ANI Pharmaceuticals, Inc. (Nasdaq: ANIP) (ANI or the Company) today

announced financial results and business highlights for the three

months ended September 30, 2024.

“I am very pleased to report our third quarter results as we

continue to execute against our purpose of ‘Serving Patients,

Improving Lives,’” said Nikhil Lalwani, President & CEO of ANI.

“During the quarter, our team drove record performance for both our

lead Rare Disease asset Cortrophin Gel and our Generics business.

We also put a new, more efficient and effective capital structure

in place and completed the acquisition of Alimera, which is highly

synergistic to our Rare Disease business. We believe our proven

commercial execution capabilities can further unlock the potential

for ILUVIEN and YUTIQ, two growing and durable assets, as well as

accelerate the growth of Cortrophin Gel in ophthalmology.”

“Based on our strong third quarter results, the continued

momentum across the business, and the addition of ILUVIEN and

YUTIQ, we are pleased to raise our full year 2024 guidance,”

concluded Mr. Lalwani.

| (1) As

compared to estimated interest expense that would have been

incurred if the new principal amount of debt was subject to rates

that would have applied under the previous debt capital

structure. |

| |

Third Quarter and Recent Business

Highlights:

Rare Disease Segment

Revenues for ANI’s lead asset, Cortrophin Gel, totaled $52.6

million for the third quarter of 2024, an increase of 76.8% over

the same period in 2023, driven by increased volume from both

overall ACTH market growth and share growth. During the quarter,

the Company saw increasing demand with the highest number of

quarterly new patient starts and unique prescribers since launch

and achieved growth across all targeted specialties –

ophthalmology, neurology, rheumatology nephrology and pulmonology.

ANI continued taking steps to further strengthen the Cortrophin Gel

franchise and completed development of a Pre-Filled Syringe for

Cortrophin Gel and submitted a supplemental new drug application

(sNDA) in October.

Generics Business

ANI’s Generics business achieved 10.8% year-over-year growth in

the third quarter of 2024, driven by strong R&D capabilities

and operational excellence leveraging its U.S. based manufacturing

footprint and robust FDA compliance track record. The Company

launched five new products during the quarter, several into limited

competition markets, and one additional product so far in the

fourth quarter, bringing the year to date total to sixteen.

Closed Acquisition of Alimera Sciences

On September 16, 2024, the Company completed the acquisition of

Alimera Sciences. The transaction significantly expands the scope

and scale of ANI’s Rare Disease business with the addition of two

growing and durable ophthalmology products, ILUVIEN and YUTIQ.

Integration is progressing as anticipated and the Company now has a

45-person ophthalmology sales force promoting ILUVIEN, YUTIQ and

Cortrophin. In addition, the Company remains on track to capture

approximately $10 million of identified cost synergies in 2025.

The acquisition contributed $3.9 million of revenues to ANI for

the last two weeks of the quarter, and the Company expects revenue

between $30.0 million and $32.0 million for the year (for the

period of September 16, 2024 through December 31, 2024).

New Capital Structure

During the quarter, ANI completed an offering of $316.25 million

aggregate principal amount of 2.25% convertible senior notes due

September 1, 2029, repaid its existing senior secured term loan

facility ($292.5 million that carried an interest rate of

SOFR+6.0%), and entered into a new senior secured credit agreement

consisting of a $325.0 million delayed draw term loan facility

(initial interest rate SOFR+2.75%) and $75.0 million revolving

credit facility. The Company expects these capital structure

changes to reduce interest expense by approximately $39.0 million

on an annualized basis as compared to estimated interest expense

that would have been incurred if the new principal amount of debt

was subject to rates that would have applied under the previous

debt capital structure.

Third Quarter 2024 Financial Results

| |

|

Three Months EndedSeptember 30, |

|

|

|

|

| (in

thousands) |

|

|

2024 |

|

|

2023 |

|

Change |

|

% Change |

|

Rare Disease Segment |

|

|

|

|

|

|

|

|

|

Cortrophin Gel |

|

$ |

52,555 |

|

$ |

29,734 |

|

$ |

22,821 |

|

|

76.8 |

% |

|

ILUVIEN and YUTIQ |

|

|

3,871 |

|

|

— |

|

|

3,871 |

|

|

100.0 |

% |

|

Rare Disease segment total net revenues |

|

$ |

56,426 |

|

$ |

29,734 |

|

$ |

26,692 |

|

|

89.8 |

% |

| Generics, Established

Brands, and Other Segment |

|

|

|

|

|

|

|

|

|

Generic pharmaceutical products |

|

$ |

78,223 |

|

$ |

70,593 |

|

$ |

7,630 |

|

|

10.8 |

% |

|

Established brand pharmaceutical products, royalties, and other

pharmaceutical services |

|

|

13,683 |

|

|

31,502 |

|

|

(17,819 |

) |

|

(56.6 |

)% |

|

Generics, established brands, and other segment total net

revenues |

|

$ |

91,906 |

|

$ |

102,095 |

|

$ |

(10,189 |

) |

|

(10.0 |

)% |

|

Total net revenues |

|

$ |

148,332 |

|

$ |

131,829 |

|

$ |

16,503 |

|

|

12.5 |

% |

|

|

All comparisons are made versus the same period in 2023 unless

otherwise stated.

Net revenues for Rare Disease pharmaceutical products, which

include Cortrophin Gel and a partial quarter of contribution from

ILUVIEN and YUTIQ, increased 89.8% to $56.4 million. Cortrophin Gel

net revenues increased 76.8% to $52.6 million driven by increased

volume.

