0001701732false00017017322025-02-202025-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 20, 2025 |

Altair Engineering Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38263 |

38-2591828 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1820 E. Big Beaver Road |

|

Troy, Michigan |

|

48083 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (248) 614-2400 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock $0.0001 par value per share |

|

ALTR |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 20, 2025, Altair Engineering Inc. issued a press release disclosing its financial information and operating metrics for its fourth quarter and full year ended December 31, 2024. A copy of the press release is being furnished as Exhibit 99.1 to this Report on Form 8-K.

The information in this Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

ALTAIR ENGINEERING INC. |

|

|

|

Date: February 20, 2025 |

By: |

/s/ Matthew Brown |

|

|

Matthew Brown |

|

|

Chief Financial Officer |

|

|

|

Exhibit 99.1

Altair Announces Fourth Quarter and Full Year 2024 Financial Results

TROY, Mich. – February 20, 2025 – Altair (Nasdaq: ALTR), a global leader in computational intelligence, today released its financial results for the fourth quarter and full year ended December 31, 2024.

Fourth Quarter 2024 Financial Highlights

•Software revenue was $179.4 million compared to $155.9 million for the fourth quarter of 2023, an increase of 15.0% in reported currency and 16.5% in constant currency

•Total revenue was $192.6 million compared to $171.5 million for the fourth quarter of 2023, an increase of 12.3% in reported currency and 13.8% in constant currency

•Net income was $1.0 million compared to $19.7 million for the fourth quarter of 2023, a decrease in earnings of $18.7 million. Net income per share, diluted was $0.01 based on 89.3 million diluted weighted average common shares outstanding, compared to net income per share, diluted of $0.22 for the fourth quarter of 2023, based on 89.0 million diluted weighted average common shares outstanding. Net income margin was 0.5% compared to net income margin of 11.5% for the fourth quarter of 2023

•Non-GAAP net income was $47.4 million, compared to non-GAAP net income of $41.1 million for the fourth quarter of 2023, an increase of $6.3 million. Non-GAAP net income per share, diluted was $0.52 based on 92.6 million non-GAAP diluted common shares outstanding, compared to non-GAAP net income per share, diluted of $0.47 for the fourth quarter of 2023, based on 89.0 million non-GAAP diluted common shares outstanding

•Adjusted EBITDA was $61.0 million compared to $53.6 million for the fourth quarter of 2023, an increase of 13.9%. Adjusted EBITDA margin was 31.7% compared to 31.2% for the fourth quarter of 2023

•Cash provided by operating activities was $37.5 million, compared to $21.7 million for the fourth quarter of 2023

•Free cash flow was $33.2 million, compared to $19.3 million for the fourth quarter of 2023.

Full Year 2024 Financial Highlights

•Software revenue was $611.9 million compared to $550.0 million for the full year of 2023, an increase of 11.3% in reported currency and 12.5% in constant currency

•Total revenue was $665.8 million compared to $612.7 million for the full year of 2023, an increase of 8.7% in reported currency and 9.8% in constant currency

•Net income was $14.2 million compared to a net loss of $(8.9) million for the full year of 2023, an improvement in earnings of $23.1 million. Net income per share, diluted was $0.16 based on 88.6 million diluted weighted average common shares outstanding, compared to net loss per share, diluted of $(0.11) for the full year of 2023, based on 80.6 million diluted weighted average common shares outstanding. Net income margin was 2.1% compared to net loss margin of -1.5% for the full year of 2023

•Non-GAAP net income was $119.6 million, compared to non-GAAP net income of $98.8 million for the full year of 2023, an increase of $20.8 million. Non-GAAP net income per share, diluted was $1.35 based on 91.8 million non-GAAP diluted common shares outstanding, compared to non-GAAP net income per share, diluted of $1.17 for the full year of 2023, based on 84.4 million non-GAAP diluted common shares outstanding

•Adjusted EBITDA was $149.9 million compared to $129.1 million for the full year of 2023, an increase of 16.1%, Adjusted EBITDA margin was 22.5% compared to 21.1% for the full year of 2023

•Cash provided by operating activities was $154.1 million, compared to $127.3 million for the full year of 2023

•Free cash flow was $140.0 million, compared to $117.1 million for the full year of 2023.

Pending Transaction with Siemens and Conference Call Information

On January 22, 2025, Altair’s stockholders approved the previously announced merger agreement providing for the acquisition of Altair by Siemens Industry Software Inc. ("Siemens"). Completion of the pending transaction remains subject to certain customary closing conditions. Altair now anticipates that this transaction may close in the first half of 2025. In light of the pending transaction with Siemens, Altair is suspending quarterly financial results conference calls and its quarterly and annual guidance.

