As filed with the Securities and Exchange Commission on January 27, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ANGI INC.

(Exact Name of Registrant as Specified in Its Charter)

| |

Delaware

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

|

82-1204801

(I.R.S. Employer

Identification Number)

|

|

3601 Walnut Street, Denver, Colorado 80205

Telephone: (303) 963-7200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Shannon Shaw

Chief Legal Officer

Angi Inc.

c/o IAC Inc.

555 West 18th Street

New York, New York 10011

Telephone: (212) 314-7300

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Andrew J. Nussbaum, Esq.

Jenna E. Levine, Esq.

Wachtell, Lipton, Rosen & Katz

51 West 52nd Street

New York, New York 10019

(212) 403-1000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☒

|

|

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☐

|

|

|

Smaller reporting company ☐

|

|

| |

|

|

|

|

|

|

|

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION. PRELIMINARY PROSPECTUS, DATED JANUARY 27, 2025.

PROSPECTUS

Class A Common Stock

This prospectus relates to a special dividend by IAC Inc., a Delaware corporation (which we refer to as “IAC”), to the holders of IAC’s common stock, par value $0.0001 per share (which we refer to as “IAC common stock”) and IAC’s Class B common stock, par value $0.0001 per share (which we refer to as “IAC Class B common stock”) of all of the shares of common stock of Angi Inc. (“Angi,” “we,” “us”, “our” or the “Company”) owned by IAC. IAC currently owns [•] shares of Class A common stock, par value $0.001 per share, of Angi (which we refer to as “Angi Class A common stock”) and [•] shares of Class B common stock, par value $0.001 per share, of Angi (which we refer to as “Angi Class B common stock”), which shares of Angi Class B common stock are convertible to shares of Angi Class A common stock on a one-for-one basis. Prior to the effective time of the special dividend, IAC intends to voluntarily convert all of the shares of Angi Class B common stock that it owns to shares of Angi Class A common stock. As a result of this conversion, there will be no shares of Angi Class B common stock outstanding, and the only class of Angi capital stock with shares outstanding will be the Angi Class A common stock.

The special dividend, which we refer to as the “Distribution”, will be paid on [•], 2025 (which we refer to as the “distribution date”) to holders of record of IAC common stock and IAC Class B common stock, as of the close of business, New York City time, on [•], 2025 (which we refer to as the “record date”), on a pro rata basis, subject to the satisfaction or waiver of certain conditions to the Distribution that are described in this prospectus. IAC expects to distribute approximately [•] shares of Angi Class A common stock in the Distribution (as adjusted for the anticipated occurrence of the reverse stock split of outstanding shares of Angi common stock described in this prospectus), which IAC expects will represent approximately [•]% of the outstanding shares of Angi Class A common stock as of the distribution date. Based on the number of shares of IAC common stock and IAC Class B common stock outstanding and the number of shares of Angi capital stock owned by IAC, in each case as of [•], 2025 and adjusted for the anticipated occurrence of the reverse stock split of Angi Class A common stock and Angi Class B common stock described in this prospectus, IAC expects that approximately [•] shares of Angi Class A common stock will be distributed in respect of each share of IAC common stock and IAC Class B common stock. No fractional shares of Angi Class A common stock will be received by IAC stockholders. Instead, IAC stockholders will receive a cash payment in lieu of any fractional share of Angi Class A common stock that they otherwise would have received, as described herein. Immediately following the Distribution, there will no longer be any shares of Angi Class B common stock outstanding and IAC will no longer hold any shares of Angi’s capital stock. As a result of the Distribution, Angi will cease to be a “controlled company” as defined under the Nasdaq listing rules and, as of the distribution date, will no longer rely on exemptions from corporate governance requirements that are available to controlled companies, except that it may rely on phase-in exemptions for a limited period of time as permitted.

No vote of IAC stockholders or Angi stockholders is required to approve the Distribution. Neither IAC nor Angi is asking you for a proxy, and you are not required to send a proxy. IAC stockholders will not be required to pay any consideration for the shares of Angi Class A common stock they receive in the Distribution, and they will not be required to surrender or exchange shares of their IAC common stock and/or IAC Class B common stock in connection with the Distribution.

Pursuant to the registration statement of which this prospectus forms a part, Angi is registering shares of Angi Class A common stock that will be distributed by IAC in order for IAC to effect the Distribution, though IAC stockholders will not be required to pay any consideration for the shares of Angi Class A common stock they receive in the Distribution and IAC will not receive any proceeds in connection with the Distribution. Angi will not be selling or distributing any shares of its common stock itself pursuant to this prospectus, and Angi will not receive any proceeds from the transactions described in this prospectus. Angi has agreed to pay certain expenses relating to the Distribution.

The completion of the Distribution remains subject to the satisfaction or waiver by IAC of important conditions, which are described in this prospectus, and accordingly the Distribution may not be completed on the timeline anticipated or at all.

Prior to the effectiveness of the Distribution, Angi expects to effect a reverse stock split of the outstanding shares of Angi Class A common stock and Angi Class B common stock, in each case at a ratio of one-for-ten (which we refer to as the “reverse stock split”).

If the Distribution is completed, Angi expects that its amended and restated certificate of incorporation and amended and restated bylaws will each be amended in order to implement certain changes relating to Angi ceasing to have a controlling stockholder (we refer to these amendments to Angi’s amended and restated certificate of incorporation as the “Distribution Amendments”). These amendments will not become effective unless the Distribution is completed. If they become effective, the amendments will provide for a classified Angi board of directors (subject to a sunset at the Angi 2032 annual meeting of stockholders), provide that Angi stockholders must take action at a meeting rather than by written consent, provide that vacancies on the board may be filled only by the board of directors, and provide for Angi to opt into the Delaware statutory provision relating to limitations on business combinations with interested stockholders. Angi’s board of directors has approved the proposed amendments to Angi’s amended and restated certificate of incorporation and amended and restated bylaws, subject to the completion of the Distribution, and expects that a subsidiary of IAC, in its capacity as the record holder of a majority of Angi shares entitled to vote on the matter, will approve the proposed amendments to Angi’s amended and restated certificate of incorporation. No further stockholder approval would then be required. If the Distribution is not completed, these amendments will not become effective.

If the amendments to the Angi amended and restated certificate of incorporation are approved through a stockholder written consent, Angi will file with the U.S. Securities and Exchange Commission (which we refer to as the “SEC”), and provide to Angi stockholders, an Information Statement on Schedule 14C with respect to the Distribution Amendments and the amendment to Angi’s amended and restated certificate of incorporation required for the reverse stock split.

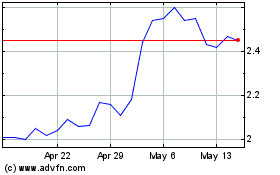

The Angi Class A common stock is listed on The Nasdaq Global Select Market (“Nasdaq”) under the ticker symbol “ANGI.” The last reported sale price of the Angi Class A common stock on January 27, 2025 was $1.93 per share.