Net revenues for generic pharmaceutical products increased 10.8%

to $78.2 million, driven by increased volumes in the base business

and contribution from new product launches.

Net revenues for established brand pharmaceutical products,

royalties, and other pharmaceutical services decreased 56.6% to

$13.7 million, in line with Company expectations.

On a GAAP basis, gross margin decreased from 63.5% to 57.5%,

primarily due to an unfavorable mix resulting from decreased

revenues from established brand pharmaceutical products, as well as

significant growth of royalty bearing products. On a non-GAAP

basis, gross margin decreased from 63.7% to 59.9%.

On a GAAP basis, research and development expenses decreased

8.9% to $10.1 million. On a non-GAAP basis, research and

development expenses decreased 20.4% to $8.7 million.

On a GAAP basis, selling, general, and administrative expenses

increased 88.2% to $79.1 million, primarily due to increased

employment-related costs, investment in Rare Disease sales and

marketing infrastructure and activities, legal expenses, expenses

related to the acquisition of Alimera, and an overall increase in

activities to support revenue growth. On a non-GAAP basis, selling,

general, and administrative expenses increased 22.8% to $45.0

million.

On a GAAP basis, the Company reported a net loss attributable to

common shareholders of $(24.6) million, or $(1.27) per share, for

the third quarter of 2024 compared to net income of $9.5 million,

or $0.46 per share, in the prior year period. On a non-GAAP basis,

the Company reported diluted earnings per share of $1.34 for the

third quarter of 2024 compared to $1.27 in the prior year

period.

The Company reported a net loss of $(24.2) million, alongside,

adjusted non-GAAP EBITDA for the third quarter of 2024 was $35.1

million, a decrease of 3.8% over the third quarter of 2023.

For reconciliations of adjusted non-GAAP EBITDA, non-GAAP

research and development expenses, non-GAAP selling, general, and

administrative expenses, and adjusted non-GAAP diluted earnings per

share to the most directly comparable GAAP financial measure,

please see Table 3 and Table 4 below, respectively.

Liquidity

As of September 30, 2024, the Company had $145.0 million in

unrestricted cash and cash equivalents, $196.4 million in net

accounts receivable and $641.3 million in principal value of

outstanding debt (inclusive of our senior convertible notes). The

Company generated year-to-date cash flow from operations of $48.2

million.

Revised Full Year 2024 Guidance:

The Company is updating its full year 2024 guidance for the

combined organization, which includes the anticipated results of

Alimera from September 16, 2024.

|

|

|

Revised Full Year 2024 Guidance |

|

Prior Full Year 2024 Guidance |

|

2023 Actual |

|

Growth |

|

Net Revenue (Total Company) |

|

$594 million - $602 million |

|

$540 million - $560 million |

|

$486.8 million |

|

22% - 24% |

| Cortrophin Gel Net

Revenue |

|

$196 million - $200 million |

|

$185 million - $195 million |

|

$112.1 million |

|

75% - 78% |

| ILUVIEN and YUTIQ Net

Revenue |

|

$30 million - $32 million |

|

NA |

|

NA |

|

NA |

| Adjusted Non-GAAP EBITDA |

|

$149 million - $153 million |

|

$140 million - $150 million |

|

$133.8 million |

|

11% - 14% |

|

Adjusted Non-GAAP Diluted EPS |

|

$4.90 - $5.05 |

|

$4.38 - $4.82 |

|

$4.71 |

|

4% - 7% |

|

|

|

|

|

|

|

|

|

|

ANI now expects total company adjusted non-GAAP gross margin to

be at the high end of our previously communicated range of 61% to

62%. The Company will continue to tax effect non-GAAP adjustments

for computation of adjusted non-GAAP diluted earnings per share at

a tax rate of 26.0%, unless the item being adjusted is not tax

deductible in whole or in part.

The Company now anticipates approximately 19.7 million and 19.9

million shares outstanding for the purpose of calculating adjusted

non-GAAP diluted EPS for full year 2024 and fourth quarter 2024,

respectively. The Company now expects its annual U.S. GAAP

effective tax rate to be in the mid-single digits as compared to

our previous expectation of between 22% and 25%, driven by the

non-deductible nature of certain expenses incurred in conjunction

with the acquisition of Alimera (against an annual forecasted GAAP

pre-tax loss).

Upcoming Events

ANI plans to participate in the following investor events:

Guggenheim’s Inaugural Healthcare Innovation ConferenceNovember

13, 2024Boston, MA

Jefferies London Healthcare ConferenceNovember 20, 2024London,

UK

Conference Call

The Company’s management will host a conference call today to

discuss its third quarter 2024 results.

| Date |

|

Friday,

November 8, 2024 |

| Time |

|

8:00 a.m. ET |

| Toll free (U.S.) |

|

800-445-7795 |

| Conference ID |

|

4757982 |

This conference call will also be webcast and can be accessed

from the “Investors” section of ANI’s website at

www.anipharmaceuticals.com. The webcast replay of the call will be

available at the same site approximately one hour after the end of

the call.

A replay of the conference call will also be available within

two hours of the call’s completion and will remain accessible for

two weeks by dialing 800-839-8389 and entering access code

4757982.

Non-GAAP Financial Measures

Adjusted non-GAAP EBITDA

ANI’s management considers adjusted non-GAAP EBITDA to be an

important financial indicator of ANI’s operating performance,

providing investors and analysts with a useful measure of operating

results unaffected by non-cash stock-based compensation and

differences in capital structures, tax structures, capital

investment cycles, ages of related assets, and compensation

structures among otherwise comparable companies. Management uses

adjusted non-GAAP EBITDA when analyzing Company performance.