Non-GAAP Financial Measures

This press release contains the following non-GAAP financial measures: Non-GAAP Net Income, Non-GAAP Net Income Per Share, Billings, Adjusted EBITDA, Free Cash Flow, Non-GAAP Gross Profit and Non-GAAP Operating Expense.

Altair believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to its financial condition and results of operations. The Company’s management uses these non-GAAP measures to compare the Company’s performance to that of prior periods for trend analysis, for purposes of determining executive and senior management incentive compensation and for budgeting and planning purposes. The Company also believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with other software companies, many of which present similar non-GAAP financial measures to investors.

Non-GAAP net income excludes stock-based compensation, amortization of intangible assets related to acquisitions, asset impairment charges, non-cash interest expense, other special items as identified by management and described elsewhere in this press release, and the impact of non-GAAP tax rate to income tax expense, which approximates our tax rate excluding discrete items and other specific events that can fluctuate from period to period.

Non-GAAP diluted common shares is calculated using the treasury stock method to calculate the effect of dilutive securities, stock options, restricted stock units and employee stock purchase plan shares and using the if-converted method to calculate the effect of convertible instruments. This is the same methodology that is used when calculating GAAP diluted shares. However, the determination of whether the shares are dilutive or antidilutive is made independently on a GAAP and non-GAAP net income (loss) basis and therefore the number of diluted shares outstanding for GAAP and non-GAAP may be different.

Billings consists of total revenue plus the change in deferred revenue, excluding deferred revenue from acquisitions.

Adjusted EBITDA represents net income adjusted for income tax expense, interest expense, interest income and other, depreciation and amortization, stock-based compensation expense, asset impairment charges and other special items as identified by management and described elsewhere in this press release.

Free cash flow consists of cash flow from operations less capital expenditures.

Non-GAAP gross profit represents gross profit adjusted for stock-based compensation expense and other special items as identified by management and described elsewhere in this press release.

Non-GAAP operating expense represents operating expense excluding stock-based compensation expense, amortization, asset impairment charges and other special items as identified by management and described elsewhere in this press release.

Company management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by management about which expenses and income are excluded or included in determining these non-GAAP financial measures. Altair urges investors to review the reconciliation of its non-GAAP financial measures to the comparable GAAP financial measures, which it includes in press releases announcing quarterly financial results, including this press release, and not to rely on any single financial measure to evaluate the Company’s business.

Reconciliation tables of the most comparable GAAP financial measures to the non-GAAP financial measures used in this press release are included with the financial tables at the end of this release.

About Altair

Altair is a global leader in computational intelligence that provides software and cloud solutions in simulation, high-performance computing, data analytics and AI. Altair enables organizations across all industries to compete more effectively and drive smarter decisions in an increasingly connected world – all while creating a greener, more sustainable future. To learn more, please visit https://www.altair.com.

Forward-Looking Statements

This communication contains “forward-looking statements” within the Private Securities Litigation Reform Act of 1995. Any statements contained in this communication that are not statements of historical fact, including statements regarding the proposed transaction, including the expected timing and closing of the proposed transaction; Altair’s ability to consummate the proposed transaction; the expected benefits of the proposed transaction and other considerations taken into account by the Altair Board of Directors in approving the proposed transaction; the amounts to be received by stockholders and expectations for Altair prior to and following the closing of the proposed transaction, may be deemed to be forward-looking statements. All such forward-looking statements are intended to provide management’s current expectations for the future of Altair based on current expectations and assumptions relating to Altair’s business, the economy and other future conditions. Forward-looking statements generally can be identified through the use of words such as “believes,” “anticipates,” “may,” “should,” “will,” “plans,” “projects,” “expects,” “expectations,” “estimates,” “forecasts,” “predicts,” “targets,” “prospects,” “strategy,” “signs,” and other words of similar meaning in connection with the discussion of future performance, plans, actions or events. Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and changes in circumstances that are difficult to predict. Such risks and uncertainties include, among others: (i) the timing to consummate the pending merger transaction with Siemens Industry Software Inc. (the “Merger”), (ii) the risk that a condition of closing of the pending Merger transaction may not be satisfied or that the closing of the proposed transaction might otherwise not occur, (iii) the risk that a regulatory approval that may be required for the pending Merger transaction is not obtained or is obtained subject to conditions that are not anticipated, (iv) the diversion of management time on transaction-related issues, (v) risks related to disruption of management time from ongoing business operations due to the pending Merger transaction, (vi) the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of the common stock of Altair, (vii) the risk that the pending Merger transaction and its announcement could have an adverse effect on the ability of Altair to retain customers and retain and hire key personnel and maintain relationships with its suppliers and customers, (viii) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Merger Agreement, dated October 30, 2024, with Siemens Industry Software Inc. (the “Merger Agreement”), (ix) business uncertainties and contractual restrictions on our operations while the proposed Merger transaction is pending, (x) unexpected costs, charges or expenses resulting from the pending Merger transaction, (xi) potential litigation relating to the pending Merger transaction that could be instituted against the parties to the Merger Agreement or their respective directors, managers or officers, including the effects of any outcomes related thereto, (xii) worldwide economic or political changes that affect the markets that Altair’s businesses serve which could have an effect on demand for Altair’s products and impact Altair’s profitability, and (xiii) disruptions in the global credit and financial markets, including diminished liquidity and credit availability, changes in international trade agreements, including tariffs and trade restrictions, cyber-security vulnerabilities, foreign currency volatility, swings in consumer confidence and spending, raw material pricing and supply issues, retention of key employees, increases in fuel prices, and outcomes of legal proceedings, claims and investigations. Accordingly, actual results may differ materially from those contemplated by these forward-looking statements. Investors, therefore, are cautioned against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in Altair’s filings with the SEC, including the risks and uncertainties identified in Part I, Item 1A - Risk Factors of Altair’s Annual Report on Form 10-K for the year ended December 31, 2024 and in Altair’s other filings with the SEC. The list of factors is not intended to be exhaustive. These forward-looking statements speak only as of the date of this communication, and Altair does not assume any obligation to update or revise any forward-looking statement made in this communication or that may from time to time be made by or on behalf of Altair.