We urge you to read carefully this prospectus, any accompanying prospectus supplement and any other offering materials filed or provided by us before you make your investment decision.

Investing in our common stock involves risk. You should consider the risks described in “Risk Factors” beginning on page 10 of this prospectus before investing in our common stock.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [•], 2025.

TABLE OF CONTENTS

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

You should rely only on the information contained in this prospectus, any accompanying prospectus supplement, any free writing prospectus prepared by us and which we have provided to you, and the documents incorporated by reference into this prospectus and any accompanying prospectus supplement. We have not authorized anyone to provide you with information or make any representation that is different from those set forth herein or therein. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus, any accompanying prospectus supplement and any free writing prospectus do not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which they relate, and this prospectus, any accompanying prospectus supplement and any free writing prospectus prepared by us and which we have provided to you do not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or solicitation. You should not assume that the information contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus is correct on any date after the respective dates of this prospectus, such prospectus supplement or such free writing prospectus, as applicable, even though this prospectus, such prospectus supplement or such free writing prospectus is delivered or securities are sold pursuant to this prospectus, such prospectus supplement or such free writing prospectus at a later date. Since the respective dates of this prospectus, any accompanying prospectus supplement and any free writing prospectus prepared by us and which we have provided to you, the business, financial condition, results of operations and prospects of Angi may have changed.

You should not construe the contents of this prospectus as legal, tax or financial advice. You should consult with your own legal, tax, financial or other professional advisors. All summaries of, and references to, any agreements described in this prospectus (including through incorporation by reference) are qualified by the full copies of and complete text of such agreements, which are attached to this prospectus as annexes and/or filed as exhibits to the registration statement on Form S-3 of which this prospectus forms a part and incorporated by reference into this prospectus. All such exhibits are available on the Electronic Data Gathering Analysis and Retrieval System of the SEC website at www.sec.gov. See the section of this prospectus entitled “Where You Can Find More Information” beginning on page 17 of this prospectus.

CERTAIN DEFINITIONS

Unless otherwise indicated or as the context otherwise requires, references in this prospectus to “Angi,” the “Company,” “we,” “us,” “our” and similar names refer to Angi Inc., a Delaware corporation, and references in this prospectus to:

•

“Angi board of directors” refers to the board of directors of Angi;

•

“Angi capital stock” refers to Angi Class A common stock and Angi Class B common stock;

•

“Angi Class A common stock” refers to the shares of Class A common stock, par value $0.001 per share, of Angi;

•

“Angi Class B common stock” refers to the shares of Class B common stock, par value $0.001 per share, of Angi;

•

“DGCL” refers to the General Corporation Law of the State of Delaware, as amended;

•

“Distribution” refers to the special dividend by IAC of all of the shares of Angi Class A common stock that are owned by IAC after the voluntary conversion by IAC of all shares of Angi Class B common stock held by IAC into shares of Angi Class A common stock, in accordance with Angi’s amended and restated certificate of incorporation, that will be paid pro rata to holders of record of IAC common stock and IAC Class B common stock as of the record date;

•

“Distribution Amendments” refers to the amendments to Angi’s amended and restated certificate of incorporation that Angi expects will be made if the Distribution is completed, in order to implement certain changes relating to Angi ceasing to have a controlling stockholder;

•

“distribution date” refers to the date of the Distribution;

•

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

•

“IAC board of directors” refers to the board of directors of IAC;

•

“IAC capital stock” refers to IAC common stock and IAC Class B common stock;

•

“IAC Class B common stock” refers to the shares of Class B common stock, par value $0.0001 per share, of IAC;

•

“IAC common stock” refers to the shares of common stock, par value $0.0001 per share, of IAC;

•

“IAC” refers to IAC Inc., a Delaware corporation;

•

“record date” refers to the close of business, New York City time, on [•], 2025;

•

“reverse stock split” refers to the reverse stock split of the outstanding shares of Angi Class A common stock and Angi Class B common stock, in each case at a ratio of one-for-ten, that Angi expects to effect prior to the effectiveness of the Distribution; and

•

“Securities Act” refers to the Securities Act of 1933, as amended.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the SEC. You should read this prospectus, including the documents incorporated by reference herein, and the related registration statement carefully. This prospectus and registration statement contain important information you should consider when making your investment decision.

You should rely only on the information contained in this prospectus, any accompanying prospectus supplement, any free writing prospectus prepared by us and which we have provided to you, and the documents incorporated by reference into this prospectus and any accompanying prospectus supplement. We have not authorized anyone to provide you with information or make any representation that is different from those set forth herein or therein. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus, any accompanying prospectus supplement and any free writing prospectus do not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which they relate, and this prospectus, any accompanying prospectus supplement and any free writing prospectus prepared by us and which we have provided to you do not constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction where, or to any person to whom, it is unlawful to make such an offer or solicitation. You should not assume that the information contained in this prospectus, any accompanying prospectus supplement or any free writing prospectus is correct on any date after the respective dates of this prospectus, such prospectus supplement or such free writing prospectus, as applicable, even though this prospectus, such prospectus supplement or such free writing prospectus is delivered or securities are sold pursuant to this prospectus, such prospectus supplement or such free writing prospectus at a later date. Since the respective dates of this prospectus, any accompanying prospectus supplement and any free writing prospectus prepared by us and which we have provided to you, the business, financial condition, results of operations and prospects of Angi may have changed.

SUMMARY

The following is a summary of some of the important information contained in this prospectus or incorporated by reference in this prospectus and does not contain all of the information that you need to consider in making your investment decision. In addition to this summary, you should read the entire prospectus carefully, including (1) the risks associated with the Distribution and the securities of Angi after the Distribution, as discussed under “Risk Factors” and (2) the unaudited pro forma condensed consolidated financial statements for Angi, included as Annex A to this prospectus. In addition, we incorporate by reference into this prospectus important business and financial information about Angi, including the historical financial statements and related notes for Angi. For more information on how you may obtain copies of these documents, see the section entitled “Where You Can Find More Information” beginning on page 17 of this prospectus.

Company Information

Angi Inc.

3601 Walnut Street

Denver, Colorado 80205

Telephone: (303) 963-7200

Angi Inc. (Nasdaq: ANGI) is a Delaware corporation that connects quality home service professionals with consumers across more than 500 different categories, from repairing and remodeling homes to cleaning and landscaping.

For information regarding the results of Angi’s historical operations, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Angi’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which is incorporated by reference into this prospectus. For pro forma condensed consolidated financial information of Angi giving effect to the Distribution, see Annex A to this prospectus.

Additional information about Angi and its subsidiaries is included in the documents incorporated by reference in this prospectus. See the sections entitled “Where You Can Find More Information” beginning on page 17 of this prospectus and “Incorporation of Certain Documents by Reference” beginning on page 18 of this prospectus.

