false0001564824NONE00015648242025-01-272025-01-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 27, 2025 |

Allakos Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38582 |

45-4798831 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

825 Industrial Road, Suite 500 |

|

San Carlos, California |

|

94070 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 650 597-5002 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 |

|

ALLK |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On January 27, 2025, Allakos Inc. (the “Company”) released an updated corporate presentation. A copy of the presentation is attached as Exhibit 99.1 to this Current Report on Form 8-K.

All of the information in this Item 7.01 and Item 9.01 of this Form 8-K, including the attached Exhibit 99.1, is intended to be furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Allakos Inc. |

|

|

|

|

Date: |

January 27, 2025 |

By: |

/s/ H. Baird Radford, III |

|

|

|

H. Baird Radford, III

Chief Financial Officer |

AK006 Phase 1 CSU Study Results �& Business Update January 27, 2025 Exhibit 99.1

Disclaimer This presentation contains forward-looking statements. All statements other than statements of historical fact contained in this presentation, including statements regarding the expectations of Allakos Inc. (“Allakos,” the “Company,” “we” or “our”) regarding its financial position and guidance, including estimated costs of restructuring activities to closeout AK006 development, the timing of payment of such restructuring costs, and estimated ending 2024 and second quarter 2025 cash, cash equivalents and investments; restructuring activities and plans; and exploration of strategic alternatives, are forward-looking statements. Allakos has based these forward-looking statements on its estimates and assumptions and its current expectations and projections about future events. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “target,” “should,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The Company may not actually achieve the plans, intentions, or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. The forward-looking statements included in this presentation speak only as of the date of this presentation and are subject to a number of risks, uncertainties, and assumptions, including, but not limited to: uncertainties related to Allakos’ ability to realize the contemplated benefits of its restructuring activities and related reduction in force; Allakos’ ability to accurately forecast financial results, including restructuring and other costs and expenses; availability of suitable third parties with which to conduct contemplated strategic alternative transactions; whether Allakos will be able to pursue strategic alternative transactions, or whether any transaction, if pursued, will be completed on attractive terms; whether Allakos’ cash resources will be sufficient to fund its foreseeable and unforeseeable operating expenses and capital expenditure requirements; Allakos’ ability to maintain the listing of its common stock on Nasdaq; general economic and market conditions, both domestic and international; risks associated with volatility and uncertainty in the capital markets for biotechnology companies; and other risks. Information regarding the foregoing and additional risks may be found in the section entitled “Risk Factors” included in our periodic filings that we have made and will make with the Securities and Exchange Commission (“SEC”). In addition, Allakos operates in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for Allakos’ management to predict all risks, nor can Allakos assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements that Allakos may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Allakos does not undertake any obligation to update or revise any forward-looking statements, to conform these statements to actual results or to make changes in Allakos’ expectations, except as required by law. Additional Information: The Company has filed and will file Current Reports on Form 8-K, Quarterly Reports on Form 10-Q, and Annual Reports on Form 10-K, and other documents with the SEC. You should read these documents for more complete information about the Company. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. This presentation concerns products that are under clinical investigation, and which have not yet been approved for marketing by the U.S. Food and Drug Administration. It is currently limited by federal law to investigational use, and no representation is made as to its safety or effectiveness for the purposes for which it is being investigated.

Agenda Robert Alexander, CEO Introduction Chin Lee, CMO AK006 Phase 1 CSU Study Results Baird Radford, CFO Restructuring and Financial Implications Q&A