Media Relations

Altair

Jennifer Ristic

216-849-3109

jristic@altair.com

Investor Relations

Altair

Stephen Palmtag

669-328-9111

spalmtag@altair.com

ALTAIR ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

561,898 |

|

|

$ |

467,459 |

|

Accounts receivable, net |

|

|

173,509 |

|

|

|

190,461 |

|

Income tax receivable |

|

|

21,513 |

|

|

|

16,650 |

|

Prepaid expenses and other current assets |

|

|

28,058 |

|

|

|

26,053 |

|

Total current assets |

|

|

784,978 |

|

|

|

700,623 |

|

Property and equipment, net |

|

|

41,008 |

|

|

|

39,803 |

|

Operating lease right of use assets |

|

|

31,117 |

|

|

|

30,759 |

|

Goodwill |

|

|

462,459 |

|

|

|

458,125 |

|

Other intangible assets, net |

|

|

72,937 |

|

|

|

83,550 |

|

Deferred tax assets |

|

|

8,770 |

|

|

|

9,955 |

|

Other long-term assets |

|

|

44,378 |

|

|

|

40,678 |

|

TOTAL ASSETS |

|

$ |

1,445,647 |

|

|

$ |

1,363,493 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

Accounts payable |

|

$ |

7,316 |

|

|

$ |

8,995 |

|

Accrued compensation and benefits |

|

|

50,328 |

|

|

|

45,081 |

|

Current portion of operating lease liabilities |

|

|

7,876 |

|

|

|

8,825 |

|

Other accrued expenses and current liabilities |

|

|

56,058 |

|

|

|

48,398 |

|

Deferred revenue |

|

|

139,085 |

|

|

|

131,356 |

|

Current portion of convertible senior notes, net |

|

|

227,106 |

|

|

|

81,455 |

|

Total current liabilities |

|

|

487,769 |

|

|

|

324,110 |

|

Convertible senior notes, net |

|

|

— |

|

|

|

225,929 |

|

Operating lease liabilities, net of current portion |

|

|

24,141 |

|

|

|

22,625 |

|

Deferred revenue, non-current |

|

|

28,531 |

|

|

|

32,347 |

|

Other long-term liabilities |

|

|

48,017 |

|

|

|

47,151 |

|

TOTAL LIABILITIES |

|

|

588,458 |

|

|

|

652,162 |

|

Commitments and contingencies |

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Preferred stock ($0.0001 par value), authorized 45,000 shares, none issued or outstanding |

|

|

— |

|

|

|

— |

|

Common stock ($0.0001 par value) |

|

|

|

|

|

|

Class A common stock, authorized 513,797 shares, issued and outstanding 60,181

and 55,240 shares as of December 31, 2024 and 2023, respectively |

|

|

6 |

|

|

|

5 |

|

Class B common stock, authorized 41,203 shares, issued and outstanding 25,394

and 26,814 shares as of December 31, 2024 and 2023, respectively |

|

|

3 |

|

|

|

3 |

|

Additional paid-in capital |

|

|

1,010,789 |

|

|

|

864,135 |

|

Accumulated deficit |

|

|

(116,328 |

) |

|

|

(130,503 |

) |

Accumulated other comprehensive loss |

|

|

(37,281 |

) |

|

|

(22,309 |

) |

TOTAL STOCKHOLDERS’ EQUITY |

|

|

857,189 |

|

|

|

711,331 |

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

1,445,647 |

|

|

$ |

1,363,493 |

|

ALTAIR ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(in thousands, except per share data) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