The Distribution (page 20)

On [•], 2025, IAC announced that its board of directors had declared a special dividend to the registered holders of IAC common stock and IAC Class B common stock, on a pro rata basis, of all of the shares of Angi Class A common stock that will be owned by IAC as of immediately prior to the effective time of the Distribution. IAC currently owns [•] shares of Angi Class A common stock and [•] shares of Angi Class B common stock, which shares of Angi Class B common stock are convertible to shares of Angi Class A common stock on a one-for-one basis. Prior to the effective time of the Distribution, IAC intends to voluntarily convert all of the shares of Angi Class B common stock owned by IAC into an equivalent number of shares of Angi Class A common stock. As a result of this conversion, as of the distribution date, there will be no shares of Angi Class B common stock outstanding, and the only class of Angi capital stock with shares outstanding will be the Angi Class A common stock. The effective time of the Distribution will be as of the close of business, New York City time, [•] on [•], 2025, subject to the satisfaction or waiver of certain conditions to the Distribution that are described in this prospectus. IAC expects to distribute approximately [•] shares of Angi Class A common stock in the Distribution (as adjusted for the anticipated occurrence of the reverse stock split of outstanding shares of Angi common stock described in this prospectus), which IAC expects will represent approximately [•]% of the outstanding shares of Angi Class A common stock as of the distribution date. Based on the number of shares of IAC common stock and IAC Class B common stock outstanding and the number of shares of Angi capital stock owned by IAC, in each case as of [•], 2025, and adjusted for the anticipated occurrence of the reverse stock split of Angi Class A common stock and Angi Class B common stock described in this prospectus, IAC expects that approximately [•] shares of Angi Class A common stock will be distributed in respect of each share of IAC common stock and IAC Class B common stock. No fractional shares of Angi Class A common stock will be distributed to IAC stockholders

in the Distribution. Instead, IAC stockholders will receive a cash payment in lieu of any fractional share of Angi Class A common stock that they otherwise would have received, as described herein.

Immediately following the Distribution, there will no longer be any shares of Angi Class B common stock outstanding and IAC will no longer hold any shares of Angi capital stock.

Following the Distribution, shares of IAC capital stock will continue to trade on The Nasdaq Global Select Market under the symbol “IAC,” and shares of Angi Class A common stock will continue to trade on The Nasdaq Global Select Market under the symbol “ANGI.” No vote of IAC stockholders or Angi stockholders is required in connection with the Distribution. Neither IAC nor Angi is asking you for a proxy, and you are not required to send a proxy. IAC stockholders will not be required to pay any consideration for the shares of Angi Class A common stock they receive in the Distribution, and they will not be required to surrender or exchange shares of their IAC common stock and/or IAC Class B common stock in connection with the Distribution. The Distribution will not affect the number of shares of IAC capital stock that are held by IAC stockholders as of the distribution date.

Pursuant to the registration statement of which this prospectus forms a part, Angi is registering shares of Angi Class A common stock that will be distributed by IAC in order for IAC to effect the Distribution, though IAC stockholders will not be required to pay any consideration for the shares of Angi Class A common stock they receive in the Distribution and IAC will not receive any proceeds in connection with the Distribution. Angi will not be selling or distributing any shares of its common stock itself pursuant to this prospectus, and Angi will not receive any proceeds from the transactions described in this prospectus. Angi has agreed to pay certain expenses relating to the Distribution.

See the section entitled “The Distribution” beginning on page 20 of this prospectus.

Loss of Controlled Company Status

Prior to the Distribution, IAC controls a majority of the voting power of Angi’s outstanding capital stock. As a result of the Distribution, IAC will cease to own or control any of Angi’s outstanding capital stock, Angi will cease to be a “controlled company” under the Nasdaq listing standards and, as of the distribution date, Angi will no longer rely on exemptions from corporate governance requirements that are available to controlled companies, except that Angi may rely on phase-in exemptions for a limited period of time, as permitted. Upon the consummation of the Distribution, Angi expects to be in full compliance with all applicable Nasdaq corporate governance requirements, taking into account such permitted phase-in exemptions.

Post-Distribution Governance and Management of Angi (page 22)

Angi will file with the SEC, and provide to Angi stockholders, an Information Statement on Schedule 14C with respect to the Distribution Amendments and the amendment to Angi’s amended and restated certificate of incorporation required for the reverse stock split.

If the Distribution is completed, Angi expects that its amended and restated certificate of incorporation and amended and restated bylaws will each be amended in order to implement certain changes relating to Angi ceasing to have a controlling stockholder. These amendments will not become effective unless the Distribution is completed. If they become effective, the Distribution Amendments will provide for a classified Angi board of directors (subject to a sunset at the Angi 2032 annual meeting of stockholders), provide that Angi stockholders must take action at a meeting rather than by written consent, provide that vacancies on the board may be filled only by the board of directors, and provide for Angi to opt into the Delaware statutory provision relating to limitations on business combinations with interested stockholders. The Angi board of directors has approved the proposed Distribution Amendments and the proposed amendment to Angi’s amended and restated bylaws, subject to the completion of the Distribution, and expects that a subsidiary of IAC, in its capacity as the record holder of a majority of Angi shares entitled to vote on the matter, will approve the proposed Distribution Amendments. No further stockholder approval will be required. If the Distribution is not completed, these amendments will not become effective.

Upon the earlier of the completion of the Distribution and May 31, 2025, Joseph Levin, the current Chairman of the Angi board of directors, will become the Executive Chairman of Angi. It is anticipated

that Christopher Halpin, Kendall Handler, and Mark Stein will resign from the Angi board of directors in connection with the closing of the Distribution. Upon the effectiveness of such resignations, the size of the Angi board of directors will be reduced to eliminate the resulting vacancies.

Relationship Between IAC and Angi After the Distribution (page 24)

Following the Distribution, IAC and Angi will both be independent, publicly traded companies. IAC and Angi are party to a number of agreements that were put in place in 2017 when IAC’s HomeAdvisor business and Angie’s List, Inc. were combined (the “Separation Agreements”). These Separation Agreements will survive the Distribution in accordance with their terms (except as noted otherwise in this prospectus).

See the section entitled “The Distribution — Relationship Between IAC and Angi After the Distribution” beginning on page 24 of this prospectus.

Recent Developments (page 28)

Prior to the completion of the Distribution, and regardless of whether the Distribution occurs, Angi expects to effect a reverse stock split of the outstanding shares of Angi Class A common stock and Angi Class B common stock, in each case at a ratio of one-for-ten. This will be effected pursuant to an amendment to Angi’s amended and restated certificate of incorporation, which the Angi board of directors has approved. Angi expects that a subsidiary of IAC, in its capacity as the record holder of a majority of Angi shares entitled to vote on the matter, will approve the amendment to Angi’s amended and restated certificate of incorporation to authorize the reverse stock split. Following such approval, the Angi board of directors will be able to effect the reverse stock split at any time after the 20th day following the mailing of the Information Statement on Schedule 14C to Angi stockholders describing the reverse stock split.