Phase 1 Study of AK006 in �Chronic Spontaneous Urticaria

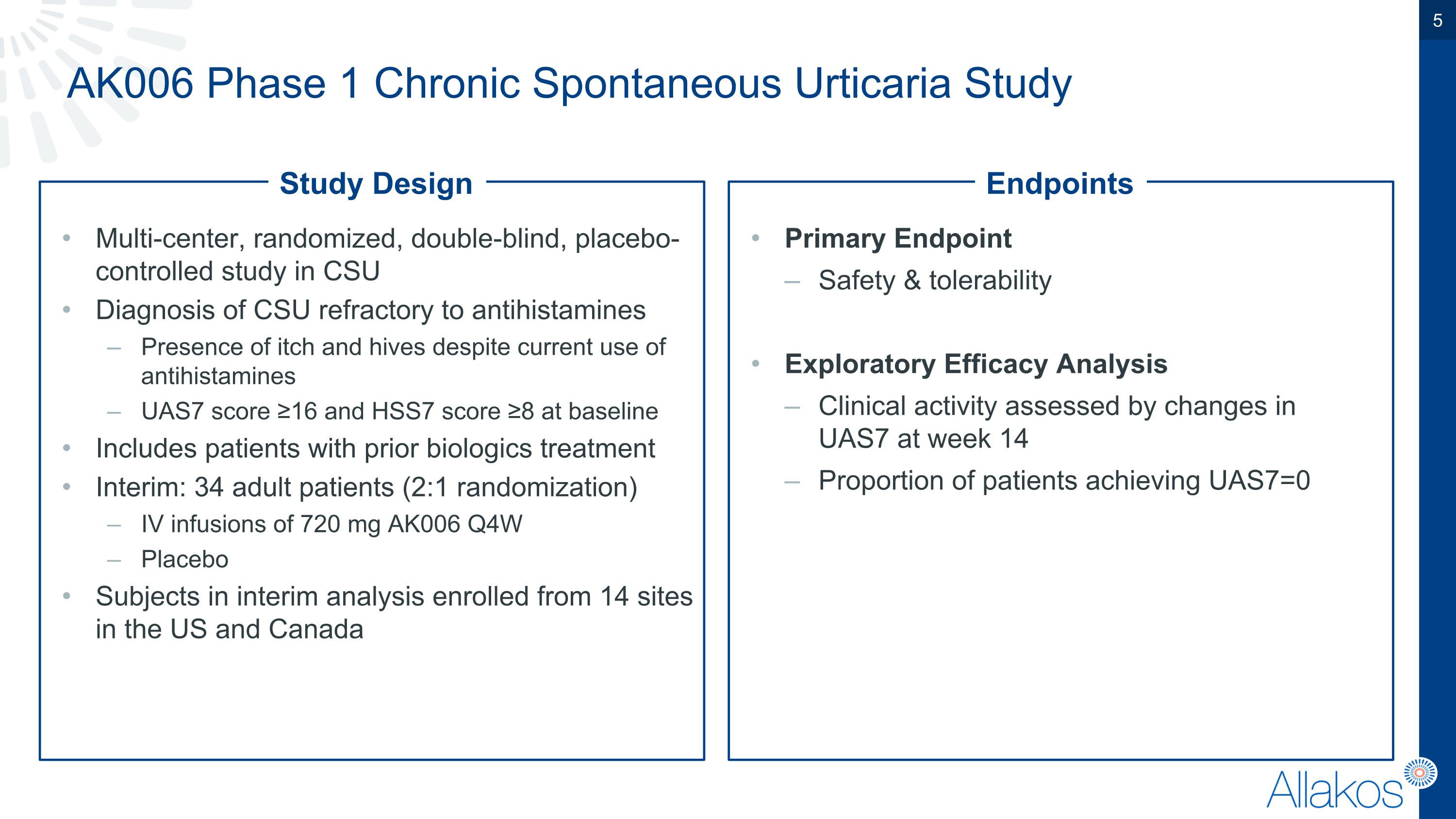

AK006 Phase 1 Chronic Spontaneous Urticaria Study Multi-center, randomized, double-blind, placebo-controlled study in CSU Diagnosis of CSU refractory to antihistamines Presence of itch and hives despite current use of antihistamines UAS7 score ≥16 and HSS7 score ≥8 at baseline Includes patients with prior biologics treatment Interim: 34 adult patients (2:1 randomization) IV infusions of 720 mg AK006 Q4W Placebo Subjects in interim analysis enrolled from 14 sites in the US and Canada Primary Endpoint Safety & tolerability Exploratory Efficacy Analysis Clinical activity assessed by changes in UAS7 at week 14 Proportion of patients achieving UAS7=0 Study Design Endpoints