Adjusted non-GAAP EBITDA is defined as net (loss) income,

excluding tax provision or benefit, interest expense, net, other

expense, net, loss on extinguishment of debt, depreciation and

amortization expense, non-cash stock-based compensation expense,

M&A transaction and integration expenses, contingent

consideration fair value adjustments, unrealized gain on our

investment in equity securities, gain on sale of the former

Oakville, Ontario manufacturing site, litigation expenses related

to certain matters, amortization of certain purchase price

adjustments, severance expense, and certain other items that vary

in frequency and impact on ANI’s results of operations. Adjusted

non-GAAP EBITDA should be considered in addition to, but not in

lieu of, net income or loss reported under GAAP. A reconciliation

of adjusted non-GAAP EBITDA to the most directly comparable GAAP

financial measure is provided below.

ANI is not providing a reconciliation for the forward-looking

full year 2024 adjusted EBITDA guidance because it does not

currently have sufficient information to accurately estimate all of

the variables and individual adjustments for such reconciliation,

including “with” and “without” tax provision information. As such,

ANI’s management cannot estimate on a forward-looking basis without

unreasonable effort the impact these variables and individual

adjustments will have on its reported results.

Adjusted non-GAAP Net Income

ANI’s management considers adjusted non-GAAP net income to be an

important financial indicator of ANI’s operating performance,

providing investors and analysts with a useful measure of operating

results unaffected by the non-cash stock-based compensation,

non-cash interest expense, depreciation and amortization, M&A

transaction and integration expenses, contingent consideration fair

value adjustment, unrealized gain on our investment in equity

securities, gain on sale of the former Oakville, Ontario

manufacturing site, litigation expenses related to certain matters,

loss on extinguishment of debt, amortization of certain purchase

price adjustments, severance expense, and certain other items that

vary in frequency and impact on ANI’s results of operations.

Management uses adjusted non-GAAP net income when analyzing Company

performance.

Adjusted non-GAAP net income is defined as net (loss) income,

plus the non-cash stock-based compensation, non-cash interest

expense, depreciation and amortization, M&A transaction and

integration expenses, contingent consideration fair value

adjustment, unrealized gain on our investment in equity securities,

gain on sale of the former Oakville, Ontario manufacturing site,

litigation expenses related to certain matters, loss on

extinguishment of debt, amortization of certain purchase price

adjustments, severance expense, and certain other items that vary

in frequency and impact on ANI’s results of operations, less the

tax impact of these adjustments calculated using an estimated

statutory tax rate. Management will continually analyze this metric

and may include additional adjustments in the calculation in order

to provide further understanding of ANI’s results. Adjusted

non-GAAP net income should be considered in addition to, but not in

lieu of, net income reported under GAAP. A reconciliation of

adjusted non-GAAP net income to the most directly comparable GAAP

financial measure is provided below.

Adjusted non-GAAP Diluted Earnings per

Share

ANI’s management considers adjusted non-GAAP diluted earnings

per share to be an important financial indicator of ANI’s operating

performance, providing investors and analysts with a useful measure

of operating results unaffected by the non-cash stock-based

compensation, non-cash interest expense, depreciation and

amortization, M&A transaction and integration expenses,

contingent consideration fair value adjustment, unrealized gain on

our investment in equity securities, gain on sale of the former

Oakville, Ontario manufacturing site, litigation expenses related

to certain matters, loss on extinguishment of debt, amortization of

certain purchase price adjustments, severance expense, and certain

other items that vary in frequency and impact on ANI’s results of

operations. Management uses adjusted non-GAAP diluted earnings per

share when analyzing Company performance.

Adjusted non-GAAP diluted earnings per share is defined as

adjusted non-GAAP net income, as defined above, divided by the

diluted weighted average shares outstanding during the period.

Management will continually analyze this metric and may include

additional adjustments in the calculation in order to provide

further understanding of ANI’s results. Adjusted non-GAAP diluted

earnings per share should be considered in addition to, but not in

lieu of, diluted earnings (loss) per share reported under GAAP. A

reconciliation of adjusted non-GAAP diluted earnings per share to

the most directly comparable GAAP financial measure is provided

below.

ANI is not providing a reconciliation for the forward-looking

full year 2024 adjusted diluted earnings per share guidance because

it does not currently have sufficient information to accurately

estimate all of the variables and individual adjustments for such

reconciliation, including “with” and “without” tax provision

information. As such, ANI’s management cannot estimate on a

forward-looking basis without unreasonable effort the impact these

variables and individual adjustments will have on its reported

results.

Other non-GAAP metrics

ANI’s management considers non-GAAP research and development

expenses and non-GAAP selling, general, and administrative expenses

to be financial indicators of ANI’s operating performance,

providing investors and analysts with useful measures of operating

results unaffected by non-cash stock-based compensation expense,

M&A transaction and integration expenses, contingent

consideration fair value adjustments, unrealized gain on our

investment in equity securities, gain on sale of the former

Oakville, Ontario manufacturing site, litigation expenses related

to certain matters, amortization of certain purchase price

adjustments, severance expense, and certain other items that vary

in frequency and impact on ANI’s results of operations. Management

uses adjusted non-GAAP research and development expenses and

non-GAAP selling, general, and administrative expenses when

analyzing Company performance.