The Angi board of directors considered various factors in connection with approving the amendment to Angi’s amended and restated certificate of incorporation for the reverse stock split. The primary purposes of the reverse stock split include improving the perception of Angi Class A common stock as an investment security and decreasing price volatility for Angi Class A common stock, as currently small price movements may cause relatively large percentage changes in the stock price. The Angi board of directors considered that any resulting increase in the per share price of Angi Class A common stock following a reverse stock split could encourage increased investor interest in the stock and promote greater liquidity for holders of Angi Class A common stock, although they noted that there was no assurance that the reverse stock split would cause any such increase.

If the reverse stock split is effected, no fractional shares of Angi Class A common stock or Angi Class B common stock will be issued. In lieu of fractional shares that would otherwise be issued, (i) all fractional shares otherwise issuable to the holders of Angi Class A common stock in the reverse stock split will be aggregated and sold by the Company’s transfer agent as soon as practicable after the effective time of the reverse stock split on the basis of prevailing market prices of the Angi Class A common stock at the time of sale, and (ii) all fractional shares of Angi Class B common stock otherwise issuable to the holders of Angi Class B common stock in the reverse stock split will be reclassified into the same number of fractional shares of Angi Class A common stock and then aggregated and sold by the Company’s transfer agent on the basis of prevailing market prices of the Angi Class A common stock at the time of sale. After such sale, the net proceeds derived from the sale of fractional interests will be distributed to holders who would otherwise have been entitled to receive fractional shares of Angi Class A common stock or Angi Class B common stock pro rata based on the number of fractional shares that they would otherwise be entitled to receive. In the case of shares of Angi Class A common stock held in street name, the applicable broker, bank or nominee will determine the process for dealing with any entitlements to fractional shares of Angi Class A common stock, which may include allocation of fractional shares at the account level.

Material U.S. Federal Income Tax Consequences (page 41)

It is a condition to the completion of the Distribution that IAC receive an opinion of IAC’s outside counsel satisfactory to the IAC board of directors regarding the qualification of the Distribution as a transaction that is generally tax-free for U.S. federal income tax purposes under Section 355(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that, for U.S. federal income

tax purposes, no gain or loss will be recognized by U.S. holders of IAC common stock upon the receipt of Angi Class A common stock in the Distribution, except with respect to cash received in lieu of fractional shares of Angi Class A common stock, as described herein.

All holders of IAC common stock should consult their own tax advisors as to the particular consequences to them of the Distribution, including the applicability and effect of any U.S. federal, state, local, non-U.S. and other tax laws. For more information regarding the material U.S. federal income tax consequences of the Distribution, see “Material U.S. Federal Income Tax Consequences” below.

QUESTIONS AND ANSWERS ABOUT THE DISTRIBUTION

The following provides only a summary of the terms of the Distribution. You should read the sections entitled “The Distribution,” “Description of Angi Class A Common Stock,” and “Material U.S. Federal Income Tax Consequences” below in this prospectus for a more detailed description of the matters described below.

| |

I own shares of IAC capital stock. What will I receive as a result of the Distribution?

|

|

|

Subject to the satisfaction or waiver by IAC of certain conditions, IAC will distribute to the holders of record of IAC common stock and IAC Class B common stock, on a pro rata basis, all of the shares of Angi Class A common stock that will be owned by IAC as of immediately prior to the effective time of the Distribution. Prior to the effective time of the Distribution, IAC intends to voluntarily convert all of the shares of Angi Class B common stock then owned by IAC into an equivalent number of shares of Angi Class A common stock. IAC expects to distribute approximately [•] shares of Angi Class A common stock in the Distribution, as adjusted for the anticipated occurrence of the reverse stock split, which IAC expects will represent approximately [•]% of the outstanding shares of Angi Class A common stock as of the distribution date. Based on the number of shares of IAC common stock and IAC Class B common stock outstanding and the number of shares of Angi capital stock owned by IAC, in each case as of [•], 2025, and adjusted for the anticipated occurrence of the reverse stock split, IAC expects that approximately [•] shares of Angi Class A common stock will be distributed in respect of each share of IAC common stock and IAC Class B common stock. No fractional shares of Angi Class A common stock will be distributed to IAC stockholders in the Distribution. Instead, IAC stockholders will receive a cash payment in lieu of any fractional share of Angi Class A common stock that they otherwise would have received, as described herein. In the case of shares of IAC capital stock held in street name, the applicable broker, bank or nominee will determine the process for dealing with any entitlements to fractional shares of Angi Class A common stock, which may include allocation of fractional shares at the account level.

|

|

| |

I own shares of Angi Class A common stock. What will I receive as a result of the Distribution?

|

|

|

Holders of shares of Angi Class A common stock will not receive any Angi shares or other consideration in the Distribution.

|

|

| |

What is the record date for the Distribution, and when will the Distribution occur?

|

|

|

The record date for the Distribution is the close of business, New York City time, on [•], 2025. Subject to the satisfaction or waiver by IAC of certain conditions, the Distribution will take place at [•] on [•], 2025 to registered holders of IAC common stock and IAC Class B common stock as of the record date.

|

|

| |

What do I have to do to participate in the Distribution?

|

|

|

No action is required to be taken by IAC stockholders as of the record date to receive their shares of Angi Class A common stock in the Distribution.

|

|

| |

If I sell my shares of IAC capital stock before the distribution date, will I still be entitled to receive shares of Angi Class A common stock in the Distribution?

|

|

|

Beginning on or shortly before the record date for the Distribution and continuing up to and through the distribution date, it is expected that there will be two markets in IAC common stock: a “regular-way” market and an “ex-distribution” market. Shares of IAC common stock that trade in the “regular-way” market will trade with an entitlement to the special dividend of shares of Angi Class A common stock. Shares that trade in the “ex-distribution” market will trade without an entitlement to the special dividend of shares of Angi Class A common stock. Each stockholder trading in IAC common stock shares would make its own decision as to whether to trade any of such shares of IAC common stock in the “regular-way” market or the “ex-distribution” market. If you decide to sell any shares of your IAC common stock after the record date for the Distribution and before the distribution date, you should make sure your stockbroker, bank or other nominee understands whether you want to sell your IAC common stock with or without your entitlement to the special dividend of shares of Angi Class A common stock.

|

|

| |

How will the Distribution affect the number of shares of IAC capital stock I currently hold?

|

|

|

The number of shares of IAC capital stock you hold will not be affected as a result of the Distribution. While the number of shares of IAC capital stock you hold will not change as a result of the Distribution, the market value of IAC capital stock may adjust to reflect the Distribution.

|

|

| |

How will the Distribution affect the number of shares of Angi Class A common stock I currently hold?

|

|

|

The number of shares of Angi Class A common stock you hold will not be changed as a result of the Distribution (unless you also hold shares of IAC capital stock as of the record date, in which case you may receive shares of Angi Class A common stock in the Distribution). However, the market value of Angi capital stock may adjust as a result of the Distribution.