License |

|

$ |

131,943 |

|

|

$ |

113,172 |

|

|

$ |

435,288 |

|

|

$ |

393,144 |

|

Maintenance and other services |

|

|

47,433 |

|

|

|

42,761 |

|

|

|

176,612 |

|

|

|

156,830 |

|

Total software |

|

|

179,376 |

|

|

|

155,933 |

|

|

|

611,900 |

|

|

|

549,974 |

|

Engineering services and other |

|

|

13,255 |

|

|

|

15,570 |

|

|

|

53,888 |

|

|

|

62,727 |

|

Total revenue |

|

|

192,631 |

|

|

|

171,503 |

|

|

|

665,788 |

|

|

|

612,701 |

|

Cost of revenue |

|

|

|

|

|

|

|

|

|

|

|

|

License |

|

|

4,662 |

|

|

|

3,200 |

|

|

|

15,099 |

|

|

|

15,088 |

|

Maintenance and other services |

|

|

17,604 |

|

|

|

14,340 |

|

|

|

64,014 |

|

|

|

56,094 |

|

Total software * |

|

|

22,266 |

|

|

|

17,540 |

|

|

|

79,113 |

|

|

|

71,182 |

|

Engineering services and other |

|

|

11,113 |

|

|

|

11,633 |

|

|

|

45,690 |

|

|

|

50,609 |

|

Total cost of revenue |

|

|

33,379 |

|

|

|

29,173 |

|

|

|

124,803 |

|

|

|

121,791 |

|

Gross profit |

|

|

159,252 |

|

|

|

142,330 |

|

|

|

540,985 |

|

|

|

490,910 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development * |

|

|

57,147 |

|

|

|

52,519 |

|

|

|

221,161 |

|

|

|

212,645 |

|

Sales and marketing * |

|

|

47,812 |

|

|

|

43,595 |

|

|

|

184,280 |

|

|

|

176,138 |

|

General and administrative * |

|

|

35,595 |

|

|

|

17,096 |

|

|

|

90,150 |

|

|

|

70,887 |

|

Amortization of intangible assets |

|

|

8,709 |

|

|

|

7,708 |

|

|

|

33,022 |

|

|

|

30,851 |

|

Other operating (income) expense, net |

|

|

(976 |

) |

|

|

(1,178 |

) |

|

|

(5,313 |

) |

|

|

146 |

|

Total operating expenses |

|

|

148,287 |

|

|

|

119,740 |

|

|

|

523,300 |

|

|

|

490,667 |

|

Operating income |

|

|

10,965 |

|

|

|

22,590 |

|

|

|

17,685 |

|

|

|

243 |

|

Interest expense |

|

|

1,339 |

|

|

|

1,533 |

|

|

|

5,836 |

|

|

|

6,116 |

|

Other income, net |

|

|

(316 |

) |

|

|

(8,794 |

) |

|

|

(20,781 |

) |

|

|

(18,492 |

) |

Income before income taxes |

|

|

9,942 |

|

|

|

29,851 |

|

|

|

32,630 |

|

|

|

12,619 |

|

Income tax expense |

|

|

8,946 |

|

|

|

10,176 |

|

|

|

18,455 |

|

|

|

21,545 |

|

Net income (loss) |

|

$ |

996 |

|

|

$ |

19,675 |

|

|

$ |

14,175 |

|

|

$ |

(8,926 |

) |

Earnings (loss) per share, basic |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share |

|

$ |

0.01 |

|

|

$ |

0.24 |

|

|

$ |

0.17 |

|

|

$ |

(0.11 |

) |

Weighted average shares |

|

|

85,289 |

|

|

|

81,760 |

|

|

|

84,085 |

|

|

|

80,596 |

|

Earnings (loss) per share, diluted |

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share |

|

$ |

0.01 |

|

|

$ |

0.22 |

|

|

$ |

0.16 |

|

|

$ |

(0.11 |

) |

Weighted average shares |

|

|

89,346 |

|

|

|

88,977 |

|

|

|

88,558 |

|

|

|

80,596 |

|

* Amounts include stock-based compensation expense as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Cost of revenue – software |