Non-GAAP research and development expenses is defined as

research and development expenses, excluding non-cash stock-based

compensation expense, M&A transaction and integration expenses,

and certain other items that vary in frequency and impact on ANI’s

results of operations.

Non-GAAP selling, general, and administrative expenses is

defined as selling, general, and administrative expenses, excluding

impact of Canada operations, non-cash stock-based compensation

expense, M&A transaction and integration expenses, litigation

expenses related to certain matters, severance expense, and certain

other items that vary in frequency and impact on ANI’s results of

operations.

Each of adjusted non-GAAP research and development expenses and

non-GAAP selling, general, and administrative expenses should be

considered in addition to, but not in lieu of, research and

development expenses, and selling, general, and administrative

expenses reported under GAAP, respectively.

A reconciliation of each of non-GAAP research and development

expenses and non-GAAP selling, general and administrative expenses

to the most directly comparable GAAP financial measure is provided

below.

ANI’s management also considers non-GAAP gross margin to be a

financial indicator of ANI’s operating performance, providing

investors and analysts with a useful measure of operating results

unaffected by unaffected by non-cash stock-based compensation

expense, M&A transaction and integration expenses, contingent

consideration fair value adjustments, unrealized gain on our

investment in equity securities, gain on sale of the former

Oakville, Ontario manufacturing site, litigation expenses related

to certain matters, amortization of certain purchase price

adjustments, severance expense, and certain other items that vary

in frequency and impact on ANI’s results of operations. Management

uses non-GAAP gross margin when analyzing Company performance.

Non-GAAP gross margin is defined as adjusted non-GAAP net

revenues less non-GAAP cost of sales (excluding depreciation and

amortization) divided by non-GAAP net revenues. Non-GAAP gross

margin should be considered in addition to, but not in lieu of,

gross margin reported under GAAP.

About ANI

ANI Pharmaceuticals, Inc. (Nasdaq: ANIP) is a diversified

biopharmaceutical company committed to its mission of “Serving

Patients, Improving Lives" by developing, manufacturing, and

commercializing innovative and high-quality therapeutics. The

Company is focused on delivering sustainable growth through its

Rare Disease business, which markets novel products in the areas of

ophthalmology, rheumatology, nephrology, neurology, and

pulmonology; its Generics business, which leverages R&D

expertise, operational excellence, and U.S.-based manufacturing;

and its Established Brands business. For more information, visit

www.anipharmaceuticals.com.

Forward-Looking Statements

To the extent any statements made in this release deal with

information that is not historical, these are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements include, but are not limited

to, those relating to the commercialization and potential sales of

the product and any additional product launches from the Company’s

generic pipeline, 2024 guidance, other statements that are not

historical in nature, particularly those that utilize terminology

such as “anticipates,” “will,” “expects,” “plans,” “potential,”

“future,” “believes,” “intends,” “continue,” other words of similar

meaning, derivations of such words and the use of future dates.

Uncertainties and risks may cause the Company’s actual results

to be materially different than those expressed in or implied by

such forward-looking statements. Uncertainties and risks include,

but are not limited to: our ability to continue to achieve

commercial success with Cortrophin Gel, our first rare disease

pharmaceutical product, including expanding the market and gaining

market share, our business, financial condition, and results of

operations will be negatively impacted; the ability of our approved

products, including Cortrophin Gel, and products acquired in the

acquisition of Alimera, to achieve commercialization at levels of

market acceptance that will continue to allow us to achieve

profitability; our ability to complete or achieve any, or all of

the intended benefits of acquisitions and investments, including

the acquisition of Alimera, in a timely manner or at all; the risks

that our acquisitions and investments, including the recent

acquisition of Alimera, could disrupt our business and harm our

financial position and operating results; delays in production,

increased costs and potential loss of revenues if we need to change

suppliers due to the limited number of suppliers for our raw

materials, active pharmaceutical ingredients, expedients, and other

materials; our reliance on single source third party contract

manufacturing supply for certain of our key products, including

Cortrophin Gel and products acquired in the acquisition of Alimera;

delays or failure in obtaining and maintaining approvals by the FDA

of the products we sell; changes in policy or actions that may be

taken by the FDA, United States Drug Enforcement Administration and

other regulatory agencies, including among other things, drug

recalls, regulatory approvals, facility inspections and potential

enforcement actions; risks that we may face with respect to

importing raw materials and delays in delivery of raw materials and

other ingredients and supplies necessary for the manufacture of our

products from both domestic and overseas sources due to supply

chain disruptions or for any other reason; the ability of our

manufacturing partners to meet our product demands and timelines;

the impact of changes or fluctuations in exchange rates; our

ability to develop, license or acquire, and commercialize new

products; the level of competition we face and the legal,

regulatory and/or legislative strategies employed by our

competitors to prevent or delay competition from generic

alternatives to branded products; our ability to protect our

intellectual property rights; the impact of legislative or

regulatory reform on the pricing for pharmaceutical products; the

impact of any litigation to which we are, or may become, a party;

our ability, and that of our suppliers, development partners, and

manufacturing partners, to comply with laws, regulations and

standards that govern or affect the pharmaceutical and

biotechnology industries; our ability to maintain the services of

our key executives and other personnel; and general business and

economic conditions, such as inflationary pressures, geopolitical

conditions including but not limited to the conflict between Russia

and the Ukraine, the conflict in the Middle East, conflicts related

to the attacks on cargo ships in the Red Sea, and the effects and

duration of outbreaks of public health emergencies, and other risks

and uncertainties that are described in ANI’s Annual Report on Form

10-K, quarterly reports on Form 10-Q, and other periodic reports

filed with the Securities and Exchange Commission.