While the Distribution itself will not affect the number of shares of Angi Class A common stock that you currently hold, the number of shares of Angi Class A common stock that you hold will be reduced, by a multiple of ten, except for treatment of fractional shares, upon the occurrence of the anticipated reverse stock split.

|

|

| |

What are the U.S. federal income tax consequences of the Distribution to holders of IAC capital stock?

|

|

|

It is a condition to the completion of the Distribution that IAC receive an opinion of IAC’s outside counsel satisfactory to the IAC board of directors regarding the qualification of the Distribution as a transaction that is generally tax-free for U.S. federal income tax purposes under Section 355(a) of the Code. Accordingly, it is expected that, for U.S. federal income tax purposes, no gain or loss will be recognized by U.S. holders of IAC common stock upon the receipt of Angi Class A common stock in the Distribution, except with respect to any cash received in lieu of fractional shares of Angi Class A common stock, as described herein.

All holders of IAC common stock should consult their own tax advisors as to their particular consequences of the Distribution, including the applicability and effect of any U.S. federal, state, local, non-U.S. and other tax laws. For more information regarding the material U.S. federal income tax consequences of the Distribution, see “Material U.S. Federal Income Tax Consequences” below.

|

|

| |

When will I receive my shares of Angi Class A common stock? Will I receive a stock

|

|

|

Record holders of shares of IAC capital stock who are entitled to receive the Distribution will receive a book-entry account statement reflecting their ownership of shares of Angi Class A common stock. No certificates

|

|

| |

certificate for shares of Angi Class A common stock distributed as a result of the Distribution?

|

|

|

will be issued in the Distribution. For additional information, registered stockholders should contact IAC’s distribution agent, Computershare Trust Company, N.A., at 866-203-6218 (toll-free) or 201-680-6578.

|

|

| |

What if I hold my shares of IAC capital stock through a broker, bank or other nominee?

|

|

|

IAC stockholders who hold their shares of IAC capital stock through a broker, bank or other nominee will have their brokerage account credited with shares of Angi Class A common stock. For additional information, those stockholders should contact their broker, bank or other nominee directly. Questions regarding the Distribution can also be directed to IAC’s distribution agent, Computershare Trust Company, N.A., at 866-203-6218 (toll-free) or 201-680-6578.

|

|

| |

What if I have stock certificates reflecting my shares of IAC capital stock? Should I send them to the transfer agent or to IAC?

|

|

|

No, you should not send your stock certificates to the transfer agent or to IAC. You should retain your IAC stock certificates. No certificates representing your shares of Angi Class A common stock will be mailed to you; however, you will receive a book entry account statement indicating your ownership of shares of Angi Class A common stock from Computershare Trust Company, N.A. Angi Class A common stock will be issued as uncertificated shares registered in book-entry form through the direct registration system.

|

|

| |

How will the Distribution affect my IAC equity awards?

|

|

|

Each option to purchase shares of IAC common stock will continue to be an option to purchase shares of IAC common stock, with adjustments to the number of shares subject to such option and the option exercise price based on (1) the value of IAC common stock prior to the Distribution and (2) the value of IAC common stock after giving effect to the Distribution.

Except as otherwise described above and except to the extent otherwise provided under local law, following the Distribution, the adjusted options generally will have the same terms and conditions, including the same exercise periods, as the options to purchase shares of IAC common stock had immediately prior to the Distribution.

All IAC restricted stock units (“RSUs”) will continue to be IAC RSUs following the Distribution, with adjustments to the number of RSUs based on (1) the value of IAC common stock prior to the Distribution and (2) the value of IAC common stock after giving effect to the Distribution.

Except as otherwise described above and except to the extent otherwise provided under local law, following the Distribution, the IAC RSUs will generally have the same terms and conditions, including the same vesting provisions, as the IAC RSUs had immediately prior to the date of the Distribution.

|

|

| |

How will the Distribution affect my Angi equity awards?

|

|

|

Following the Distribution, all Angi equity awards that are outstanding immediately prior to the Distribution will remain outstanding, without adjustment, with the same terms and conditions following the Distribution as were in effect immediately prior to the Distribution.

While the Distribution itself will not affect Angi equity awards, all Angi equity awards will be adjusted proportionately upon the occurrence of the anticipated reverse stock split.

|

|

| |

Have IAC and Angi entered into any agreements in connection with the Distribution?

|

|

|

In 2017, Angi became a new publicly traded company through a transaction in which IAC combined its HomeAdvisor businesses with Angie’s List, Inc. In connection with the consummation of such transaction, Angi and IAC entered into certain agreements governing the relationship between the two companies. These agreements include a contribution agreement, an investor rights agreement, a services agreement, a tax sharing agreement, and an employee matters agreement. Copies of all of such agreements are filed as exhibits to the Registration Statement on Form S-3 of which this prospectus forms a part. Angi is not entering into any new agreements with IAC in connection with the Distribution; however, it is anticipated that IAC and Angi will enter into modifications to certain of these agreements, as further described in this prospectus.

|

|

| |

What happens if the Distribution is not completed?

|

|

|

If the Distribution is not completed, the transactions described in this prospectus will not be implemented.

|

|

RISK FACTORS

An investment in Angi Class A common stock involves risks. You should carefully consider each of the following risks and uncertainties associated with Angi and the ownership of Angi Class A common stock, as well as the risks described under “Risk Factors” in Angi’s most recent Annual Report on Form 10-K, and subsequent updates to those Risk Factors in Angi’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, together with all of the other information appearing in this prospectus or incorporated by reference into this prospectus and any applicable prospectus supplement, in light of your particular investment objectives and financial circumstances. In addition to those risk factors, there may be additional risks and uncertainties of which management is not aware or on which management is not focused or that management deems immaterial. Angi’s business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of Angi Class A common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Relating to the Distribution

Some or all of the expected benefits of the Distribution may not be achieved.

The full strategic and financial benefits expected to result from the Distribution may not be achieved, or such benefits may be delayed or may never occur at all. The Distribution is expected to provide the following benefits to Angi, among others:

•

enabling Angi to allocate its financial resources to meet the unique needs of its businesses and to implement its own optimal capital structure tailored to its strategy and business needs;

•

greater flexibility to raise equity capital needed to fund growth, including by using its stock as equity currency to make strategic acquisitions and for employee compensation;

•

a potential increase in the equity value of Angi, including through the elimination of its controlling shareholder;

•

the potential to attract new investors and expanded coverage of Angi by equity research analysts, which increase, if realized, could provide Angi with a more efficient equity currency for acquisitions and employee compensation;

•

providing Angi’s management team with undiluted focus on its specific operating and strategic priorities and customer requirements and streamlined decision-making; and

•

an ability to select a board of directors with the right mix of experience, skills and other qualifications to oversee Angi’s operation as an independent company.