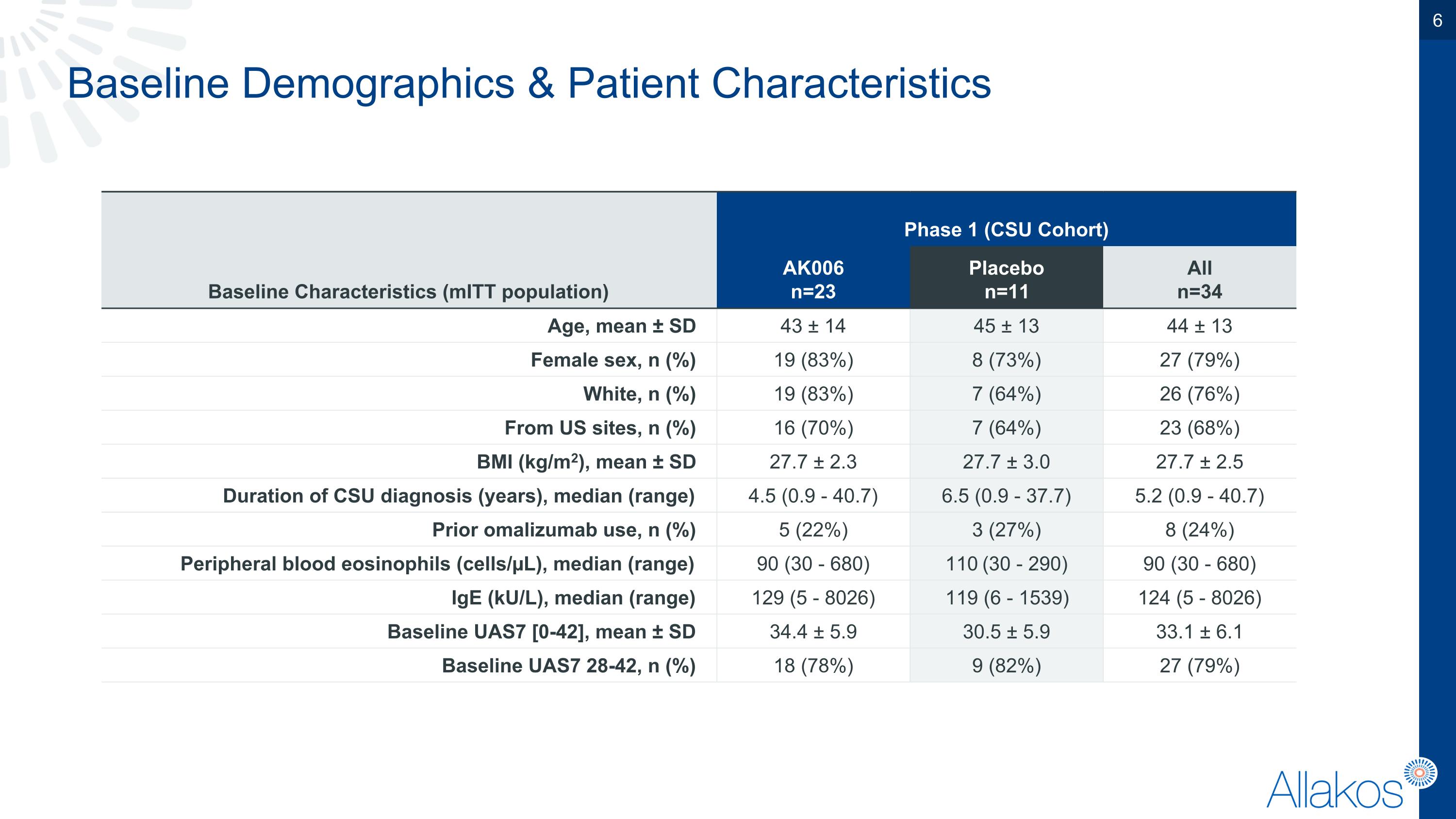

Baseline Demographics & Patient Characteristics Baseline Characteristics (mITT population) Phase 1 (CSU Cohort) Patient Characteristics AK006 n=23 Placebo n=11 All n=34 Age, mean ± SD 43 ± 14 45 ± 13 44 ± 13 Female sex, n (%) 19 (83%) 8 (73%) 27 (79%) White, n (%) 19 (83%) 7 (64%) 26 (76%) From US sites, n (%) 16 (70%) 7 (64%) 23 (68%) BMI (kg/m2), mean ± SD 27.7 ± 2.3 27.7 ± 3.0 27.7 ± 2.5 Duration of CSU diagnosis (years), median (range) 4.5 (0.9 - 40.7) 6.5 (0.9 - 37.7) 5.2 (0.9 - 40.7) Prior omalizumab use, n (%) 5 (22%) 3 (27%) 8 (24%) Peripheral blood eosinophils (cells/µL), median (range) 90 (30 - 680) 110 (30 - 290) 90 (30 - 680) IgE (kU/L), median (range) 129 (5 - 8026) 119 (6 - 1539) 124 (5 - 8026) Baseline UAS7 [0-42], mean ± SD 34.4 ± 5.9 30.5 ± 5.9 33.1 ± 6.1 Baseline UAS7 28-42, n (%) 18 (78%) 9 (82%) 27 (79%)