More detailed information on these and additional factors that

could affect the Company’s actual results are described in the

Company’s filings with the Securities and Exchange Commission

(SEC), including its most recent annual report on Form 10-K and

quarterly reports on Form 10-Q, as well as other filings with the

SEC. All forward-looking statements in this news release speak only

as of the date of this news release and are based on the Company’s

current beliefs, assumptions, and expectations. The Company

undertakes no obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Investor Contact Lisa M. Wilson, In-Site Communications,

Inc.

212-452-2793lwilson@insitecony.com

SOURCE: ANI Pharmaceuticals, Inc.

FINANCIAL TABLES FOLLOW

|

|

|

ANI Pharmaceuticals, Inc. and

Subsidiaries |

|

Table 1: US GAAP Statements of Operations |

|

(unaudited, in thousands, except per share amounts) |

| |

|

|

|

|

| |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net Revenues |

$ |

148,332 |

|

|

$ |

131,829 |

|

|

$ |

423,802 |

|

|

$ |

355,162 |

|

| |

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

Cost of sales (excluding depreciation and amortization) |

|

63,075 |

|

|

|

48,101 |

|

|

|

169,930 |

|

|

|

128,093 |

|

|

Research and development |

|

10,128 |

|

|

|

11,121 |

|

|

|

27,935 |

|

|

|

24,419 |

|

|

Selling, general, and administrative |

|

79,075 |

|

|

|

42,007 |

|

|

|

179,917 |

|

|

|

117,235 |

|

|

Depreciation and amortization |

|

15,748 |

|

|

|

15,207 |

|

|

|

45,131 |

|

|

|

44,597 |

|

|

Contingent consideration fair value adjustment |

|

825 |

|

|

|

(2,555 |

) |

|

|

1,274 |

|

|

|

(559 |

) |

|

Restructuring activities |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,132 |