|

$ |

2,167 |

|

|

$ |

2,303 |

|

|

$ |

8,397 |

|

|

$ |

10,095 |

|

Research and development |

|

|

6,274 |

|

|

|

7,332 |

|

|

|

25,630 |

|

|

|

33,842 |

|

Sales and marketing |

|

|

4,784 |

|

|

|

6,271 |

|

|

|

19,459 |

|

|

|

28,376 |

|

General and administrative |

|

|

3,745 |

|

|

|

3,252 |

|

|

|

14,194 |

|

|

|

13,268 |

|

Total stock-based compensation expense |

|

$ |

16,970 |

|

|

$ |

19,158 |

|

|

$ |

67,680 |

|

|

$ |

85,581 |

|

ALTAIR ENGINEERING INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOW

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2022 |

|

OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

14,175 |

|

|

$ |

(8,926 |

) |

|

$ |

(43,429 |

) |

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

42,164 |

|

|

|

39,124 |

|

|

|

35,504 |

|

Stock-based compensation expense |

|

|

67,680 |

|

|

|

85,581 |

|

|

|

84,787 |

|

Deferred income taxes |

|

|

(707 |

) |

|

|

(2,319 |

) |

|

|

(4,164 |

) |

Loss (gain) on mark-to-market adjustment of contingent consideration |

|

|

476 |

|

|

|

5,706 |

|

|

|

(7,153 |

) |

Expense on repurchase of convertible senior notes |

|

|

— |

|

|

|

— |

|

|

|

16,621 |

|

Other, net |

|

|

2,015 |

|

|

|

1,943 |

|

|

|

2,179 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

14,560 |

|

|

|

(19,141 |

) |

|

|

(34,175 |

) |

Prepaid expenses and other current assets |

|

|

(7,622 |

) |

|

|

(1,915 |

) |

|

|

1,014 |

|

Other long-term assets |

|

|

2,431 |

|

|

|

(52 |

) |

|

|

2,852 |

|

Accounts payable |

|

|

(2,127 |

) |

|

|

(1,878 |

) |

|

|

3,771 |

|

Accrued compensation and benefits |

|

|

7,013 |

|

|

|

1,783 |

|

|

|

280 |

|

Other accrued expenses and current liabilities |

|

|

7,791 |

|

|

|

9,068 |

|

|

|

(59,463 |

) |

Deferred revenue |

|

|

6,235 |

|

|

|

18,333 |

|

|

|

40,946 |

|

Net cash provided by operating activities |

|

|

154,084 |

|

|

|

127,307 |

|

|

|

39,570 |

|

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Payments for acquisition of businesses, net of cash acquired |

|

|

(27,070 |

) |

|

|

(3,236 |

) |

|

|

(134,541 |

) |

Capital expenditures |

|

|

(14,086 |

) |

|

|

(10,193 |

) |

|

|

(9,648 |

) |

Other investing activities, net |

|

|

(4,974 |

) |

|

|

(2,423 |

) |

|

|

(10,322 |

) |

Net cash used in investing activities |

|

|

(46,130 |

) |

|

|

(15,852 |

) |

|

|

(154,511 |

) |

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Settlement of convertible senior notes |

|

|

(81,729 |

) |

|

|

— |

|

|

|

— |

|

Proceeds from the exercise of common stock options |

|

|

65,537 |

|

|

|

36,140 |

|

|

|

3,577 |

|

Proceeds from employee stock purchase plan contributions |

|

|

9,157 |

|

|

|

7,978 |

|

|

|

8,976 |

|

Payments for repurchase and retirement of common stock |

|

|

— |

|

|

|

(6,255 |

) |

|

|

(19,659 |

) |

Proceeds from issuance of convertible senior notes,

net of underwriters' discounts and commissions |

|

|

— |

|

|

|

— |

|

|

|

224,265 |

|

Repurchase of convertible senior notes |

|

|

— |

|

|

|

— |

|

|

|

(192,422 |

) |

Payments for issuance costs of convertible senior notes |

|

|

— |

|

|

|

— |

|

|

|

(1,523 |

) |

Other financing activities |

|

|

— |

|

|

|

(97 |

) |

|

|

(233 |

) |

Net cash (used in) provided by financing activities |

|

|

(7,035 |

) |

|

|

37,766 |

|

|

|

22,981 |

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

(6,453 |

) |

|

|

1,397 |

|

|

|

(5,094 |

) |

Net increase (decrease) in cash, cash equivalents and restricted cash |

|

|

94,466 |

|

|

|

150,618 |

|

|

|

(97,054 |

) |

Cash, cash equivalents and restricted cash at beginning of year |

|

|

467,576 |

|

|

|

316,958 |

|

|

|

414,012 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

562,042 |

|

|

$ |

467,576 |

|

|

$ |

316,958 |

|

Change in Presentation of Revenue and Cost of Revenue

Effective in the first quarter of 2024, the Company changed the presentation of revenue and cost of revenue in its Consolidated Statements of Operations to combine the financial statement line items (“FSLIs”) labeled “Software related services”, “Client engineering services” and “Other” into one FSLI labeled “Engineering services and other”. The change in presentation has been applied retrospectively and does not affect the software revenue, total revenue, software cost of revenue or total cost of revenue amounts previously reported or have any effect on segment reporting.