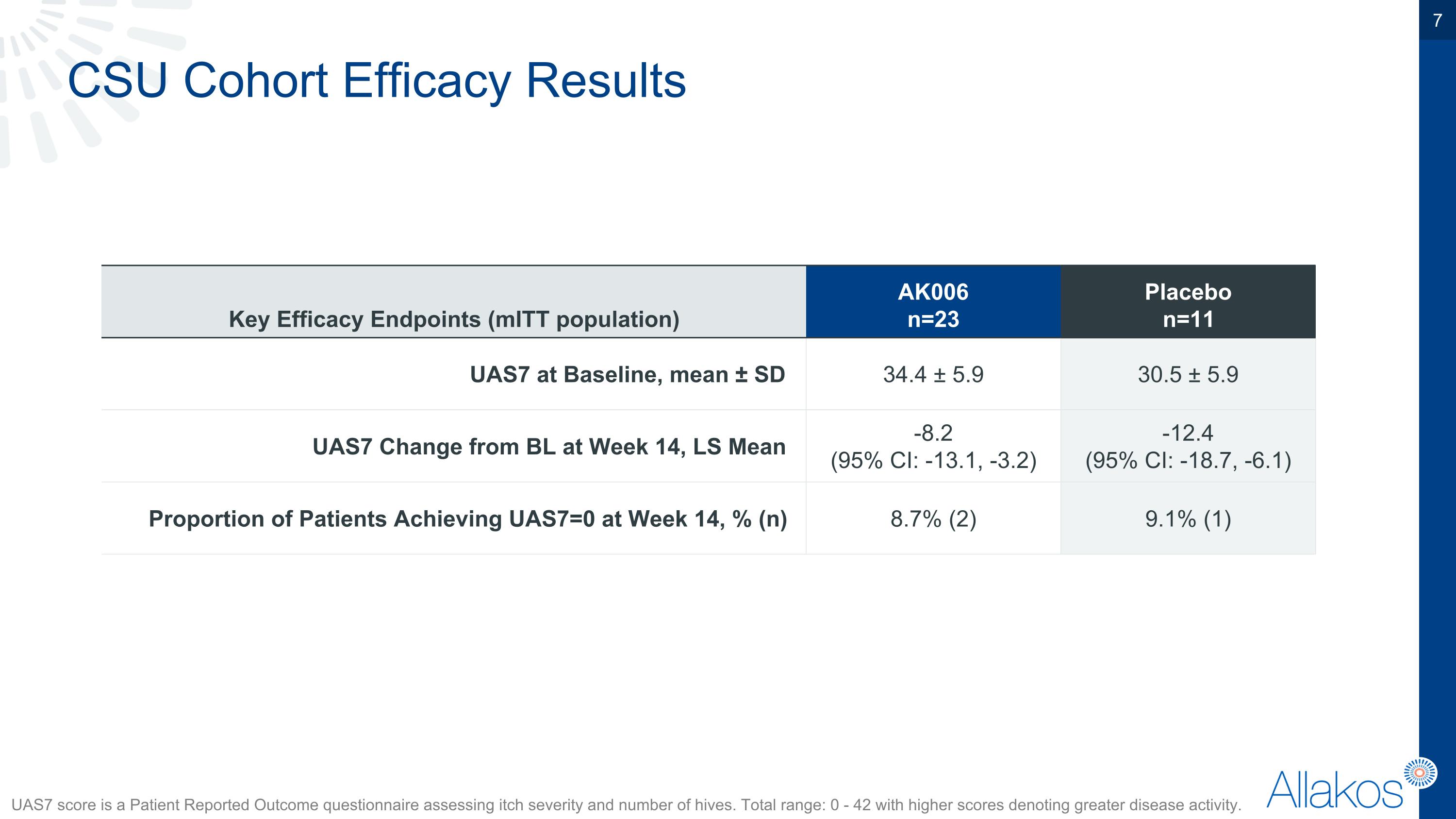

CSU Cohort Efficacy Results UAS7 score is a Patient Reported Outcome questionnaire assessing itch severity and number of hives. Total range: 0 - 42 with higher scores denoting greater disease activity. Key Efficacy Endpoints (mITT population) AK006 n=23 Placebo n=11 UAS7 at Baseline, mean ± SD 34.4 ± 5.9 30.5 ± 5.9 UAS7 Change from BL at Week 14, LS Mean -8.2 (95% CI: -13.1, -3.2) -12.4 (95% CI: -18.7, -6.1) Proportion of Patients Achieving UAS7=0 at Week 14, % (n) 8.7% (2) 9.1% (1)