|

|

Gain on sale of building |

|

- |

|

|

|

- |

|

|

|

(5,347 |

) |

|

|

- |

|

| |

|

|

|

|

|

Total Operating Expenses, net |

|

168,851 |

|

|

|

113,881 |

|

|

|

418,840 |

|

|

|

314,917 |

|

| |

|

|

|

|

|

Operating (loss) income |

|

(20,519 |

) |

|

|

17,948 |

|

|

|

4,962 |

|

|

|

40,245 |

|

| |

|

|

|

|

|

Other (Expense) Income, net |

|

|

|

|

|

Unrealized gain on investment in equity securities |

|

1,355 |

|

|

|

- |

|

|

|

8,298 |

|

|

|

- |

|

|

Interest expense, net |

|

(2,331 |

) |

|

|

(6,398 |

) |

|

|

(11,587 |

) |

|

|

(21,194 |

) |

|

Other expense, net |

|

(2,535 |

) |

|

|

(39 |

) |

|

|

(2,655 |

) |

|

|

(126 |

) |

|

Loss on extinguishment of debt |

|

(7,468 |

) |

|

|

- |

|

|

|

(7,468 |

) |

|

|

- |

|

| |

|

|

|

|

|

(Loss) Income Before Income Tax (Benefit) Expense |

|

(31,498 |

) |

|

|

11,511 |

|

|

|

(8,450 |

) |

|

|

18,925 |

|

|

|

|

|

|

|

|

Income tax (benefit) expense |

|

(7,332 |

) |

|

|

1,571 |

|

|

|

(204 |

) |

|

|

1,301 |

|

|

|

|

|

|

|

|

Net (Loss) Income |

$ |

(24,166 |

) |

|

$ |

9,940 |

|

|

$ |

(8,246 |

) |

|

$ |

17,624 |

|

|

|

|

|

|

|

|

Dividends on Series A Convertible Preferred Stock |

|

(406 |

) |

|

|

(406 |

) |

|

|

(1,219 |

) |

|

|

(1,219 |

) |

|

|

|

|

|

|

|

Net (Loss) Income Available to Common Shareholders |

$ |

(24,572 |

) |

|

$ |

9,534 |

|

|

$ |

(9,465 |

) |

|

$ |

16,405 |

|

|

|

|

|

|

|

|

Basic and Diluted (Loss) Income Per Share: |

|

|

|

|

|

Basic (Loss) Income Per Share |

$ |

(1.27 |

) |

|

$ |

0.46 |

|

|

$ |

(0.49 |

) |

|

$ |

0.84 |

|

|

Diluted (Loss) Income Per Share |

$ |

(1.27 |

) |

|

$ |

0.45 |

|

|

$ |

(0.49 |

) |

|

$ |

0.83 |

|

| |

|

|

|

|

|

Basic Weighted-Average Shares Outstanding |

|

19,404 |

|

|

|

18,883 |

|

|

|

19,275 |

|

|

|

17,663 |

|

|

Diluted Weighted-Average Shares Outstanding |

|

19,404 |

|

|

|

19,125 |

|

|

|

19,275 |

|

|

|

17,823 |

|

| |

|

|

|

|

| |

|

|

|

|

|

|

|

ANI Pharmaceuticals, Inc. and

Subsidiaries |

|

Table 2: US GAAP Balance Sheets |

|

(unaudited, in thousands) |

| |

|

|

| |

September 30, 2024 |

December 31, 2023 |

|

Current Assets |

|

|

|

Cash and cash equivalents |

$ |

144,982 |

|

|

$ |

221,121 |

|

|

Restricted Cash |

|

35 |

|

|

|

- |

|

|

Accounts receivable, net |

|

196,361 |

|

|

|

162,079 |

|

|

Inventories |

|

148,042 |

|

|

|

111,196 |

|

|

Prepaid income taxes |

|

6,104 |

|

|

|

- |

|

|

Assets held for sale |

|

- |

|

|

|

8,020 |

|

|

Prepaid expenses and other current assets |

|

17,475 |

|

|

|

17,400 |

|

|

Investment in equity securities |

|

8,298 |

|

|

|

- |

|

|

Total Current Assets |

|

521,297 |

|

|

|

519,816 |

|

|

Non-current Assets |

|

|

|

Property and equipment, net |

|

56,704 |

|

|

|

44,593 |

|

|

Deferred tax assets, net of deferred tax liabilities and valuation

allowance |

|

67,661 |

|

|

|

90,711 |

|

|

Intangible assets, net |

|

569,825 |

|

|

|

209,009 |

|

|

Goodwill |

|

60,426 |

|

|

|

28,221 |

|

|

Derivatives and other non-current assets |

|

11,464 |

|

|

|

12,072 |

|

|

Total Assets |

$ |

1,287,377 |

|

|

$ |

904,422 |

|

|

|

|

|

|

Current Liabilities |

|

|

|

Current debt, net of deferred financing costs |

$ |

7,152 |

|

|

$ |

850 |

|

|

Accounts payable |

|

60,890 |

|

|

|

36,683 |

|

|

Accrued royalties |

|

23,447 |

|

|

|

16,276 |

|

|

Accrued compensation and related expenses |

|

29,777 |

|

|

|

23,786 |

|

|

Accrued government rebates |

|

10,693 |

|

|

|

12,168 |

|

|

Income taxes payable |

|

- |

|

|

|

8,164 |

|

|

Returned goods reserve |

|

37,068 |

|

|

|

29,678 |

|

|

Current contingent consideration |

|

1,283 |

|

|

|

12,266 |

|

|

Accrued licensor payment |

|

1,809 |

|

|

|

- |

|

|

Accrued expenses and other |

|

17,814 |

|

|

|

5,606 |

|

|

Total Current Liabilities |

|

189,933 |

|

|

|

145,477 |

|

|

|

|

|

|

Non-current Liabilities |

|

|

|

Non-current debt, net of deferred financing costs and current

component |

|

312,918 |

|

|

|

284,819 |

|

|

Non-current convertible notes, net of deferred financing costs |

|

305,293 |

|

|

|

- |

|

|

Non-current contingent consideration |

|

20,175 |

|

|

|

11,718 |

|

|

Accrued licensor payment, net of current |

|

21,316 |

|

|

|

- |

|

|

Other non-current liabilities |

|

6,944 |

|

|

|

4,809 |

|

|

Total Liabilities |

$ |

856,579 |

|

|

$ |

446,823 |

|

| |

|

|

|

Mezzanine Equity |

|

|

|

Convertible Preferred Stock, Series A |

|

24,850 |

|

|

|

24,850 |

|

| |

|

|

|

Stockholders’ Equity |

|

|

|

Common Stock |

|

2 |

|

|

|

2 |

|

|

Class C Special Stock |

|

- |

|

|

|

- |

|

|

Preferred Stock |

|

- |

|

|

|

- |

|

|

Treasury stock |

|

(20,722 |

) |

|

|

(10,081 |

) |

|

Additional paid-in capital |

|

510,899 |

|

|

|

514,103 |

|

|

Accumulated deficit |

|

(89,597 |

) |

|

|

(80,132 |

) |

|

Accumulated other comprehensive income, net of tax |

|

5,366 |

|

|

|

8,857 |

|

|

Total Stockholders’ Equity |

|

405,948 |

|

|

|

432,749 |

|

| |

|

|

|

Total Liabilities, Mezzanine Equity, and Stockholders’ Equity |

$ |

1,287,377 |

|

|

$ |

904,422 |

|

| |

|

|

| |

| ANI

Pharmaceuticals, Inc. and Subsidiaries |

| Table 3:

Adjusted non-GAAP EBITDA Calculation and US GAAP to Non-GAAP

Reconciliation |

| (unaudited, in

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Reconciliation of certain adjusted non-GAAP

accounts: |

| |

|

|

|

|

|

Net Revenues |

Cost of sales (excluding depreciation and

amortization) |

Selling, general, and administrative |

Research and development |

| |

Three Months Ended September 30, |

|

|

|

Three Months

Ended September 30, |

Three Months

Ended September 30, |

Three Months

Ended September 30, |

Three Months

Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net (Loss)

Income |

$ |

(24,166 |

) |

$ |

9,940 |

|

|

As

reported: |

|

$ |

148,332 |

$ |

131,829 |

|

$ |

63,075 |

|

$ |

48,101 |

|

$ |

79,075 |

|

$ |

42,007 |

|

$ |

10,128 |

|

$ |

11,121 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add/(Subtract): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

2,331 |

|

|

6,398 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense, net |

|

2,535 |

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on extinguishment of debt |

|

7,468 |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Benefit) provision for income taxes |

|

(7,332 |

) |

|

1,571 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

15,748 |

|

|

15,207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration fair value adjustment |

|

825 |

|

|

(2,555 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on investment in equity securities |

|

(1,355 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Impact of Canada operations (1) |

|

— |

|

|

275 |

|

|

Impact of

Canada operations (1) |

|

|

— |

|

— |

|

|

— |

|

|

(128 |

) |

|

— |

|

|

(147 |

) |

|

— |

|

|

— |

|

|

Stock-based compensation |

|

7,484 |

|

|

5,444 |

|

|

Stock-based

compensation |

|

|

— |

|

— |

|

|

(318 |

) |

|

(182 |

) |

|

(6,723 |

) |

|

(5,023 |

) |

|

(443 |

) |

|

(239 |

) |

|

M&A transaction and integration expenses |

|

9,945 |

|

|

165 |

|

|

M&A

transaction and integration expenses |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(9,945 |