Angi may not achieve these or other anticipated benefits for a variety of reasons, including, among others: (a) the possibility that the Distribution will not be completed, (b) Angi will be more susceptible to market fluctuations and other adverse events following the consummation of the Distribution, (c) the risk of litigation, injunctions or other legal proceedings relating to the Distribution, and (d) consummation of the Distribution will require significant amounts of management time and effort, which may divert management attention from operating and growing Angi’s business. If Angi fails to achieve some or all of the benefits expected to result from the Distribution, or if such benefits are delayed, Angi’s business, financial condition and results of operations of Angi could be materially and adversely affected.

If the Distribution were to fail to qualify as a transaction that is generally tax-free for U.S. federal income tax purposes, IAC, Angi and their respective stockholders could suffer material adverse consequences.

It is a condition to the completion of the Distribution that IAC receive an opinion of IAC’s outside counsel satisfactory to the IAC board of directors, among other things, regarding the qualification of the Distribution as a transaction that is generally tax-free for U.S. federal income tax purposes under Section 355(a) of the Code. The opinion of counsel will be based upon and rely on, among other things, various facts and assumptions, as well as certain representations, statements and undertakings of IAC and Angi, including those relating to the past and future conduct of IAC and Angi. If any of these representations, statements or undertakings is, or becomes, inaccurate or incomplete, or if any of the representations or

covenants contained in any of the applicable agreements or in any document relating to the opinion of counsel are inaccurate or not complied with by IAC, Angi or any of their respective subsidiaries, the opinion of counsel may be invalid and the conclusions reached therein could be jeopardized.

Notwithstanding receipt of the opinion of counsel regarding the Distribution, the U.S. Internal Revenue Service (the “IRS”) could determine that the Distribution should be treated as a taxable transaction for U.S. federal income tax purposes if it determines that any of the representations, assumptions or undertakings upon which the opinion of counsel was based are inaccurate or have not been complied with. The opinion of counsel represents the judgment of such counsel and is not binding on the IRS or any court, and the IRS or a court may disagree with the conclusions in the opinion of counsel. Accordingly, notwithstanding receipt by IAC of the opinion of counsel, there can be no assurance that the IRS will not assert that the Distribution does not qualify for tax-free treatment for U.S. federal income tax purposes or that a court would not sustain such a challenge. In the event the IRS were to prevail with such a challenge, IAC and Angi and their respective stockholders could suffer material adverse consequences.

If the Distribution were to fail to qualify as a transaction that is generally tax-free for U.S. federal income tax purposes under Section 355(a) of the Code, in general, for U.S. federal income tax purposes, IAC would recognize a taxable gain as if it had sold the Angi Class A common stock in a taxable sale for its fair market value. In such circumstance, holders of IAC common stock who receive Angi Class A common stock in the Distribution would be subject to tax as if they had received a taxable distribution equal to the fair market value of such shares. Even if the Distribution were otherwise to qualify as a tax-free transaction under Section 355(a) of the Code, the Distribution may result in taxable gain to IAC, but not its stockholders, under Section 355(e) of the Code if the Distribution were deemed to be part of a plan (or series of related transactions) pursuant to which one or more persons acquire, directly or indirectly, shares representing a 50 percent or greater interest (by vote or value) in IAC or Angi. For this purpose, any acquisitions of IAC stock or Angi stock within the period beginning two years before, and ending two years after, the Distribution are presumed to be part of such a plan, although IAC or Angi may be able to rebut that presumption (including by qualifying for one or more safe harbors under applicable Treasury Regulations). For further discussion of U.S. federal tax consequences relating to a failure of the Distribution to qualify for tax-free treatment, see “Material U.S. Federal Income Tax Consequences — Material U.S. Federal Income Tax Consequences if the Distribution Is Taxable.” Stockholders of both IAC and Angi should consult with their own tax advisors regarding the tax consequences of the Distribution.

Under the existing Tax Sharing Agreement between IAC and Angi entered into in 2017 (the “Tax Sharing Agreement”), Angi generally is required to indemnify IAC for any taxes resulting from the failure of the Distribution to qualify for the intended tax-free treatment (and related amounts) to the extent that the failure to so qualify is attributable to (i) an acquisition of all or a portion of the equity securities or assets of Angi, whether by merger or otherwise by any person (and regardless of whether Angi participated in or otherwise facilitated the acquisition), (ii) other actions or failures to act by Angi or (iii) any of the representations or undertakings made by Angi in any of the documents relating to the opinion of counsel being incorrect or violated. Any such indemnity obligations could be material and the satisfaction of such indemnification obligations could have a material adverse effect on Angi’s financial condition, results of operations and cash flows.

Angi may not be able to engage in desirable capital-raising or strategic transactions following the Distribution.

Under current U.S. federal income tax law, a distribution that otherwise qualifies for tax-free treatment can be rendered taxable to the distributing corporation and its stockholders as a result of certain post-distribution transactions, including certain acquisitions of shares or assets of the corporation the stock of which is distributed. To preserve the tax-free treatment of the Distribution, the Tax Sharing Agreement imposes certain restrictions on Angi and its subsidiaries during the two-year period following the Distribution (including restrictions on share issuances and repurchases, business combinations, sales of assets and similar transactions). The Tax Sharing Agreement also prohibits Angi from taking or failing to take any action that could reasonably be expected to prevent the Distribution from qualifying as a transaction that is generally tax-free for U.S. federal income tax purposes under Section 355 of the Code. These restrictions may limit the ability of Angi to pursue certain equity issuances, strategic transactions, repurchases or other transactions that it may otherwise believe to be in the best interests of its stockholders or that might increase the value of its business.

The Distribution may be abandoned by IAC at any time prior to completion, and is subject to certain closing conditions that, if not satisfied or waived, will result in the Distribution not being completed.

The IAC board of directors may abandon the Distribution at any time prior to completion. In addition, the completion of the Distribution is subject to the satisfaction (or waiver) of a number of conditions, including the final approval of the IAC board of directors. Some of the conditions to the completion of the Distribution are outside of the control of Angi. If any condition to the closing of the Distribution is not satisfied or waived, or if the IAC board of directors otherwise determines to abandon the Distribution, the Distribution will not be completed.

If IAC does not complete the Distribution, the market price of IAC or Angi securities may fluctuate to the extent that the current market prices of those securities reflect a market assumption that the Distribution will be completed. Angi will also be obligated to pay certain legal and accounting fees and related expenses in connection with the Distribution, whether or not the Distribution is completed. In addition, Angi has expended, and will continue to expend, management resources in an effort to complete the Distribution.

After the Distribution, actual or potential conflicts of interest may develop between the management and directors of IAC, on the one hand, and the management and directors of Angi, on the other hand.