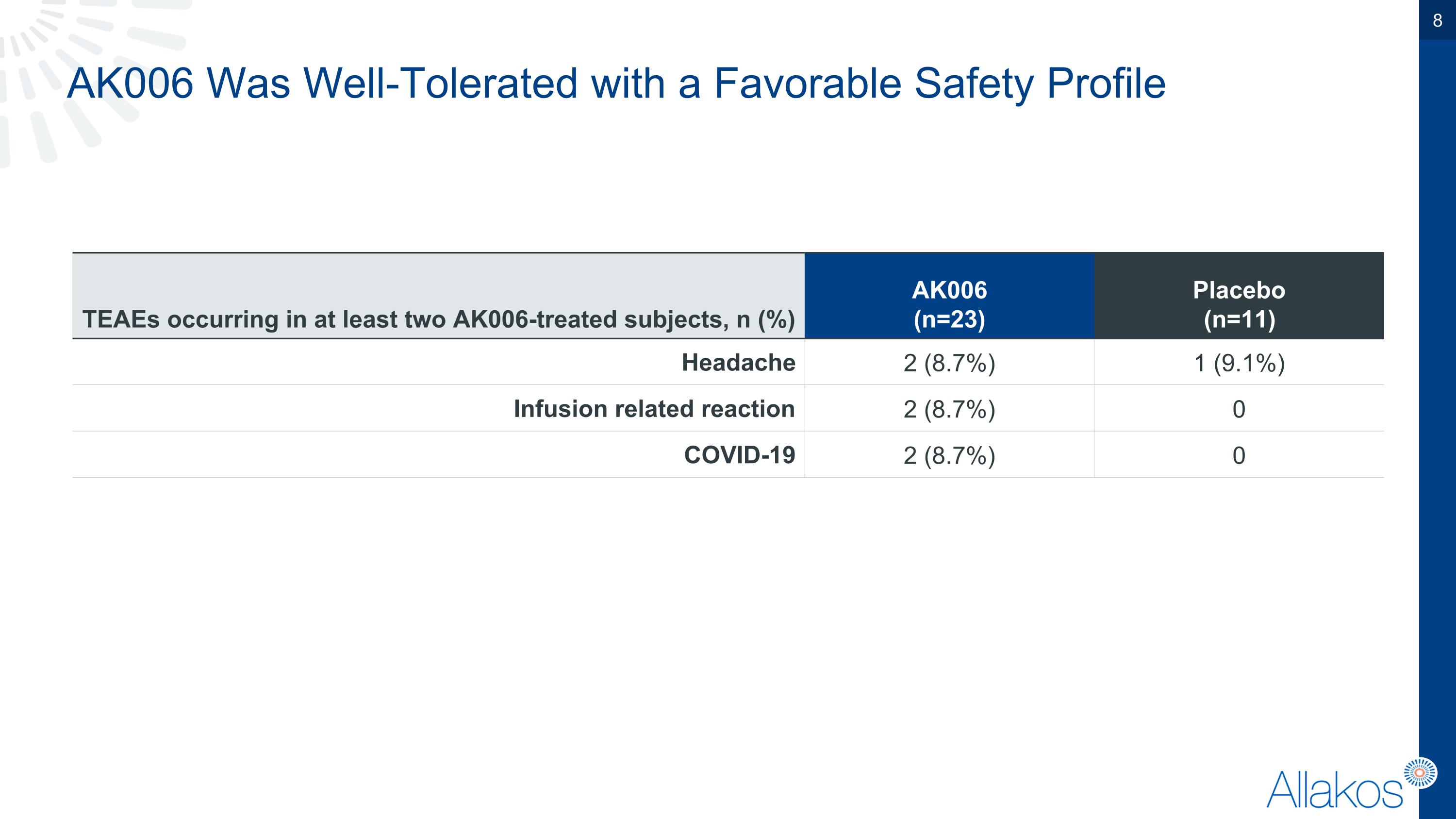

AK006 Was Well-Tolerated with a Favorable Safety Profile TEAEs occurring in at least two AK006-treated subjects, n (%) AK006 (n=23) Placebo (n=11) Headache 2 (8.7%) 1 (9.1%) Infusion related reaction 2 (8.7%) 0 COVID-19 2 (8.7%) 0

Business Update

Restructuring Activities and Planned Actions The Company plans to discontinue AK006-related activities across clinical, manufacturing, research and administrative functions and reduce its workforce �by approximately 75%. The Company plans to retain approximately 15 employees to explore strategic alternatives, maintain compliance with regulatory and financial reporting requirements, and wind-down the phase 1 clinical study.

Cash Guidance The Company ended the fourth quarter of 2024 with approximately $81 million in cash, cash equivalents, and investments (unaudited). The Company estimates that cash used in restructuring activities to closeout AK006 development, including severance and contractual payments to vendors will be approximately $34 million to $38 million. The Company also estimates that a significant majority of these restructuring costs will be paid over the first and second quarters of 2025. The Company estimates it will have cash, cash equivalents and investments in a range of approximately $35 million to $40 million at June 30, 2025.

Q&A Confidential

Thank You

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Allakos (NASDAQ:ALLK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Allakos (NASDAQ:ALLK)

Historical Stock Chart

From Feb 2024 to Feb 2025