) |

|

(165 |

) |

|

— |

|

|

— |

|

|

Litigation expenses |

|

2,899 |

|

|

— |

|

|

Litigation

expenses |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(2,899 |

) |

|

— |

|

|

— |

|

|

— |

|

|

Inventory step-up amortization |

|

3,224 |

|

|

— |

|

|

Inventory

step-up amortization |

|

|

— |

|

— |

|

|

(3,224 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Severance |

|

5,308 |

|

|

— |

|

|

Severance |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(5,308 |

) |

|

— |

|

|

— |

|

|

— |

|

|

Equity payout |

|

10,190 |

|

|

— |

|

|

Equity

payout |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(9,171 |

) |

|

— |

|

|

(1,019 |

) |

|

— |

|

| Adjusted

non-GAAP EBITDA |

$ |

35,104 |

|

$ |

36,484 |

|

|

As

adjusted: |

|

$ |

148,332 |

$ |

131,829 |

|

$ |

59,533 |

|

$ |

47,791 |

|

$ |

45,029 |

|

$ |

36,672 |

|

$ |

8,666 |

|

$ |

10,882 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Impact of Canada

operations includes CDMO revenues, cost of sales relating to CDMO

revenues, all selling, general, and administrative expenses, and

all research and development expenses recorded in Canada in the

period presented, exclusive of restructuring activities,

stock-based compensation, and depreciation and amortization, which

are included within their respective line items above. The

adjustment of Canada operations represents revenues, cost of sales

and expense that will not recur after the completion of the closure

of our Canada operations (complete as of March 31, 2023) and

the sale of the facility (complete as of March 31, 2024). The

adjustment of Canada operations does not adjust for revenues, cost

of sales, and expense that will recur at our other manufacturing

facilities after the transfer of certain manufacturing activities

is complete. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Reconciliation of certain adjusted non-GAAP

accounts: |

| |

|

|

|

|

|

Net Revenues |

Cost of sales (excluding depreciation and

amortization) |

Selling, general, and administrative |

Research and development |

| |

Nine Months Ended September 30, |

|

|

|

Nine Months

Ended September 30, |

Nine Months

Ended September 30, |

Nine Months

Ended September 30, |

Nine Months

Ended September 30, |

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

2024 |

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net (Loss)

Income |

$ |

(8,246 |

) |

$ |

17,624 |

|

|

As

reported: |

|

$ |

423,802 |

$ |

355,162 |

|

$ |

169,930 |

|

$ |

128,093 |

|

$ |

179,917 |

|

$ |

117,235 |

|

$ |

27,935 |

|

$ |

24,419 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add/(Subtract): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

11,587 |

|

|

21,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense, net |

|

2,655 |

|

|

126 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on extinguishment of debt |

|

7,468 |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Benefit) provision for income taxes |

|

(204 |

) |

|

1,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

45,131 |

|

|

44,597 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent consideration fair value adjustment |

|

1,274 |

|

|

(559 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring activities |

|

— |

|

|

1,132 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of building |

|

(5,347 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on investment in equity securities |

|

(8,298 |

) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Impact of Canada operations (1) |

|

— |

|

|

2,414 |

|

|

Impact of

Canada operations (1) |

|

|

— |

|

(565 |

) |

|

— |

|

|

(1,833 |

) |

|

— |

|

|

(1,073 |

) |

|

— |

|

|

(73 |

) |

|

Stock-based compensation |

|

22,283 |

|

|

15,031 |

|

|

Stock-based

compensation |

|

|

— |

|

— |

|

|

(911 |

) |

|

(521 |

) |

|

(20,300 |

) |

|

(13,839 |

) |

|

(1,072 |

) |

|

(671 |

) |

|

M&A transaction and integration expenses |

|

14,198 |

|

|

757 |

|

|

M&A

transaction and integration expenses |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(14,198 |

) |

|

(757 |

) |

|

— |

|

|

— |

|

|

Litigation expenses |

|

4,738 |

|

|

— |

|

|

Litigation

expenses |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(4,738 |

) |

|

— |

|

|

— |

|

|

— |

|

|

Inventory step-up amortization |

|

3,224 |

|

|

— |

|

|

Inventory

step-up amortization |

|

|

— |

|

— |

|

|

(3,224 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Severance |

|

5,308 |

|

|

— |

|

|

Severance |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(5,308 |

) |

|

— |

|

|

— |

|

|

— |

|

|

Equity payout |

|

10,190 |

|

|

— |

|

|

Equity

payout |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

(9,171 |

) |

|

— |

|

|

(1,019 |

) |

|

— |

|

| Adjusted

non-GAAP EBITDA |

$ |

105,961 |

|

$ |

103,617 |

|

|

As

adjusted: |

|

$ |

423,802 |

$ |

354,597 |

|

$ |

165,795 |

|

$ |

125,739 |

|

$ |

126,202 |

|

$ |

101,566 |

|

$ |

25,844 |

|

$ |

23,675 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Impact of Canada

operations includes CDMO revenues, cost of sales relating to CDMO

revenues, all selling, general, and administrative expenses, and

all research and development expenses recorded in Canada in the

period presented, exclusive of restructuring activities,

stock-based compensation, and depreciation and amortization, which

are included within their respective line items above. The

adjustment of Canada operations represents revenues, cost of sales

and expense that will not recur after the completion of the closure

of our Canada operations (complete as of March 31, 2023) and

the sale of the facility (complete as of March 31, 2024). The

adjustment of Canada operations does not adjust for revenues, cost

of sales, and expense that will recur at our other manufacturing

facilities after the transfer of certain manufacturing activities

is complete. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANI Pharmaceuticals, Inc. and Subsidiaries |