Financial Results

The following table provides a reconciliation of Non-GAAP net income and Non-GAAP net income per share – diluted, to net income (loss) and net income (loss) per share – diluted, the most comparable GAAP financial measures:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(in thousands, except per share amounts) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income (loss) |

|

$ |

996 |

|

|

$ |

19,675 |

|

|

$ |

14,175 |

|

|

$ |

(8,926 |

) |

Stock-based compensation expense |

|

|

16,970 |

|

|

|

19,158 |

|

|

|

67,680 |

|

|

|

85,581 |

|

Amortization of intangible assets |

|

|

8,709 |

|

|

|

7,708 |

|

|

|

33,022 |

|

|

|

30,851 |

|

Non-cash interest expense |

|

|

310 |

|

|

|

470 |

|

|

|

1,514 |

|

|

|

1,869 |

|

Impact of non-GAAP tax rate(1) |

|

|

(6,842 |

) |

|

|

(4,261 |

) |

|

|

(21,406 |

) |

|

|

(13,158 |

) |

Special adjustments and other (2) |

|

|

27,219 |

|

|

|

(1,659 |

) |

|

|

24,597 |

|

|

|

2,553 |

|

Non-GAAP net income |

|

$ |

47,362 |

|

|

$ |

41,091 |

|

|

$ |

119,582 |

|

|

$ |

98,770 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share, diluted |

|

$ |

0.01 |

|

|

$ |

0.22 |

|

|

$ |

0.16 |

|

|

$ |

(0.11 |

) |

Non-GAAP net income per share, diluted |

|

$ |

0.52 |

|

|

$ |

0.47 |

|

|

$ |

1.35 |

|

|

$ |

1.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP diluted shares outstanding: |

|

|

89,346 |

|

|

|

88,977 |

|

|

|

88,558 |

|

|

|

80,596 |

|

Non-GAAP diluted shares outstanding: |

|

|

92,555 |

|

|

|

88,977 |

|

|

|

91,767 |

|

|

|

84,433 |

|

(1)For the three months and year ended December 31, 2024, the Company used a non-GAAP effective tax rate of 25%. For the three months and year ended December 31, 2023, the Company used a non-GAAP effective tax rate of 26%.

(2)The three months ended December 31, 2024, includes $22.3 million of expenses related to the pending Merger transaction, $4.7 million of currency losses on acquisition-related intercompany loans and a $0.3 million loss from the mark-to-market adjustment of contingent consideration associated with acquisitions. The three months ended December 31, 2023, includes $2.9 million of currency gains on acquisition-related intercompany loans and a $1.2 million loss from the mark-to-market adjustment of contingent consideration associated with acquisitions. The year ended December 31, 2024, includes $22.3 million of expenses related to the pending Merger transaction, $1.9 million of currency losses on acquisition-related intercompany loans and a $0.5 million loss from the mark-to-market adjustment of contingent consideration associated with acquisitions. The year ended December 31, 2023, includes a $5.7 million loss from the mark-to-market adjustment of contingent consideration associated with acquisitions and $3.2 million of currency gains on acquisition-related intercompany loans.

The following table provides a reconciliation of Adjusted EBITDA to net income (loss), the most comparable GAAP financial measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income (loss) |