After the completion of the Distribution, the management and directors of IAC and Angi may own both IAC capital stock and Angi capital stock, and certain members of IAC’s senior management team may be directors of Angi after the Distribution. For example, Mr. Levin, who is the current, and following the Distribution will be the former, Chief Executive Officer of IAC, will serve as Executive Chairman of Angi following the Distribution. This overlap could create (or appear to create) potential conflicts of interest when IAC’s and Angi’s directors and executive officers face decisions that could have different implications for IAC and Angi. For example, potential conflicts of interest could arise in connection with the resolution of any dispute between IAC and Angi regarding the relationship between IAC and Angi following the Distribution, including any commercial agreements between the parties or their affiliates. Potential conflicts of interest could also arise if IAC and Angi enter into any commercial arrangements in the future.

IAC or Angi may fail to perform under the agreements between them and Angi may be unable to replace some of these agreements.

IAC and Angi are party to a number of agreements that either include obligations relating to the Distribution, will be amended in connection with the Distribution or will survive the completion of the Distribution in accordance with their terms. Each party will rely on the other to satisfy its performance obligations under these agreements. If either party is unable to satisfy its obligations under these agreements, including its indemnification obligations, it could have a material adverse effect on the other party’s results of operations or financial condition.

In addition, Angi may be required to enter into new agreements or assume the responsibility if and when certain of these agreements with IAC terminate. We cannot assure you that the economic terms of the new arrangements will be similar to those under our current arrangements with IAC. If Angi is unable to renew or replace such arrangements on a comparable basis, its business, financial condition and results of operations may be materially and adversely affected.

In connection with the Distribution, IAC will indemnify Angi for certain liabilities, and Angi will indemnify IAC for certain liabilities, in each case pursuant to existing agreements between IAC and Angi. If Angi is required to pay under these indemnities to IAC, Angi’s financial results could be negatively impacted.

Certain of the existing agreements in place between IAC and Angi require each of IAC and Angi to indemnify the other for certain liabilities. Any amounts Angi is required to pay pursuant to these indemnification obligations and other liabilities could require Angi to divert cash that would otherwise have been used in furtherance of its operating business. Further, the indemnity from IAC may not be sufficient to protect Angi against the full amount of such liabilities, and IAC may not be able to fully satisfy its indemnification obligations. Moreover, even if Angi ultimately succeeds in recovering from IAC any amounts for which Angi is held liable, Angi may be temporarily required to bear these losses itself. Each of these risks could have a material adverse effect on Angi’s financial position, results of operations and cash flows.

The synergies that IAC achieves with all of its businesses under the same corporate structure, and the benefits of those synergies that Angi enjoys, will cease to exist with regard to the Angi businesses following the Distribution.

Currently, IAC’s businesses share certain economies of scale in costs, human capital, vendor relationships and customer relationships with Angi’s businesses. While Angi expects to enter into third party agreements with respect to these matters after the Distribution, those arrangements may not fully capture the benefits that Angi’s businesses currently enjoy as a result of its majority ownership by IAC. The loss of these benefits as a consequence of the Distribution could have an adverse effect on Angi’s business, results of operations and financial condition following the Distribution.

IAC will provide certain services to us pursuant to a services agreement following the Distribution. When such agreements terminate, we will be required to replace such services, and the economic terms of the new arrangements may be less favorable to us.

IAC and Angi are party to a services agreement. In connection with the Distribution, Angi and IAC anticipate that the services agreement will be amended to provide that, following the Distribution, IAC will provide to Angi, for a fee, specified support services related to corporate functions for various terms following the Distribution (not to exceed one year), such as information security, legal, finance, human resources, tax, treasury services and participation in IAC’s U.S. health, welfare, benefit, and 401(k) plans. As each of the foregoing services terminate, Angi will be required to enter into new agreements or assume the responsibility for these functions. We cannot assure you that the economic terms of the new arrangements will be similar to those under our current arrangements with IAC. If Angi is unable to renew or replace such arrangements on a comparable basis, its business, financial condition and results of operations may be materially and adversely affected.

The Distribution may result in litigation and/or regulatory inquiries and investigations, which would harm Angi’s business, financial condition and operating results and could divert management attention.

In the past, securities class action litigation and/or shareholder derivative litigation and inquiries or investigations by regulatory authorities have often followed certain significant business transactions, such as the sale of a company or announcement of any other strategic transaction, such as the Distribution. Any litigation or investigation relating to the Distribution against Angi or IAC, whether or not resolved in either party’s favor, could result in substantial costs and divert management’s attention from other business concerns, which could adversely affect Angi’s business and cash resources and the ultimate value of Angi’s stock.

Risks Relating to Angi Securities Following the Distribution

The value of the Angi securities that current holders of IAC capital stock receive in the Distribution might be less than the value of the Angi securities prior to the Distribution.

If the Distribution is completed, holders of IAC common stock and IAC Class B common stock will receive Angi Class A common stock. The prices at which shares of Angi securities may trade at post-Distribution are unpredictable. The market value of one share of Angi Class A common stock following the Distribution may be less than, equal to or greater than the market value of one share of Angi Class A common stock prior to the Distribution.

Additionally, the value of Angi securities may be negatively impacted by a number of factors after the completion of the Distribution. Some of these matters are described in these risk factors and in the risk factors included in Angi’s other SEC filings, and others may or may not have been identified by Angi prior to the completion of the Distribution, and many of them are not within Angi’s control.

The market price and trading volume of Angi securities may be volatile and may face negative pressure.

Angi cannot accurately predict how investors in Angi securities will behave after the Distribution. The market price for Angi securities following the Distribution may be more volatile than the market price of Angi securities before the Distribution. The market price of Angi securities could fluctuate significantly for

many reasons, including the risks identified in this prospectus or reasons unrelated to Angi’s performance. Among the factors that could affect the stock price of Angi Class A common stock are:

•

actual or anticipated fluctuations in operating results;

•

changes in earnings estimated by securities analysts or in Angi’s ability to meet those estimates;

•

the operating and stock price performance of comparable companies;

•

changes to the regulatory and legal environment under which Angi operates;

•

changes in relationships with significant customers; and

•

domestic and worldwide economic conditions.

These factors, among others, may result in short- or long-term negative pressure on the value of Angi securities.

Substantial sales of Angi Class A common stock following the Distribution, or the perception that such sales might occur, could depress the market price of Angi Class A common stock.

Holders of IAC common stock or IAC Class B common stock may not wish to continue to hold the shares of Angi Class A common stock that they will receive as a result of the Distribution, which may lead to the disposition of a substantial number of shares of Angi Class A common stock following the Distribution. There is no assurance that there will be sufficient buying interest to offset any such sales, and, accordingly, the price of Angi Class A common stock may be depressed by those sales, or by the perception that such sales may occur, and have periods of volatility.

