- Partnership leverages Allianz’s position as

one of the world’s largest allocators to private markets via

Allianz Global Investors

- Initially focused on private debt, AlTi’s

ultra-high-net-worth (“UHNW”) clients and select institutional

investors will be able to invest in top tier managers, strategies

and deals alongside Allianz’s balance sheet

- Partnership is positioned to drive the

democratization of private markets in the UHNW wealth segment and

enables Allianz Global Investors to strategically increase access

to its $100bn+ AuM private markets platform

- Partnership is structured through JV with

Allianz X, which follows its strategic investment of up to $300mn

in AlTi closed in July this year

Allianz X today announced a joint venture (“JV”) with AlTi

Global, Inc. (NASDAQ: ALTI) (“AlTi” or the “Company”), a leading

independent global wealth manager with over $72 billion in combined

assets, enabling it to form a strategic partnership with Allianz

Global Investors (“AllianzGI”), one of the world’s leading active

investment managers and a wholly owned subsidiary of Allianz SE

(XETRA: ALV), to create a leading private markets offering for the

UHNW wealth segment.

Through the joint venture, AlTi and AllianzGI will launch a

private markets investment program for UHNW clients that will

benefit from AllianzGI’s exceptional network and scale. By

investing alongside Allianz, the program will provide unprecedented

access to leading third-party managers with outstanding track

records, significant scale benefits, low minimum ticket sizes, and

expanded investment opportunities, including secondaries and

co-investments.

The program will initially focus on the approximately $1.5

trillion global private debt market1, leveraging AllianzGI’s

long-standing and strong track record in private markets for over

25 years, and unique position in this dynamic and growing asset

class. The wider Allianz Group, including AllianzGI, is one of the

largest private debt investors worldwide.

Michael Tiedemann, CEO of AlTi Tiedemann Global, said:

“Our AlTi-Allianz Private Debt Program sets a new benchmark in the

UHNW wealth management industry. We are delighted to offer our

clients unique access to Allianz’s world-class network of

third-party managers at attractive terms and with additional access

to co-investments and secondaries. We believe the combined

resources of our platforms will provide current and prospective

clients with an offering that is unmatched in the alternatives

investment space.”

Tobias Pross, CEO of Allianz Global Investors, said: “For

ultra-high-net-worth individuals and select institutional

investors, diversification beyond the public financial markets can

help to preserve and grow capital. Private debt’s diversification

benefits, coupled with its attractive risk-adjusted returns, make

it a compelling component to investors’ portfolios. Through our

strategic partnership, we are able to bring some of the best

investment opportunities in private markets to the most discerning

and dynamic owners of capital in the world. We believe this is only

the beginning, as we seek to expand our joint offerings in private

markets in the months and years to come.”

Nazim Cetin, CEO of Allianz X, said: “This

partnership is a powerful demonstration of Allianz X’s prowess as a

strategic investor and business builder – for its partner companies

and the Allianz Group. The formation of our JV with AlTi just

months after our initial investment is a first building block of

what we can achieve together in the expanding wealth management

sector. We’re poised to revolutionize access to the private

markets, initially through private debt, and we are confident that

investing alongside Allianz will unlock new opportunities for AlTi,

Allianz, and the broader UHNW market segment.”

The AlTi-Allianz Private Debt Program is set to be offered by a

semi-liquid evergreen structure designed to invest in all aspects

of the private debt markets, covering various strategies, regions,

segments, and risk-return profiles, including direct access to

secondaries and co-investments.

The formation of the joint venture and the launch of the private

debt program are contingent upon the completion of definitive

agreements and obtaining necessary regulatory approvals.

About AlTi

AlTi Tiedemann Global is a leading independent global wealth

manager providing entrepreneurs, multi-generational families,

institutions, and emerging next-generation leaders with fiduciary

capabilities as well as alternative investment strategies and

advisory services. AlTi’s comprehensive offering is underscored by

a commitment to impact or values-aligned investing. The firm

currently manages or advises on over $72 billion in combined assets

and has an expansive network with approximately 400 professionals

across three continents. For more information, please visit us at

www.Alti-global.com.

About Allianz Global Investors

Allianz Global Investors is a leading active asset manager with

over 600 investment professionals in over 20 offices worldwide and

managing EUR 555 billion in assets. We invest for the long term and

seek to generate value for clients every step of the way. We do

this by being active – in how we partner with clients and

anticipate their changing needs, and build solutions based on

capabilities across public and private markets. Our focus on

protecting and enhancing our clients’ assets leads naturally to a

commitment to sustainability to drive positive change. Our goal is

to elevate the investment experience for clients, whatever their

location or objectives.

Data as at 30 June 2024. Total assets under management are

assets or securities portfolios, valued at current market value,

for which Allianz Global Investors companies are responsible

vis-á-vis clients for providing discretionary investment management

decisions and portfolio management, either directly or via a

sub-advisor (these include Allianz Global Investors assets which

are now sub-advised by Voya IM since 25 July 2022). This excludes

assets for which Allianz Global Investors companies are primarily

responsible for administrative services only. Assets under

management are managed on behalf of third parties as well as on

behalf of the Allianz Group.

About Allianz X

Allianz X invests in innovative growth companies in ecosystems

relevant to insurance and asset management. It has a global

portfolio of around 25 companies and assets under management of

about 1.7 billion euros. Allianz X has counted 12 unicorns among

its portfolio so far. The heart, brains, and drive behind it all

are a talented team of around 40 people in Munich and New York.

On behalf of leading global insurer and asset manager Allianz

Group, Allianz X provides an interface between Allianz companies

and the broader ecosystem, enabling collaborative partnerships in

insurtech, fintech, wealth, and beyond.

As an investor, Allianz X supports growth companies to take the

next bold steps and realize their full potential.

Keep up with the latest at Allianz X on Medium, LinkedIn, and X

(formerly Twitter).

1

https://www.morganstanley.com/ideas/private-credit-outlook-considerations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104849673/en/

AlTi Tiedemann Global Investor Relations: Lily

Arteaga, Head of Investor Relations,

investor@alti-global.com

AlTi Tiedemann Global Media Relations: Alex Jorgensen,

pro-alti@prosek.com Allianz Global Investors Media

Relations: Marion Leblanc-Wohrer Mobile +33 6 85 15 74 54

marion.leblancwohrer@allianzgi.com

Pia Groeger Mobile +49 173 358 6167

Pia.groeger@allianzgi.com

Allianz X Media Relations: Allianz X Communications,

mediarelations@allianz.com

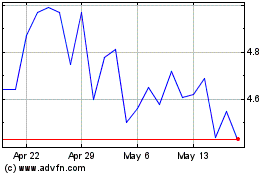

AITi Global (NASDAQ:ALTI)

Historical Stock Chart

From Oct 2024 to Nov 2024

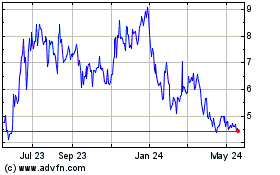

AITi Global (NASDAQ:ALTI)

Historical Stock Chart

From Nov 2023 to Nov 2024