0001517022FALSE00015170222024-07-102024-07-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 10, 2024

_____________________

AKEBIA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

_____________________

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-36352 | | 20-8756903 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

| | |

245 First Street Cambridge, Massachusetts | | 02142 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (617) 871-2098

N/A

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading

symbol(s) | | Name of each exchange

on which registered |

| Common Stock, par value $0.00001 per share | | AKBA | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

CSL Vifor Termination and Settlement Agreement

On July 10, 2024, Akebia Therapeutics, Inc. (the “Company”) and Vifor (International) Ltd. (now a part of CSL Limited) (“CSL Vifor”) entered into a Termination and Settlement Agreement (the “Termination Agreement”). Pursuant to the Termination Agreement, the Company and CSL Vifor agreed, among other things, to terminate, effective immediately, the Second Amended and Restated License Agreement, dated February 18, 2022 and as amended May 3, 2024 (the “License Agreement”), pursuant to which the Company granted to CSL Vifor an exclusive license to sell Vafseo to Fresenius Medical Care North America and its affiliates, including Fresenius Kidney Care Group LLC, to certain third-party dialysis organizations approved by the Company, to independent dialysis organizations that are members of certain group purchasing organizations, and to certain non-retail specialty pharmacies (the “Supply Group”) in the U.S. (the “Territory”). The parties agreed to terminate the License Agreement for business reasons.

Under the License Agreement, CSL Vifor contributed $40 million to a working capital facility (the “Working Capital Fund”) established to partially fund the Company’s costs of purchasing Vafseo from its contract manufacturers. Pursuant to the terms of the Termination Agreement, and generally consistent with the terms of the License Agreement, the Company will repay the Working Capital Fund to CSL Vifor through quarterly tiered royalty payments ranging from 8% to 14% of the Company’s net sales of Vafseo in the Territory (the “WCF Royalty Payments”). The WCF Royalty Payments will commence on July 1, 2025, and will continue until the earlier of (i) the cumulative total of the WCF Royalty Payments equals $40 million, or (ii) May 31, 2028 (the “WCF Royalty Term”). The WCF Royalty Payments are subject to minimum true-up milestones of $10 million, $20 million and $40 million (each, a “WCF Royalty True-Up Payment”) on each of May 31, 2026, May 31, 2027 and May 31, 2028, respectively (each, a “WCF Royalty True-Up Date”). If the cumulative total of the WCF Royalty Payments paid to CSL Vifor on any given WCF Royalty True-Up Date is less than the respective WCF Royalty True-Up Payment, the Company will pay CSL Vifor a one-time payment equal to the difference between the WCF Royalty True-Up Payment and the cumulative total of the WCF Royalty Payments paid by the Company through such WCF Royalty True-Up Date.

In addition, the Company will pay CSL Vifor decreasing quarterly tiered royalty payments ranging from a high single-digit percentage of the Company’s net sales of Vafseo up to $450 million to mid-single digit percentage of the Company’s net sales of Vafseo above $450 million, in each case, in the Territory during a calendar year (the “Settlement Royalty Payments”). The Settlement Royalty Payments will commence upon the first sale of Vafseo by the Company, its affiliates or third-party licensees to a third party for use in the Territory, and will continue until the later of the (i) expiration of the last-to-expire valid claim listed in the FDA Orange Book that would be infringed by the making, using, selling or importing of Vafseo in the Territory or (ii) the expiration of marketing or regulatory exclusivity for Vafseo in the Territory (the “Settlement Royalty Term”). Beginning on July 1, 2027 and throughout the Settlement Royalty Term, the Company has the option to make a one-time payment to CSL Vifor (the “Royalty Buy-Down Option”) upon which the Settlement Royalty Payments will be adjusted as of the date of exercise of the Royalty Buy-Down Option such that the Company will then only pay CSL Vifor quarterly royalty payments based on a mid-single digit percentage of the Company’s net sales of Vafseo up to $450 million in the Territory during a calendar year in lieu of the above Settlement Royalty Payments. If the Company exercises the Royalty Buy-Down Option, the WCF Royalty Payments will continue as described above.

The WCF Royalty Payments, the Settlement Royalty Payments and the Royalty Buy-Down Option are in consideration for the termination of the License Agreement and all obligations thereunder, and the covenants and agreements set forth in the Termination Agreement, including the settlement and release of all disputes and claims arising from the License Agreement.

The foregoing description of the Termination Agreement does not purport to be complete and is qualified in its entirety by reference to the Termination Agreement, a copy of which the Company expects to file as an exhibit to its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

Amendment to Kreos Loan Agreement

On July 10, 2024, in connection with the Termination Agreement, the Company and Kreos Capital VII (UK) Limited, which are funds and accounts managed by BlackRock Inc., entered into a First Amendment to the Agreement for the Provision of a Loan Facility (the “Amendment”), which amends certain provisions of the Agreement for the Provision of a Loan Facility, dated January 29, 2024 (the “Loan Agreement”). As previously disclosed, the Loan Agreement provides for a senior secured term loan facility in the aggregate principal amount of up to $55.0 million. The Amendment includes certain covenants of the Company related to the Termination Agreement.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the Amendment, a copy of which the Company expects to file as an exhibit to its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024.

Item 1.02. Termination of a Material Definitive Agreement.

The information contained in Item 1.01 of this Current Report on Form 8-K under the heading “CSL Vifor Termination and Settlement Agreement” is incorporated by reference herein and made a part hereof.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | AKEBIA THERAPEUTICS, INC. |

| | |

Date: July 11, 2024 | By: | /s/ John P. Butler |

| | Name: John P. Butler |

| | Title: President and Chief Executive Officer |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityListingsLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

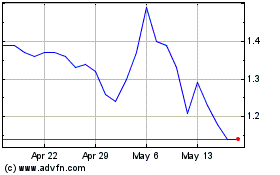

Akebia Therapeutics (NASDAQ:AKBA)

Historical Stock Chart

From Jun 2024 to Jul 2024

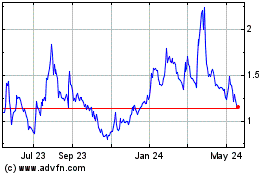

Akebia Therapeutics (NASDAQ:AKBA)

Historical Stock Chart

From Jul 2023 to Jul 2024