After the Distribution, Angi Class A common stock may not qualify for investment indices. In addition, Angi Class A common stock may fail to meet the investment guidelines of institutional investors. In either case, these factors may negatively impact the price of Angi Class A common stock and may impair Angi’s ability to raise capital through the sale of securities.

Some of the holders of IAC common stock are index funds tied to Nasdaq or other stock or investment indices, or are institutional investors bound by various investment guidelines. Companies are generally selected for investment indices, and in some cases selected by institutional investors, based on factors such as market capitalization, industry, trading liquidity and financial condition. Following the Distribution, Angi Class A common stock may not qualify for those investment indices. In addition, shares of Angi Class A common stock that are received in the Distribution may not meet the investment guidelines of some institutional investors. Consequently, these index funds and institutional investors may have to sell some or all of the shares of Angi Class A common stock they receive in the Distribution, and the prices of shares of Angi Class A common stock may fall as a result. Any such decline could impair the ability of Angi to raise capital through future sales of securities.

Angi is not expected to declare any regular cash dividends in the foreseeable future.

Angi is not expected to pay cash dividends on its capital stock in the near term. Instead, it is anticipated that Angi’s future earnings will be retained to support its operations and to finance the growth and development of its business. Any future determination relating to Angi’s dividend policy will be made by the Angi board of directors and will depend on a number of factors, including:

•

Angi’s historical and projected financial condition, liquidity and results of operations;

•

Angi’s capital levels and needs;

•

tax considerations;

•

any acquisitions or potential acquisitions that Angi may consider;

•

statutory and regulatory prohibitions and other limitations;

•

the terms of any credit agreements or other borrowing arrangements that will restrict Angi’s ability to pay cash dividends;

•

general economic conditions; and

•

other factors deemed relevant by the Angi board of directors.

In the absence of dividends, investors may need to rely on sales of their shares of Angi Class A common stock after price appreciation, which may never occur, as the only way to realize any future gains.

Provisions in the Angi certificate of incorporation and bylaws or Delaware law may discourage, delay or prevent a change of control of Angi, or changes in management and, therefore, depress the trading price of Angi Class A common stock.

The DGCL and Angi’s certificate of incorporation and bylaws currently contain provisions, and will be amended in connection with the Distribution to include provisions, that could discourage, delay or prevent a change in control of Angi, or changes in management that stockholders may deem advantageous, and provisions which:

•

provide that, from and after the completion of the Distribution until the Angi 2032 meeting of stockholders the Angi board of directors will be divided into classes, which could have the effect of making the replacement of incumbent directors more time-consuming and difficult;

•

provide that, as long as the Angi board of directors is classified, members of the Angi board of directors can be removed by stockholders only for cause;

•

provide that Angi stockholders will not have the right to act by written consent following the Distribution;

•

provide that vacancies on the Angi board of directors may be filled only by the remaining directors following the Distribution;

•

provide that, after the Distribution, Angi will be subject to the Delaware statute governing business combinations with interested stockholders;

•

authorize the issuance of “blank check” preferred stock or authorized but unissued shares of Angi Class B common stock or Angi Class C common stock that the company’s board of directors could issue to increase the number of outstanding shares and to discourage a takeover attempt;

•

provide that the company’s board of directors is expressly authorized to make, alter or repeal the bylaws;

•

provide that there will not be cumulative voting on the election of directors; and

•

establish advance notice procedures with respect to shareholder proposals and the nomination of candidates for election as directors, other than nominations made by or at the direction of the company’s board of directors.

Any provision of Angi’s certificate of incorporation, its bylaws or Delaware law that has the effect of delaying, deterring or preventing a change in control could limit the opportunity for its stockholders to receive a premium for their shares of Angi Class A common stock, and could also affect the price that some investors are willing to pay for such shares.

Angi’s bylaws designate specified courts as the sole and exclusive forum for certain types of actions or proceedings that may be initiated by its stockholders, which could discourage lawsuits against Angi and its directors, officers and other employees.

The Angi bylaws provide that, unless Angi consents in writing to the selection of an alternative forum, a state court located in the State of Delaware (or, if no state court located within the State of Delaware has jurisdiction, the federal district court for the District of Delaware) will, to the fullest extent permitted by law, be the sole and exclusive forum for:

•

any derivative action or proceeding brought on behalf of Angi;

•

any action asserting a claim for or based on a breach of a fiduciary duty owed by any current or former director or officer or other employee of Angi to Angi or its stockholders, including a claim alleging the aiding and abetting of such a breach of fiduciary duty;

•

any action asserting a claim against Angi or any current or former director or officer or other employee of Angi arising pursuant to any provision of the DGCL, the Angi certificate of incorporation or the Angi bylaws;

•

any action asserting a claim related to or involving Angi that is governed by the internal affairs doctrine; and

•

any action asserting an “internal corporate claim,” as that term is defined in Section 115 of the DGCL.

The exclusive forum provisions do not apply to suits brought to enforce any liability or duty created by the Exchange Act. The enforceability of similar exclusive forum provisions in other companies’ organizational documents has been challenged in legal proceedings, and it is possible that a court could find the exclusive forum provisions in Angi’s bylaws to be inapplicable or unenforceable.

These exclusive forum provisions may limit a stockholder’s ability to bring a claim in a judicial forum that such stockholder may find favorable for disputes with Angi or its directors, officers or employees, and may discourage lawsuits with respect to such claims and may increase the costs to bring such claims. Alternatively, if a court were to find these exclusive forum provisions inapplicable to, or unenforceable in respect of, one or more of the specified types of actions or proceedings described above for each company, the applicable company may incur additional costs associated with resolving such disputes in other jurisdictions, which could have an adverse impact on the applicable company’s business and financial condition.

If securities or industry analysts do not publish research or publish unfavorable research about Angi, the company’s stock price and trading volume could decline.

The trading market for Angi Class A common stock is, and will continue to be, influenced by the research and reports that industry or securities analysts publish about Angi and its business. If one or more of these analysts ceases coverage, or fails to publish reports about the applicable company regularly, Angi could lose visibility in the financial markets, which in turn could cause its stock price and/or trading volume to decline. Moreover, if Angi’s operating results do not meet the expectations of the investor community, one or more of the analysts who cover Angi may change their recommendations, and the stock price could decline.

WHERE YOU CAN FIND MORE INFORMATION

Angi files annual, quarterly and special reports, proxy statements and other information with the SEC. The SEC also maintains an Internet website that has reports, proxy statements and other information about Angi. The address of that site is http://www.sec.gov. The reports and other information filed by Angi with the SEC are also available free of charge at its Internet website, www.angi.com. Information on these Internet websites is not part of or incorporated by reference into this document.

Neither the information on any of the above websites, nor the information on the website of any Angi business, is incorporated by reference in this prospectus or any accompanying prospectus supplement, or in any other filings with, or in any other information furnished or submitted to, the SEC.