|

$ |

996 |

|

|

$ |

19,675 |

|

|

$ |

14,175 |

|

|

$ |

(8,926 |

) |

Income tax expense |

|

|

8,946 |

|

|

|

10,176 |

|

|

|

18,455 |

|

|

|

21,545 |

|

Stock-based compensation expense |

|

|

16,970 |

|

|

|

19,158 |

|

|

|

67,680 |

|

|

|

85,581 |

|

Interest expense |

|

|

1,339 |

|

|

|

1,533 |

|

|

|

5,836 |

|

|

|

6,116 |

|

Depreciation and amortization |

|

|

11,044 |

|

|

|

9,853 |

|

|

|

42,164 |

|

|

|

39,124 |

|

Special adjustments, interest income and other (1) |

|

|

21,746 |

|

|

|

(6,822 |

) |

|

|

1,602 |

|

|

|

(14,302 |

) |

Adjusted EBITDA |

|

$ |

61,041 |

|

|

$ |

53,573 |

|

|

$ |

149,912 |

|

|

$ |

129,138 |

|

(1)The three months ended December 31, 2024, includes $22.3 million of expenses related to the pending Merger transaction, $4.7 million of currency losses on acquisition-related intercompany loans, a $0.3 million loss from the mark-to-market adjustment of contingent consideration associated with acquisitions, and $5.5 million of interest income. The three months ended December 31, 2023, includes $2.9 million of currency gains on acquisition-related intercompany loans, a $1.2 million loss from the mark-to-market adjustment of contingent consideration associated with acquisitions, and $5.2 million of interest income. The year ended December 31, 2024, includes $22.3 million of expenses related to the pending Merger transaction, $1.9 million of currency losses on acquisition-related intercompany loans, a $0.5 million loss from the mark-to-market adjustment of contingent consideration associated with acquisitions, and $23.0 million of interest income. The year ended December 31, 2023, includes a $5.7 million loss from the mark-to-market adjustment of contingent consideration associated with acquisitions, $3.2 million of currency gains on acquisition-related intercompany loans, and $16.9 million of interest income.

The following table provides a reconciliation of Free Cash Flow to net cash provided by operating activities, the most comparable GAAP financial measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(in thousands) |

|

2024 (1) |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net cash provided by operating activities |

|

$ |

37,530 |

|

|

$ |

21,651 |

|

|

$ |

154,084 |

|

|

$ |

127,307 |

|

Capital expenditures |

|

|

(4,347 |

) |

|

|

(2,311 |

) |

|

|

(14,086 |

) |

|

|

(10,193 |

) |

Free Cash Flow |

|

$ |

33,183 |

|

|

$ |

19,340 |

|

|

$ |

139,998 |

|

|

$ |

117,114 |

|

(1) Free Cash Flow for the year ended December 31, 2024, was adversely impacted by approximately $13.2 million of expenses paid related to the pending Merger transaction.

The following table provides a reconciliation of Non-GAAP gross profit to gross profit, the most comparable GAAP financial measure, and a comparison of Non-GAAP gross margin (Non-GAAP gross profit as a percentage of total revenue) to gross margin (gross profit as a percentage of total revenue), the most comparable GAAP financial measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Gross profit |

|

$ |

159,252 |

|

|

$ |

142,330 |

|

|

$ |

540,985 |

|

|

$ |

490,910 |

|

Stock-based compensation expense |

|

|

2,167 |

|

|

|

2,303 |

|

|

|

8,397 |

|

|

|

10,095 |

|

Pending merger expenses |

|

|

1,155 |

|

|

|

— |

|

|

|

1,155 |

|

|

|

— |

|

Non-GAAP gross profit |

|

$ |

162,574 |

|

|

$ |

144,633 |

|

|

$ |

550,537 |

|

|

$ |

501,005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit margin |

|

|

82.7 |

% |

|

|

83.0 |

% |

|

|

81.3 |

% |

|

|

80.1 |

% |

Non-GAAP gross margin |

|

|

84.4 |

% |

|

|

84.3 |

% |

|

|

82.7 |

% |

|

|

81.8 |

% |

The following table provides a reconciliation of Non-GAAP operating expense to Total operating expense, the most comparable GAAP financial measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total operating expense |

|

$ |

148,287 |

|

|

$ |

119,740 |

|

|

$ |

523,300 |

|

|

$ |

490,667 |

|

Stock-based compensation expense |

|

|

(14,803 |

) |

|

|

(16,855 |

) |

|

|

(59,283 |

) |

|

|

(75,486 |

) |

Amortization |

|

|

(8,709 |

) |

|

|

(7,708 |

) |

|

|

(33,022 |

) |

|

|

(30,851 |

) |

Loss on mark-to-market adjustment of

contingent consideration |

|

|

(287 |

) |

|

|

(1,212 |

) |

|

|

(476 |

) |

|

|

(5,706 |

) |

Pending merger expenses |

|

|

(21,095 |

) |

|

|

— |

|

|

|

(21,095 |

) |

|

|

— |

|

Non-GAAP operating expense |

|

$ |

103,393 |

|

|

$ |

93,965 |

|

|

$ |

409,424 |

|

|

$ |

378,624 |

|

The following table provides the calculation of non-GAAP diluted common shares and non-GAAP net income per share, diluted:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income |