|

Table 4: Adjusted non-GAAP Net Income and Adjusted non-GAAP

Diluted Earnings per Share Reconciliation |

|

(unaudited, in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net (Loss) Income Available to Common Shareholders |

$ |

(24,572 |

) |

|

$ |

9,534 |

|

|

$ |

(9,465 |

) |

|

$ |

16,405 |

|

|

|

|

|

|

|

|

Add/(Subtract): |

|

|

|

|

|

Non-cash interest (income) expense |

|

(18 |

) |

|

|

856 |

|

|

|

(82 |

) |

|

|

2,530 |

|

|

Depreciation and amortization |

|

15,748 |

|

|

|

15,207 |

|

|

|

45,131 |

|

|

|

44,597 |

|

|

Contingent consideration fair value adjustment |

|

825 |

|

|

|

(2,555 |

) |

|

|

1,274 |

|

|

|

(559 |

) |

|

Restructuring activities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,132 |

|

|

Gain on sale of building |

|

— |

|

|

|

— |

|

|

|

(5,347 |

) |

|

|

— |

|

|

Unrealized gain on investment in equity securities |

|

(1,355 |

) |

|

|

— |

|

|

|

(8,298 |

) |

|

|

— |

|

|

Impact of Canada operations (1) |

|

— |

|

|

|

275 |

|

|

|

— |

|

|

|

2,414 |

|

|

Stock-based compensation |

|

7,484 |

|

|

|

5,444 |

|

|

|

22,283 |

|

|

|

15,031 |

|

|

M&A transaction and integration expenses |

|

9,945 |

|

|

|

165 |

|

|

|

14,198 |

|

|

|

757 |

|

|

Litigation expenses |

|

2,899 |

|

|

|

— |

|

|

|

4,738 |

|

|

|

— |

|

|

Inventory step-up amortization |

|

3,224 |

|

|

|

— |

|

|

|

3,224 |

|

|

|

— |

|

|

Severance |

|

5,308 |

|

|

|

— |

|

|

|

5,308 |

|

|

|

— |

|

|

Equity payout |

|

10,190 |

|

|

|

— |

|

|

|

10,190 |

|

|

|

— |

|

|

Loss on extinguishment of debt |

|

7,468 |

|

|

|

— |

|

|

|

7,468 |

|

|

|

— |

|

|

Other expense |

|

2,493 |

|

|

|

— |

|

|

|

2,536 |

|

|

|

— |

|

|

Less: |

|

|

|

|

|

Estimated tax impact of adjustments |

|

(13,147 |

) |

|

|

(4,654 |

) |

|

|

(23,134 |

) |

|

|

(15,816 |

) |

|

|

|

|

|

|

|

Adjusted non-GAAP Net Income Available to Common Shareholders

(2) |

$ |

26,492 |

|

|

$ |

24,272 |

|

|

$ |

70,024 |

|

|

$ |

66,491 |

|

|

Diluted Weighted-Average |

|

|

|

|

|

Shares Outstanding |

|

19,404 |

|

|

|

19,125 |

|

|

|

19,275 |

|

|

|

17,823 |

|

|

Adjusted Diluted Weighted-Average |

|

|

|

|

|

Shares Outstanding |

|

19,766 |

|

|

|

19,125 |

|

|

|

19,629 |

|

|

|

17,823 |

|

|

|

|

|

|

|

|

Adjusted non-GAAP |

|

|

|

|

|

Diluted Earnings per Share |

$ |

1.34 |

|

|

$ |

1.27 |

|

|

$ |

3.57 |

|

|

$ |

3.73 |

|

|

|

|

|

|

|

|

(1) Impact of Canada operations includes CDMO revenues, cost of

sales relating to CDMO revenues, all selling, general, and

administrative expenses, and all research and development expenses

recorded in Canada in the period presented, exclusive of

restructuring activities, stock-based compensation, and

depreciation and amortization, which are included within their

respective line items above. The adjustment of Canada operations

represents revenues, cost of sales and expense that will not recur

after the completion of the closure of our Canada operations

(complete as of March 31, 2023) and the sale of the facility

(complete as of March 31, 2024). The adjustment of Canada

operations does not adjust for revenues, cost of sales, and expense

that will recur at our other manufacturing facilities after the

transfer of certain manufacturing activities is complete. |

|

|

|

|

|

|

|

(2) Adjusted non-GAAP Net Income Available to Common Shareholders

excludes undistributed earnings to participating securities. |

|

|

|

|

|

|

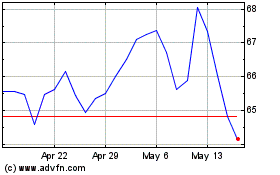

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Oct 2024 to Nov 2024

ANI Pharmaceuticals (NASDAQ:ANIP)

Historical Stock Chart

From Nov 2023 to Nov 2024