned not to place undue reliance on these forward-looking

statements. Forward-looking statements relate only to the date they

were made, and Aimfinity, Docter, and their subsidiaries undertake

no obligation to update forward-looking statements to reflect

events or circumstances after the date they were made except as

required by law or applicable regulation.

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of any potential transaction and does not constitute an

offer to sell or a solicitation of an offer to buy any securities

of AIMA, Purchaser or Docter, nor shall there be any sale of any

such securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such state or

jurisdiction. No offer of securities shall be made except by means

of a prospectus meeting the requirements of the Securities Act.

Participants in the Solicitation

AIMA, Docter, and their respective directors, executive

officers, other members of management, and employees, under SEC

rules, may be deemed to be participants in the solicitation of

proxies of AIMA’s shareholders in connection with the proposed

transaction. Information regarding the persons who may, under SEC

rules, be deemed participants in the solicitation of AIMA’s

shareholders in connection with the proposed business combination

will be set forth in the proxy statement/prospectus on Form F-4 to

be filed with the SEC.

Contact Information:

Aimfinity Investment Corp. I

I-Fa ChangChief Executive Officer221 W 9th St,

PMB 235Wilmington, Delaware 19801ceo@aimfinityspac.com

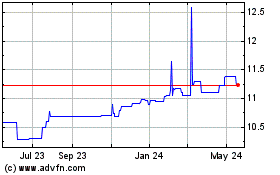

Aimfinity Investment Cor... (NASDAQ:AIMAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

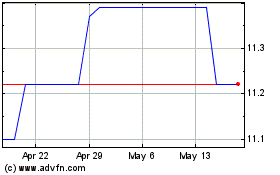

Aimfinity Investment Cor... (NASDAQ:AIMAU)

Historical Stock Chart

From Jan 2024 to Jan 2025