|

$ |

47,362 |

|

|

$ |

41,091 |

|

|

$ |

119,582 |

|

|

$ |

98,770 |

|

Interest expense related to convertible notes, net of tax |

|

|

1,006 |

|

|

|

1,006 |

|

|

|

4,024 |

|

|

|

— |

|

Numerator for non-GAAP diluted income per share |

|

$ |

48,368 |

|

|

$ |

42,097 |

|

|

$ |

123,606 |

|

|

$ |

98,770 |

|

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding, basic |

|

|

85,289 |

|

|

|

81,760 |

|

|

|

84,085 |

|

|

|

80,596 |

|

Effect of dilutive shares |

|

|

7,266 |

|

|

|

7,217 |

|

|

|

7,682 |

|

|

|

3,837 |

|

Non-GAAP diluted shares outstanding |

|

|

92,555 |

|

|

|

88,977 |

|

|

|

91,767 |

|

|

|

84,433 |

|

Non-GAAP net income per share, diluted |

|

$ |

0.52 |

|

|

$ |

0.47 |

|

|

$ |

1.35 |

|

|

$ |

1.17 |

|

The following table provides a reconciliation of Billings to revenue, the most comparable GAAP financial measure:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(in thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

$ |

192,631 |

|

|

$ |

171,503 |

|

|

$ |

665,788 |

|

|

$ |

612,701 |

|

Ending deferred revenue |

|

|

167,616 |

|

|

|

163,703 |

|

|

|

167,616 |

|

|

|

163,703 |

|

Beginning deferred revenue |

|

|

(140,835 |

) |

|

|

(138,933 |

) |

|

|

(163,703 |

) |

|

|

(144,460 |

) |

Deferred revenue acquired |

|

|

— |

|

|

|

(149 |

) |

|

|

(1,825 |

) |

|

|

(149 |

) |

Billings |

|

$ |

219,412 |

|

|

$ |

196,124 |

|

|

$ |

667,876 |

|

|

$ |

631,795 |

|

The following table provides Software revenue, Total revenue, Billings and Adjusted EBITDA on a constant currency basis:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Three Months Ended

December 31, 2024 |

|

|

Three Months Ended December 31, 2023 |

|

|

Increase/

(Decrease) % |

|

(in thousands) |

|

As reported |

|

|

Currency changes |

|

|

As adjusted for constant currency |

|

|

As reported |

|

|

As reported |

|

|

As adjusted for constant currency |

|

Software revenue |

|

$ |

179.4 |

|

|

$ |

2.3 |

|

|

$ |

181.7 |

|

|

$ |

155.9 |

|

|

|

15.0 |

% |

|

|

16.5 |

% |

Total revenue |

|

$ |

192.6 |

|

|

$ |

2.6 |

|

|

$ |

195.2 |

|

|

$ |

171.5 |

|

|

|

12.3 |

% |

|

|

13.8 |

% |

Billings |

|

$ |

219.4 |

|

|

$ |

3.6 |

|

|

$ |

223.0 |

|

|

$ |

196.1 |

|

|

|

11.9 |

% |

|

|

13.7 |

% |

Adjusted EBITDA |

|

$ |

61.0 |

|

|

$ |

1.3 |

|

|

$ |

62.3 |

|

|

$ |

53.6 |

|

|

|

13.9 |

% |

|

|

16.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

Year Ended

December 31, 2024 |

|

|

Year Ended

December 31, 2023 |

|

|

Increase/

(Decrease) % |

|

(in thousands) |

|

As reported |

|

|

Currency changes |

|

|

As adjusted for constant currency |

|

|

As reported |

|

|

As reported |

|

|

As adjusted for constant currency |

|

Software revenue |

|

$ |

611.9 |

|

|

$ |

6.8 |

|

|

$ |

618.7 |

|

|

$ |

550.0 |

|

|

|

11.3 |

% |

|

|

12.5 |

% |

Total revenue |

|

$ |

665.8 |

|

|

$ |

7.2 |

|

|

$ |

673.0 |

|

|

$ |

612.7 |

|

|

|

8.7 |

% |

|

|

9.8 |

% |

Billings |

|

$ |

667.9 |

|

|

$ |

8.1 |

|

|

$ |

676.0 |

|

|

$ |

631.8 |

|

|

|

5.7 |

% |

|

|

7.0 |

% |

Adjusted EBITDA |

|

$ |

149.9 |

|

|

$ |

4.6 |

|

|

$ |

154.5 |

|

|

$ |

129.1 |

|

|

|

16.1 |

% |

|

|

19.7 |

% |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

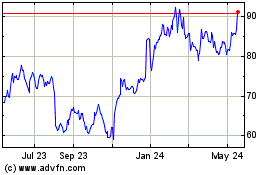

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Feb 2024 to Feb 2025